概述

“基于EMA和SMA交叉的趋势跟踪策略”是一个基于指数移动平均线(EMA)和简单移动平均线(SMA)交叉的趋势跟踪交易策略。该策略旨在通过捕捉短期EMA跨过长期SMA的时机,识别潜在的买入和卖出信号。

策略原理

该策略基于两个条件判断产生交易信号:

- 最新5期EMA上穿最新20期SMA

- 4小时级别上,最新5期EMA上穿最新20期SMA

当这两个条件同时满足时,产生买入信号;当这两个条件同时不满足时,产生卖出信号。

该策略通过比较不同时间周期上的EMA和SMA的交叉情况,综合判断趋势方向,产生交易信号。短期EMA反映价格的趋势变化更为敏感,而长期SMA具有更好的趋势过滤能力。当短期EMA上穿长期SMA时,表示价格略微反转,进入趋势状况,因此产生买入信号;反之,短期EMA下穿长期SMA时,表示趋势结束,因此产生卖出信号。

同时,策略加入4小时级别EMA和SMA的判断,可过滤掉短期噪音,使交易信号更加可靠。

策略优势

该策略具有以下优势:

- 简单实用,容易理解实现

- 响应迅速,可及时捕捉趋势转折

- 结合多时间周期判断,可有效过滤噪音

策略风险

该策略也存在一些风险:

- 容易产生假信号,须慎重验证信号

- 无法很好应对趋势震荡市

- 需谨慎选择EMA和SMA的参数

可通过加入止损止盈、优化参数等方法来控制风险。

优化方向

该策略可从以下几个方面进行优化:

- 测试更多的EMA和SMA周期参数组合

- 加入其它指标进行信号验证,如MACD、布林带等

- 建立动态止损机制

- 结合交易量进行信号过滤

总结

该策略整体较为简单实用,通过EMA和SMA交叉判断趋势转折,是一个基础的趋势跟踪策略。可通过参数优化、信号过滤等方法进行改进,从而适应更多市场情况,提高策略效果。

策略源码

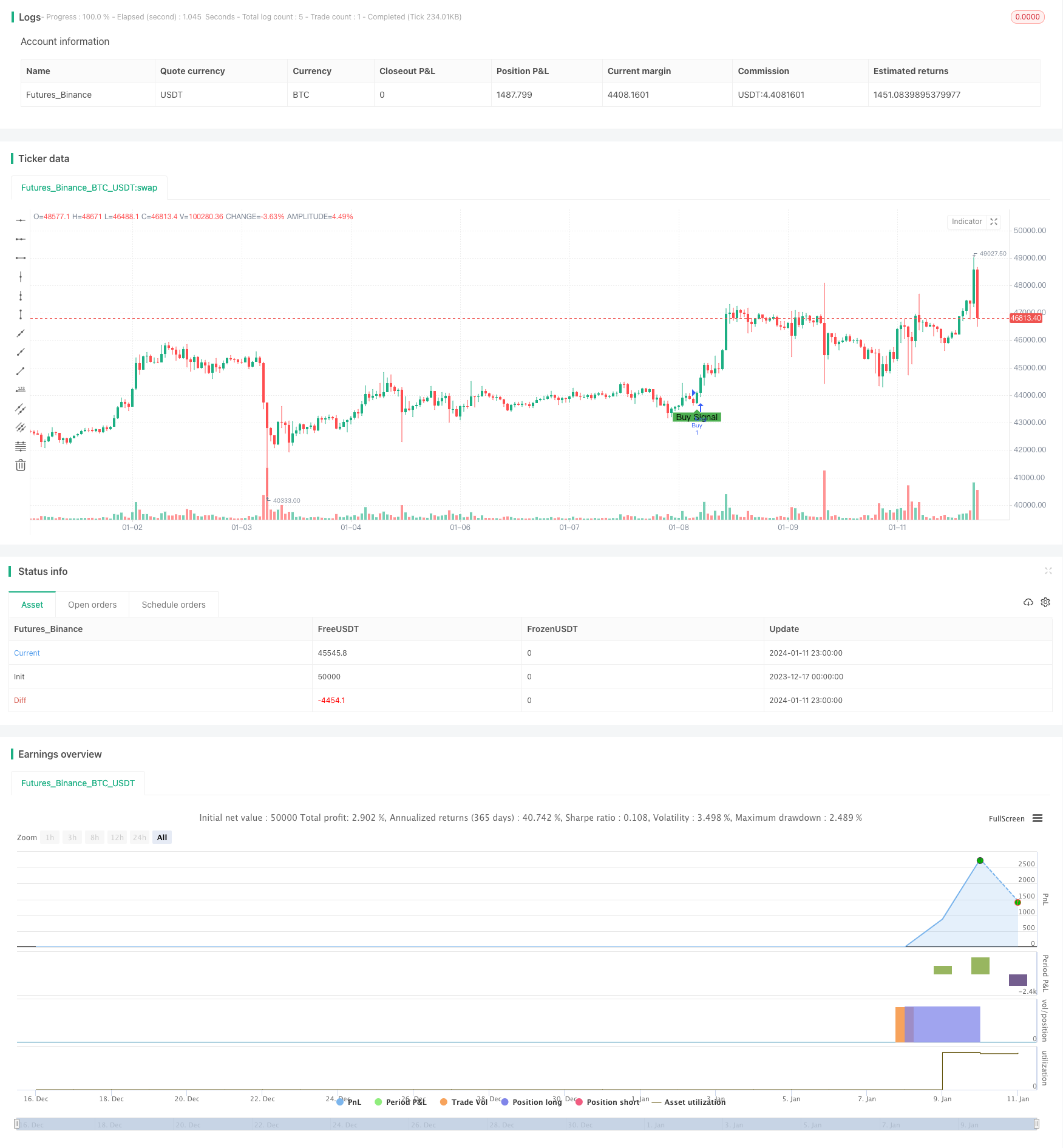

/*backtest

start: 2023-12-17 00:00:00

end: 2024-01-12 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA and SMA Crossover Strategy", shorttitle="Shashank Cross", overlay=true)

// Condition 1: Latest EMA (Close, 5) crossed above Latest SMA (Close, 20)

ema5 = ta.ema(close, 5)

sma20 = ta.sma(close, 20)

condition1 = ta.crossover(ema5, sma20)

// Condition 2: [0] 4-hour EMA ([0] 4-hour Close, 5) crossed above [0] 4-hour SMA ([0] 4-hour Close, 20)

ema5_4h = request.security(syminfo.tickerid, "240", ta.ema(close, 5))

sma20_4h = request.security(syminfo.tickerid, "240", ta.sma(close, 20))

condition2 = ta.crossover(ema5_4h, sma20_4h)

// Combine both conditions for a buy signal

buy_signal = condition1 and condition2

// Plotting signals on the chart

plotshape(buy_signal, color=color.green, style=shape.labelup, location=location.belowbar, size=size.small, text="Buy Signal")

// Strategy logic

if (buy_signal)

strategy.entry("Buy", strategy.long)

// Exit long position on the next bar at market price

if (ta.barssince(buy_signal) == 1)

strategy.close("Exit")

// You can add more code for stop-loss, take-profit, etc., as per your strategy.