概述

本策略是一个只做多头的趋势跟踪策略,它通过Aroon指标和线性回归移动平均线的双重确认来产生交易信号。该策略适用于中长线趋势交易。

策略原理

本策略使用Aroon指标的上轨和下轨的交叉来判断趋势方向。当上轨从下轨向上突破时生成买入信号。当上轨从上轨向下跌破时生成卖出信号。为了过滤假突破,策略还引入了线性回归移动平均线LSMA作为辅助判断标准。只有当收盘价高于LSMA时才会触发买入信号。

具体来说,策略的交易信号生成规则为:

买入信号生成条件:上轨突破下轨(Aroon指标判定双轨交叉形成上升趋势)且当日收盘价高于LSMA移动平均线(收盘价处于上升趋势中)

卖出信号生成条件:上轨跌破下轨(Aroon指标判定双轨交叉形成下降趋势)且当日收盘价低于LSMA移动平均线(收盘价处于下降趋势中)

策略优势

- 使用Aroon指标判断趋势方向,避免被噪音干扰

- 增加LSMA移动平均线作为辅助过滤条件,避免假突破带来不必要的交易

- 只做多头,符合大盘的长期向上特征,避免做空带来的无限亏损风险

- 策略参数设置简单,容易实施

策略风险

- 策略只做多头,在震荡行情中难以获利

- 固定参数设置可能导致过拟合风险

- 趋势反转时难以及时止损

要防范风险,可以设置止损策略,或者结合其他指标判断趋势反转时机,及时止损。

优化方向

- 可以考虑加入做空机会,在下跌行情中也可以获利

- 可以测试不同周期参数的指标效果

- 可以加入机器学习模块,实现参数的自动优化

总结

本策略总体来说是一个较为简单实用的双重确认趋势跟踪策略。它使用Aroon判定趋势方向和LSMA过滤噪音的思路简单直接,在参数设置得当的情况下,可以获得不错的效果。该策略适合中长线持有,避免被短期市场噪音干扰。通过加入止损策略等模块进行优化,可以进一步扩大策略优势,减小风险。

策略源码

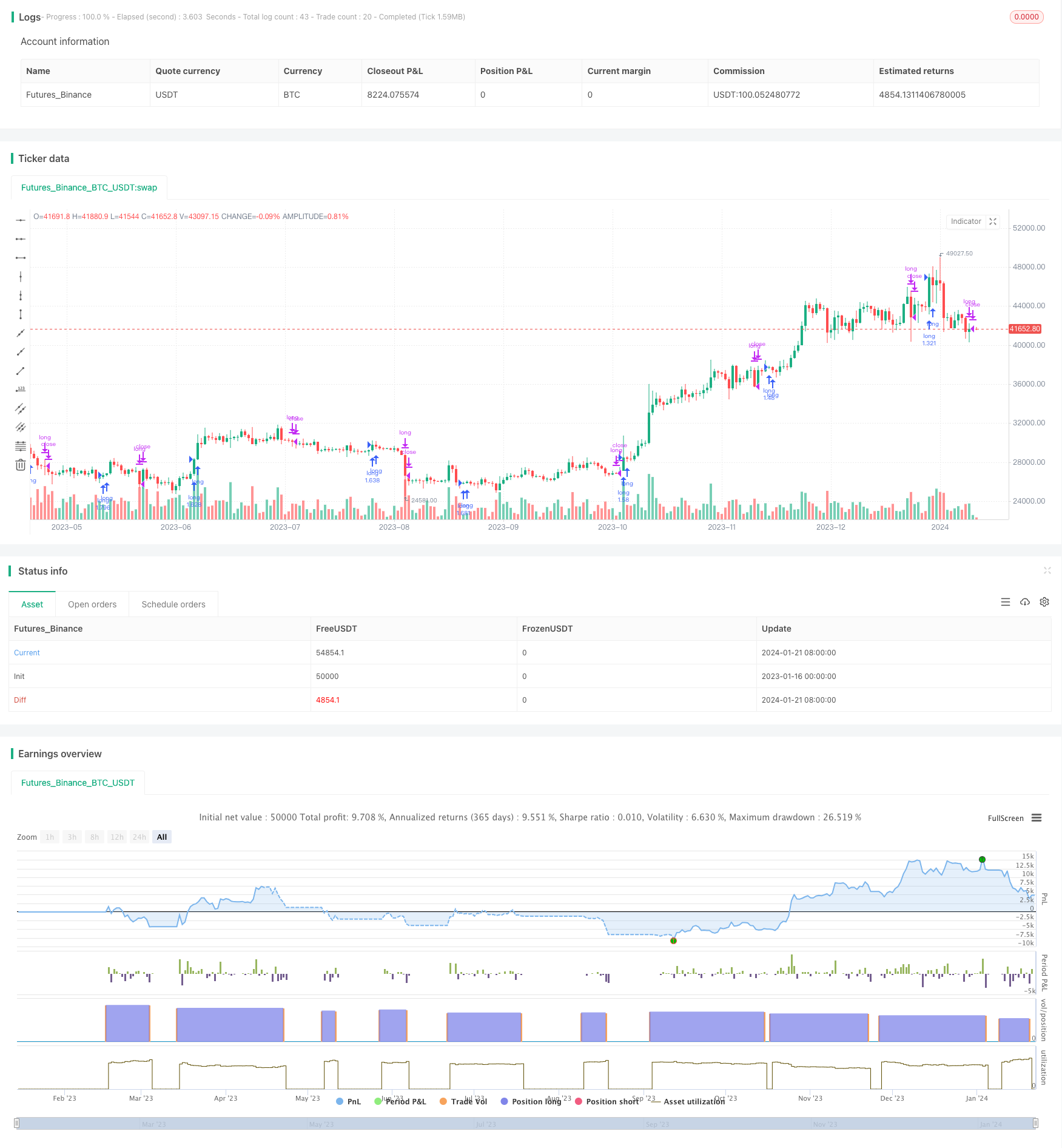

/*backtest

start: 2023-01-16 00:00:00

end: 2024-01-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © exlux99

//@version=4

strategy(title = "Aroon Strategy long only", overlay = true, pyramiding=1,initial_capital = 100, default_qty_type= strategy.percent_of_equity, default_qty_value = 100, calc_on_order_fills=false, slippage=0,commission_type=strategy.commission.percent,commission_value=0.1)

//Time

fromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

fromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

fromYear = input(defval = 2010, title = "From Year", minval = 1970)

//monday and session

// To Date Inputs

toDay = input(defval = 31, title = "To Day", minval = 1, maxval = 31)

toMonth = input(defval = 12, title = "To Month", minval = 1, maxval = 12)

toYear = input(defval = 2021, title = "To Year", minval = 1970)

startDate = timestamp(fromYear, fromMonth, fromDay, 00, 00)

finishDate = timestamp(toYear, toMonth, toDay, 00, 00)

time_cond = true

//INPUTS

length = input(15, minval=1, title="Aroon Legnth")

upper = 100 * (highestbars(high, length+1) + length)/length

lower = 100 * (lowestbars(low, length+1) + length)/length

lengthx = input(title="Length LSMA", type=input.integer, defval=20)

offset = 0//input(title="Offset", type=input.integer, defval=0)

src = input(close, title="Source")

lsma = linreg(src, lengthx, offset)

long = crossover(upper,lower) and close > lsma

longexit = crossunder(upper,lower) and close < lsma

if(time_cond)

strategy.entry("long",1,when=long)

strategy.close("long",when=longexit)