概述

该策略基于快速和慢速移动平均线的交叉来判断市场趋势和买卖点。当快速EMA上穿慢速EMA时判断为市场处于上升趋势并产生买入信号;当快速EMA下穿慢速EMA时判断为市场处于下降趋势并产生卖出信号。策略还设定止损和止盈价格来管理风险。

策略原理

该策略使用快速EMA(8日线)和慢速EMA(21日线)的交叉来判断市场趋势。具体逻辑是:

- 计算8日EMA和21日EMA

- 当8日EMA上穿21日EMA时,判断为市场转势,上升趋势开始

- 当8日EMA下穿21日EMA时,判断为市场转势,下降趋势开始

- 在上升趋势时,产生买入信号;在下降趋势时,产生卖出信号

- 设置止损和止盈价格来管理每个订单的风险

该策略结合了动量指标和趋势分析,可以有效捕捉市场的方向和反转点。快慢EMA交叉并结合平滑移动平均线,可以过滤掉部分噪音交易信号。

优势分析

该策略有以下主要优势:

- 快速EMA和慢速EMA交叉可以有效判断市场趋势和买卖点

- 策略参数优化余地大,EMA周期可以进一步调整

- 结合动量指标,可以有效过滤噪音信号

- 设置止损止盈逻辑,可以主动控制风险

总的来说,该策略结合趋势和动量指标,通过参数调整可以适应不同市场环境,是一种相对灵活的短线交易策略。

风险分析

该策略也存在一定的风险:

- 在震荡行情中,EMA交叉信号频繁,会产生较多的错误交易

- 无法有效处理发生跳空缺口的情况

- 没有考虑大级别的长期趋势走向

针对这些风险,我们可以从以下几个方面进行优化:

- 增加其他指标过滤,如布林带、KDJ等,降低错误信号概率

- 结合更大级别周期指标判断长期趋势

- 优化参数,调整EMA长度,适应不同市场环境

- 人工干预交易,避免跳空缺口造成超过止损的巨额亏损

优化方向

该策略的优化空间还很大,主要可以从以下几个方向进行:

- 优化EMA周期参数,测试不同的参数在历史数据上的收益率

- 增加其他技术指标进行过滤,如KDJ、MACD等,提高策略准确率

- 优化止损止盈设定,使其更适合行情特点

- 通过机器学习方法自动优化参数

这些优化措施可以大幅提升策略的稳定性、适应性和盈利能力。

总结

本策略整体来说是一个典型的基于趋势跟随和动量指标交叉的短线交易策略。它结合EMA快慢线交叉和止损止盈逻辑,可以快速捕捉市场方向性机会。该策略优化空间很大,如果进一步引入其他辅助指标、自动参数优化等手段,可以使策略的表现更加稳定和出色。本策略适用于对市场有一定了解并愿意频繁操作的投资者。

策略源码

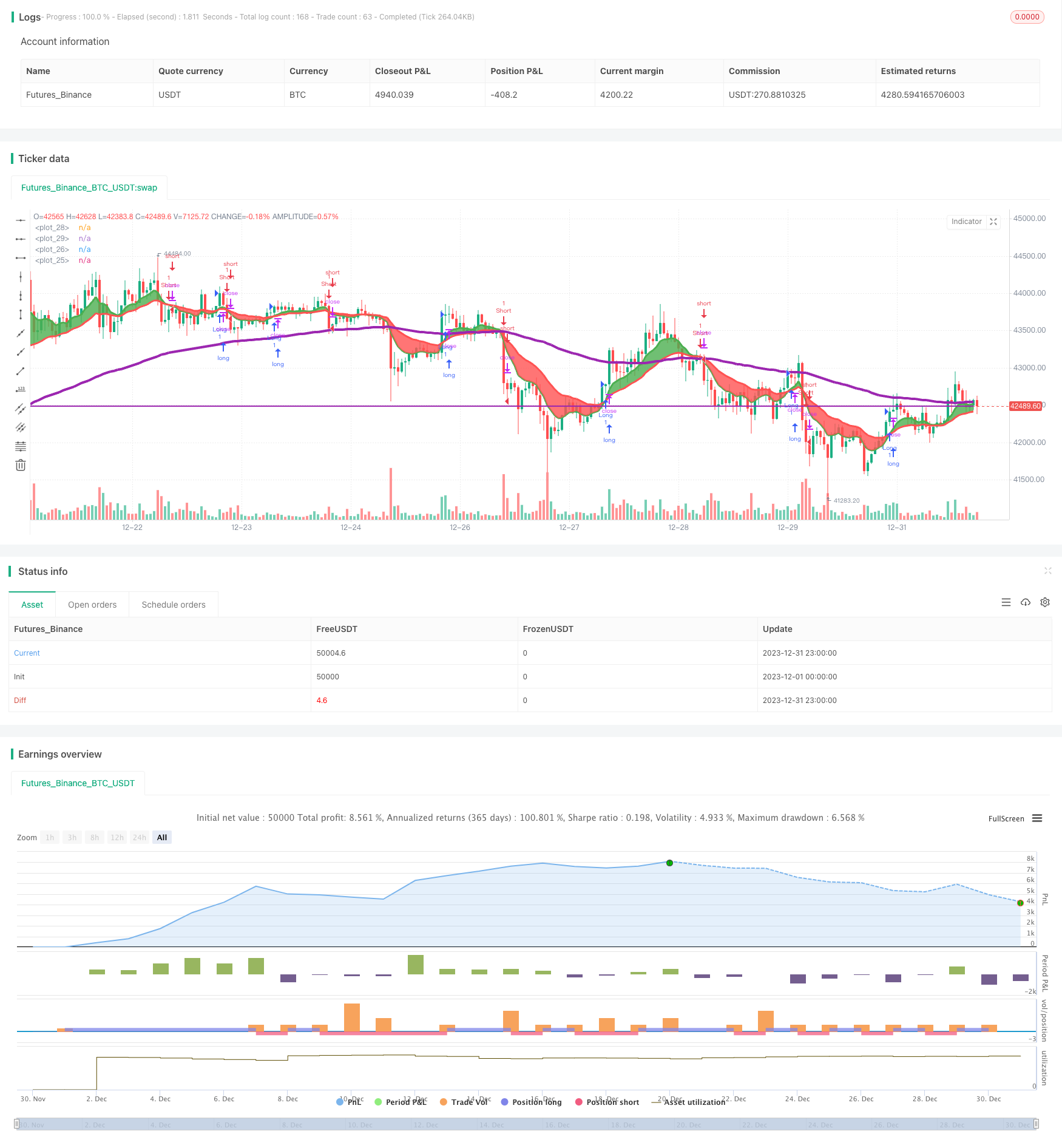

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © TradersPostInc

//@version=5

strategy('TradersPost Example MOMO Strategy', overlay=true)

startTime = input(defval = timestamp('01 Jan 2021 00:00 +0000'), title = 'Start Time', group = 'Date Range')

endTime = input(defval = timestamp('31 Dec 2023 23:59 +0000'), title = 'End Time', group = 'Date Range')

timeCondition = true

timeConditionEnd = timeCondition[1] and not timeCondition

fastEmaLength = input.int(defval = 8, title = 'Fast EMA Length')

slowEmaLength = input.int(defval = 21, title = 'Slow EMA Length')

sides = input.string(defval = 'Both', title = 'Sides', options = ['Long', 'Short', 'Both', 'None'])

fastEma = ta.ema(close, fastEmaLength)

slowEma = ta.ema(close, slowEmaLength)

isUptrend = fastEma >= slowEma

isDowntrend = fastEma <= slowEma

trendChanging = ta.cross(fastEma, slowEma)

ema105 = request.security(syminfo.tickerid, '30', ta.ema(close, 105)[1], barmerge.gaps_off, barmerge.lookahead_on)

ema205 = request.security(syminfo.tickerid, '30', ta.ema(close, 20)[1], barmerge.gaps_off, barmerge.lookahead_on)

plot(ema105, linewidth=4, color=color.new(color.purple, 0), editable=true)

plot(ema205, linewidth=2, color=color.new(color.purple, 0), editable=true)

aa = plot(fastEma, linewidth=3, color=color.new(color.green, 0), editable=true)

bb = plot(slowEma, linewidth=3, color=color.new(color.red, 0), editable=true)

fill(aa, bb, color=isUptrend ? color.green : color.red, transp=90)

tradersPostBuy = trendChanging and isUptrend and timeCondition

tradersPostSell = trendChanging and isDowntrend and timeCondition

pips = syminfo.pointvalue / syminfo.mintick

percentOrPipsInput = input.string('Percent', title='Percent or Pips', options=['Percent', 'Pips'])

stopLossLongInput = input.float(defval=0, step=0.01, title='Stop Loss Long', minval=0)

stopLossShortInput = input.float(defval=0, step=0.01, title='Stop Loss Short', minval=0)

takeProfitLongInput = input.float(defval=0, step=0.01, title='Target Profit Long', minval=0)

takeProfitShortInput = input.float(defval=0, step=0.01, title='Target Profit Short', minval=0)

stopLossPriceLong = ta.valuewhen(tradersPostBuy, close, 0) * (stopLossLongInput / 100) * pips

stopLossPriceShort = ta.valuewhen(tradersPostSell, close, 0) * (stopLossShortInput / 100) * pips

takeProfitPriceLong = ta.valuewhen(tradersPostBuy, close, 0) * (takeProfitLongInput / 100) * pips

takeProfitPriceShort = ta.valuewhen(tradersPostSell, close, 0) * (takeProfitShortInput / 100) * pips

takeProfitALong = takeProfitLongInput > 0 ? takeProfitLongInput : na

takeProfitBLong = takeProfitPriceLong > 0 ? takeProfitPriceLong : na

takeProfitAShort = takeProfitShortInput > 0 ? takeProfitShortInput : na

takeProfitBShort = takeProfitPriceShort > 0 ? takeProfitPriceShort : na

stopLossALong = stopLossLongInput > 0 ? stopLossLongInput : na

stopLossBLong = stopLossPriceLong > 0 ? stopLossPriceLong : na

stopLossAShort = stopLossShortInput > 0 ? stopLossShortInput : na

stopLossBShort = stopLossPriceShort > 0 ? stopLossPriceShort : na

takeProfitLong = percentOrPipsInput == 'Pips' ? takeProfitALong : takeProfitBLong

stopLossLong = percentOrPipsInput == 'Pips' ? stopLossALong : stopLossBLong

takeProfitShort = percentOrPipsInput == 'Pips' ? takeProfitAShort : takeProfitBShort

stopLossShort = percentOrPipsInput == 'Pips' ? stopLossAShort : stopLossBShort

buyAlertMessage = '{"ticker": "' + syminfo.ticker + '", "action": "buy", "price": ' + str.tostring(close) + '}'

sellAlertMessage = '{"ticker": "' + syminfo.ticker + '", "action": "sell", "price": ' + str.tostring(close) + '}'

exitLongAlertMessage = '{"ticker": "' + syminfo.ticker + '", "action": "exit", "price": ' + str.tostring(close) + '}'

exitShortAlertMessage = '{"ticker": "' + syminfo.ticker + '", "action": "exit", "price": ' + str.tostring(close) + '}'

if (sides != "None")

if tradersPostBuy

strategy.entry('Long', strategy.long, when = sides != 'Short', alert_message = buyAlertMessage)

strategy.close('Short', when = sides == "Short" and timeCondition, alert_message = exitShortAlertMessage)

if tradersPostSell

strategy.entry('Short', strategy.short, when = sides != 'Long', alert_message = sellAlertMessage)

strategy.close('Long', when = sides == 'Long', alert_message = exitLongAlertMessage)

exitAlertMessage = '{"ticker": "' + syminfo.ticker + '", "action": "exit"}'

strategy.exit('Exit Long', from_entry = "Long", profit = takeProfitLong, loss = stopLossLong, alert_message = exitAlertMessage)

strategy.exit('Exit Short', from_entry = "Short", profit = takeProfitShort, loss = stopLossShort, alert_message = exitAlertMessage)

strategy.close_all(when = timeConditionEnd)