概述

该策略是一种5分钟震荡交易策略,旨在捕捉比特币和黄金市场的短期价格波动,实现盈利。它结合使用EMA均线、布林带指标以及止损方法来实现入场和出场。

策略原理

该策略使用快速EMA指标和慢速EMA指标构建趋势判断系统。当快速EMA上穿慢速EMA时产生买入信号;当快速EMA下穿慢速EMA时产生卖出信号,捕捉短期趋势的转折。

同时,该策略结合布林带指标判断价格波动区间。只有当价格接近布林带上轨或中轨时,才产生交易信号。这能过滤掉大部分假信号。

入场后,该策略使用ATR指标计算止损位。并且设定止损为入场蜡烛的低点再减去n倍ATR,用于控制每个交易的风险。

优势分析

该策略最大的优势在于 capturing short-term swings and price volatility, taking small but consistent profits 每次只追求小利润,但持续盈利。通过快速EMA和慢速EMA的配合,能快速判断短期趋势;布林带和ATR止损能有效控制风险,是一种相对稳定的震荡策略。

另外, 5分钟周期操作使得该策略交易频率较高,这也增大了其盈利空间。同时也方便进行人工监控或优化。

风险分析

该策略主要风险在于 whipsaws leading to multiple small losses 抄底反转造成的小额连续亏损。当价格在一个范围内震荡时,EMA交叉信号可能频繁出现,造成不必要的交易和连续小额亏损。

此外,作为一个短期震荡策略,它也面临着高交易频率带来的交易成本风险。如果交易成本过高,可能会侵蚀利润空间。

优化方向

该策略可以通过以下方式进行优化:

增加其他oscillators作为辅助判断指标,如RSI, Stochastics等,避免在震荡市场中被套。

增加machine learning模型判断趋势方向,提高入场的准确性。

利用遗传算法、随机森林等方法自动优化参数,使之更符合当下市场情况。

结合深度学习判断关键支持位和关键压力位,设定更优的止损位置。

测试不同交易品种如股指、外汇、加密货币等,选择交易效果最好的品种作为主要交易标的。

总结

总的来说,该策略作为一个短期频繁交易策略,能够有效捕捉价格短期震荡和趋势反转,通过快速EMA判断,布林带过滤和ATR止损来控制风险,可以获得稳定收益。如果进一步优化和改进,在降低交易频率的同时保持盈利能力,将是一个非常具有潜力的量化策略。

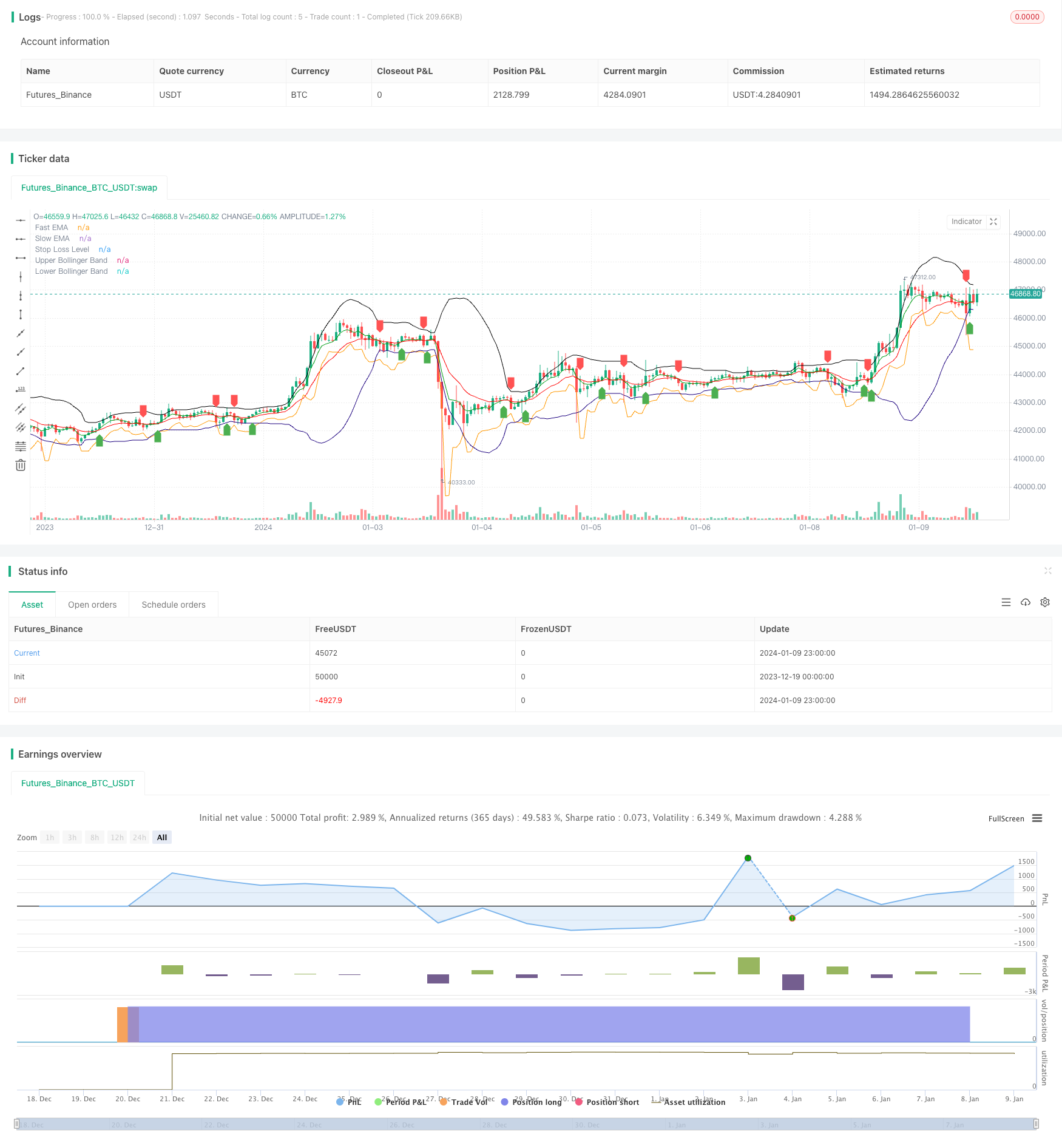

/*backtest

start: 2023-12-19 00:00:00

end: 2024-01-10 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © singhak8757

//@version=5

strategy("Bitcoin and Gold 5min Scalping Strategy2.0", overlay=true)

// Input parameters

fastLength = input(5, title="Fast EMA Length")

slowLength = input(13, title="Slow EMA Length")

bollingerLength = input(20, title="Bollinger Band Length")

bollingerMultiplier = input(2, title="Bollinger Band Multiplier")

stopLossMultiplier = input(1, title="Stop Loss Multiplier")

// Calculate EMAs

fastEMA = ta.ema(close, fastLength)

slowEMA = ta.ema(close, slowLength)

// Calculate Bollinger Bands

basis = ta.sma(close, bollingerLength)

upperBand = basis + bollingerMultiplier * ta.stdev(close, bollingerLength)

lowerBand = basis - bollingerMultiplier * ta.stdev(close, bollingerLength)

// Buy condition

buyCondition = ta.crossover(fastEMA, slowEMA) and (close <= upperBand or close <= basis)

// Sell condition

sellCondition = ta.crossunder(fastEMA, slowEMA) and (close >= lowerBand or close >= basis)

// Calculate stop loss level

stopLossLevel = ta.lowest(low, 2)[1] - stopLossMultiplier * ta.atr(14)

// Plot EMAs

plot(fastEMA, color=color.rgb(0, 156, 21), title="Fast EMA")

plot(slowEMA, color=color.rgb(255, 0, 0), title="Slow EMA")

// Plot Bollinger Bands

plot(upperBand, color=color.new(#000000, 0), title="Upper Bollinger Band")

plot(lowerBand, color=color.new(#1b007e, 0), title="Lower Bollinger Band")

// Plot Buy and Sell signals

plotshape(series=buyCondition, title="Buy Signal", color=color.green, style=shape.labelup, location=location.belowbar)

plotshape(series=sellCondition, title="Sell Signal", color=color.red, style=shape.labeldown, location=location.abovebar)

// Plot Stop Loss level

plot(stopLossLevel, color=color.orange, title="Stop Loss Level")

// Strategy logic

strategy.entry("Buy", strategy.long, when = buyCondition)

strategy.exit("Stop Loss/Close", from_entry="Buy", loss=stopLossLevel)

strategy.close("Sell", when = sellCondition)