概述

这个策略利用前一日的开盘价和收盘价,以及快线EMA和慢线EMA的组合,在用户定义的交易时间段内,判断市场的价值方向,并做出相应的买入或卖出操作。同时,策略使用追踪止损来锁定利润或限制损失。

策略原理

该策略判断金本位的价值方向主要基于两点:

前一日的收盘价相对于开盘价的涨跌。如果收盘价高于开盘价,表示当日的价值整体上升;如果收盘价低于开盘价,表示当日的价值整体下跌。

50周期的快线EMA与200周期的慢线EMA的位置关系。如果快线在慢线之上,表示短期的价值上升速度大于长期趋势;如果快线在慢线之下,表示短期的价值上升速度小于长期趋势。

在符合做多条件时,如果前一日收盘价高于开盘价,当前价高于前一日开盘价,且快线EMA高于慢线EMA,并且在用户定义的交易时间内,则策略做多金本位。

在符合做空条件时,如果前一日收盘价低于开盘价,当前价低于前一日开盘价,且快线EMA低于慢线EMA,并且在用户定义的交易时间内,则策略做空金本位。

此外,策略使用追踪止损来锁定利润或限制损失。追踪止损距离根据用户设定的初始距离和移动步进来调整。

优势分析

该策略有以下优势:

利用多种指标判断金本位的价值方向,降低了错误交易的概率。

追踪止损可以有效锁定利润,在行情反转时及时止损,降低风险。

用户可以根据自己的交易时间选择合适的交易区间,避免在机构性操作时段被套牢。

EMA的周期值可以根据市场变化进行调整优化,使策略更具弹性。

风险分析

该策略也存在一定风险:

在突发事件发生时,策略可能会产生较大亏损。这需要人工干预或设置更为宽松的止损距离。

EMA并不能完全过滤市场噪音。当EMA产生错误信号时,会引发不必要的交易。可以适当优化EMA参数或增加其他过滤指标。

追踪止损距离设置不当也会增加风险。距离过近很容易被止损出局;距离过远则不能有效控制损失。需要测试确定最佳参数。

优化方向

该策略还可以从以下几个方面进行优化:

增加其他技术指标过滤信号,如MACD、Bollinger Bands等,降低EMA错误信号的概率。

将追踪止损改为自适应止损,根据市场波动程度智能调整止损距离。

增加仓位管理模块,Allow分仓进行风险控制,降低单笔损失的影响。

增加机器学习模型判断趋势方向,利用更多历史数据提高判断准确性。

优化交易时间段的选择,结合常态分布选择策略参与度更高的交易区间。

总结

该策略整体来说是一种典型的趋势跟随策略。它结合多种指标判断价值上升下降的趋势方向,属于较为稳健的策略类型。追踪止损的应用也使其可以有效控制损失。通过对指标和止损规则的不断优化,可以使策略在回报和风险控制之间达到更好的平衡。它适用于有一定量化投资基础而想参与数字货币交易的投资者。

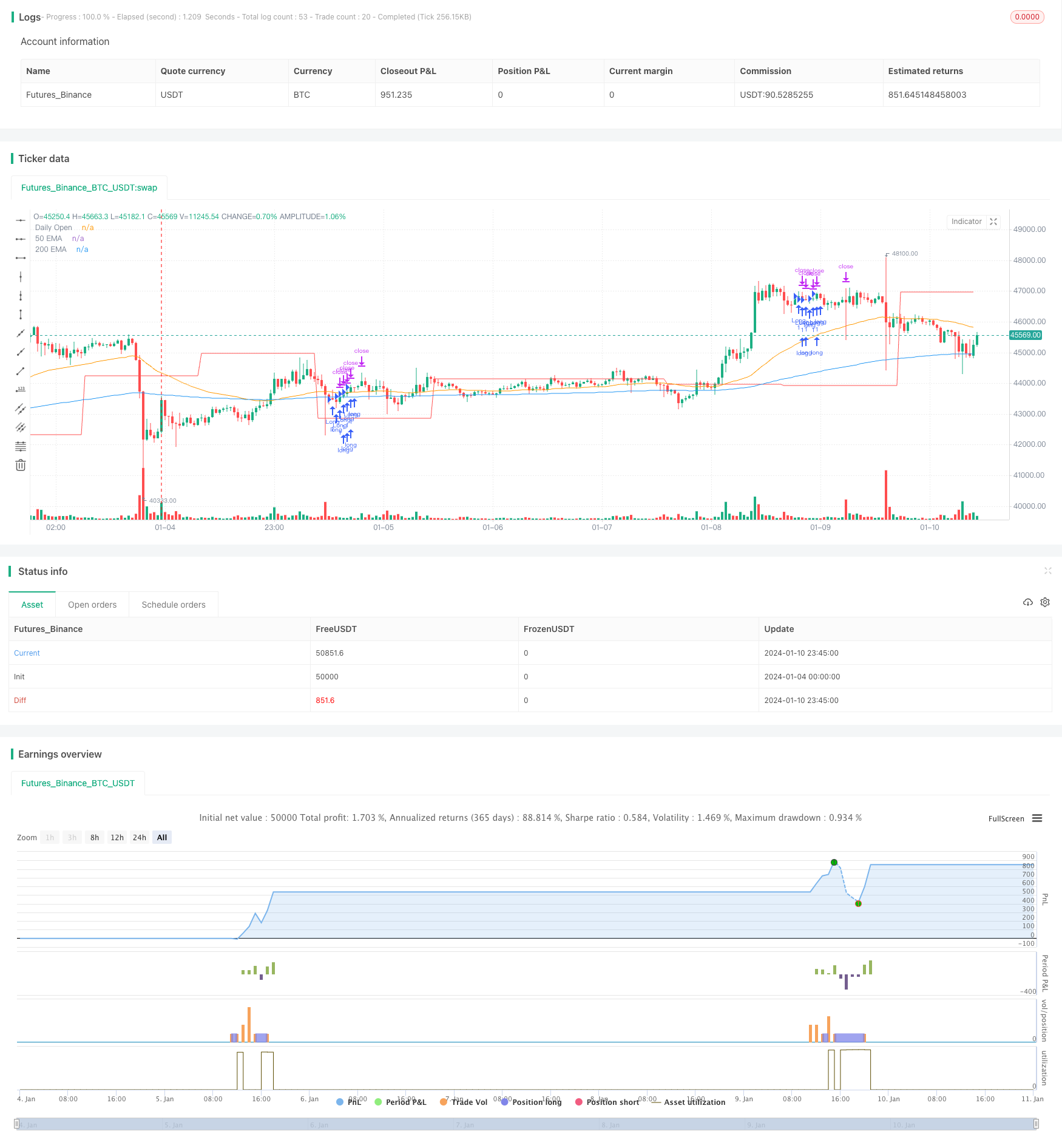

/*backtest

start: 2024-01-04 00:00:00

end: 2024-01-11 00:00:00

period: 45m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("My Strategy", overlay=true)

// Inputs for user to modify

startHour = input(11, title="Start Hour")

endHour = input(16, title="End Hour")

trailingStop = input(100, title="Trailing Stop Start (pips)")

trailingStep = input(10, title="Trailing Step (pips)")

// Define the EMAs

longEma = ema(close, 200)

shortEma = ema(close, 50)

// Calculate daily open, high, low, close

daily_open = security(syminfo.tickerid, "D", open[1])

daily_close = security(syminfo.tickerid, "D", close[1])

// Time conditions

timeAllowed = (hour >= startHour) and (hour <= endHour)

// Define long condition based on your criteria

longCondition = (daily_close > daily_open) and (close > daily_open) and (shortEma > longEma) and timeAllowed

// Define short condition based on your criteria

shortCondition = (daily_close < daily_open) and (close < daily_open) and (shortEma < longEma) and timeAllowed

// Enter the trade

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

// Trailing Stop Loss

strategy.exit("Exit Long", "Long", trail_points = trailingStop / syminfo.mintick, trail_offset = trailingStep / syminfo.mintick)

strategy.exit("Exit Short", "Short", trail_points = trailingStop / syminfo.mintick, trail_offset = trailingStep / syminfo.mintick)

// Plotting

plot(daily_open, color=color.red, title="Daily Open")

plot(longEma, color=color.blue, title="200 EMA")

plot(shortEma, color=color.orange, title="50 EMA")