概述

本策略基于枢轴点的突破来进行反转交易。它会计算指定周期的最高价和最低价,以此确定枢轴高点和枢轴低点。当价格超过枢轴高点时,做空;当价格低于枢轴低点时,做多。这是一个典型的短线反转策略。

策略原理

该策略的核心逻辑是计算枢轴高点和枢轴低点。枢轴高低点的计算公式如下:

枢轴高点 = 最近N1根K线的最高价之和 / N1

枢轴低点 = 最近N2根K线的最低价之和 / N2

其中N1和N2是可以设置的两个参数,代表计算枢轴点所需要的K线数量。

计算出枢轴高低点后,策略就可以进行交易了。具体交易规则是:

- 当价格上穿枢轴高点时,做空仓位

- 当价格下破枢轴低点时,做多仓位

- 持仓后设置止损位

这样,它就实现了一个基于枢轴点突破的短线反转策略。

优势分析

这是一个非常简单的反转策略,具有如下优势:

- 原理简单,容易理解和实现

- 适合短线频繁交易

- 可以捕捉突破枢轴后的反转行情

- 可以通过调整参数进行优化

风险分析

该策略也存在一些风险:

- 反转失败的风险。枢轴点突破后的反转不一定会成功,存在继续原趋势运行的可能。

- 止损被击破的风险。设置的止损价格可能会被突破,造成较大损失。

- 参数不当带来的风险。如果参数设置不当,将严重影响策略效果。

可以通过调整参数、设置离场策略等方法来控制这些风险。

优化方向

该策略还有很大的优化空间:

- 结合其他技术指标,确定更准确的入场时机

- 增加离场条件,例如移动止损、盈利后止损等

- 动态调整参数,让策略更具有适应性

- 优化参数,找到最佳的参数组合

总结

本策略是一个非常简单的短线枢轴反转策略。它的优点是简单易理解,适合频繁交易,可以捕捉反转行情。但也存在一定的风险,需要进一步优化以减少风险。总体来说,这是一个非常适合新手练习的策略,也为高级策略奠定了基础。

策略源码

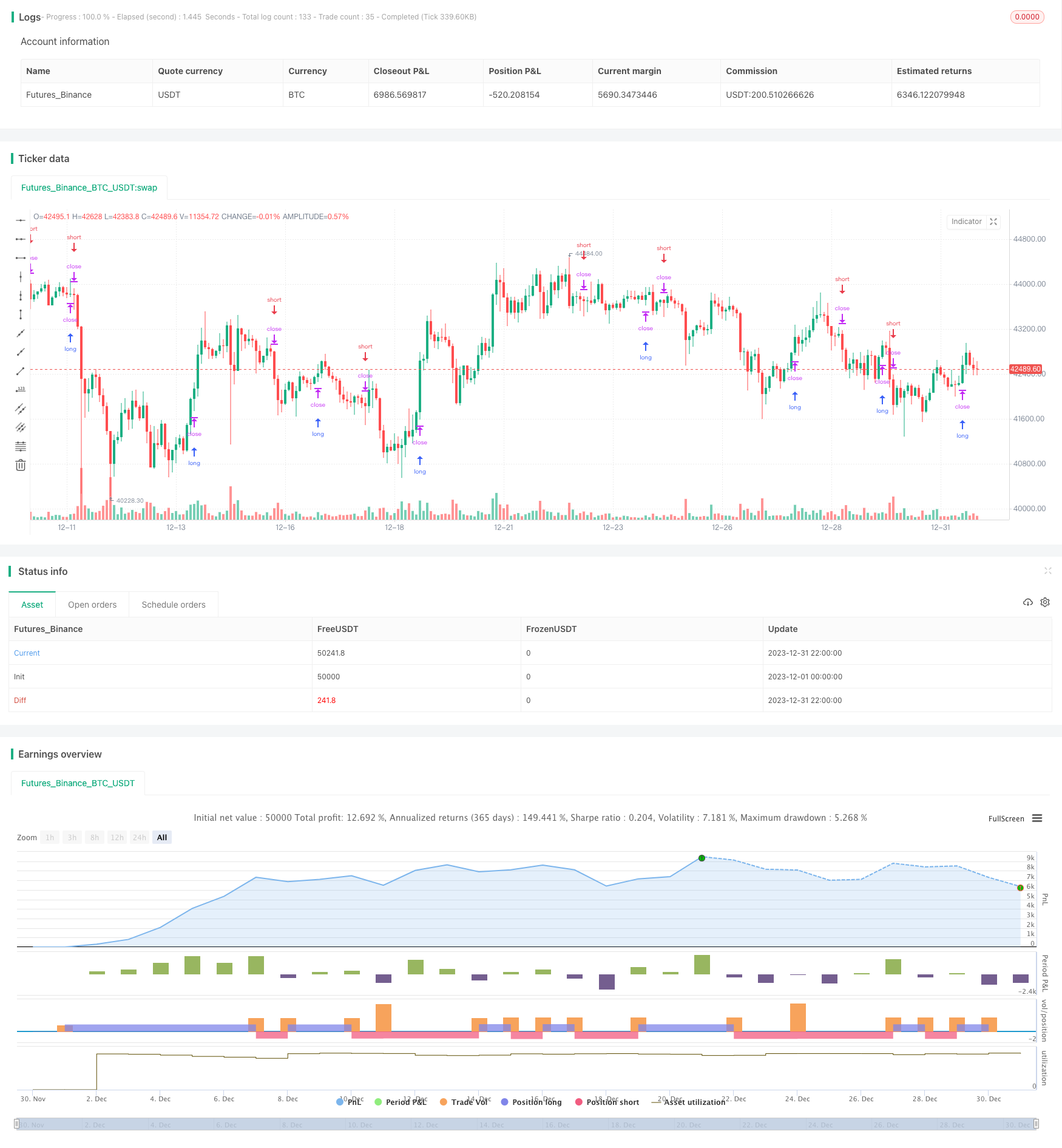

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Pivot Reversal Strategy - FIGS & DATES 2.0", overlay=true, pyramiding=0, initial_capital=10000, currency="USD", default_qty_type=strategy.percent_of_equity, default_qty_value=100.0, commission_value=0.075)

leftBars = input(4)

rightBars = input(2)

// backtesting date range

from_day = input(defval=1, title="From Day", minval=1, maxval=31)

from_month = input(defval=1, title="From Month", minval=1, maxval=12)

from_year = input(defval=2018, title="From Year", minval=1900)

to_day = input(defval=1, title="To Day", minval=1, maxval=31)

to_month = input(defval=1, title="To Month", minval=1, maxval=12)

to_year = input(defval=9999, title="To Year", minval=1900)

time_cond = true

swh = pivothigh(leftBars, rightBars)

swl = pivotlow(leftBars, rightBars)

middle = (swh+swl)/2

swh_cond = not na(swh)

hprice = 0.0

hprice := swh_cond ? swh : hprice[1]

le = false

le := swh_cond ? true : le[1] and high > hprice ? false : le[1]

if le and time_cond

strategy.entry("LONG", strategy.long, comment="LONG", stop=hprice + syminfo.mintick)

swl_cond = not na(swl)

lprice = 0.0

lprice := swl_cond ? swl : lprice[1]

se = false

se := swl_cond ? true : se[1] and low < lprice ? false : se[1]

if se and time_cond

strategy.entry("SHORT", strategy.short, comment="SHORT", stop=lprice - syminfo.mintick)

//plot(strategy.equity, title="equity", color=red, linewidth=2, style=areabr)