概述

本策略通过对经典MACD指标进行多项优化,实现更准确可靠的交易信号产生和更严格的风险控制。主要优化内容包括:1引入RSI指标避免过度买卖;2加入成交量确认;3设置止损止盈;4优化参数组合。

策略原理

基本原理仍然是MACD指标的快慢线金叉做多,死叉做空。主要优化体现在:

引入RSI指标,这样可以避免在市场被高估或低估的情况下产生虚假信号。RSI可以有效反映市场的买卖压力。

加入成交量的判断,只有在成交量放大的情况下才产生信号,避免无效突破。成交量的放大可以证实趋势的力度。

设置止损止盈机制,可以动态跟踪市场波动将风险控制在可承受范围。止损可以有效控制单笔损失;止盈可以锁定利润,避免利润回吐。

优化MACD参数组合,调整快慢线和信号线的参数,取得更好的参数组合,产生更精确的交易信号。

优势分析

这套策略通过多重优化后的MACD具有以下显著优势:

减少了虚假信号的产生,信号的可靠性和准确性大为提高。

严格的止损止盈机制控制了交易风险,最大程度锁定了盈利。

MACD的参数经过优化调整,更契合不同品种和时间周期。

多指标组合产生信号,系统性强,适应更广泛的市场环境。

整体而言,资金效率和收益风险比有很大提高。

风险分析

本策略也存在一些风险需要防范:

优化后参数不一定百分之百适合所有品种和周期,需要根据实际情况调整。

信号产生频率会有所降低,存在一定程度的漏单风险。

在极端市场情况下,多个指标可能会发出冲突信号,需要人工进行判断。

自动止损在快速跳空的情况下可能会过早止损,给利润带来一定风险。

对策主要是人工监控判断,根据市场情况适当调整参数,并控制好仓位规模。

优化方向

本策略可以继续从以下方面进行优化:

测试更多指标的组合,如布林带、KD等,形成指标群体判定。

应用机器学习算法自动优化参数,使之更智能化。

加入更严格的资金管理策略,如固定份额、Kelly公式等。

开发自动止盈策略,根据趋势和波动率调整止盈点。

应用深度学习等前沿算法实现更准确预测。

总结

本策略通过原始MACD指标的多重优化,解决了MACD容易产生假信号和风险控制不足的缺点。多指标组合与止损止盈的运用使得信号更加准确可靠,风险控制也更为严密。本策略值得进一步开发与应用,是MACD指标改进的一个典范。

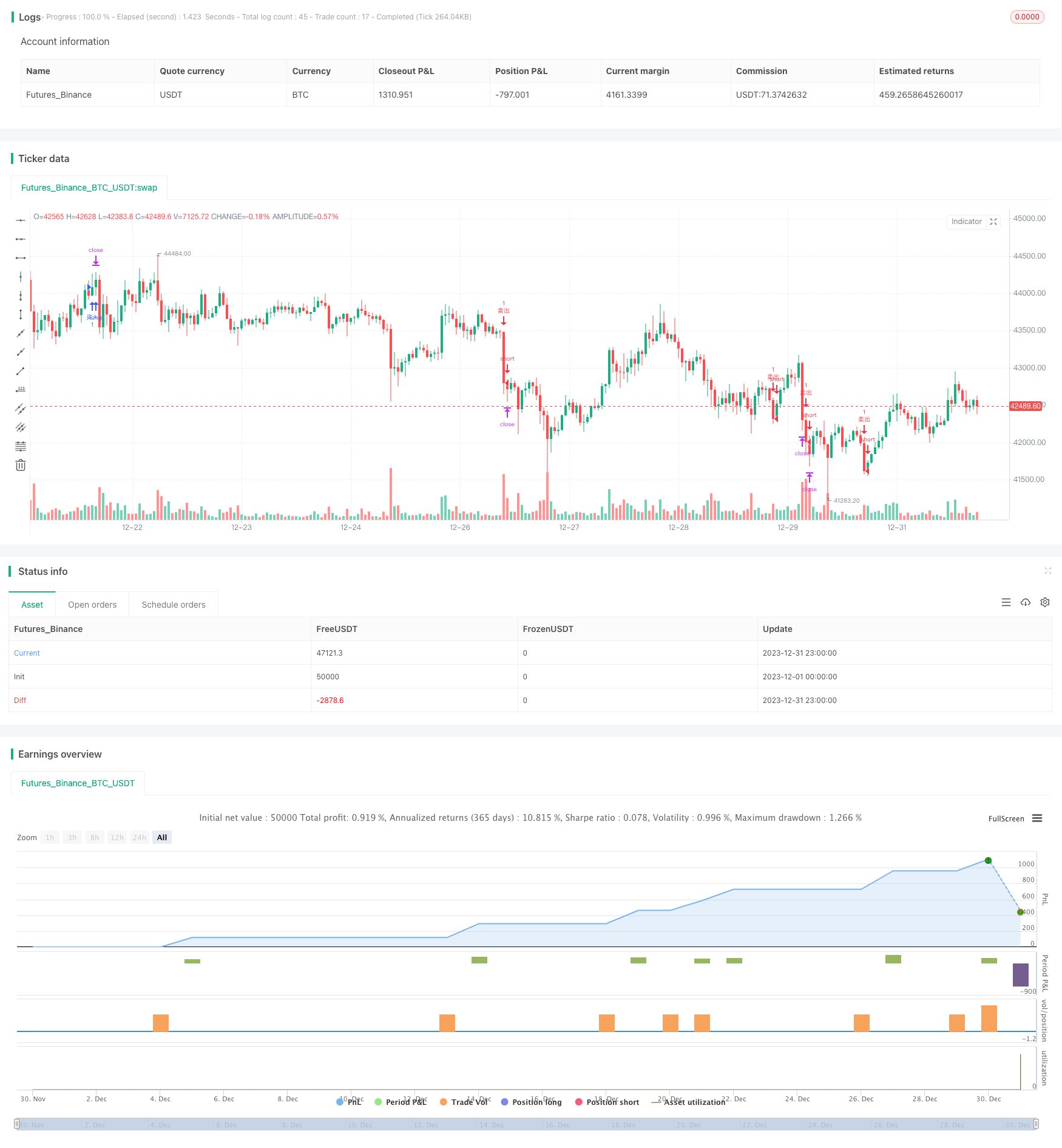

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("优化版MACD交易策略 ", overlay=true)

// 输入参数

fastLength = input(16, "快速线周期")

slowLength = input(34, "慢速线周期")

signalSmoothing = input(10, "信号线平滑")

rsiPeriod = input(19, "RSI周期")

overboughtRsi = 70

oversoldRsi = 30

volumeAvgPeriod = input(13, "成交量平均周期")

stopLossPerc = input.float(10.5, "止损百分比", step=0.1)

takeProfitPerc = input.float(0.3, "止盈百分比", step=0.1)

// 计算指标

[macdLine, signalLine, _] = ta.macd(close, fastLength, slowLength, signalSmoothing)

rsi = ta.rsi(close, rsiPeriod)

volumeAvg = ta.sma(volume, volumeAvgPeriod)

// 交易信号

longCondition = ta.crossover(macdLine, signalLine) and macdLine > 0 and rsi < overboughtRsi and volume > volumeAvg

shortCondition = ta.crossunder(macdLine, signalLine) and macdLine < 0 and rsi > oversoldRsi and volume > volumeAvg

// 止损和止盈

longStopLossPrice = close * (1 - stopLossPerc / 100)

longTakeProfitPrice = close * (1 + takeProfitPerc / 100)

shortStopLossPrice = close * (1 + stopLossPerc / 100)

shortTakeProfitPrice = close * (1 - takeProfitPerc / 100)

// 执行交易

if longCondition

strategy.entry("买入", strategy.long)

strategy.exit("买入止损止盈", "买入", stop=longStopLossPrice, limit=longTakeProfitPrice)

if shortCondition

strategy.entry("卖出", strategy.short)

strategy.exit("卖出止损止盈", "卖出", stop=shortStopLossPrice, limit=shortTakeProfitPrice)