概述

双RSI突破策略是一种同时利用快速RSI和慢速RSI指标产生交易信号的量化交易策略。该策略通过快慢两个RSI指标之间的突破形成交易信号,实现追踪市场趋势的效果。

策略原理

该策略同时运用两个RSI指标,一个快速RSI指标周期为2,一个慢速RSI指标周期为14。策略的交易信号来自于两个RSI指标之间的突破。

当慢速RSI大于50,快速RSI小于50时,产生做多信号;当慢速RSI小于50,快速RSI大于50时,产生做空信号。做多做空后,如果出现止损信号(多单亏损时出现红色K线柱,空单亏损时出现绿色K线柱),则平仓止损。

优势分析

- 利用RSI指标的超买超卖特征形成交易信号,避免追高杀跌;

- 快慢RSI结合使用,能跟踪市场趋势变化,实现及时 entries 和 exits;

- 追踪中长线趋势,避免被短期市场噪音干扰;

- 风险控制到位,有止损机制。

风险及解决方法

- 虚假突破的风险。解决方法是合理设定快慢RSI的参数,确保真实突破。

- 止损点设置不当带来的风险。解决方法是根据市场波动度合理设定止损距离。

- 螺旋式亏损风险。解决方法是不追涨杀跌,按策略规则进行 entries 和 exits。

优化方向

该策略还可从以下几个方面进行优化:

- 快慢RSI的参数可进行优化,找到最佳参数组合;

- 可以引入其他指标进行组合,形成更可靠的交易信号;

- 可以设定动态止损,根据市场波动实时调整止损点。

总结

双RSI突破策略利用快慢RSI指标跟踪市场趋势变化,在超买超卖区域形成交易信号,能有效避免追高杀跌。同时设置了止损机制来控制风险。该策略操作简单,易于实现,适合量化交易。通过参数优化、组合指标等方式,还可进一步提高策略profit因子。

策略源码

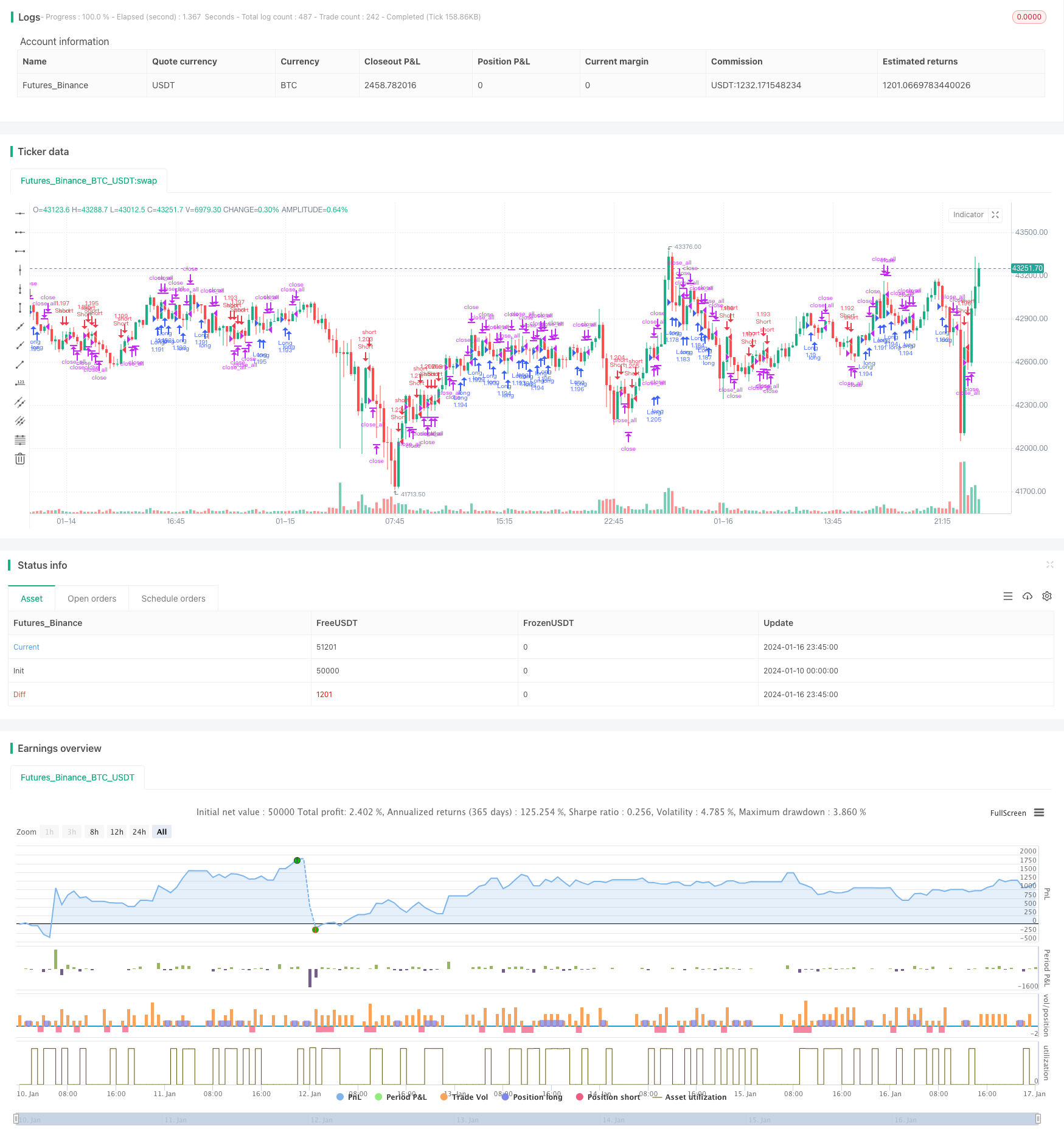

/*backtest

start: 2024-01-10 00:00:00

end: 2024-01-17 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Noro

//2018

//@version=2

strategy(title = "Noro's Double RSI Strategy 1.0", shorttitle = "2RSI str 1.0", overlay=true )

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

leverage = input(1, defval = 1, minval = 1, maxval = 100, title = "leverage")

fast = input(2, defval = 2, minval = 2, maxval = 100, title = "Fast RSI Period")

slow = input(14, defval = 14, minval = 2, maxval = 100, title = "Slow RSI Period")

fromyear = input(2018, defval = 2018, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

//Fast RSI

fastup = rma(max(change(close), 0), fast)

fastdown = rma(-min(change(close), 0), fast)

fastrsi = fastdown == 0 ? 100 : fastup == 0 ? 0 : 100 - (100 / (1 + fastup / fastdown))

//Slow RSI

slowup = rma(max(change(close), 0), slow)

slowdown = rma(-min(change(close), 0), slow)

slowrsi = slowdown == 0 ? 100 : slowup == 0 ? 0 : 100 - (100 / (1 + slowup / slowdown))

//Signals

up = slowrsi > 50 and fastrsi < 50

dn = slowrsi < 50 and fastrsi > 50

exit = (strategy.position_size > 0 and close > open) or (strategy.position_size < 0 and close < open)

lot = strategy.position_size == 0 ? strategy.equity / close * leverage : lot[1]

//Trading

if up

if strategy.position_size < 0

strategy.close_all()

strategy.entry("Long", strategy.long, needlong == false ? 0 : lot )

if dn

if strategy.position_size > 0

strategy.close_all()

strategy.entry("Short", strategy.short, needshort == false ? 0 : lot )

if exit

strategy.close_all()