概述

该策略利用市场密码指标的波浪理论,结合多种技术指标实现自动买卖。它可以在趋势开始时识别机会,实现趋势跟踪。

策略原理

该策略主要基于市场密码波浪B指标。该指标将价格行情分为1波和2波两个层面。1波反应敏感,2波反应平滑。它们的交叉为买卖信号。当1波上穿2波时为买入机会,下穿为卖出机会。

代码中通过Wavetrend函数计算出1波和2波。然后结合超买超卖区分波浪方向。例如当Wave1下穿Wave2,同时Wave2位于超买区,就是卖出信号。

此外,代码还引入多种辅助指标提高决策准确性,主要包括:

极值区域:结合RSI和资金流指标判断价格波动区域。

KD:判断多空势头

背离:找出买卖转折点

旗形:判断趋势持续性

最后,根据Wave和辅助指标情况判断最终交易决策。

策略优势

该策略最大优势在于能够应对不同市场环境。具体来说,主要体现在以下几个方面:

- 多种指标组合,判断准确性高

策略不仅使用Wave本身的交叉作为判断标准,还引入RSI、KD、背离等多个指标,通过组合提高决策的准确性。

- 旗形判断,擅长捕捉趋势

通过引入旗形判断模块,能够有效判断趋势的持续性,避免头重脚轻,从而在趋势开始时就可以识别机会。这使得策略特别擅长趋势跟踪。

- 手动参数优化空间大

策略参数可自定义程度高,用户可以根据自己对市场的判断和理解,选择不同参数进行优化,从而适应更加复杂的市场环境。这使策略应用范围更广。

策略风险

该策略也存在一些潜在风险,主要体现在以下几个方面:

- 多辅助指标判断冲突

辅助指标众多,在某些极端行情下,可能存在指标判断发生冲突的情况。这会对最终决策带来不确定性。

- 参数调优难度大

由于可调参数较多,想要达到最优的参数组合需要大量数据回测和测试,难度较大,容易出现过优化。

- 买卖频率可能过高

在震荡行情中,Wave交叉可能出现频繁,从而导致交易次数过于频繁。这会带来额外的交易成本。

对应地,可以从以下几个方面来优化:

引入更多过滤条件,确保决策稳健性

优先调整对策略影响大的参数

增大止损范围,降低买卖频率

总结

总的来说,该策略综合运用市场密码波浪理论和多种技术指标,实现了自动识别买卖点和跟踪趋势的能力。它参数可调性强,适应性广,擅长捕捉趋势机会。同时也需要注意一定的潜在风险,需要从升级判断规则和调整参数等方面不断优化,使策略更加稳健。

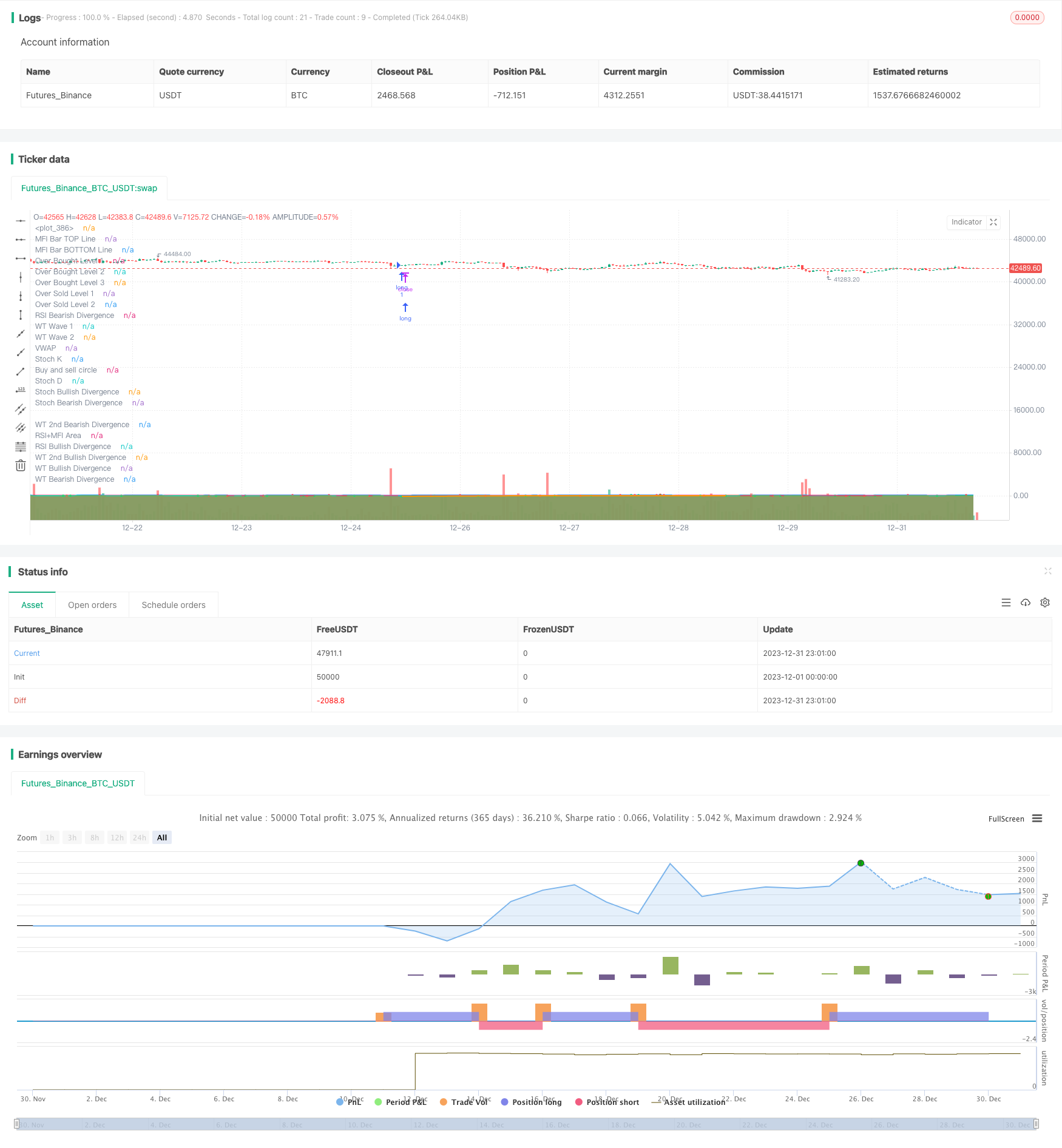

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © vumanchu

//@version=5

// Thanks to dynausmaux for the code

// Thanks to falconCoin for https://www.tradingview.com/script/KVfgBvDd-Market-Cipher-B-Free-version-with-Buy-and-sell/ inspired me to start this.

// Thanks to LazyBear for WaveTrend Oscillator https://www.tradingview.com/script/2KE8wTuF-Indicator-WaveTrend-Oscillator-WT/

// Thanks to RicardoSantos for https://www.tradingview.com/script/3oeDh0Yq-RS-Price-Divergence-Detector-V2/

// Thanks to LucemAnb for Plain Stochastic Divergence https://www.tradingview.com/script/FCUgF8ag-Plain-Stochastic-Divergence/

// Thanks to andreholanda73 for MFI+RSI Area https://www.tradingview.com/script/UlGZzUAr/

// I especially want to thank TradingView for its platform that facilitates development and learning.

//

// CIRCLES & TRIANGLES:

// - LITTLE CIRCLE: They appear at all WaveTrend wave crossings.

// - GREEN CIRCLE: The wavetrend waves are at the oversold level and have crossed up (bullish).

// - RED CIRCLE: The wavetrend waves are at the overbought level and have crossed down (bearish).

// - GOLD/ORANGE CIRCLE: When RSI is below 20, WaveTrend waves are below or equal to -80 and have crossed up after good bullish divergence (DONT BUY WHEN GOLD CIRCLE APPEAR).

// - None of these circles are certain signs to trade. It is only information that can help you.

// - PURPLE TRIANGLE: Appear when a bullish or bearish divergence is formed and WaveTrend waves crosses at overbought and oversold points.

//

// NOTES:

// - I am not an expert trader or know how to program pine script as such, in fact it is my first indicator only to study and all the code is copied and modified from other codes that are published in TradingView.

// - I am very grateful to the entire TV community that publishes codes so that other newbies like me can learn and present their results. This is an attempt to imitate Market Cipher B.

// - Settings by default are for 4h timeframe, divergences are more stronger and accurate. Haven't tested in all timeframes, only 2h and 4h.

// - If you get an interesting result in other timeframes I would be very grateful if you would comment your configuration to implement it or at least check it.

//

// CONTRIBUTIONS:

// - Tip/Idea: Add higher timeframe analysis for bearish/bullish patterns at the current timeframe.

// + Bearish/Bullish FLAG:

// - MFI+RSI Area are RED (Below 0).

// - Wavetrend waves are above 0 and crosses down.

// - VWAP Area are below 0 on higher timeframe.

// - This pattern reversed becomes bullish.

// - Tip/Idea: Check the last heikinashi candle from 2 higher timeframe

// + Bearish/Bullish DIAMOND:

// - HT Candle is red

// - WT > 0 and crossed down

strategy(title='MCB CIRCLE ONLY PGB STRAT BUN TP SL TEST', shorttitle='MCB CIRCLE ONLY PGB STRAT BUN TP SL TEST', overlay=true )

// strategy.cash

//max_bars_back = 200)

// PARAMETERS {

// WaveTrend

wtShow = input(true, title='Show WaveTrend')

wtBuyShow = input(true, title='Show Buy dots')

wtGoldShow = input(true, title='Show Gold dots')

wtSellShow = input(true, title='Show Sell dots')

wtDivShow = input(true, title='Show Div. dots')

vwapShow = input(true, title='Show Fast WT')

wtChannelLen = input(9, title='WT Channel Length')

wtAverageLen = input(12, title='WT Average Length')

wtMASource = input(hlc3, title='WT MA Source')

wtMALen = input(3, title='WT MA Length')

// WaveTrend Overbought & Oversold lines

obLevel = input(70, title='WT Overbought Level 1')

obLevel2 = input(99, title='WT Overbought Level 2')

obLevel3 = input(99, title='WT Overbought Level 3')

osLevel = -obLevel

osLevel2 = input(-99, title='WT Oversold Level 2')

osLevel3 = input(-99, title='WT Oversold Level 3')

// Divergence WT

wtShowDiv = input(true, title='Show WT Regular Divergences')

wtShowHiddenDiv = input(false, title='Show WT Hidden Divergences')

showHiddenDiv_nl = input(true, title='Not apply OB/OS Limits on Hidden Divergences')

wtDivOBLevel = input(81, title='WT Bearish Divergence min')

// wtDivOSLevel = input(-91, title='WT Bullish Divergence min')

wtDivOSLevel = -wtDivOBLevel

// Divergence extra range

wtDivOBLevel_addshow = input(true, title='Show 2nd WT Regular Divergences')

wtDivOBLevel_add = input(63, title='WT 2nd Bearish Divergence')

// wtDivOSLevel_add = input(-40, title='WT 2nd Bullish Divergence 15 min')

wtDivOSLevel_add = -wtDivOBLevel_add

// RSI+MFI

rsiMFIShow = input(true, title='Show MFI')

rsiMFIperiod = input(60, title='MFI Period')

rsiMFIMultiplier = input.float(150, title='MFI Area multiplier')

rsiMFIPosY = input(2.5, title='MFI Area Y Pos')

// RSI

rsiShow = input(false, title='Show RSI')

rsiSRC = input(close, title='RSI Source')

rsiLen = input(14, title='RSI Length')

rsiOversold = input.int(30, title='RSI Oversold', minval=30, maxval=100)

rsiOverbought = input.int(60, title='RSI Overbought', minval=0, maxval=60)

// Divergence RSI

rsiShowDiv = input(false, title='Show RSI Regular Divergences')

rsiShowHiddenDiv = input(false, title='Show RSI Hidden Divergences')

rsiDivOBLevel = input(60, title='RSI Bearish Divergence min')

rsiDivOSLevel = input(30, title='RSI Bullish Divergence min')

// RSI Stochastic

stochShow = input(true, title='Show Stochastic RSI')

stochUseLog = input(true, title=' Use Log?')

stochAvg = input(false, title='Use Average of both K & D')

stochSRC = input(close, title='Stochastic RSI Source')

stochLen = input(14, title='Stochastic RSI Length')

stochRsiLen = input(14, title='RSI Length ')

stochKSmooth = input(3, title='Stochastic RSI K Smooth')

stochDSmooth = input(3, title='Stochastic RSI D Smooth')

// Divergence stoch

stochShowDiv = input(false, title='Show Stoch Regular Divergences')

stochShowHiddenDiv = input(false, title='Show Stoch Hidden Divergences')

// Schaff Trend Cycle

tcLine = input(false, title='Show Schaff TC line')

tcSRC = input(close, title='Schaff TC Source')

tclength = input(10, title='Schaff TC')

tcfastLength = input(23, title='Schaff TC Fast Lenght')

tcslowLength = input(50, title='Schaff TC Slow Length')

tcfactor = input(0.5, title='Schaff TC Factor')

// Sommi Flag

sommiFlagShow = input(false, title='Show Sommi flag')

sommiShowVwap = input(false, title='Show Sommi F. Wave')

sommiVwapTF = input('720', title='Sommi F. Wave timeframe')

sommiVwapBearLevel = input(0, title='F. Wave Bear Level (less than)')

sommiVwapBullLevel = input(0, title='F. Wave Bull Level (more than)')

soomiFlagWTBearLevel = input(0, title='WT Bear Level (more than)')

soomiFlagWTBullLevel = input(0, title='WT Bull Level (less than)')

soomiRSIMFIBearLevel = input(0, title='Money flow Bear Level (less than)')

soomiRSIMFIBullLevel = input(0, title='Money flow Bull Level (more than)')

// Sommi Diamond

sommiDiamondShow = input(false, title='Show Sommi diamond')

sommiHTCRes = input('60', title='HTF Candle Res. 1')

sommiHTCRes2 = input('240', title='HTF Candle Res. 2')

soomiDiamondWTBearLevel = input(0, title='WT Bear Level (More than)')

soomiDiamondWTBullLevel = input(0, title='WT Bull Level (Less than)')

// macd Colors

macdWTColorsShow = input(false, title='Show MACD Colors')

macdWTColorsTF = input('240', title='MACD Colors MACD TF')

darkMode = input(false, title='Dark mode')

// Colors

colorRed = #ff0000

colorPurple = #e600e6

colorGreen = #3fff00

colorOrange = #e2a400

colorYellow = #ffe500

colorWhite = #ffffff

colorPink = #ff00f0

colorBluelight = #31c0ff

colorWT1 = #90caf9

colorWT2 = #0d47a1

colorWT2_ = #131722

colormacdWT1a = #4caf58

colormacdWT1b = #af4c4c

colormacdWT1c = #7ee57e

colormacdWT1d = #ff3535

colormacdWT2a = #305630

colormacdWT2b = #310101

colormacdWT2c = #132213

colormacdWT2d = #770000

// } PARAMETERS

// FUNCTIONS {

// Divergences

f_top_fractal(src) =>

src[4] < src[2] and src[3] < src[2] and src[2] > src[1] and src[2] > src[0]

f_bot_fractal(src) =>

src[4] > src[2] and src[3] > src[2] and src[2] < src[1] and src[2] < src[0]

f_fractalize(src) =>

f_top_fractal(src) ? 1 : f_bot_fractal(src) ? -1 : 0

f_findDivs(src, topLimit, botLimit, useLimits) =>

fractalTop = f_fractalize(src) > 0 and (useLimits ? src[2] >= topLimit : true) ? src[2] : na

fractalBot = f_fractalize(src) < 0 and (useLimits ? src[2] <= botLimit : true) ? src[2] : na

highPrev = ta.valuewhen(fractalTop, src[2], 0)[2]

highPrice = ta.valuewhen(fractalTop, high[2], 0)[2]

lowPrev = ta.valuewhen(fractalBot, src[2], 0)[2]

lowPrice = ta.valuewhen(fractalBot, low[2], 0)[2]

bearSignal = fractalTop and high[2] > highPrice and src[2] < highPrev

bullSignal = fractalBot and low[2] < lowPrice and src[2] > lowPrev

bearDivHidden = fractalTop and high[2] < highPrice and src[2] > highPrev

bullDivHidden = fractalBot and low[2] > lowPrice and src[2] < lowPrev

[fractalTop, fractalBot, lowPrev, bearSignal, bullSignal, bearDivHidden, bullDivHidden]

// RSI+MFI

f_rsimfi(_period, _multiplier, _tf) =>

request.security(syminfo.tickerid, _tf, ta.sma((close - open) / (high - low) * _multiplier, _period) - rsiMFIPosY)

// WaveTrend

f_wavetrend(src, chlen, avg, malen, tf) =>

tfsrc = request.security(syminfo.tickerid, tf, src)

esa = ta.ema(tfsrc, chlen)

de = ta.ema(math.abs(tfsrc - esa), chlen)

ci = (tfsrc - esa) / (0.015 * de)

wt1 = request.security(syminfo.tickerid, tf, ta.ema(ci, avg))

wt2 = request.security(syminfo.tickerid, tf, ta.sma(wt1, malen))

wtVwap = wt1 - wt2

wtOversold = wt2 <= osLevel

wtOverbought = wt2 >= obLevel

wtCross = ta.cross(wt1, wt2)

wtCrossUp = wt2 - wt1 <= 0

wtCrossDown = wt2 - wt1 >= 0

wtCrosslast = ta.cross(wt1[2], wt2[2])

wtCrossUplast = wt2[2] - wt1[2] <= 0

wtCrossDownlast = wt2[2] - wt1[2] >= 0

[wt1, wt2, wtOversold, wtOverbought, wtCross, wtCrossUp, wtCrossDown, wtCrosslast, wtCrossUplast, wtCrossDownlast, wtVwap]

// Schaff Trend Cycle

f_tc(src, length, fastLength, slowLength) =>

ema1 = ta.ema(src, fastLength)

ema2 = ta.ema(src, slowLength)

macdVal = ema1 - ema2

alpha = ta.lowest(macdVal, length)

beta = ta.highest(macdVal, length) - alpha

gamma = (macdVal - alpha) / beta * 100

gamma := beta > 0 ? gamma : nz(gamma[1])

delta = gamma

delta := na(delta[1]) ? delta : delta[1] + tcfactor * (gamma - delta[1])

epsilon = ta.lowest(delta, length)

zeta = ta.highest(delta, length) - epsilon

eta = (delta - epsilon) / zeta * 100

eta := zeta > 0 ? eta : nz(eta[1])

stcReturn = eta

stcReturn := na(stcReturn[1]) ? stcReturn : stcReturn[1] + tcfactor * (eta - stcReturn[1])

stcReturn

// Stochastic RSI

f_stochrsi(_src, _stochlen, _rsilen, _smoothk, _smoothd, _log, _avg) =>

src = _log ? math.log(_src) : _src

rsi = ta.rsi(src, _rsilen)

kk = ta.sma(ta.stoch(rsi, rsi, rsi, _stochlen), _smoothk)

d1 = ta.sma(kk, _smoothd)

avg_1 = math.avg(kk, d1)

k = _avg ? avg_1 : kk

[k, d1]

// MACD

f_macd(src, fastlen, slowlen, sigsmooth, tf) =>

fast_ma = request.security(syminfo.tickerid, tf, ta.ema(src, fastlen))

slow_ma = request.security(syminfo.tickerid, tf, ta.ema(src, slowlen))

macd = fast_ma - slow_ma

signal = request.security(syminfo.tickerid, tf, ta.sma(macd, sigsmooth))

hist = macd - signal

[macd, signal, hist]

// MACD Colors on WT

f_macdWTColors(tf) =>

hrsimfi = f_rsimfi(rsiMFIperiod, rsiMFIMultiplier, tf)

[macd, signal, hist] = f_macd(close, 28, 42, 9, macdWTColorsTF)

macdup = macd >= signal

macddown = macd <= signal

macdWT1Color = macdup ? hrsimfi > 0 ? colormacdWT1c : colormacdWT1a : macddown ? hrsimfi < 0 ? colormacdWT1d : colormacdWT1b : na

macdWT2Color = macdup ? hrsimfi < 0 ? colormacdWT2c : colormacdWT2a : macddown ? hrsimfi < 0 ? colormacdWT2d : colormacdWT2b : na

[macdWT1Color, macdWT2Color]

// Get higher timeframe candle

f_getTFCandle(_tf) =>

_open = request.security(ticker.heikinashi(syminfo.tickerid), _tf, open, barmerge.gaps_off, barmerge.lookahead_on)

_close = request.security(ticker.heikinashi(syminfo.tickerid), _tf, close, barmerge.gaps_off, barmerge.lookahead_on)

_high = request.security(ticker.heikinashi(syminfo.tickerid), _tf, high, barmerge.gaps_off, barmerge.lookahead_on)

_low = request.security(ticker.heikinashi(syminfo.tickerid), _tf, low, barmerge.gaps_off, barmerge.lookahead_on)

hl2 = (_high + _low) / 2.0

newBar = ta.change(_open)

candleBodyDir = _close > _open

[candleBodyDir, newBar]

// Sommi flag

f_findSommiFlag(tf, wt1, wt2, rsimfi, wtCross, wtCrossUp, wtCrossDown) =>

[hwt1, hwt2, hwtOversold, hwtOverbought, hwtCross, hwtCrossUp, hwtCrossDown, hwtCrosslast, hwtCrossUplast, hwtCrossDownlast, hwtVwap] = f_wavetrend(wtMASource, wtChannelLen, wtAverageLen, wtMALen, tf)

bearPattern = rsimfi < soomiRSIMFIBearLevel and wt2 > soomiFlagWTBearLevel and wtCross and wtCrossDown and hwtVwap < sommiVwapBearLevel

bullPattern = rsimfi > soomiRSIMFIBullLevel and wt2 < soomiFlagWTBullLevel and wtCross and wtCrossUp and hwtVwap > sommiVwapBullLevel

[bearPattern, bullPattern, hwtVwap]

f_findSommiDiamond(tf, tf2, wt1, wt2, wtCross, wtCrossUp, wtCrossDown) =>

[candleBodyDir, newBar] = f_getTFCandle(tf)

[candleBodyDir2, newBar2] = f_getTFCandle(tf2)

bearPattern = wt2 >= soomiDiamondWTBearLevel and wtCross and wtCrossDown and not candleBodyDir and not candleBodyDir2

bullPattern = wt2 <= soomiDiamondWTBullLevel and wtCross and wtCrossUp and candleBodyDir and candleBodyDir2

[bearPattern, bullPattern]

// } FUNCTIONS

// CALCULATE INDICATORS {

// RSI

rsi = ta.rsi(rsiSRC, rsiLen)

rsiColor = rsi <= rsiOversold ? colorGreen : rsi >= rsiOverbought ? colorRed : colorPurple

// RSI + MFI Area

rsiMFI = f_rsimfi(rsiMFIperiod, rsiMFIMultiplier, timeframe.period)

rsiMFIColor = rsiMFI > 0 ? #3ee145 : #ff3d2e

// Calculates WaveTrend

[wt1, wt2, wtOversold, wtOverbought, wtCross, wtCrossUp, wtCrossDown, wtCross_last, wtCrossUp_last, wtCrossDown_last, wtVwap] = f_wavetrend(wtMASource, wtChannelLen, wtAverageLen, wtMALen, timeframe.period)

// Stochastic RSI

[stochK, stochD] = f_stochrsi(stochSRC, stochLen, stochRsiLen, stochKSmooth, stochDSmooth, stochUseLog, stochAvg)

// Schaff Trend Cycle

tcVal = f_tc(tcSRC, tclength, tcfastLength, tcslowLength)

// Sommi flag

[sommiBearish, sommiBullish, hvwap] = f_findSommiFlag(sommiVwapTF, wt1, wt2, rsiMFI, wtCross, wtCrossUp, wtCrossDown)

//Sommi diamond

[sommiBearishDiamond, sommiBullishDiamond] = f_findSommiDiamond(sommiHTCRes, sommiHTCRes2, wt1, wt2, wtCross, wtCrossUp, wtCrossDown)

// macd colors

[macdWT1Color, macdWT2Color] = f_macdWTColors(macdWTColorsTF)

// WT Divergences

[wtFractalTop, wtFractalBot, wtLow_prev, wtBearDiv, wtBullDiv, wtBearDivHidden, wtBullDivHidden] = f_findDivs(wt2, wtDivOBLevel, wtDivOSLevel, true)

[wtFractalTop_add, wtFractalBot_add, wtLow_prev_add, wtBearDiv_add, wtBullDiv_add, wtBearDivHidden_add, wtBullDivHidden_add] = f_findDivs(wt2, wtDivOBLevel_add, wtDivOSLevel_add, true)

[wtFractalTop_nl, wtFractalBot_nl, wtLow_prev_nl, wtBearDiv_nl, wtBullDiv_nl, wtBearDivHidden_nl, wtBullDivHidden_nl] = f_findDivs(wt2, 0, 0, false)

wtBearDivHidden_ = showHiddenDiv_nl ? wtBearDivHidden_nl : wtBearDivHidden

wtBullDivHidden_ = showHiddenDiv_nl ? wtBullDivHidden_nl : wtBullDivHidden

wtBearDivColor = wtShowDiv and wtBearDiv or wtShowHiddenDiv and wtBearDivHidden_ ? colorRed : na

wtBullDivColor = wtShowDiv and wtBullDiv or wtShowHiddenDiv and wtBullDivHidden_ ? colorGreen : na

wtBearDivColor_add = wtShowDiv and wtDivOBLevel_addshow and wtBearDiv_add or wtShowHiddenDiv and wtDivOBLevel_addshow and wtBearDivHidden_add ? #9a0202 : na

wtBullDivColor_add = wtShowDiv and wtDivOBLevel_addshow and wtBullDiv_add or wtShowHiddenDiv and wtDivOBLevel_addshow and wtBullDivHidden_add ? #1b5e20 : na

// RSI Divergences

[rsiFractalTop, rsiFractalBot, rsiLow_prev, rsiBearDiv, rsiBullDiv, rsiBearDivHidden, rsiBullDivHidden] = f_findDivs(rsi, rsiDivOBLevel, rsiDivOSLevel, true)

[rsiFractalTop_nl, rsiFractalBot_nl, rsiLow_prev_nl, rsiBearDiv_nl, rsiBullDiv_nl, rsiBearDivHidden_nl, rsiBullDivHidden_nl] = f_findDivs(rsi, 0, 0, false)

rsiBearDivHidden_ = showHiddenDiv_nl ? rsiBearDivHidden_nl : rsiBearDivHidden

rsiBullDivHidden_ = showHiddenDiv_nl ? rsiBullDivHidden_nl : rsiBullDivHidden

rsiBearDivColor = rsiShowDiv and rsiBearDiv or rsiShowHiddenDiv and rsiBearDivHidden_ ? colorRed : na

rsiBullDivColor = rsiShowDiv and rsiBullDiv or rsiShowHiddenDiv and rsiBullDivHidden_ ? colorGreen : na

// Stoch Divergences

[stochFractalTop, stochFractalBot, stochLow_prev, stochBearDiv, stochBullDiv, stochBearDivHidden, stochBullDivHidden] = f_findDivs(stochK, 0, 0, false)

stochBearDivColor = stochShowDiv and stochBearDiv or stochShowHiddenDiv and stochBearDivHidden ? colorRed : na

stochBullDivColor = stochShowDiv and stochBullDiv or stochShowHiddenDiv and stochBullDivHidden ? colorGreen : na

// Small Circles WT Cross

signalColor = wt2 - wt1 > 0 ? color.red : color.lime

// Buy signal.

buySignal = wtCross and wtCrossUp and wtOversold

buySignalDiv = wtShowDiv and wtBullDiv or wtShowDiv and wtBullDiv_add or stochShowDiv and stochBullDiv or rsiShowDiv and rsiBullDiv

buySignalDiv_color = wtBullDiv ? colorGreen : wtBullDiv_add ? color.new(colorGreen, 100) : rsiShowDiv ? colorGreen : na

// Sell signal

sellSignal = wtCross and wtCrossDown and wtOverbought

sellSignalDiv = wtShowDiv and wtBearDiv or wtShowDiv and wtBearDiv_add or stochShowDiv and stochBearDiv or rsiShowDiv and rsiBearDiv

sellSignalDiv_color = wtBearDiv ? colorRed : wtBearDiv_add ? color.new(colorRed, 60) : rsiBearDiv ? colorRed : na

// Gold Buy

lastRsi = ta.valuewhen(wtFractalBot, rsi[2], 0)[2]

wtGoldBuy = (wtShowDiv and wtBullDiv or rsiShowDiv and rsiBullDiv) and wtLow_prev <= osLevel3 and wt2 > osLevel3 and wtLow_prev - wt2 <= -5 and lastRsi < 30

// } CALCULATE INDICATORS

// DRAW {

bgcolor(darkMode ? color.new(#000000, 80) : na, transp=90)

zLine = plot(0, color=color.new(colorWhite, 50))

// MFI BAR

rsiMfiBarTopLine = plot(rsiMFIShow ? -95 : na, title='MFI Bar TOP Line', transp=100)

rsiMfiBarBottomLine = plot(rsiMFIShow ? -99 : na, title='MFI Bar BOTTOM Line', transp=50)

fill(rsiMfiBarTopLine, rsiMfiBarBottomLine, title='MFI Bar Colors', color=rsiMFIColor, transp=75)

// WT Areas

plot(wtShow ? wt1 : na, style=plot.style_area, title='WT Wave 1', color=macdWTColorsShow ? macdWT1Color : colorWT1, transp=0)

plot(wtShow ? wt2 : na, style=plot.style_area, title='WT Wave 2', color=macdWTColorsShow ? macdWT2Color : darkMode ? colorWT2_ : colorWT2, transp=20)

// VWAP

plot(vwapShow ? wtVwap : na, title='VWAP', color=color.new(colorYellow, 45), style=plot.style_area, linewidth=2)

// MFI AREA

rsiMFIplot = plot(rsiMFIShow ? rsiMFI : na, title='RSI+MFI Area', color=rsiMFIColor, transp=20)

fill(rsiMFIplot, zLine, rsiMFIColor, transp=40)

// WT Div

plot(series=wtFractalTop ? wt2[2] : na, title='WT Bearish Divergence', color=wtBearDivColor, linewidth=2, offset=-2)

plot(series=wtFractalBot ? wt2[2] : na, title='WT Bullish Divergence', color=wtBullDivColor, linewidth=2, offset=-2)

// WT 2nd Div

plot(series=wtFractalTop_add ? wt2[2] : na, title='WT 2nd Bearish Divergence', color=wtBearDivColor_add, linewidth=2, offset=-2)

plot(series=wtFractalBot_add ? wt2[2] : na, title='WT 2nd Bullish Divergence', color=wtBullDivColor_add, linewidth=2, offset=-2)

// RSI

plot(rsiShow ? rsi : na, title='RSI', color=rsiColor, linewidth=2, transp=25)

// RSI Div

plot(series=rsiFractalTop ? rsi[2] : na, title='RSI Bearish Divergence', color=rsiBearDivColor, linewidth=1, offset=-2)

plot(series=rsiFractalBot ? rsi[2] : na, title='RSI Bullish Divergence', color=rsiBullDivColor, linewidth=1, offset=-2)

// Stochastic RSI

stochKplot = plot(stochShow ? stochK : na, title='Stoch K', color=color.new(#21baf3, 0), linewidth=2)

stochDplot = plot(stochShow ? stochD : na, title='Stoch D', color=color.new(#673ab7, 60), linewidth=1)

stochFillColor = stochK >= stochD ? color.new(#21baf3, 75) : color.new(#673ab7, 60)

fill(stochKplot, stochDplot, title='KD Fill', color=stochFillColor, transp=90)

// Stoch Div

plot(series=stochFractalTop ? stochK[2] : na, title='Stoch Bearish Divergence', color=stochBearDivColor, linewidth=1, offset=-2)

plot(series=stochFractalBot ? stochK[2] : na, title='Stoch Bullish Divergence', color=stochBullDivColor, linewidth=1, offset=-2)

// Schaff Trend Cycle

plot(tcLine ? tcVal : na, color=color.new(#673ab7, 25), linewidth=2, title='Schaff Trend Cycle 1')

plot(tcLine ? tcVal : na, color=color.new(colorWhite, 50), linewidth=1, title='Schaff Trend Cycle 2')

// Draw Overbought & Oversold lines

plot(obLevel, title='Over Bought Level 1', color=color.new(colorWhite, 11), linewidth=1, style=plot.style_line)

plot(obLevel2, title='Over Bought Level 2', color=color.new(colorWhite, 85), linewidth=1, style=plot.style_stepline)

plot(obLevel3, title='Over Bought Level 3', color=color.new(colorWhite, 95), linewidth=1, style=plot.style_circles)

plot(osLevel, title='Over Sold Level 1', color=color.new(colorWhite, 11), linewidth=1, style=plot.style_line)

plot(osLevel2, title='Over Sold Level 2', color=color.new(colorWhite, 85), linewidth=1, style=plot.style_stepline)

// Sommi flag

plotchar(sommiFlagShow and sommiBearish ? 108 : na, title='Sommi bearish flag', char='⚑', color=color.new(colorPink, 0), location=location.absolute, size=size.tiny)

plotchar(sommiFlagShow and sommiBullish ? -108 : na, title='Sommi bullish flag', char='⚑', color=color.new(colorBluelight, 0), location=location.absolute, size=size.tiny)

plot(sommiShowVwap ? ta.ema(hvwap, 3) : na, title='Sommi higher VWAP', color=color.new(colorYellow, 15), linewidth=2, style=plot.style_line)

// Sommi diamond

plotchar(sommiDiamondShow and sommiBearishDiamond ? 108 : na, title='Sommi bearish diamond', char='◆', color=color.new(colorPink, 0), location=location.absolute, size=size.tiny)

plotchar(sommiDiamondShow and sommiBullishDiamond ? -108 : na, title='Sommi bullish diamond', char='◆', color=color.new(colorBluelight, 0), location=location.absolute, size=size.tiny)

// Circles

plot(wtCross ? wt2 : na, title='Buy and sell circle', color=signalColor, style=plot.style_circles, linewidth=3, transp=15)

plotchar(wtBuyShow and buySignal ? -107 : na, title='Buy circle', char='·', color=color.new(colorGreen, 10), location=location.absolute, size=size.small)

plotchar(wtSellShow and sellSignal ? 105 : na, title='Sell circle', char='·', color=color.new(colorRed, 10), location=location.absolute, size=size.small)

plotchar(wtDivShow and buySignalDiv ? -106 : na, title='Divergence buy circle', char='•', color=buySignalDiv_color, location=location.absolute, size=size.small, offset=-2, transp=70)

plotchar(wtDivShow and sellSignalDiv ? 106 : na, title='Divergence sell circle', char='•', color=sellSignalDiv_color, location=location.absolute, size=size.small, offset=-2, transp=70)

plotchar(wtGoldBuy and wtGoldShow ? -106 : na, title='Gold buy gold circle', char='•', color=color.new(colorOrange, 60), location=location.absolute, size=size.small, offset=-2)

// } DRAW

long = ta.crossover (wt1, wt2) and wt1<osLevel

// long = wtBullDiv or ta.crossover (wt1, wt2) and wt1<osLevel

// long = wtBullDiv

// short= wtBearDiv

// short= wtBearDiv or ta.crossunder(wt1, wt2) and wt1>obLevel

short= ta.crossunder(wt1, wt2) and wt1>obLevel

// Position Management Tools

pos = 0.0

pos:= long? 1 : short? -1 : pos[1]

longCond = long and (pos[1]!= 1 or na(pos[1]))

shortCond = short and (pos[1]!=-1 or na(pos[1]))

// EXIT FUNCTIONS //

i_sl = input.float(0.0, title="Stop Loss % ", minval=0, step=1, inline='sl ')

i_tp = input.float(0.0, title="Take Profit % ", minval=0, step=1, inline='tp ')

i_tsl = input.float(0.0, title="Trailing Stop Loss %", minval=0, step=1, inline='tsl')

sl = i_sl >0? i_sl /100 : 99999

tp = i_tp >0? i_tp /100 : 99999

tsl = i_tsl>0? i_tsl/100 : 99999

long_entry = ta.valuewhen(longCond , close, 0)

short_entry = ta.valuewhen(shortCond, close, 0)

// Trailing Stop Loss

trail_long = 0.0, trail_short = 0.0

trail_long := longCond? high : high>trail_long[1]? high : pos<1 ? 0 : trail_long[1]

trail_short := shortCond? low : low<trail_short[1]? low : pos>-1 ? 99999 : trail_short[1]

trail_long_final = trail_long * (1-tsl)

trail_short_final = trail_short * (1+tsl)

// Simple Stop Loss and Take Profit

sl_long0 = long_entry * (1 - sl)

sl_short0 = short_entry * (1 + sl)

tp_long = long_entry * (1 + tp)

tp_short = short_entry * (1 - tp)

sl_long = math.max(sl_long0, trail_long_final)

sl_short = math.min(sl_short0, trail_short_final)

// Position Adjustment

long_sl = low <sl_long[1] and pos[1]==1

short_sl = high>sl_short[1] and pos[1]==-1

final_long_tp = high>tp_long[1] and pos[1]==1

final_short_tp = low <tp_short[1] and pos[1]==-1

if ((long_sl or final_long_tp) and not shortCond) or ((short_sl or final_short_tp) and not longCond)

pos:=0

// Strategy Backtest Limiting Algorithm

i_startTime = input(defval = timestamp("01 Sep 2002 13:30 +0000"), title = "Backtesting Start Time")

i_endTime = input(defval = timestamp("30 Sep 2099 19:30 +0000"), title = "Backtesting End Time" )

timeCond = true

strategy.initial_capital = 50000

equity = strategy.initial_capital + strategy.netprofit

if equity>0 and timeCond

if longCond

strategy.entry("long" , strategy.long )

if shortCond

strategy.entry("short", strategy.short)

strategy.exit("SL/TP", from_entry = "long" , stop=sl_long , limit=tp_long , comment_profit ='TP', comment_loss='SL')

strategy.exit("SL/TP", from_entry = "short", stop=sl_short, limit=tp_short, comment_profit ='TP', comment_loss='SL')

// ALERTS {

// BUY

alertcondition(longCond, 'Buy (Big green circle)', 'Green circle WaveTrend Oversold')

alertcondition(buySignalDiv, 'Buy (Big green circle + Div)', 'Buy & WT Bullish Divergence & WT Overbought')

alertcondition(wtGoldBuy, 'GOLD Buy (Big GOLDEN circle)', 'Green & GOLD circle WaveTrend Overbought')

alertcondition(sommiBullish or sommiBullishDiamond, 'Sommi bullish flag/diamond', 'Blue flag/diamond')

alertcondition(wtCross and wtCrossUp, 'Buy (Small green dot)', 'Buy small circle')

// SELL

alertcondition(sommiBearish or sommiBearishDiamond, 'Sommi bearish flag/diamond', 'Purple flag/diamond')

alertcondition(sellSignal, 'Sell (Big red circle)', 'Red Circle WaveTrend Overbought')

alertcondition(sellSignalDiv, 'Sell (Big red circle + Div)', 'Buy & WT Bearish Divergence & WT Overbought')

alertcondition(wtCross and wtCrossDown, 'Sell (Small red dot)', 'Sell small circle')

// } ALERTS