概述

三均线黄金交叉交易策略是一种典型的技术分析策略。该策略同时利用三条不同时间长度的移动平均线来捕捉趋势,实现低风险交易。当短期移动平均线上穿中期移动平均线,并且中期移动平均线高于长期移动平均线时,产生买入信号;当短期移动平均线下穿中期移动平均线,并且中期移动平均线低于长期移动平均线时,产生卖出信号。

策略原理

三均线黄金交叉策略主要依赖三条移动平均线来判断趋势方向。短期移动平均线能 sensitively 响应价格变化;中期移动平均线提供较为清晰的趋势判断;长期移动平均线过滤市场噪音,确定长期趋势方向。

当短期移动平均线上穿中期移动平均线时,表示价格开始向上突破;此时如果中期移动平均线高于长期移动平均线,则说明目前处于涨势,所以此时产生买入信号。

相反,当短期移动平均线下穿中期移动平均线时,表示价格开始向下突破;此时如果中期移动平均线低于长期移动平均线,则说明目前处于跌势,所以此时产生卖出信号。

该策略同时设置了止损止盈线。交易之后,会根据设置的止损止盈比例计算出止损和止盈价格。如果价格触及止损或止盈线,则平仓离场。

策略优势

- 利用三条移动平均线共同判断趋势,提高判断准确性

- 设置止损止盈,能够有效控制单笔交易的风险

- 可自定义移动平均线参数,适用于不同品种

- 可选择七种不同类型的移动平均线,丰富策略类型

策略风险及解决方法

三均线互相盘整时,可能产生错误信号

解决方法:适当调整移动平均线参数,避免产生错误信号

设定过激的止损止盈比例

解决方法:适当调整止损止盈比例,不能过大也不能过小

参数设置不当,导致交易频率过高或过低

解决方法:测试不同参数,寻找最优参数组合

策略优化方向

三均线黄金交叉策略可以从以下几个方面进行优化:

测试不同类型、不同长度的参数,寻找最优参数

可以测试不同长度或不同类型的移动平均线组合,以获得最佳交易效果

增加其他技术指标过滤信号

可以在策略中加入如KDJ,MACD等其他指标,进行多因素验证,过滤错误信号

根据不同品种特点选择参数

可以针对高波动品种缩短移动平均线周期;针对低波动品种加长移动平均线周期

利用机器学习方法寻找最优参数组合

通过算法自动遍历参数空间,快速定位最优参数

总结

三均线黄金交叉策略整体来说是一种较为简单实用的趋势跟踪策略。它同时利用三条移动平均线捕捉趋势方向,设置止损止盈控制风险,可以获得稳定收益。通过参数优化和加入其他技术指标,可以进一步提高策略效果。总的来说,该策略适合追求稳定获利的投资者。

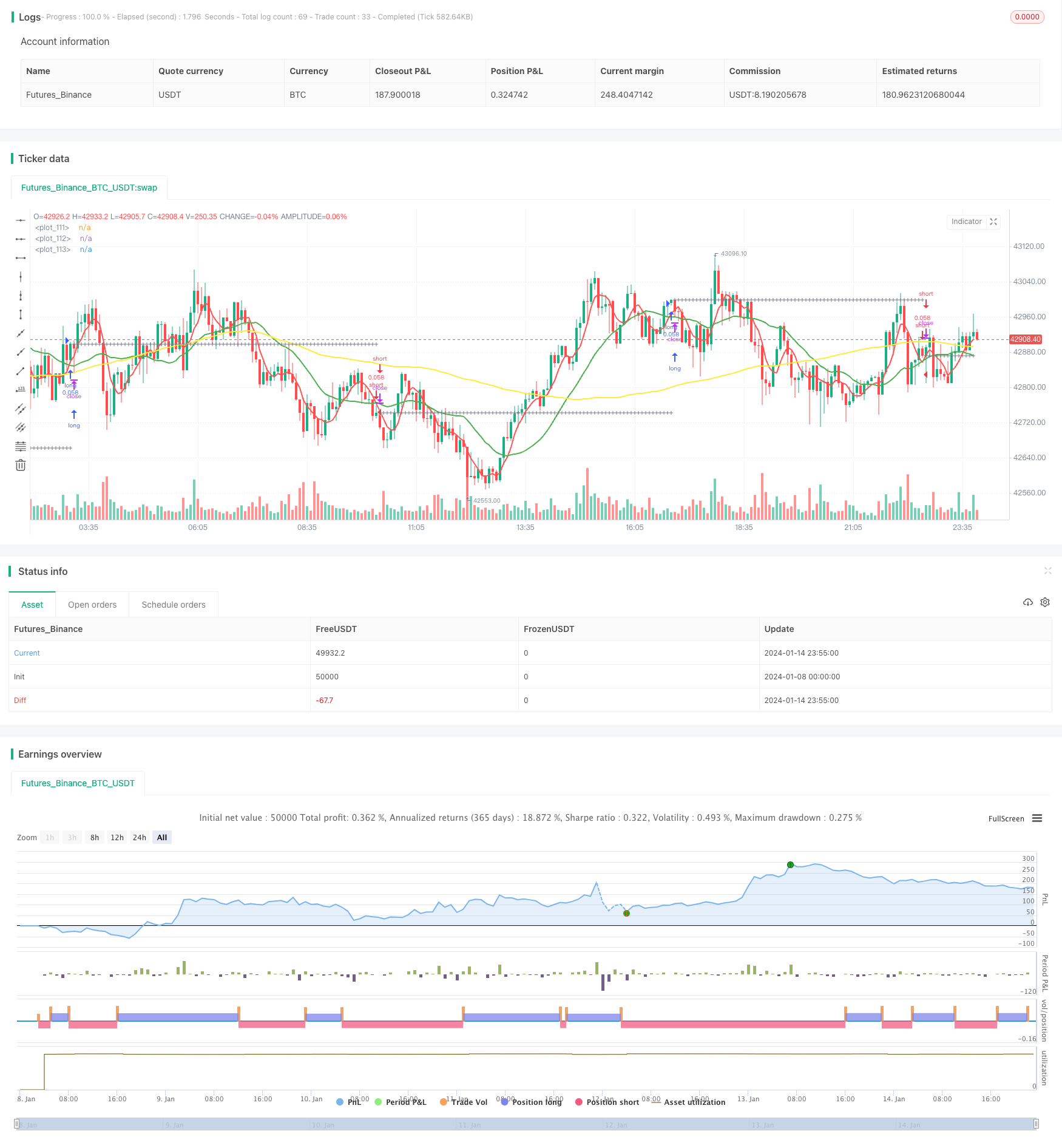

/*backtest

start: 2024-01-08 00:00:00

end: 2024-01-15 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("Kozlod - 3 MA strategy with SL/PT", shorttitle="kozlod_3ma", overlay = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 5)

//

// author: Kozlod

// date: 2018-03-25

//

////////////

// INPUTS //

////////////

ma_type = input(title = "MA Type", defval = "SMA", options = ['SMA', 'EMA', 'WMA', 'VWMA', 'HMA', 'SMMA', 'DEMA'])

short_ma_len = input(title = "Short MA Length", defval = 5, minval = 1)

short_ma_src = input(title = "Short MA Source", defval = close)

medium_ma_len = input(title = "Medium MA Length", defval = 20, minval = 2)

medium_ma_src = input(title = "Medium MA Source", defval = close)

long_ma_len = input(title = "Long MA Length", defval = 100, minval = 3)

long_ma_src = input(title = "Long MA Source", defval = close)

sl_lev_perc = input(title = "SL Level % (0 - Off)", type = float, defval = 0, minval = 0, step = 0.01)

pt_lev_perc = input(title = "PT Level % (0 - Off)", type = float, defval = 0, minval = 0, step = 0.01)

// Set initial values to 0

short_ma = 0.0

long_ma = 0.0

medium_ma = 0.0

// Simple Moving Average (SMA)

if ma_type == 'SMA'

short_ma := sma(short_ma_src, short_ma_len)

medium_ma := sma(medium_ma_src, medium_ma_len)

long_ma := sma(long_ma_src, long_ma_len)

// Exponential Moving Average (EMA)

if ma_type == 'EMA'

short_ma := ema(short_ma_src, short_ma_len)

medium_ma := ema(medium_ma_src, medium_ma_len)

long_ma := ema(long_ma_src, long_ma_len)

// Weighted Moving Average (WMA)

if ma_type == 'WMA'

short_ma := wma(short_ma_src, short_ma_len)

medium_ma := wma(medium_ma_src, medium_ma_len)

long_ma := wma(long_ma_src, long_ma_len)

// Hull Moving Average (HMA)

if ma_type == 'HMA'

short_ma := wma(2*wma(short_ma_src, short_ma_len / 2) - wma(short_ma_src, short_ma_len), round(sqrt(short_ma_len)))

medium_ma := wma(2*wma(medium_ma_src, medium_ma_len / 2) - wma(medium_ma_src, medium_ma_len), round(sqrt(medium_ma_len)))

long_ma := wma(2*wma(long_ma_src, long_ma_len / 2) - wma(long_ma_src, long_ma_len), round(sqrt(long_ma_len)))

// Volume-weighted Moving Average (VWMA)

if ma_type == 'VWMA'

short_ma := vwma(short_ma_src, short_ma_len)

medium_ma := vwma(medium_ma_src, medium_ma_len)

long_ma := vwma(long_ma_src, long_ma_len)

// Smoothed Moving Average (SMMA)

if ma_type == 'SMMA'

short_ma := na(short_ma[1]) ? sma(short_ma_src, short_ma_len) : (short_ma[1] * (short_ma_len - 1) + short_ma_src) / short_ma_len

medium_ma := na(medium_ma[1]) ? sma(medium_ma_src, medium_ma_len) : (medium_ma[1] * (medium_ma_len - 1) + medium_ma_src) / medium_ma_len

long_ma := na(long_ma[1]) ? sma(long_ma_src, long_ma_len) : (long_ma[1] * (long_ma_len - 1) + long_ma_src) / long_ma_len

// Double Exponential Moving Average (DEMA)

if ma_type == 'DEMA'

e1_short = ema(short_ma_src , short_ma_len)

e1_medium = ema(medium_ma_src, medium_ma_len)

e1_long = ema(long_ma_src, long_ma_len)

short_ma := 2 * e1_short - ema(e1_short, short_ma_len)

medium_ma := 2 * e1_medium - ema(e1_medium, medium_ma_len)

long_ma := 2 * e1_long - ema(e1_long, long_ma_len)

/////////////

// SIGNALS //

/////////////

long_signal = crossover( short_ma, medium_ma) and medium_ma > long_ma

short_signal = crossunder(short_ma, medium_ma) and medium_ma < long_ma

// Calculate PT/SL levels

// Initial values

last_signal = 0

prev_tr_price = 0.0

pt_level = 0.0

sl_level = 0.0

// Calculate previous trade price

prev_tr_price := (long_signal[1] and nz(last_signal[2]) != 1) or (short_signal[1] and nz(last_signal[2]) != -1) ? open : nz(last_signal[1]) != 0 ? prev_tr_price[1] : na

// Calculate SL/PT levels

pt_level := nz(last_signal[1]) == 1 ? prev_tr_price * (1 + pt_lev_perc / 100) : nz(last_signal[1]) == -1 ? prev_tr_price * (1 - pt_lev_perc / 100) : na

sl_level := nz(last_signal[1]) == 1 ? prev_tr_price * (1 - sl_lev_perc / 100) : nz(last_signal[1]) == -1 ? prev_tr_price * (1 + sl_lev_perc / 100) : na

// Calculate if price hit sl/pt

long_hit_pt = pt_lev_perc > 0 and nz(last_signal[1]) == 1 and close >= pt_level

long_hit_sl = sl_lev_perc > 0 and nz(last_signal[1]) == 1 and close <= sl_level

short_hit_pt = pt_lev_perc > 0 and nz(last_signal[1]) == -1 and close <= pt_level

short_hit_sl = sl_lev_perc > 0 and nz(last_signal[1]) == -1 and close >= sl_level

// What is last active trade?

last_signal := long_signal ? 1 : short_signal ? -1 : long_hit_pt or long_hit_sl or short_hit_pt or short_hit_sl ? 0 : nz(last_signal[1])

//////////////

// PLOTTING //

//////////////

// Plot MAs

plot(short_ma, color = red, linewidth = 2)

plot(medium_ma, color = green, linewidth = 2)

plot(long_ma, color = yellow, linewidth = 2)

// Plot Levels

plotshape(prev_tr_price, style = shape.cross, color = gray, location = location.absolute, size = size.small)

plotshape(sl_lev_perc > 0 ? sl_level : na, style = shape.cross, color = red, location = location.absolute, size = size.small)

plotshape(pt_lev_perc > 0 ? pt_level : na, style = shape.cross, color = green, location = location.absolute, size = size.small)

//////////////

// STRATEGY //

//////////////

strategy.entry("long", true, when = long_signal)

strategy.entry("short", false, when = short_signal)

strategy.close("long", when = long_hit_pt or long_hit_sl)

strategy.close("short", when = short_hit_pt or short_hit_sl)