概述

双EMA黄金交叉突破策略是一种基于双指数移动平均线(EMA)的趋势跟踪和突破交易策略。它通过计算两个不同周期的EMA,在它们发生黄金交叉时产生买入信号,在死亡交叉时产生卖出信号,以捕捉价格趋势的变化。此策略同时结合价格突破EMA的条件来发出信号,从而过滤假信号。

策略原理

双EMA黄金交叉突破策略主要基于以下原理:

使用较短周期的EMA(26日线)来捕捉价格的短期趋势,使用较长周期的EMA(200日线)来判断长期趋势走向。

当短期EMA从下向上突破长期EMA时,称为“黄金交叉”,表示价格走势由跌转涨,产生买入信号。

当短期EMA从上向下突破长期EMA时,称为“死亡交叉”,表示价格走势由涨转跌,产生卖出信号。

交叉信号发出时,还需要价格同时突破EMA,以过滤假信号,确保交易信号的可靠性。

采用交易止损和止盈方法,以控制交易风险并锁定盈利。

优势分析

双EMA黄金交叉突破策略具有以下优势:

使用双EMA判断价格趋势和交叉信号,可有效跟踪市场走势。

结合价格突破过滤信号,避免交叉假信号的误导。

采用简单明了的交易逻辑,容易理解和实现。

适用于不同品种和时间周期,灵活通用。

可配置EMA参数和止损止盈条件,适应性强。

风险分析

双EMA黄金交叉突破策略也存在以下风险:

价格震荡时,EMA交叉可能频繁发生,产生过多交易信号。可适当调整EMA参数以减少交叉次数。

双EMA有时会产生滞后性,无法及时反应价格变化。可结合其他指标进行确认。

止损点过小容易被价格略微波动触发,止盈点过大可能错过部分盈利。需根据市场调整止损止盈位置。

交易信号产生前需判断大级别趋势,避免逆势交易。

优化方向

双EMA黄金交叉突破策略可从以下几个方面进行优化:

应用机器学习算法动态优化EMA参数,使其能更好适应价格波动。

增加其他指标确认信号,如成交量、布林带等,提高信号质量。

结合深度学习预测价格路径,使止损止盈更接近最优位置。

针对高频数据进行策略优化,提高信号精准度。

增加自适应调整止损机制,防止过于频繁停损。

总结

综上所述,双EMA黄金交叉突破策略利用EMA交叉信号判断价格走势和转折点,并加入价格突破过滤以避免假信号,是一种可靠、稳定、易于实现的趋势跟踪交易策略。通过参数优化、信号过滤和自适应调整可进一步增强策略的效果。其交易思路简单直观,适用于各类投资者,是量化交易的基础策略之一。

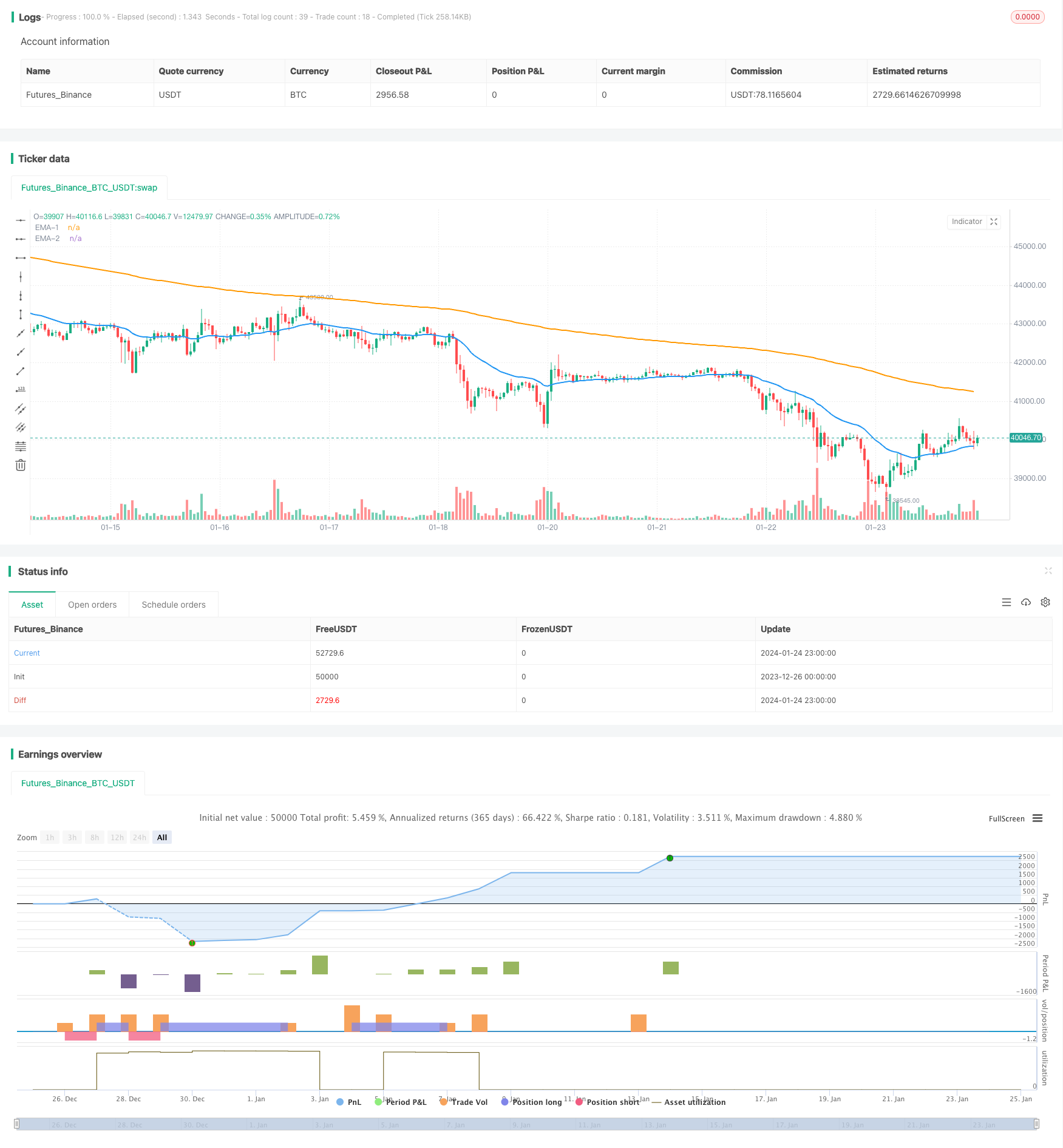

/*backtest

start: 2023-12-26 00:00:00

end: 2024-01-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA Buy/Sell Signal", shorttitle="EMABuySell", overlay=true)

// === INPUTS ===

src = input(close)

ema1Length = input(26, title='EMA-1')

ema2Length = input(200, title='EMA-2')

EMASig = input(true, title="Show EMA ?")

takeProfitPercent = input(2.0, title="Take Profit (%)") / 100

stopLossPercent = input(1, title="Stop Loss (%)") / 100

pema1 = ta.ema(src, ema1Length)

pema2 = ta.ema(src, ema2Length)

// Plotting EMAs

plot(EMASig ? pema1 : na, title='EMA-1', color=color.new(color.blue, 0), linewidth=2)

plot(EMASig ? pema2 : na, title='EMA-2', color=color.new(color.orange, 0), linewidth=2)

// EMA Crossover Buy Signal

EMACrossoverLong = ta.crossover(pema1, pema2)

// EMA Crossunder Short Signal

EMACrossoverShort = ta.crossunder(pema1, pema2)

// Crossover above EMA-200 Long Signal

CrossoverAboveEMA200 = ta.crossover(close, pema2)

// Trading logic for Long

if ((EMACrossoverLong and close > pema1 and close > pema2) or CrossoverAboveEMA200)

strategy.entry("Buy", strategy.long, qty=1)

// Take Profit logic for Long

longCondition = close >= strategy.position_avg_price * (1 + takeProfitPercent)

if (strategy.position_size > 0 and longCondition)

strategy.close("Buy")

// Stop Loss logic for Long

stopLossConditionLong = ta.crossunder(pema1, pema2)

if (strategy.position_size > 0 and stopLossConditionLong)

strategy.close("Buy")

// Trading logic for Short

if (EMACrossoverShort and close < pema1 and close < pema2)

strategy.entry("Sell", strategy.short, qty=1)

// Take Profit logic for Short

shortCondition = close <= strategy.position_avg_price * (1 - takeProfitPercent)

if (strategy.position_size < 0 and shortCondition)

strategy.close("Sell")

// Stop Loss logic for Short

stopLossConditionShort = ta.crossover(pema1, pema2)

if (strategy.position_size < 0 and stopLossConditionShort)

strategy.close("Sell")

// Visual Signals

plotshape(series=EMACrossoverLong or CrossoverAboveEMA200, title="Buy Signal", color=color.green, style=shape.triangleup, size=size.small)

plotshape(series=EMACrossoverShort, title="Sell Signal", color=color.red, style=shape.triangledown, size=size.small)