概述

这是一个基于布林带指标判断趋势,并利用ATR指标设定止损止盈的趋势追踪策略。该策略首先判断市场趋势,在IRONMENT线,并在平仓时设定止损止盈点。

策略原理

- 计算布林带的上轨、下轨。

- 判断收盘价是否高于上轨或低于下轨,如果是则判断为趋势市场,分别为多头和空头市场。

- 如果是趋势市场,则计算环境线。环境线基于最低价减去ATR的值(多头市场)或最高价加上ATR的值(空头市场)。

- 如果不是趋势市场,则环境线保持与前一根K线的环境线值相同。

- 比较ENVIRONMENT线,判断趋势方向。如果上升为多头,下跌为空头。

- 在ENVIRONMENT线方向转变时,产生买入/卖出信号。

- 设置止损止盈:固定止损距离为入场价的100倍;浮动止盈距离为入场价的1.1倍(多头)或0.9倍(空头)。

优势分析

- 能够判断市场趋势,减少假突破操作。

- 设定ENVIRONMENT线,避免被套。

- 止损止盈设置合理,能够在保证盈利的同时控制风险。

风险分析

- 参数设置不当可能导致错失交易机会。

- 布林带指标在震荡行情中判断错误概率较大。

- 止损点过于接近可能被秒出场。

优化方向

- 优化布林带的参数,使之更适合不同品种。

- 优化ENVIRONMENT线的计算方式,如引入其他指标等。

- 测试并优化止损止盈的参数设置。

总结

这是一个以布林带判断趋势,利用ENVIRONMENT线设置止损止盈的策略。核心优势是趋势判断清晰、止损止盈设置合理,能有效控制风险。主要风险在于布林带趋势判断错误和止损点过近。未来优化方向包括参数优化、ENVIRONMENT线计算方式优化和止损止盈优化等。

策略源码

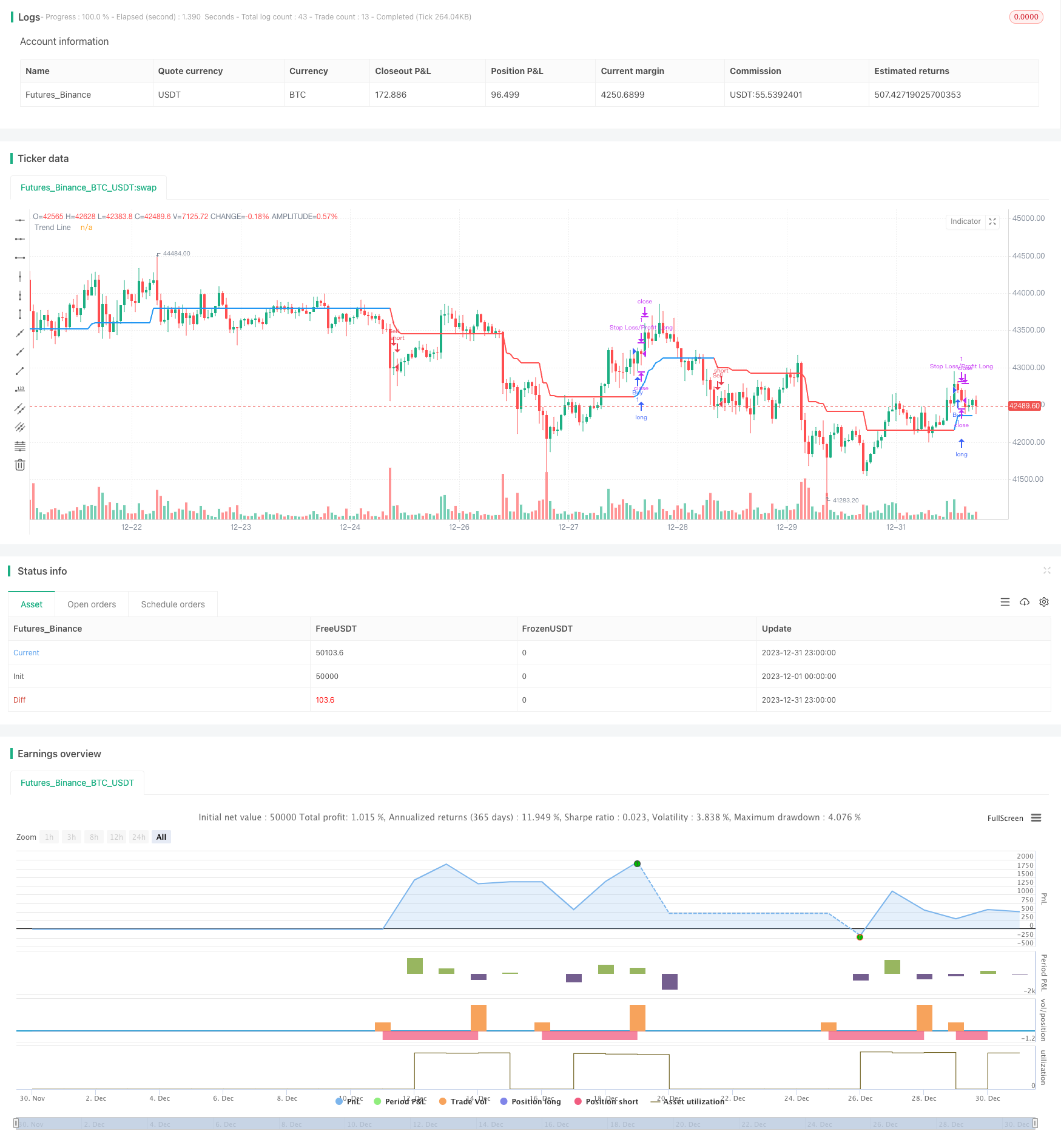

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © zhuenrong

// © Dreadblitz

//@version=4

strategy(shorttitle="FLI", title="Follow Line Indicator", overlay=true)

//

BBperiod = input(defval = 21, title = "BB Period", type = input.integer, minval = 1)

BBdeviations = input(defval = 1.00, title = "BB Deviations", type = input.float, minval = 0.1, step=0.05)

UseATRfilter = input(defval = true, title = "ATR Filter", type = input.bool)

ATRperiod = input(defval = 5, title = "ATR Period", type = input.integer, minval = 1)

hl = input(defval = false, title = "Hide Labels", type = input.bool)

//

BBUpper=sma (close,BBperiod)+stdev(close, BBperiod)*BBdeviations

BBLower=sma (close,BBperiod)-stdev(close, BBperiod)*BBdeviations

//

TrendLine = 0.0

iTrend = 0.0

buy = 0.0

sell = 0.0

//

BBSignal = close>BBUpper? 1 : close<BBLower? -1 : 0

//

if BBSignal == 1 and UseATRfilter == 1

TrendLine:=low-atr(ATRperiod)

if TrendLine<TrendLine[1]

TrendLine:=TrendLine[1]

if BBSignal == -1 and UseATRfilter == 1

TrendLine:=high+atr(ATRperiod)

if TrendLine>TrendLine[1]

TrendLine:=TrendLine[1]

if BBSignal == 0 and UseATRfilter == 1

TrendLine:=TrendLine[1]

//

if BBSignal == 1 and UseATRfilter == 0

TrendLine:=low

if TrendLine<TrendLine[1]

TrendLine:=TrendLine[1]

if BBSignal == -1 and UseATRfilter == 0

TrendLine:=high

if TrendLine>TrendLine[1]

TrendLine:=TrendLine[1]

if BBSignal == 0 and UseATRfilter == 0

TrendLine:=TrendLine[1]

//

iTrend:=iTrend[1]

if TrendLine>TrendLine[1]

iTrend:=1

if TrendLine<TrendLine[1]

iTrend:=-1

//

buy:=iTrend[1]==-1 and iTrend==1 ? 1 : na

sell:=iTrend[1]==1 and iTrend==-1? 1 : na

//

plot(TrendLine, color=iTrend > 0?color.blue:color.red ,style=plot.style_line,linewidth=2,transp=0,title="Trend Line")

plotshape(buy == 1 and hl == false? TrendLine-atr(8) :na, text='💣', style= shape.labelup, location=location.absolute, color=color.blue, textcolor=color.white, offset=0, transp=0,size=size.auto)

plotshape(sell == 1 and hl == false ?TrendLine+atr(8):na, text='🔨', style=shape.labeldown, location=location.absolute, color=color.red, textcolor=color.white, offset=0, transp=0,size=size.auto)

//

alertcondition(sell == 1 ,title="Sell",message="Sell")

alertcondition(buy == 1 ,title="Buy",message="Buy")

alertcondition(buy == 1 or sell == 1 ,title="Buy/Sell",message="Buy/Sell")

if (buy==1)

strategy.entry("Buy", strategy.long)

if (sell==1)

strategy.entry("Sell", strategy.short)

// === Stop LOSS ===

if strategy.position_size>0

strategy.exit("Stop Loss/Profit Long","Buy", stop=strategy.position_avg_price*100, limit=strategy.position_avg_price*1.1)

if strategy.position_size<0

strategy.exit("Stop Loss/Profit Short","Sell", stop=strategy.position_avg_price*100, limit=strategy.position_avg_price*0.9)