概述

智能追踪止损策略(Intelligent Trailing Stop Loss Strategy)是一个根据价格变化自动调整止损点的策略。它结合了 SAR 指标的逻辑,当价格达到新的高点或低点时,追踪调整止损线,实现最大回撤控制。

策略原理

该策略的核心逻辑是根据 SAR 指标自动调整止损线。具体来说,它定义了 4 个变量:

- EP:极值点

- SAR:当前的止损点

- AF:步长因子,用来控制止损线调整的幅度

- 上涨趋势标志:判断当前是上涨趋势还是下跌趋势

在上涨趋势时,止损线会不断上调,追踪价格上涨;当价格转为下跌,止损线保持不变,直到再次转为上涨趋势。

止损线调整的幅度通过步长因子 AF 控制。AF 会在成功设置新的止损点时增加,从而扩大下一步的调整幅度。

策略优势

该策略最大的优势是可以根据市场波动智能调整止损点,在保证足够的盈利空间的同时,也可以尽量减小最大回撤。相比传统的静态止损方法,它可以更好地捕捉价格趋势。

具体来说,主要有以下几个优势:

- 减小最大回撤:智能调整止损线,可以在行情反转前退出,最大限度地保护已经实现的盈利

- 捕捉趋势:止损线会随着新高或者新低而调整,可以自动追踪价格趋势

- 可自定义参数:用户可以根据自己的风险偏好,自定义 AF 的步长值以及起始值,控制止损调整的灵敏度

风险分析

该策略也存在一些风险需要注意:

- 过于灵敏:如果 AF 的步长调整过大或起始值过小,止损线会过于灵敏,可能会被短期的市场噪音刺激触发

- 漏失机会:止损太早被触发也可能会导致损失继续上涨后的盈利机会

- 参数选取:参数设置不当也会影响策略效果,需要针对不同市场调整参数

优化方向

该策略还可以从以下几个方向进行优化:

- 结合其他指标:可以在大周期指标发出信号时暂停止损线调整,避免在趋势反转前过早止损

- 增加参数自适应模块:可以通过机器学习算法,根据历史数据自动优化参数

- 多级止损:可以设置多个止损线,追踪不同幅度的行情波动

总结

智能追踪止损策略通过模拟 SAR 指标的运行逻辑,实时调整止损线位置,在保护利润的同时,尽量减少漏失机会的可能。它最大限度发挥了止损这个功能本身的价值。

相比传统固定止损点的策略,该策略可以更好地适应市场的变化,更灵活。通过自定义参数设置,用户可以根据自己的风险偏好选择适合自己的止损模式。

当然,该策略也存在一定的参数优化空间,及结合其他指标可以实现的提高效果。总体来说,它为投资者在止损和止盈之间找到了更加智能的平衡点。

策略源码

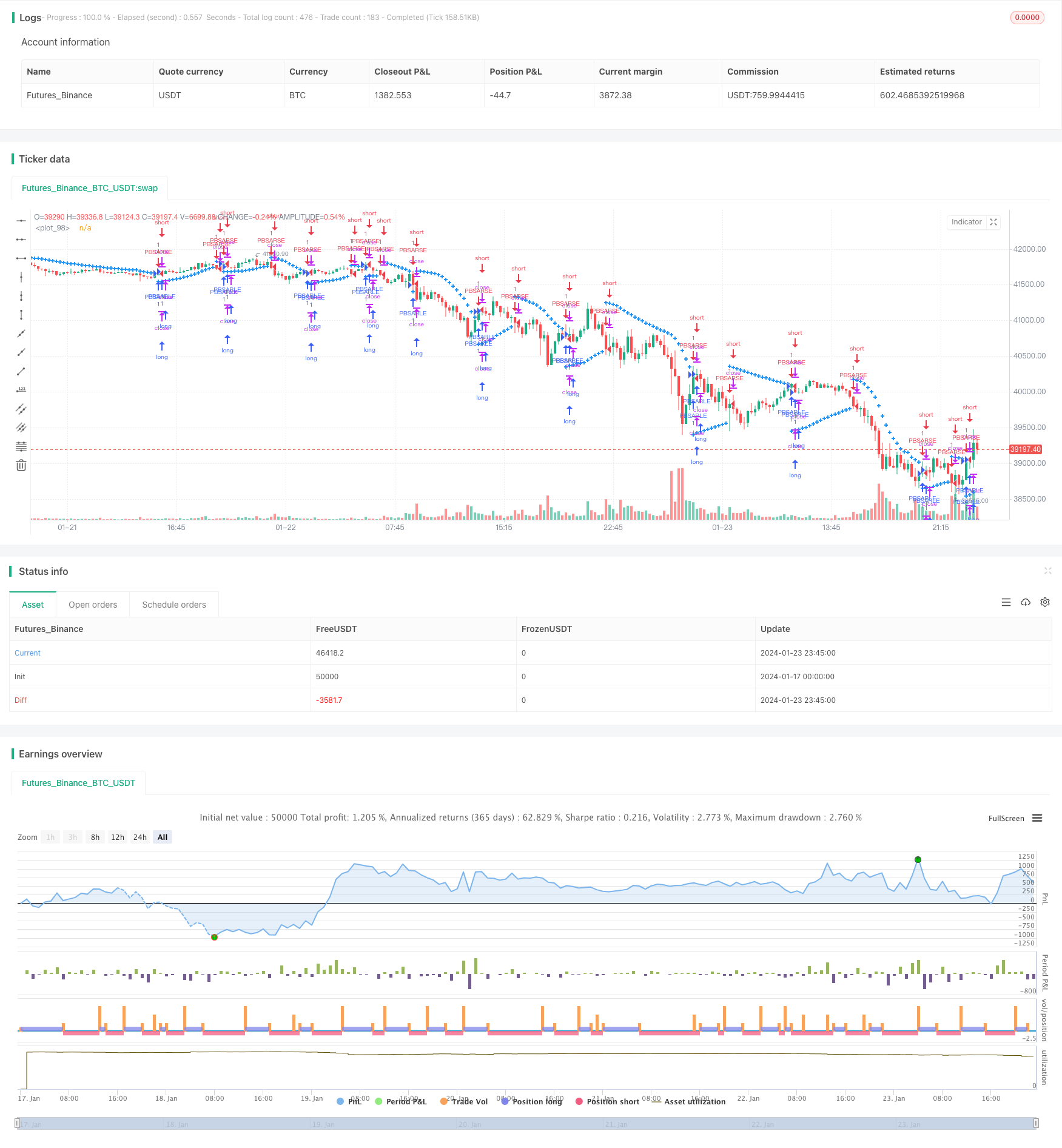

/*backtest

start: 2024-01-17 00:00:00

end: 2024-01-24 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Lucid SAR Strategy", shorttitle="Lucid SAR Strategy", overlay=true)

// Full credit to Sawcruhteez, Lucid Investment Strategies LLC and Casey Bowman.

// This is a strategy version of the Lucid SAR indicator created by the above-mentioned parties.

// Original version of the indicator: https://www.tradingview.com/script/OkACQQgL-Lucid-SAR/

// Branded under the name "Lucid SAR"

// As agreed to with Lucid Investment Strategies LLC on July 9, 2019

// https://lucidinvestmentstrategies.com/

// Created by Casey Bowman on July 4, 2019

// MIT License

// Copyright (c) 2019 Casey Bowman

// Permission is hereby granted, free of charge, to any person obtaining a copy

// of this software and associated documentation files (the "Software"), to deal

// in the Software without restriction, including without limitation the rights

// to use, copy, modify, merge, publish, distribute, sublicense, and/or sell

// copies of the Software, and to permit persons to whom the Software is

// furnished to do so, subject to the following conditions:

// The above copyright notice and this permission notice shall be included in all

// copies or substantial portions of the Software.

// THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND, EXPRESS OR

// IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY,

// FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE

// AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER

// LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM,

// OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE

// SOFTWARE.

AF_initial = input(0.02)

AF_increment = input(0.02)

AF_maximum = input(0.2)

// start with uptrend

uptrend = true

newtrend = false

EP = high

SAR = low

AF = AF_initial

if not na(uptrend[1]) and not na(newtrend[1])

if uptrend[1]

EP := max(high, EP[1])

else

EP := min(low, EP[1])

if newtrend[1]

AF := AF_initial

else

if EP != EP[1]

AF := min(AF_maximum, AF[1] + AF_increment)

else

AF := AF[1]

SAR := SAR[1] + AF * (EP - SAR[1])

if uptrend[1]

if newtrend

SAR := max(high, EP[1])

EP := min(low, low[1])

else

SAR := min(SAR, low[1])

if not na(low[2])

SAR := min(SAR, low[2])

if SAR > low

uptrend := false

newtrend := true

SAR := max(high, EP[1])

EP := min(low, low[1])

else

uptrend := true

newtrend := false

else

if newtrend

SAR := min(low, EP[1])

EP := max(high, high[1])

else

SAR := max(SAR, high[1])

if not na(high[2])

SAR := max(SAR, high[2])

if SAR < high

uptrend := true

newtrend := true

SAR := min(low, EP[1])

EP := max(high, high[1])

else

uptrend := false

newtrend := false

plot(SAR, color = color.blue, style = plot.style_cross, linewidth = 2)

if (uptrend)

strategy.entry("PBSARLE", strategy.long, comment="PBSARLE")

if (newtrend)

strategy.entry("PBSARSE", strategy.short, comment="PBSARSE")