概述

该策略是一个基于价格Channel的突破策略,结合了均线指标和跟踪止损/止盈来进行入场和退出。它使用高低价的均线构建价格Channel,在价格突破Channel时入场做多/空,并使用固定止损或 trailing stop来控制风险。

策略原理

该策略通过计算高低价的均线,形成一个价格Channel。具体来说,是计算长度为10的高价和低价的SMA均线,形成Channel的上轨和下轨。当价格从下轨突破到上轨时,做多入场;当价格从上轨突破到下轨时,做空入场。

在入场后,策略采用固定止损或 trailing stop来退出持仓。trailing stop 包括两个参数:固定止盈位和 activating offset。当价格达到激活偏移量时,止盈位会被 trail 跟踪价格。这可以锁定利润,同时保持让利空间。

该策略同时结合了时间段过滤,只在指定的历史日期内进行回测,可以测试不同市场阶段的表现。

优势分析

该策略采用价格Channel和趋势跟踪止损,可以捕捉中长线趋势的方向。相比单纯的移动均线策略,它减少了因价格震荡造成的无效交易。通过 trailing stop,可以dynamically trail 价格来锁定利润。

整体来说,该策略逻辑清晰,使用指标和参数较少,回测容易,适合中长线趋势交易,可以在强势行情中获利。

风险分析

该策略在震荡行情中容易被套住退出,无法持久获利。此外,在极端行情中,价格可能直接突破止损位造成较大亏损。

参数设置比较主观,不同市场阶段需要调整参数。固定的止盈位和激活偏移量,无法根据市场波动程度做调整。

优化方向

可以考虑结合其他指标过滤入场信号,例如成交量,布林带等,避免被套。或使用动态止损,根据ATR 或价格波动程度来设置止损位。

退出规则可以优化为移动止损或 Chandelier Exit。当价格重新进入Channel时也可以考虑部分退出。入场过滤和退出规则的优化可以大幅提高策略稳定性。

总结

本策略整体是一个基于价格Channel、趋势跟踪、止损/止盈管理的量化策略。它具有清晰的逻辑结构、简单的参数结构,容易理解和回测,适合用来学习量化交易。该策略可以通过多种方式进行优化,提高稳定性和盈利能力。其核心思路为捕捉价格趋势的方向,并通过止损和止盈来控制风险,可以运用到多种品种和时间周期。

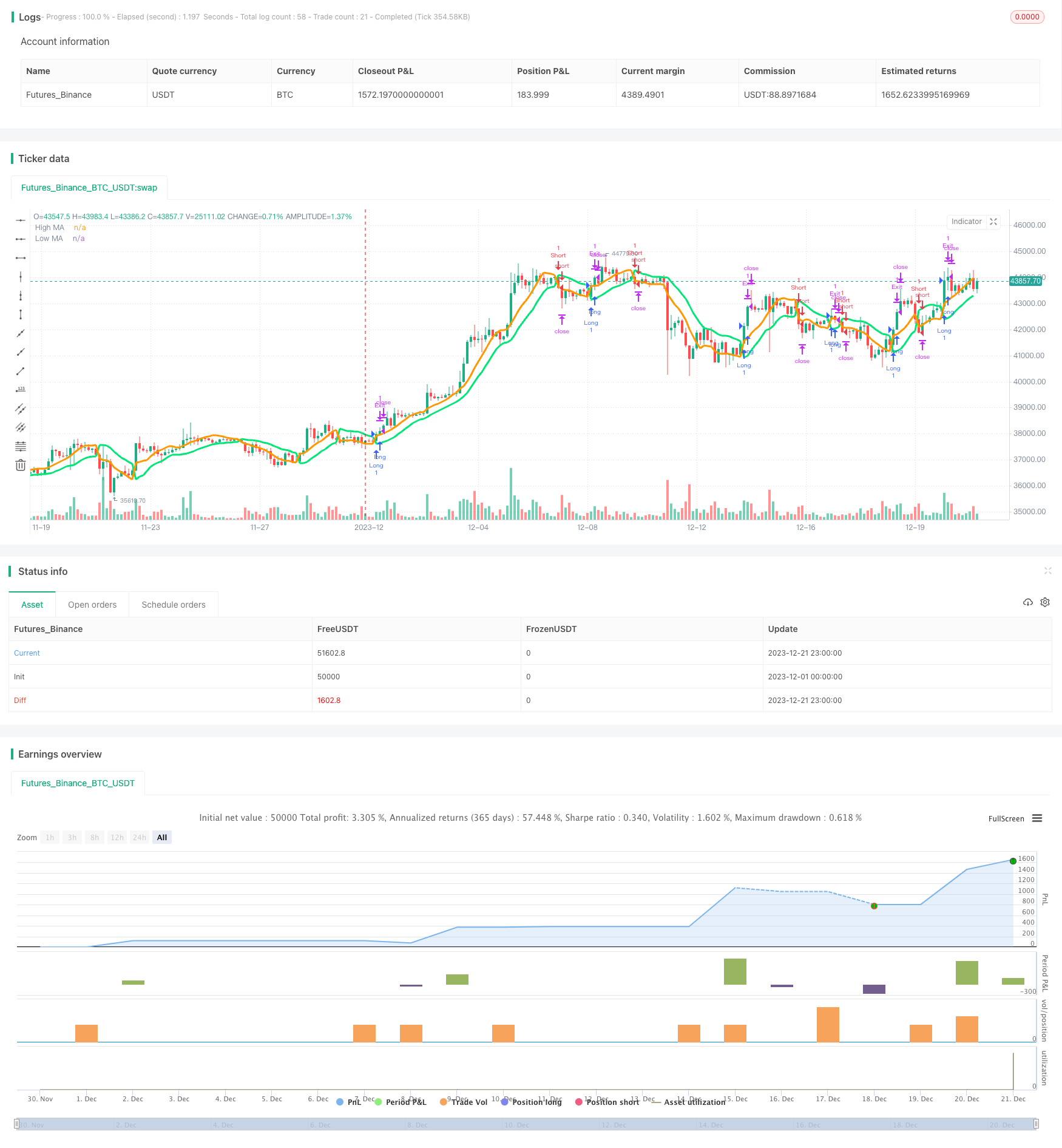

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-21 23:59:59

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("Generalized SSL Backtest w/ TSSL", shorttitle="GSSL Backtest", overlay=true )

// Generalized SSL:

// This is the very first time the SSL indicator, whose acronym I ignore, is on Tradingview.

// It is based on moving averages of the highs and lows.

// Similar channel indicators can be found, whereas

// this one implements the persistency inside the channel, which is rather tricky.

// The green line is the base line which decides entries and exits, possibly with trailing stops.

// With respect to the original version, here one can play with different moving averages.

// The default settings are (10,SMA)

//

// Vitelot/Yanez/Vts March 2019

lb = input(10, title="Lb", minval=1)

maType = input( defval="SMA", title="MA Type", options=["SMA","EMA","HMA","McG","WMA","Tenkan"])

fixedSL = input(title="SL Activation", defval=300)

trailSL = input(title="SL Trigger", defval=1)

fixedTP = input(title="TP Activation", defval=150)

trailTP = input(title="TP Trigger", defval=1)

FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2019, title = "From Year", minval = 2017)

ToMonth = input(defval = 6, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 19, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 2020, title = "To Year", minval = 2017)

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

startTimeOk() => true // create function "within window of time" if statement true

// QUANDL:BCHAIN/ETRVU is USD-denominated daily transaction value on BTC blockchain

// QUANDL:BCHAIN/MKTCP is USD-denominated Bitcoin marketcap

hma(sig, n) => // Hull moving average definition

wma( 2*wma(sig,round(n/2))-wma(sig,n), round(sqrt(n)))

mcg(sig,length) => // Mc Ginley MA definition

mg = 0.0

mg := na(mg[1]) ? ema(sig, length) : mg[1] + (sig - mg[1]) / (length * pow(sig/mg[1], 4))

tenkan(sig,len) =>

0.5*(highest(sig,len)+lowest(sig,len))

ma(t,sig,len) =>

sss=na

if t =="SMA"

sss := sma(sig,len)

if t == "EMA"

sss := ema(sig,len)

if t == "HMA"

sss := hma(sig,len)

if t == "McG" // Mc Ginley

sss := mcg(sig,len)

if t == "Tenkan"

sss := tenkan(sig,len)

if t == "WMA"

sss := wma(sig,len)

sss

base(mah, mal) =>

bbb = na

inChannel = close<mah and close>mal

belowChannel = close<mah and close<mal

bbb := inChannel? bbb[1]: belowChannel? -1: 1

uuu = bbb==1? mal: mah

ddd = bbb==1? mah: mal

[uuu, ddd]

maH = ma(maType, high, lb)

maL = ma(maType, low, lb)

[up, dn] = base(maH,maL)

plot(up, title="High MA", color=lime, linewidth=3)

plot(dn, title="Low MA", color=orange, linewidth=3)

long = crossover(dn,up)

short = crossover(up,dn)

// === STRATEGY - LONG POSITION EXECUTION ===

strategy.entry("Long", strategy.long, when= long and startTimeOk())

strategy.exit("Exit", qty_percent = 100, loss=fixedSL, trail_offset=trailTP, trail_points=fixedTP)

strategy.exit("Exit", when= short)

// === STRATEGY - SHORT POSITION EXECUTION ===

strategy.entry("Short", strategy.short, when= short and startTimeOk())

strategy.exit("Exit", qty_percent = 100, loss=fixedSL, trail_offset=trailTP, trail_points=fixedTP)

strategy.exit("Exit", when= long)