概述

快速响应型加密货币RSI趋势跟踪策略是一种适用于高波动性加密货币交易的积极策略。它结合相对强度指数(RSI)指标和简单移动平均线,在5分钟时间周期内捕捉加密货币价格的重大变动。

该策略可以快速响应加密货币市场上的短期价格波动,适合喜欢高频交易环境且注重短期价格移动的交易者。

策略原理

该策略使用以下指标和条件来生成交易信号:

RSI(14周期):识别超买(高于65)和超卖(低于35)条件,为可能的价格反转或趋势延续提供信号

SMA400: 400周期的简单移动平均线,用于判断长期趋势方向。只有与SMA400指示的趋势方向一致的交易才会考虑

做多条件: 当RSI低于超卖水平(35)且当前价格高于SMA400时,表示上涨动能,符合总体上涨趋势

做多退出条件: 当RSI达到极高值(表示超买)或预设的止损或止盈水平被触发时,平仓做多头寸

做空条件: 当RSI高于超买水平(65)且当前价格低于SMA400时,表示下跌动能,符合总体下跌趋势

做空退出条件: 当RSI达到极低值(表示超卖)或预设的止损或止盈水平被触发时,平仓做空头寸

该策略使用2%的初始止损来限制亏损,并使用5%的止盈来锁定利润。这些参数可以根据资产的波动性和交易者的风险偏好进行调整。

优势分析

该策略具有以下优势:

快速响应: 5分钟周期使其可以快速响应加密货币市场的剧烈价格波动

效率: 只在趋势方向与长线一致时考虑交易,避免假突破

灵活: 可以通过调整止损,止盈,交易频率等参数进行优化

流动性强: 交易主流加密货币,不必担心流动性问题

风险控制: 使用止损来管理风险,最大程度减少单笔损失

风险分析

该策略也存在以下风险:

止损被追究: 加密货币波动剧烈,止损有时会被突破触发

趋势反转风险: 趋势可能会在止损或止盈水平之前发生反转

交易成本: 较高的交易频率会产生更多的手续费和滑点成本

过度交易: 参数设置不当可能导致过度交易和资金锁定

假突破: 短期内价格可能出现不符合总体趋势方向的假突破

可以通过以下方法降低风险:

适当放宽止损范围

优化参数,降低交易频率

选择手续费更低的交易平台

在回测中充分验证参数,避免过度交易

结合其他指标识别假突破

优化方向

该策略还可以从以下方面进行优化:

多时间框架验证: 结合更高时间框架的指标,避免被短期噪音误导

参数优化: 通过更多回测来找到最优参数组合

突破验证: 在突破后寻找其他指标的验证信号

趋势过滤: 结合趋势线,避免逆势交易

交易成本优化: 调整固定止盈止损设置,使用自适应止损

基于机器学习的入场: 使用神经网络等技术判断潜在入场时机

组合改进: 与其他非相关策略组合,提高整体稳定性

总结

该快速响应型加密货币RSI趋势跟踪策略通过跟踪短期超买超卖现象,在长期趋势方向指引下,在加密货币市场的短期价格波动中捕捉利润。

它快速响应的特点使其非常适合那些有足够时间密切观察市场,并享受高频交易刺激的加密货币交易者。通过本文对该策略的深入解读,我们分析了其运作原理,概述了优势,剖析了风险并提出了多种优化思路。

总的来说,通过 parameter tuning, time frame confluence, risk management 和 composability 的改进,该策略可以成为一个非常强大的加密货币量化交易工具。

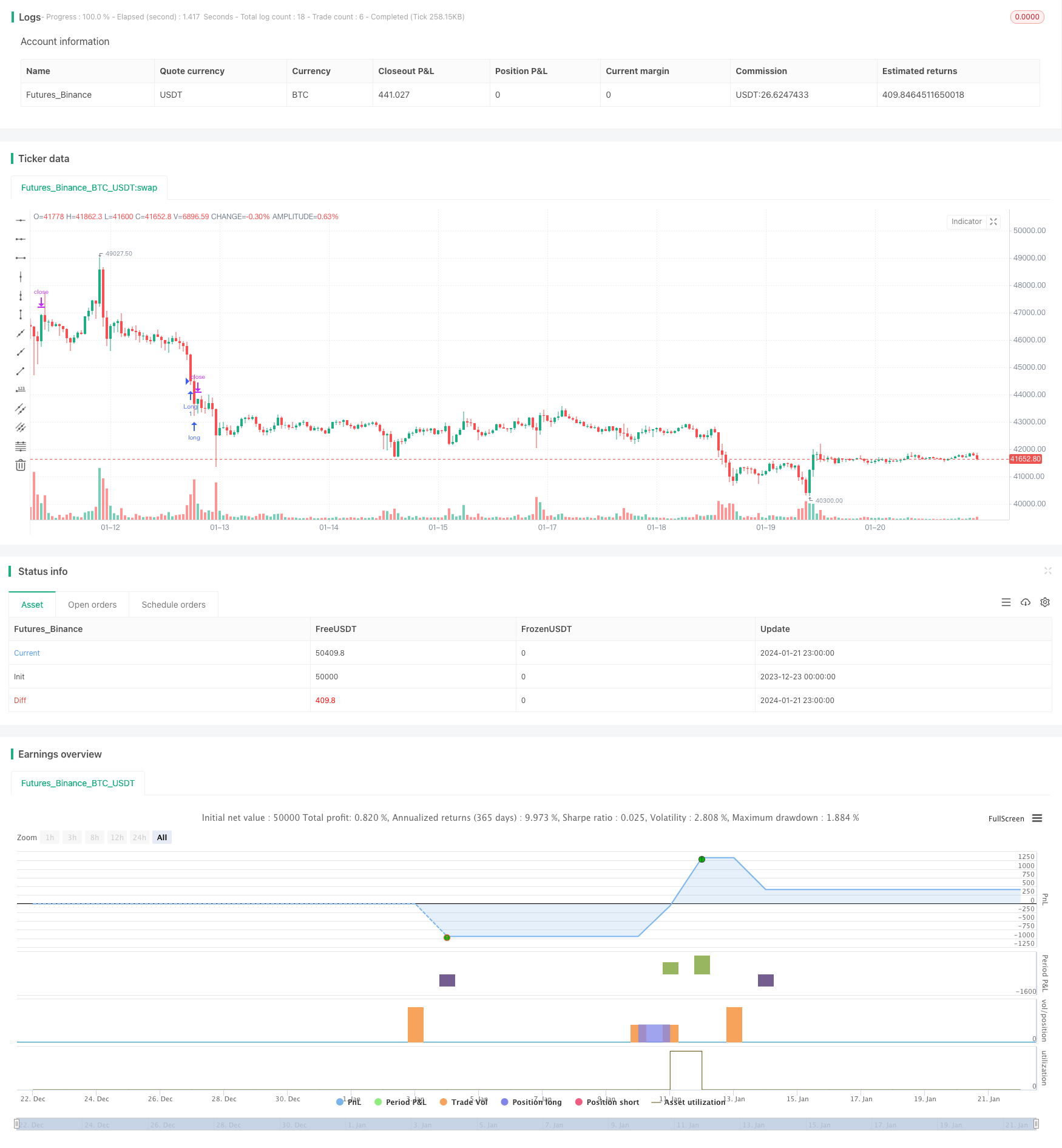

/*backtest

start: 2023-12-23 00:00:00

end: 2024-01-22 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Wielkieef

//@version=5

strategy("Crypto RSI mini-Sniper [5min]", shorttitle="RSI Strategy", overlay=true)

// Inputs

rsiLength = input(14, title="RSI Length")

oversoldLevel = input(35, title="Oversold Level")

overboughtLevel = input(65, title="Overbought Level")

sma400 = ta.sma(close, 400)

tp_1 = input.float(5.0, title="Take Profit 1 (%)")

sl = input.float(2.0, title="Stop Loss (%)")

// Longs Logic

rsi = ta.rsi(close, rsiLength)

longCondition = rsi < oversoldLevel and close > sma400

longExitCondition = rsi > 80 and close > sma400

longStopPrice = strategy.position_avg_price * (1 - sl / 100)

longTargetPrice = strategy.position_avg_price * (1 + tp_1 / 100)

//

strategy.entry("Long", strategy.long, when=longCondition)

strategy.close("Long", when=longExitCondition)

strategy.exit("Exit Long", "Long", stop=longStopPrice, limit=longTargetPrice)

// Shorts Logic

shortCondition = rsi > overboughtLevel and close < sma400

shortExitCondition = rsi < 20 and close < sma400

shortStopPrice = strategy.position_avg_price * (1 + sl / 100)

shortTargetPrice = strategy.position_avg_price * (1 - tp_1 / 100)

//

strategy.entry("Short", strategy.short, when=shortCondition)

strategy.close("Short", when=shortExitCondition)

strategy.exit("Exit Short", "Short", stop=shortStopPrice, limit=shortTargetPrice)

//by wielkieef