概述

该策略是一个基于弹性成交量加权移动平均线(EVWMA)的MACD交易策略。它利用EVWMA的优点,设计了一个交易信号清晰、实用性强的策略。

策略原理

EVWMA指标把成交量信息融入移动平均线计算中,使得移动平均线能更准确反映价格变化。该策略构建快速线和慢速线的计算都是基于EVWMA实现的。快速线的参数设置更加灵敏,能捕捉短期价格变动;慢速线参数设置更加稳健,能过滤掉部分噪音。两条EVWMA形成的MACD进行交叉做多做空,并设计histogram给出视觉效果更佳的交易提示。

优势分析

该策略最大的优势是利用EVWMA指标的力量,使得MACD策略参数设置更加稳定,交易信号更加清晰。相比简单移动平均线,EVWMA能更好地把握市场变化趋势。这使得该策略适应性更广,在各种市场环境下都能稳定工作。

风险分析

该策略主要风险在于MACD本身就存在一定滞后,不能及时捕捉价格反转。此外,EVWMA的参数设置也会影响策略表现。如果快慢线参数设置不当,会出现交易信号错乱,影响盈利能力。

为降低风险,应适当调整参数,使快速线和慢速线之间差距适中,Histogram可以辅助判断是否需要调参。此外,也可以设计止损策略,避免单笔损失过大。

优化方向

该策略主要可以从以下几个方面进行优化:

利用自适应参数设置技术,使EVWMA的参数能根据市场环境自动调整,保证交易信号的清晰度。

增加止损机制,能够有效控制单笔损失。

结合其他指标过滤误报信号。例如结合成交量,大幅度价格变动时才产生信号。

优化入场点选择。目前的策略是在MACD零轴交叉时开仓。可以测试是否改为深度拉胯更适合。

总结

本策略利用EVWMA指标的优势,构建了一个简单实用的MACD策略。它稳定性更好,适应性更广。同时也存在MACD本身的滞后问题。我们可以从自适应参数优化、止损设计、信号过滤等方面进行改进,使策略更加稳健。

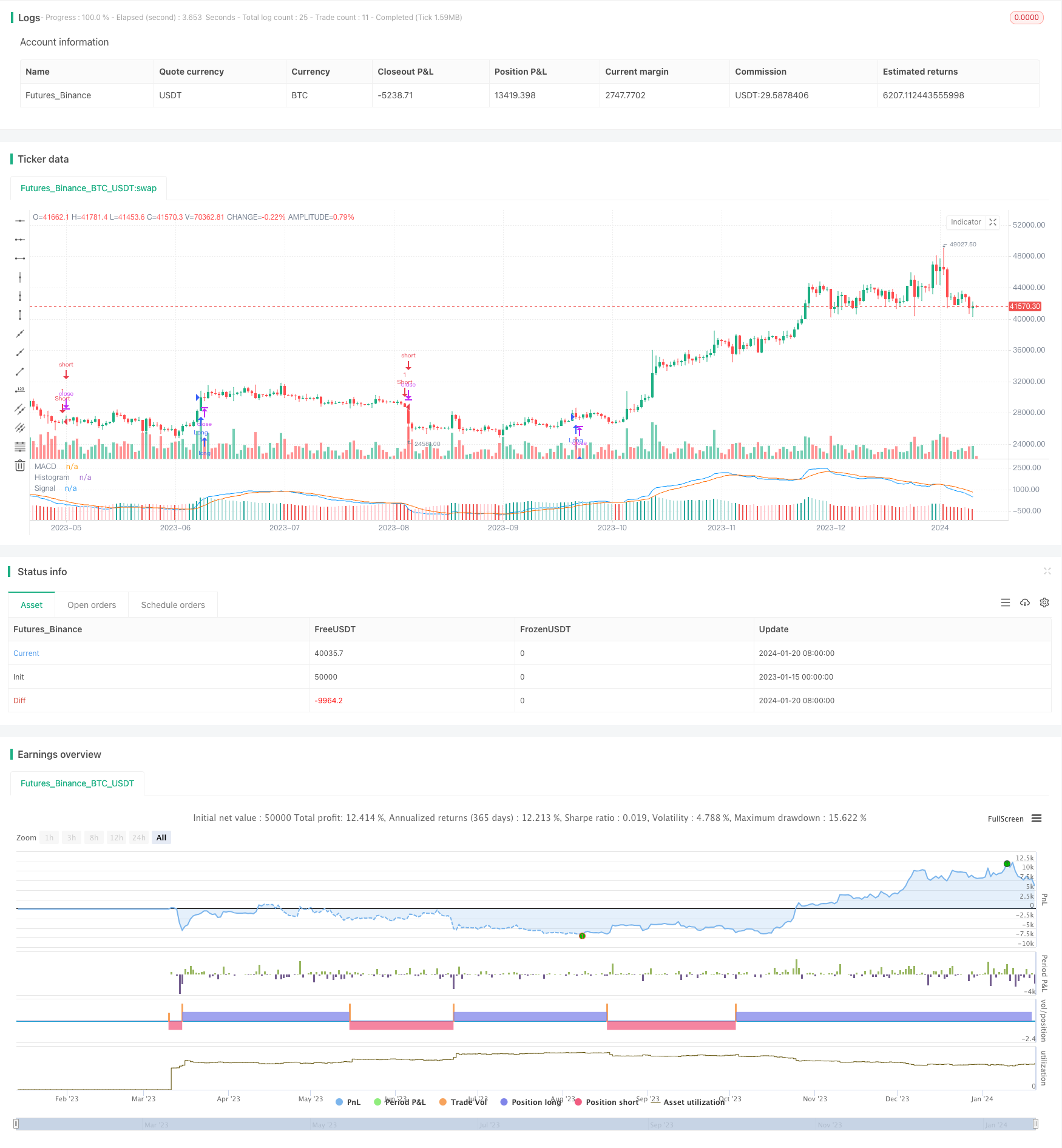

/*backtest

start: 2023-01-15 00:00:00

end: 2024-01-21 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("QuantNomad - EVWMA MACD Strategy", shorttitle = "EVWMA MACD", overlay = false)

// Inputs

fast_sum_length = input(10, title = "Fast Sum Length", type = input.integer)

slow_sum_length = input(20, title = "Slow Sum Length", type = input.integer)

signal_length = input(9, title = "Signal Smoothing", type = input.integer, minval = 1, maxval = 50)

// Calculate Volume Period

fast_vol_period = sum(volume, fast_sum_length)

slow_vol_period = sum(volume, slow_sum_length)

// Calculate EVWMA

fast_evwma = 0.0

fast_evwma := ((fast_vol_period - volume) * nz(fast_evwma[1], close) + volume * close) / (fast_vol_period)

// Calculate EVWMA

slow_evwma = 0.0

slow_evwma := ((slow_vol_period - volume) * nz(slow_evwma[1], close) + volume * close) / (slow_vol_period)

// Calculate MACD

macd = fast_evwma - slow_evwma

signal = ema(macd, signal_length)

hist = macd - signal

// Plot

plot(hist, title = "Histogram", style = plot.style_columns, color=(hist>=0 ? (hist[1] < hist ? #26A69A : #B2DFDB) : (hist[1] < hist ? #FFCDD2 : #EF5350) ), transp=0 )

plot(macd, title = "MACD", color = #0094ff, transp=0)

plot(signal, title = "Signal", color = #ff6a00, transp=0)

// Strategy

strategy.entry("Long", true, when = crossover(fast_evwma, slow_evwma))

strategy.entry("Short", false, when = crossunder(fast_evwma, slow_evwma))