概述

本策略运用多种移动平均线指标,结合交易时间选择进入和退出的时机,实现量化交易。

策略原理

该策略使用了9种移动平均线包括SMA、EMA、WMA等。根据用户选择,进入多仓时,收盘价上穿选定的移动平均线且前一根K线收盘价在移动平均线以下;做空时,收盘价下穿选定的移动平均线且前一根K线收盘价在移动平均线以上。所有交易只在周一开盘时发出。平仓条件为固定止盈止损或周日收盘前平仓。

优势分析

本策略集多种移动平均线精华于一身,用户可以选择不同参数来适应不同市场环境。只有确定趋势出现才入场,避免了 \‘%失效交易\’ 的出现。同时,本策略只在周一开仓,周日前止盈止损或平仓,限制了单周最大开仓次数,有效控制了交易风险。

风险分析

该策略主要依赖均线指标判断趋势,当趋势发生转折时,存在部分交易被套住的风险。此外,限定只有周一能够开仓,如果在周一之后出现较好的交易机会也无法入场,可能错过部分利润。

为控制这些风险,建议采用动态移动平均线参数,当市场进入震荡时,适当缩短参数;同时,也可以增加开仓时间,在周三或周四仍允许开新仓。

优化方向

该策略可以从以下几个方面进行优化:

增加止盈止损Algerism算法,动态调整止盈止损点;

增加机器学习模型判断趋势年,避免在震荡市场入场;

优化开仓和平仓逻辑,允许更多的开仓机会出现。

总结

本策略集成多种移动平均线指标判断趋势方向,以周一开仓周日平仓的方式有效控制了单周最大交易次数。同时,严格的止盈止损规则也限制了单笔交易的最大亏损。综合来看,本策略从趋势判断和风险控制两个维度进行优化设计,是一种较为稳健的量化交易策略。

策略源码

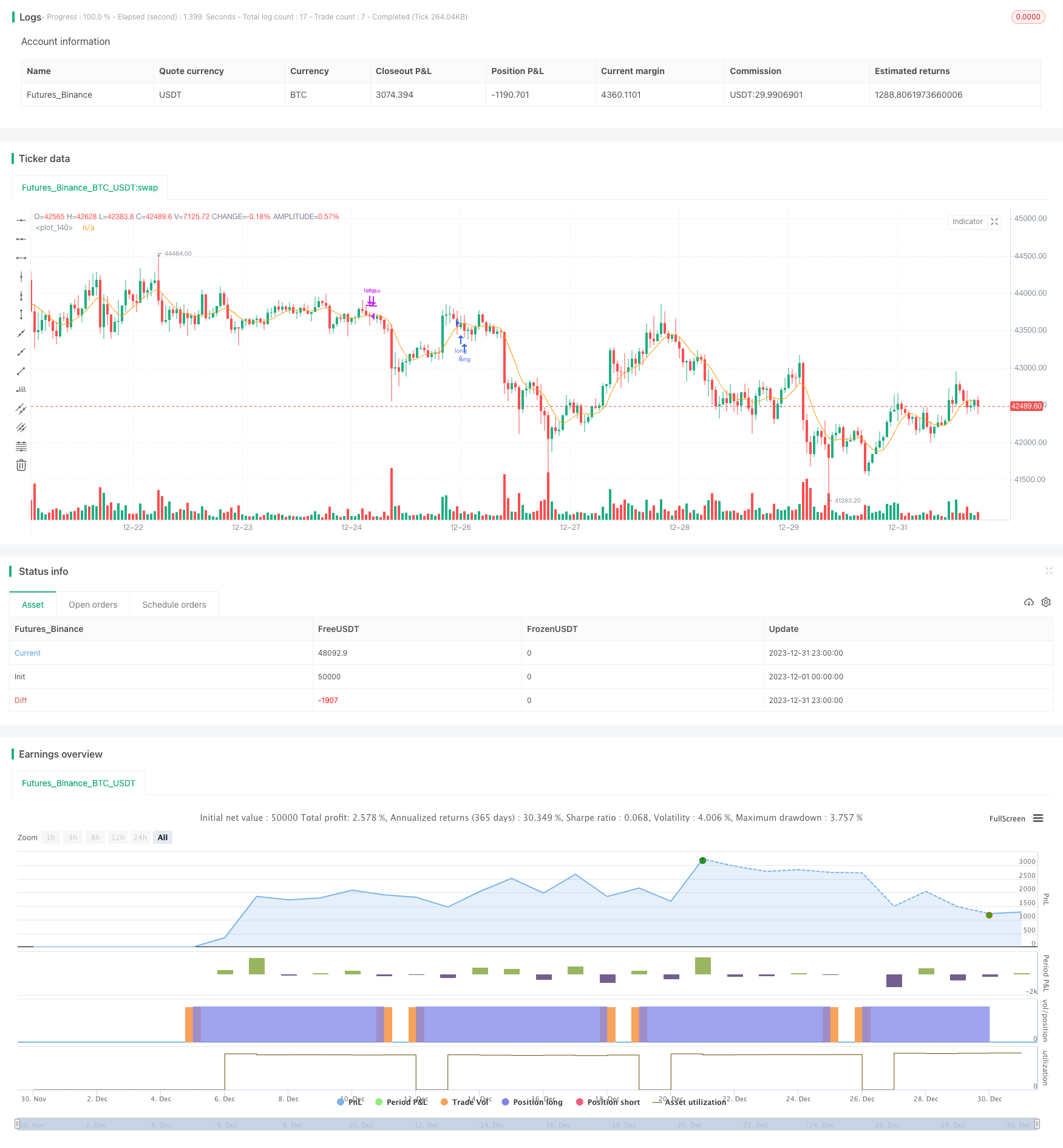

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © exlux99

//@version=5

strategy('Time MA strategy ', overlay=true)

longEntry = input.bool(true, group="Type of Entries")

shortEntry = input.bool(false, group="Type of Entries")

//==========DEMA

getDEMA(src, len) =>

dema = 2 * ta.ema(src, len) - ta.ema(ta.ema(src, len), len)

dema

//==========HMA

getHULLMA(src, len) =>

hullma = ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

hullma

//==========KAMA

getKAMA(src, len, k1, k2) =>

change = math.abs(ta.change(src, len))

volatility = math.sum(math.abs(ta.change(src)), len)

efficiency_ratio = volatility != 0 ? change / volatility : 0

kama = 0.0

fast = 2 / (k1 + 1)

slow = 2 / (k2 + 1)

smooth_const = math.pow(efficiency_ratio * (fast - slow) + slow, 2)

kama := nz(kama[1]) + smooth_const * (src - nz(kama[1]))

kama

//==========TEMA

getTEMA(src, len) =>

e = ta.ema(src, len)

tema = 3 * (e - ta.ema(e, len)) + ta.ema(ta.ema(e, len), len)

tema

//==========ZLEMA

getZLEMA(src, len) =>

zlemalag_1 = (len - 1) / 2

zlemadata_1 = src + src - src[zlemalag_1]

zlema = ta.ema(zlemadata_1, len)

zlema

//==========FRAMA

getFRAMA(src, len) =>

Price = src

N = len

if N % 2 != 0

N := N + 1

N

N1 = 0.0

N2 = 0.0

N3 = 0.0

HH = 0.0

LL = 0.0

Dimen = 0.0

alpha = 0.0

Filt = 0.0

N3 := (ta.highest(N) - ta.lowest(N)) / N

HH := ta.highest(N / 2 - 1)

LL := ta.lowest(N / 2 - 1)

N1 := (HH - LL) / (N / 2)

HH := high[N / 2]

LL := low[N / 2]

for i = N / 2 to N - 1 by 1

if high[i] > HH

HH := high[i]

HH

if low[i] < LL

LL := low[i]

LL

N2 := (HH - LL) / (N / 2)

if N1 > 0 and N2 > 0 and N3 > 0

Dimen := (math.log(N1 + N2) - math.log(N3)) / math.log(2)

Dimen

alpha := math.exp(-4.6 * (Dimen - 1))

if alpha < .01

alpha := .01

alpha

if alpha > 1

alpha := 1

alpha

Filt := alpha * Price + (1 - alpha) * nz(Filt[1], 1)

if bar_index < N + 1

Filt := Price

Filt

Filt

//==========VIDYA

getVIDYA(src, len) =>

mom = ta.change(src)

upSum = math.sum(math.max(mom, 0), len)

downSum = math.sum(-math.min(mom, 0), len)

out = (upSum - downSum) / (upSum + downSum)

cmo = math.abs(out)

alpha = 2 / (len + 1)

vidya = 0.0

vidya := src * alpha * cmo + nz(vidya[1]) * (1 - alpha * cmo)

vidya

//==========JMA

getJMA(src, len, power, phase) =>

phase_ratio = phase < -100 ? 0.5 : phase > 100 ? 2.5 : phase / 100 + 1.5

beta = 0.45 * (len - 1) / (0.45 * (len - 1) + 2)

alpha = math.pow(beta, power)

MA1 = 0.0

Det0 = 0.0

MA2 = 0.0

Det1 = 0.0

JMA = 0.0

MA1 := (1 - alpha) * src + alpha * nz(MA1[1])

Det0 := (src - MA1) * (1 - beta) + beta * nz(Det0[1])

MA2 := MA1 + phase_ratio * Det0

Det1 := (MA2 - nz(JMA[1])) * math.pow(1 - alpha, 2) + math.pow(alpha, 2) * nz(Det1[1])

JMA := nz(JMA[1]) + Det1

JMA

//==========T3

getT3(src, len, vFactor) =>

ema1 = ta.ema(src, len)

ema2 = ta.ema(ema1, len)

ema3 = ta.ema(ema2, len)

ema4 = ta.ema(ema3, len)

ema5 = ta.ema(ema4, len)

ema6 = ta.ema(ema5, len)

c1 = -1 * math.pow(vFactor, 3)

c2 = 3 * math.pow(vFactor, 2) + 3 * math.pow(vFactor, 3)

c3 = -6 * math.pow(vFactor, 2) - 3 * vFactor - 3 * math.pow(vFactor, 3)

c4 = 1 + 3 * vFactor + math.pow(vFactor, 3) + 3 * math.pow(vFactor, 2)

T3 = c1 * ema6 + c2 * ema5 + c3 * ema4 + c4 * ema3

T3

//==========TRIMA

getTRIMA(src, len) =>

N = len + 1

Nm = math.round(N / 2)

TRIMA = ta.sma(ta.sma(src, Nm), Nm)

TRIMA

src = input.source(close, title='Source', group='Parameters')

len = input.int(17, minval=1, title='Moving Averages', group='Parameters')

out_ma_source = input.string(title='MA Type', defval='ALMA', options=['SMA', 'EMA', 'WMA', 'ALMA', 'SMMA', 'LSMA', 'VWMA', 'DEMA', 'HULL', 'KAMA', 'FRAMA', 'VIDYA', 'JMA', 'TEMA', 'ZLEMA', 'T3', 'TRIM'], group='Parameters')

out_ma = out_ma_source == 'SMA' ? ta.sma(src, len) : out_ma_source == 'EMA' ? ta.ema(src, len) : out_ma_source == 'WMA' ? ta.wma(src, len) : out_ma_source == 'ALMA' ? ta.alma(src, len, 0.85, 6) : out_ma_source == 'SMMA' ? ta.rma(src, len) : out_ma_source == 'LSMA' ? ta.linreg(src, len, 0) : out_ma_source == 'VWMA' ? ta.vwma(src, len) : out_ma_source == 'DEMA' ? getDEMA(src, len) : out_ma_source == 'HULL' ? ta.hma(src, len) : out_ma_source == 'KAMA' ? getKAMA(src, len, 2, 30) : out_ma_source == 'FRAMA' ? getFRAMA(src, len) : out_ma_source == 'VIDYA' ? getVIDYA(src, len) : out_ma_source == 'JMA' ? getJMA(src, len, 2, 50) : out_ma_source == 'TEMA' ? getTEMA(src, len) : out_ma_source == 'ZLEMA' ? getZLEMA(src, len) : out_ma_source == 'T3' ? getT3(src, len, 0.7) : out_ma_source == 'TRIM' ? getTRIMA(src, len) : na

plot(out_ma)

long = close> out_ma and close[1] < out_ma and dayofweek==dayofweek.monday

short = close< out_ma and close[1] > out_ma and dayofweek==dayofweek.monday

stopPer = input.float(10.0, title='LONG Stop Loss % ', group='Fixed Risk Management') / 100

takePer = input.float(30.0, title='LONG Take Profit %', group='Fixed Risk Management') / 100

stopPerShort = input.float(5.0, title='SHORT Stop Loss % ', group='Fixed Risk Management') / 100

takePerShort = input.float(10.0, title='SHORT Take Profit %', group='Fixed Risk Management') / 100

longStop = strategy.position_avg_price * (1 - stopPer)

longTake = strategy.position_avg_price * (1 + takePer)

shortStop = strategy.position_avg_price * (1 + stopPerShort)

shortTake = strategy.position_avg_price * (1 - takePerShort)

// strategy.risk.max_intraday_filled_orders(2) // After 10 orders are filled, no more strategy orders will be placed (except for a market order to exit current open market position, if there is any).

if(longEntry)

strategy.entry("long",strategy.long,when=long )

strategy.exit('LONG EXIT', "long", limit=longTake, stop=longStop)

strategy.close("long",when=dayofweek==dayofweek.sunday)

if(shortEntry)

strategy.entry("short",strategy.short,when=short )

strategy.exit('SHORT EXIT', "short", limit=shortTake, stop=shortStop)

strategy.close("short",when=dayofweek==dayofweek.sunday)