Myo_LS_D量化策略

概述

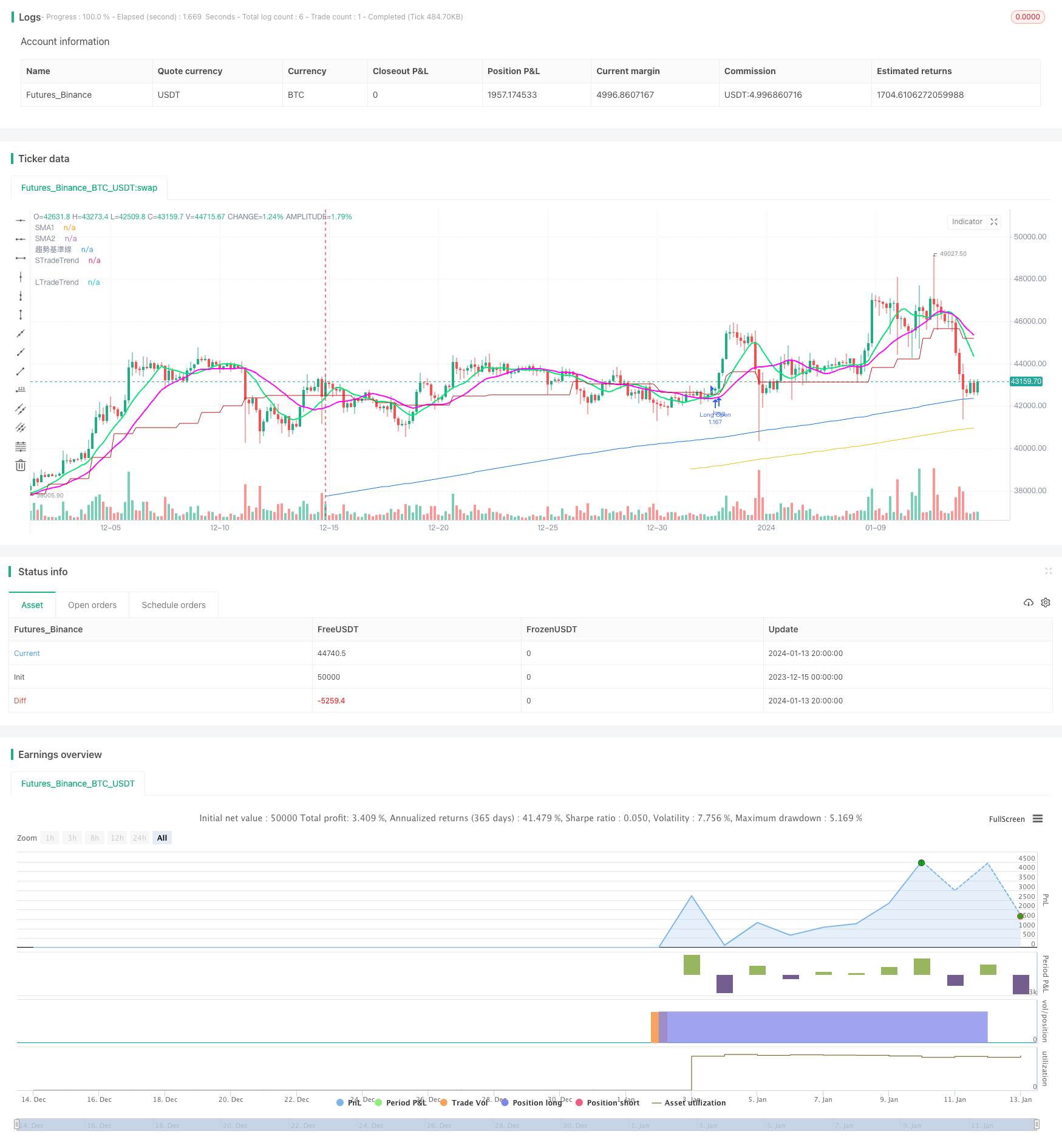

Myo_LS_D量化策略是一个基于多空双轨的追踪止盈策略。该策略综合利用均线、价格突破、风险回报比等多个指标构建交易信号。在趋势判断准确的前提下,实现了较高的胜率和盈利率。

策略原理

该策略主要由趋势判断模块、做多模块、做空模块、追踪止盈模块等组成。

趋势判断模块运用donchain通道判断整体趋势方向。做多进入的前提是处于上升趋势,做空则需要处于下降趋势。

做多模块考量了新的高点、低点、长线均线位置等因素。做空模块考量了新的高点、低点、短线均线位置等因素。这确保了在向上或向下突破关键价格点时建仓。

追踪止盈模块使用两条不同周期的SMA均线实时追踪价格变动。当价格跌破均线时平仓止盈。这种实时追踪可以最大化获取趋势中的利润。

止损设置考虑扩大止损,确保止损点距离支持位较远,避免被震出。

优势分析

该策略最大的优势在于多空分离建仓,追踪止盈策略。具体来说主要体现在:

多空分离可以最大化抓取单边趋势行情的盈利机会。

追踪止盈通过实时调整可以获得更高的盈利率。与传统止盈方法相比,收益能获得显著提升。

扩大止损可以减少被震出的概率,降低亏损风险。

风险及解决

该策略主要的风险集中在以下几点:

趋势判断出现错误,可能造成逆势建仓亏损。可以适当调整donchain参数或添加其他指标判断来优化。

追踪止盈过于激进,可能提前止盈无法持续获利。可以适当扩大止盈均线间距来优化。

止损范围过小,可能增加被震出概率。可以适当扩大止损幅度以降低风险。

优化方向

该策略主要可以从以下几个方面继续优化:

优化趋势判断模块,提高判断准确性。可考虑结合更多指标如MACD等来实现。

调整追踪止盈方式,进一步扩大获利空间。例如可以按比例移动止盈线等。

扩大止损范围或考虑缩进止损来进一步降低被震出概率。

不同品种参数不一样,可以训练获得最优参数组合。进一步提升策略收益。

总结

Myo_LS_D策略总体来说是一个比较成熟稳定的多空追踪止盈策略。它优势明显,风险可控,是值得长期持有使用的量化方案之一。未来通过进一步优化,可以使其收益性能得到持续提升,成为更加卓越的量化策略。

/*backtest

start: 2023-12-15 00:00:00

end: 2024-01-14 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © agresiynin

//@version=5

// ©Myo_Pionex

strategy(

title = "Myo_simple strategy_LS_D",

shorttitle = "Myo_LS_D",

overlay = true )

// var

lowest_price = ta.lowest(low, 200)

highest_price = ta.highest(high, 200)

min_800 = ta.lowest(low, 800)

max_800 = ta.highest(high, 800)

tp_target_L = min_800 + (max_800 - min_800) * math.rphi

tp_target_S = max_800 - (max_800 - min_800) * math.rphi

sl_length_L = input.int(100, "做多的止損長度", minval = 50, maxval = 300, step = 50)

sl_length_S = input.int(100, "做空的止損長度", minval = 50, maxval = 300, step = 50)

sl_L = lowest_price * (1 - 0.005)

sl_S = highest_price * (1 + 0.005)

rrr_L = tp_target_L - sl_L / sl_L

rrr_S = ta.lowest(low, 800) + ta.highest(high, 800) - ta.lowest(low, 800) * math.rphi / ta.highest(high, 200) + 0.005 * ta.highest(high, 200) - ta.lowest(low, 200) - 0.005 * ta.lowest(low, 200)

smalen1 = input.int(10, "做多追蹤止盈SMA長度1", options = [5, 10, 20, 40, 60, 80])

smalen2 = input.int(20, "做多追蹤止盈SMA長度2", options = [5, 10, 20, 40, 60, 80])

smalen1_S = input.int(5, "做空追蹤止盈SMA長度1", options = [5, 10, 20, 40, 60, 80])

smalen2_S = input.int(10, "做空追蹤止盈SMA長度2", options = [5, 10, 20, 40, 60, 80])

TrendLength_L = input.int(400, "做多趨勢線", options = [100, 200, 300, 400, 500])

TrendLength_S = input.int(300, "做空趨勢線", options = [100, 200, 300, 400, 500])

SMA1 = ta.sma(close, smalen1)

SMA2 = ta.sma(close, smalen2)

SMA1_S = ta.sma(close, smalen1_S)

SMA2_S = ta.sma(close, smalen2_S)

shortlength = input.int(20, "短期均價K線數量")

midlength = input.int(60, "中期均價K線數量")

longlength = input.int(120, "長期均價K線數量")

ShortAvg = math.sum(close, shortlength)/shortlength

MidAvg = math.sum(close, midlength)/midlength

LongAvg = math.sum(close, longlength)/longlength

// Trend

basePeriods = input.int(8, minval=1, title="趨勢基準線")

basePeriods_Short = input.int(26, "做空基準線")

donchian(len) => math.avg(ta.lowest(len), ta.highest(len))

baseLine = donchian(basePeriods)

baseLine_Short = donchian(basePeriods_Short)

trend = request.security(syminfo.tickerid, "D", baseLine)

isUptrend = false

isDowntrend = false

baseLine_D = request.security(syminfo.tickerid, "D", baseLine)

plot(baseLine_D, color=#B71C1C, title="趨勢基準線")

if close[0] > baseLine_D

isUptrend := true

if close[0] < baseLine_Short

isDowntrend := true

// Long

// Condition

// entry

con_a = low > lowest_price ? 1 : 0

con_b = high > highest_price ? 1 : 0

con_c = close[0] > ta.sma(close, TrendLength_L) ? 1 : 0

con_d = isUptrend ? 1 : 0

con_e = rrr_L > 3 ? 1 : 0

con_a1 = close[0] > ShortAvg[shortlength] ? 1 : 0

con_b1 = close[0] > MidAvg[midlength] ? 1 : 0

// close

con_f = ta.crossunder(close, SMA1) and ta.crossunder(close, SMA2) ? 1 : 0

con_g = close < ta.lowest(low, sl_length_L)[1] * (1 - 0.005) ? 1 : 0

// exit

con_h = tp_target_L

// Main calculation

LongOpen = false

AddPosition_L = false

if con_a + con_b + con_c + con_e + con_a1 + con_b1 >= 4 and con_d >= 1

LongOpen := true

// Short

// Condition

// entry

con_1 = high < highest_price ? 1 : 0

con_2 = low < lowest_price ? 1 : 0

con_3 = close[0] < ta.sma(close, TrendLength_S) ? 1 : 0

con_4 = isDowntrend ? 1 : 0

con_5 = rrr_S > 3 ? 1 : 0

con_11 = close[0] < ShortAvg[shortlength] ? 1 : 0

con_12 = close[0] < MidAvg[midlength] ? 1 : 0

// close

con_6 = ta.crossover(close, SMA1_S) and ta.crossover(close, SMA2_S) ? 1 : 0

con_7 = close > ta.highest(high, sl_length_S)[1] * (1 + 0.005) ? 1 : 0

// exit

con_8 = tp_target_S

// Main calculation

ShortOpen = false

AddPosition_S = false

if con_1 + con_2 + con_3 + con_4 + con_5 + con_11 + con_12 >= 5

ShortOpen := true

//

// execute

//

strategy.initial_capital = 50000

if strategy.position_size == 0

if LongOpen

strategy.entry("Long Open" , strategy.long , comment= "Long Open " + str.tostring(close[0]), qty=strategy.initial_capital/close[0])

if strategy.position_size > 0

if (con_f > 0 or con_g > 0 or ShortOpen) and close <= baseLine_D

strategy.close_all(comment="Close Long " + str.tostring(close[0]))

if strategy.position_size == 0

if ShortOpen

strategy.entry("Short Open" , strategy.short , comment= "Short Open " + str.tostring(close[0]), qty=strategy.initial_capital/close[0])

if strategy.position_size < 0

if (con_6 > 0 or con_7 > 0 or LongOpen) and close >= baseLine_D

strategy.close_all(comment="Close Short " + str.tostring(close[0]))

plot(ta.sma(close, TrendLength_L), color=#e5c212, title="LTradeTrend")

plot(ta.sma(close, TrendLength_S), color=#1275e5, title="STradeTrend")

plot(SMA1, "SMA1", color = color.lime, linewidth = 2)

plot(SMA2, "SMA2", color = color.rgb(255, 0, 255), linewidth = 2)