概述

本策略基于移动平均线(Moving Average, MA)的金叉死叉来识别市场趋势的转折点,以捕捉短期股票价格的涨跌。策略会计算两条不同周期的MA,即一条较短周期的MA和一条较长周期的MA。当短周期MA上穿长周期MA时,产生买入信号;当短周期MA下穿长周期MA时,产生卖出信号。

策略原理

该策略的核心判定逻辑在于短周期MA和长周期MA的交叉关系。短周期MA能更迅速地反应最近一段时间内的价格变动,而长周期MA具有更好的去噪能力,能反映长期价格趋势。当短MA上穿长MA时,说明近期价格开始走高,可能是短期股价反转的信号,因此产生买入信号,以捕捉后续的涨势。相反,当短MA下穿长MA时,说明近期价格开始走低,可能是短期股价反转的信号,因此产生卖出信号。

具体来说,该策略会对close价格应用ta.sma函数计算出两条MA线:maShort(9周期)和maLong(21周期)。然后利用ta.crossover和ta.crossunder函数判定短MA和长MA的交叉关系,以生成买入和卖出信号。最后设置止损止盈逻辑以锁定利润并控制风险。

策略优势

- 利用MA交叉原理,可有效识别短期趋势的转折点

- 同时考量近期和长期价格变化,提高信号质量

- 直观反映股价的移动方向和动量

- 简单易懂,容易实现,适合高频短线交易

- 可灵活调整MA参数,适应不同交易品种

相比单一MA系统,该策略综合考量了短周期MA和长周期MA的价值,能减少假信号,提高盈利概率。同时,MA交叉信号清晰易读,操作规则直接有效,非常适合熟悉技术分析的交易者使用。

策略风险

- MA交叉信号可能出现滞后,错过反转的最佳时点

- 严格遵循MA交叉可能带来过多的交易次数

- MA周期设置不当将影响信号质量

- 个股特质也会影响MA交叉系统的效果

如果仅机械跟随MA交叉信号,无法判断市场趋势和个股特质,可能面临获利能力低下或高频交易增加交易成本的问题。此外,MA交叉信号本身也可能滞后于真正的趋势转折点,从而错过最佳的反转时机。

策略优化方向

- 优化MA的短长周期参数组合

- 结合其他分析工具,识别股票长短期趋势

- 考量个股特质,调整策略参数

- 结合量能指标,识别真正的反转信号

- 利用止损方法,合理控制单笔损失

例如,可以借助其它技术指标比如MACD、KDJ等来验证MA交叉信号,避免出现误判。也可以针对不同的交易品种,调整MA参数,从而提高策略稳定性。同时适当调整止损水平,防止单笔损失过大。综合运用各类优化手段,可以大幅提升基于MA交叉的短线交易策略的实际表现。

总结

本策略基于MA交叉原理设计了一个简单直接的短线交易策略。它同时结合了短周期MA和长周期MA的优势,既考虑了近期价格动向也兼顾了长期趋势判断,从而产生了高质量的交易信号。该策略适合习惯使用技术分析工具的活跃交易者,可以通过调整MA参数等方法进行优化,从中获得丰厚的超额收益。

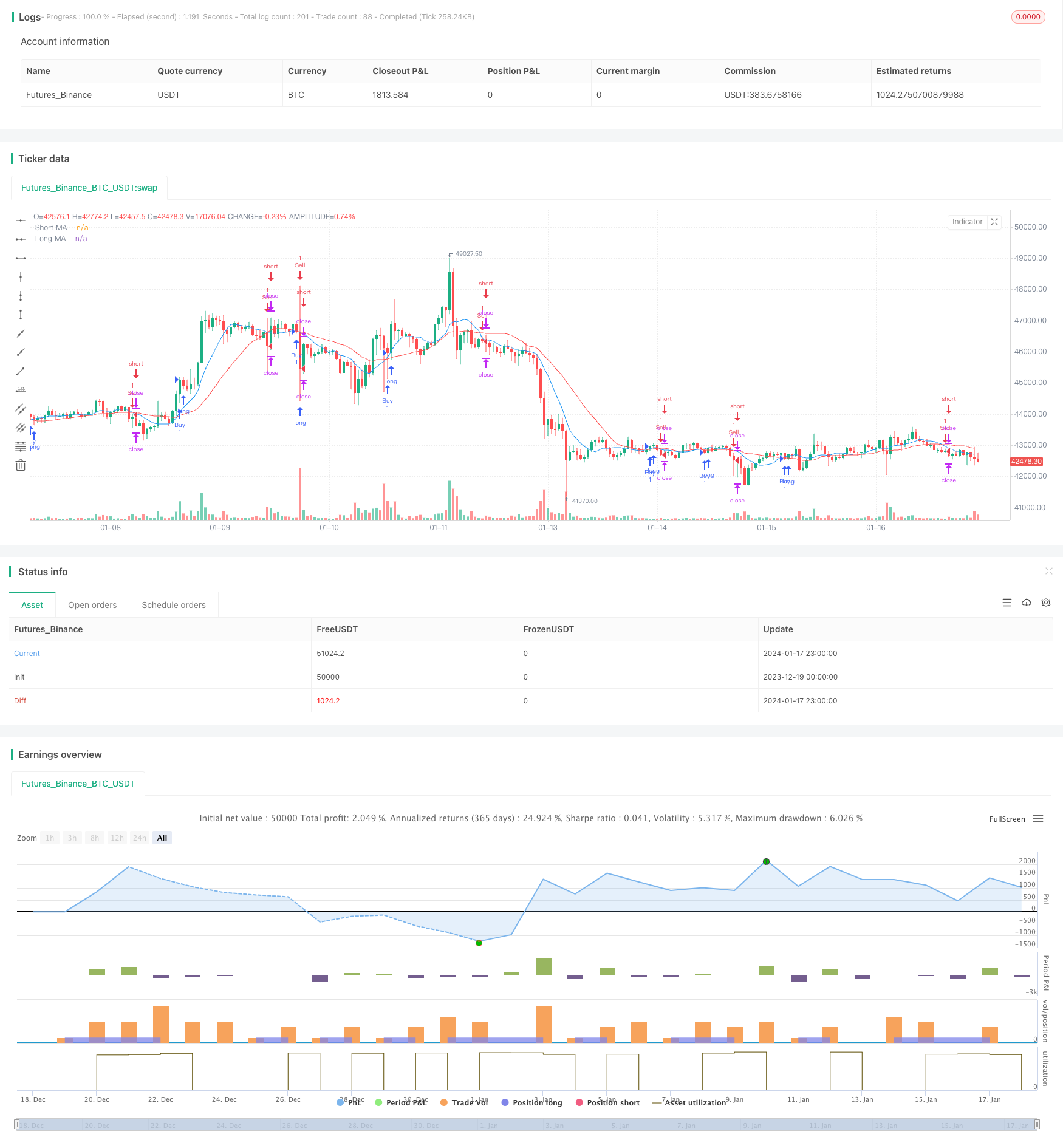

/*backtest

start: 2023-12-19 00:00:00

end: 2024-01-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Intraday MA Crossover Strategy", overlay=true)

// Define MA lengths

maLengthShort = input.int(9, title="Short MA Length", minval=1)

maLengthLong = input.int(21, title="Long MA Length", minval=1)

// Calculate MAs

maShort = ta.sma(close, maLengthShort)

maLong = ta.sma(close, maLengthLong)

// Plot MAs on the chart

plot(maShort, color=color.blue, title="Short MA")

plot(maLong, color=color.red, title="Long MA")

// Generate Buy Signal (Golden Cross: Short MA crosses above Long MA)

buySignal = ta.crossover(maShort, maLong)

strategy.entry("Buy", strategy.long, when=buySignal)

// Generate Sell Signal (Death Cross: Short MA crosses below Long MA)

sellSignal = ta.crossunder(maShort, maLong)

strategy.entry("Sell", strategy.short, when=sellSignal)

// Set stop loss and take profit levels

stopLossPercent = input.float(1, title="Stop Loss %", minval=0.1, maxval=5)

takeProfitPercent = input.float(1, title="Take Profit %", minval=0.1, maxval=5)

strategy.exit("Take Profit/Stop Loss", from_entry="Buy", loss=close * stopLossPercent / 100, profit=close * takeProfitPercent / 100)

strategy.exit("Take Profit/Stop Loss", from_entry="Sell", loss=close * stopLossPercent / 100, profit=close * takeProfitPercent / 100)