概述

该策略是基于布林通道指标的突破交易策略。它通过计算布林通道的上下轨,并结合动态调整的买入卖出阈值,实现对币安BTCUSDT的自动化交易。

策略原理

该策略的核心指标是布林通道。布林通道由一个N日移动平均线及其上下两个标准差通道构成。本策略中的布林通道长度为20日,标准差倍数为2。当价格接近或触及布林通道下轨时,视为过度超售,这时策略会开仓做多;当价格接近或触及布林通道上轨时,视为过度看涨,这时策略会平仓了结多单。

除布林通道指标外,本策略还引入两个可调参数:买入阈值和卖出阈值。买入阈值默认为布林下轨之下58个点,是打开多单的条件。卖出阈值默认为布林下轨之上470个点,是平仓的条件。这两个阈值可以根据实际情况和回测结果进行动态调整,使策略更具灵活性。

在满足买入条件时,策略会使用账户权益的10%开仓做多。做多后,若价格上涨幅度达到止损条件(-125%),会止损平仓。在价格上涨后触发卖出阈值时,策略会选择全部平仓,回收利润。

优势分析

该策略具有以下几个主要优势:

- 使用布林通道指标,可以抓住价格异常离开轨道的机会,从而在反转时获利

- 引入动态调整的买入卖出阈值,优化入场出场机会

- 采取部分仓位做多,可以控制风险

- 设置止损条件,避免亏损进一步扩大

- 回测数据采用5分钟线,可以及时捕捉较短周期的交易机会

风险分析

该策略也存在一定的风险:

- 布林带指标本身并不是百分百可靠,价格可能长时间低位震荡后再次下跌

- 阈值设定不当可能导致错过最佳入场或出场点

- 止损设置过于宽松,无法及时止损,或者过于严格,止损过于灵敏

- 回测周期选择不当,可能把一些偶然的利润当作稳定收益

对策:

- 结合更多指标判断行情,避免布林通道发出错误信号

- 测试并优化阈值参数,找到最佳参数组合

- 测试并优化止损条件,找到平衡点

- 采用更长的回测周期,检验策略的稳定性

优化方向

该策略还可从以下几个方向进行优化:

- 尝试结合其他指标,例如KD、RSI等,设定更严格的入场规则,避免入场过早或过晚

- 测试不同的布林通道参数组合,优化布林通道的长度和标准差倍数

- 优化买入卖出阈值,找到最佳参数以提高获利率

- 尝试基于ATR动态调整止损比例,让止损更符合市场波动性

- 优化仓位管理,例如获利后可适当加仓,控制单笔亏损风险

总结

本策略overall是一个较为简单实用的突破策略。它采用布林通道指标判断行情反转机会,并设置动态阈值进行入场出场。同时,策略还运用了合理的仓位管理、止损条件等来控制风险。在优化几个关键参数后,该策略可以获得较为稳定的回报。它既适合定量交易,也可作为选股或判断市场情绪的辅助工具。总的来说,本策略具有较强的实用性和拓展性。

策略源码

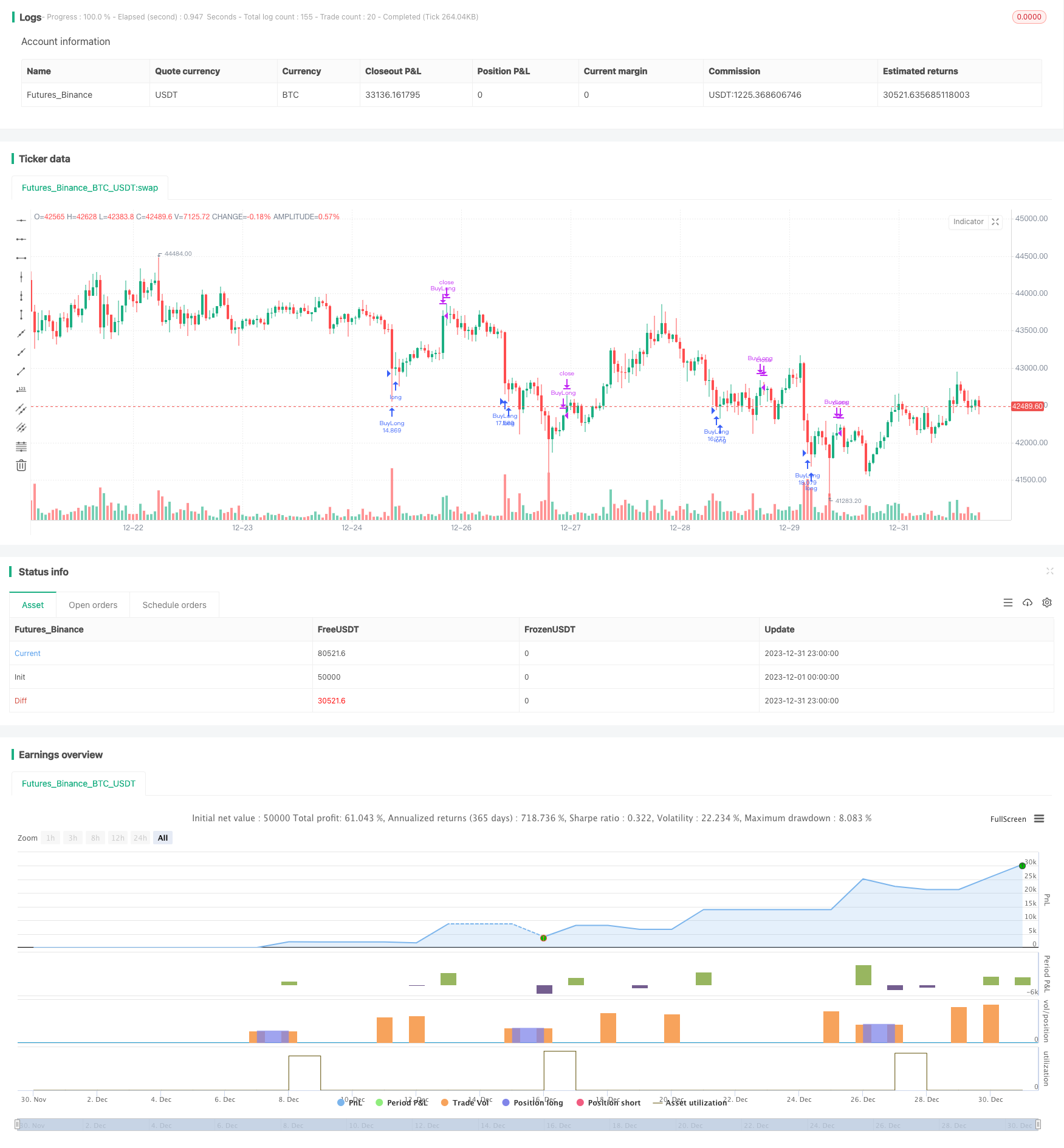

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © SuperDS_BTC

//@version=5

strategy("布林通道策略多5min", overlay=true)

// 布林通道计算

length = input(20, title="布林通道周期")

mult = input(2.0, title="标准差倍数")

basis = ta.sma(close, length)

dev = mult * ta.stdev(close, length)

upper = basis + dev

lower = basis - dev

// 计算买入数量:每次检查仓位的大小

// 每次买入使用总资金的10%

position_size = strategy.equity * 10 / close

// 定義可調整的閾值

buy_threshold = input(58, title="買入閾值")

exit_threshold = input(470, title="賣出閾值")

// 买入条件:当现价低于布林通道的下限减去 buy_threshold

buy_condition = close < lower - buy_threshold

// 卖出条件和结清仓位条件

exit_condition = close > lower + exit_threshold

// 买入逻辑

if buy_condition

strategy.entry("BuyLong", strategy.long, qty=position_size, comment="LongBTC")

// 卖出逻辑

if exit_condition

strategy.close("BuyLong")

// 止损逻辑

stop_loss_percent = -1.25 //止损百分比为-125%

if strategy.position_size > 0

position_profit_percent = (strategy.position_avg_price - close) / strategy.position_avg_price * 100

if position_profit_percent <= stop_loss_percent

strategy.close("BuyLong")