概述

该策略是一个基于TradingView平台的自适应智能网格交易策略,使用Pine Script v4编写。它在价格表上覆盖,并在指定的范围内创建一个网格,以生成买入和卖出信号。

策略原理

关键功能

金字塔形和资金管理:

- 允许同向最多14次追加(金字塔),

- 使用基于现金的策略管理头寸大小,

- 为模拟目的,初始资本设定为100美元,

- 每次交易收取0.1%的佣金。

网格范围:

- 用户可以选择使用自动计算的范围或手动设置网格的上下限,

- 自动范围可以从最近的价格高点和低点或从简单移动平均线(SMA)导出,

- 用户可以定义用于计算范围的回看周期,并调整偏差以扩大或缩小范围。

网格线:

- 该策略允许在范围内的可自定义数量的网格线,建议范围在3至15之间,

- 网格线在上限和下限之间均匀间隔。

策略逻辑

持仓进入:

- 当价格跌破网格线且该网格线没有相关的未平仓订单时,脚本会下买单,

- 每个买单数量根据初始资金除以网格线数量计算,并根据当前价格调整。

持仓退出:

- 当价格上涨超过更高的网格线,且存在与下一个更低网格线相关的未平仓订单时,会触发卖出信号。

自适应网格:

- 如果使用自动范围,则网格会通过重新计算上下限并相应调整,来适应变化的市场条件。

优势分析

该策略集成了网格交易的系统性和高效执行的优势。允许追加且使用资金管理,可以有效控制风险;网格自动自适应市场,适用于不同行情;参数可调整,适应不同交易风格。

风险分析

价格突破网格上下限可能造成较大损失。应适当调整参数,或结合止损来控制风险。此外,过于频繁交易会增加交易费用。

优化方向

可以考虑结合趋势指标过滤信号或优化网格参数,也可以通过止损来防范极端行情的风险。

总结

本策略系统地生成买卖点并管理头寸,通过参数调整可适应不同偏好。它将网格交易的规则性与趋势交易的灵活性有机结合,既降低了操作难度,又具备一定的容错性。

策略源码

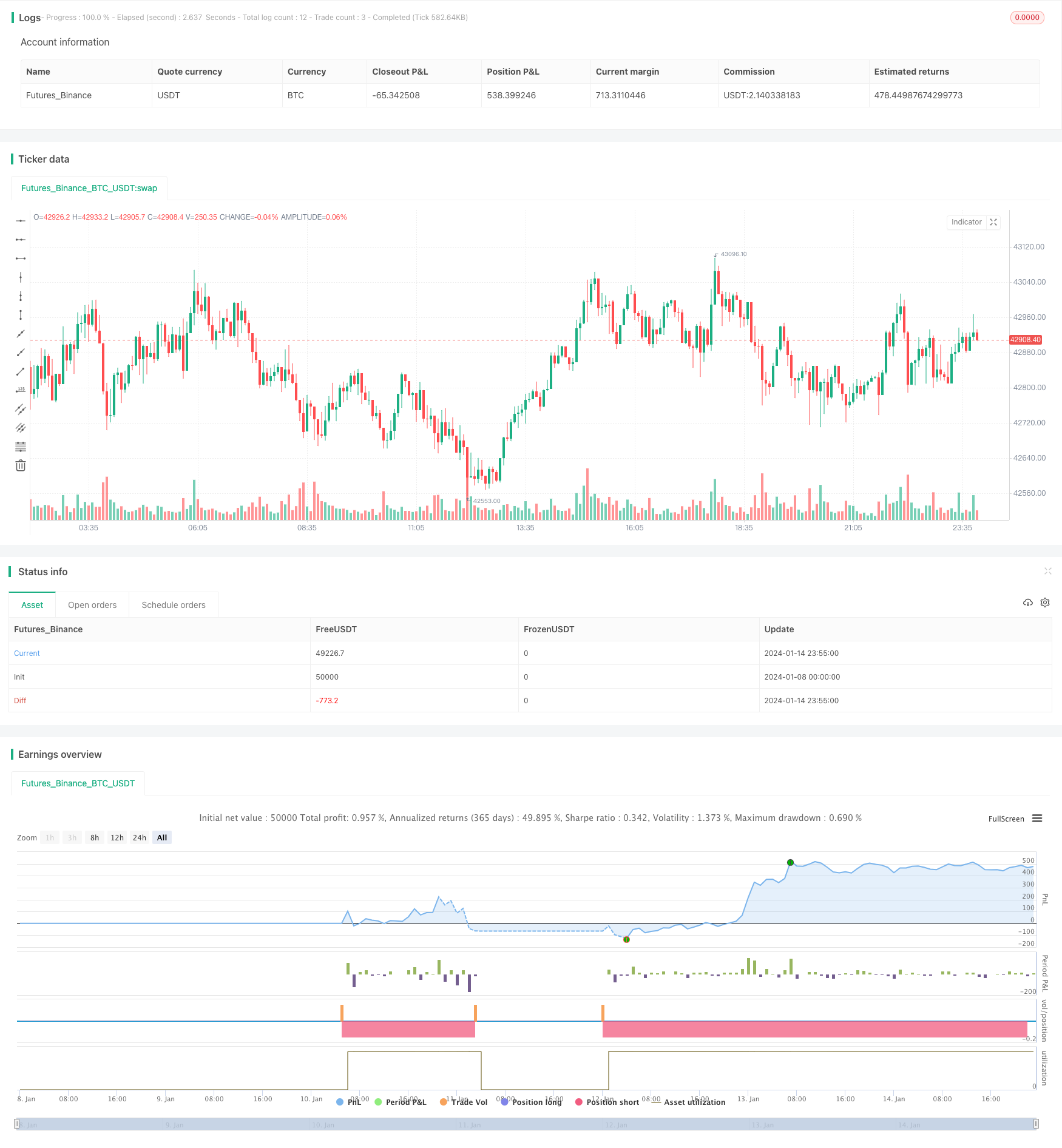

/*backtest

start: 2024-01-08 00:00:00

end: 2024-01-15 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("(IK) Grid Script", overlay=true, pyramiding=14, close_entries_rule="ANY", default_qty_type=strategy.cash, initial_capital=100.0, currency="USD", commission_type=strategy.commission.percent, commission_value=0.1)

i_autoBounds = input(group="Grid Bounds", title="Use Auto Bounds?", defval=true, type=input.bool) // calculate upper and lower bound of the grid automatically? This will theorhetically be less profitable, but will certainly require less attention

i_boundSrc = input(group="Grid Bounds", title="(Auto) Bound Source", defval="Hi & Low", options=["Hi & Low", "Average"]) // should bounds of the auto grid be calculated from recent High & Low, or from a Simple Moving Average

i_boundLookback = input(group="Grid Bounds", title="(Auto) Bound Lookback", defval=250, type=input.integer, maxval=500, minval=0) // when calculating auto grid bounds, how far back should we look for a High & Low, or what should the length be of our sma

i_boundDev = input(group="Grid Bounds", title="(Auto) Bound Deviation", defval=0.10, type=input.float, maxval=1, minval=-1) // if sourcing auto bounds from High & Low, this percentage will (positive) widen or (negative) narrow the bound limits. If sourcing from Average, this is the deviation (up and down) from the sma, and CANNOT be negative.

i_upperBound = input(group="Grid Bounds", title="(Manual) Upper Boundry", defval=0.285, type=input.float) // for manual grid bounds only. The upperbound price of your grid

i_lowerBound = input(group="Grid Bounds", title="(Manual) Lower Boundry", defval=0.225, type=input.float) // for manual grid bounds only. The lowerbound price of your grid.

i_gridQty = input(group="Grid Lines", title="Grid Line Quantity", defval=8, maxval=15, minval=3, type=input.integer) // how many grid lines are in your grid

f_getGridBounds(_bs, _bl, _bd, _up) =>

if _bs == "Hi & Low"

_up ? highest(close, _bl) * (1 + _bd) : lowest(close, _bl) * (1 - _bd)

else

avg = sma(close, _bl)

_up ? avg * (1 + _bd) : avg * (1 - _bd)

f_buildGrid(_lb, _gw, _gq) =>

gridArr = array.new_float(0)

for i=0 to _gq-1

array.push(gridArr, _lb+(_gw*i))

gridArr

f_getNearGridLines(_gridArr, _price) =>

arr = array.new_int(3)

for i = 0 to array.size(_gridArr)-1

if array.get(_gridArr, i) > _price

array.set(arr, 0, i == array.size(_gridArr)-1 ? i : i+1)

array.set(arr, 1, i == 0 ? i : i-1)

break

arr

var upperBound = i_autoBounds ? f_getGridBounds(i_boundSrc, i_boundLookback, i_boundDev, true) : i_upperBound // upperbound of our grid

var lowerBound = i_autoBounds ? f_getGridBounds(i_boundSrc, i_boundLookback, i_boundDev, false) : i_lowerBound // lowerbound of our grid

var gridWidth = (upperBound - lowerBound)/(i_gridQty-1) // space between lines in our grid

var gridLineArr = f_buildGrid(lowerBound, gridWidth, i_gridQty) // an array of prices that correspond to our grid lines

var orderArr = array.new_bool(i_gridQty, false) // a boolean array that indicates if there is an open order corresponding to each grid line

var closeLineArr = f_getNearGridLines(gridLineArr, close) // for plotting purposes - an array of 2 indices that correspond to grid lines near price

var nearTopGridLine = array.get(closeLineArr, 0) // for plotting purposes - the index (in our grid line array) of the closest grid line above current price

var nearBotGridLine = array.get(closeLineArr, 1) // for plotting purposes - the index (in our grid line array) of the closest grid line below current price

strategy.initial_capital = 50000

for i = 0 to (array.size(gridLineArr) - 1)

if close < array.get(gridLineArr, i) and not array.get(orderArr, i) and i < (array.size(gridLineArr) - 1)

buyId = i

array.set(orderArr, buyId, true)

strategy.entry(id=tostring(buyId), long=true, qty=(strategy.initial_capital/(i_gridQty-1))/close, comment="#"+tostring(buyId))

if close > array.get(gridLineArr, i) and i != 0

if array.get(orderArr, i-1)

sellId = i-1

array.set(orderArr, sellId, false)

strategy.close(id=tostring(sellId), comment="#"+tostring(sellId))

if i_autoBounds

upperBound := f_getGridBounds(i_boundSrc, i_boundLookback, i_boundDev, true)

lowerBound := f_getGridBounds(i_boundSrc, i_boundLookback, i_boundDev, false)

gridWidth := (upperBound - lowerBound)/(i_gridQty-1)

gridLineArr := f_buildGrid(lowerBound, gridWidth, i_gridQty)

closeLineArr := f_getNearGridLines(gridLineArr, close)

nearTopGridLine := array.get(closeLineArr, 0)

nearBotGridLine := array.get(closeLineArr, 1)