概述

多指标融合交易策略是一个集成移动平均线均线交叉、相对强弱指标、商品路径指标和随机指数平滑移动平均线四大指标analysis的复合交易策略。该策略通过判断不同时间周期上的趋势指标信号,实现更准确判断市场买卖点的功能。

策略原理

该策略主要基于四个指标进行判断:

MACD:计算快速移动平均线和慢速移动平均线的差值,判断价格运动趋势和动量。当快线上穿慢线时为买入信号。

RSI:计算一段时间内股价涨落的幅度。当RSI大于70时为超买,小于30时为超卖。本策略以70和30作为买入卖出标准。

CCI:通过计算价格偏离其移动平均线的百分比来测量价格动量。本策略以100和-100作为买入卖出标准。

StochRSI:结合随机指数指标和RSI指标。K线和D线黄金交叉为买入信号,死亡交叉为卖出信号。

当上述四个指标都同时满足条件时,该策略才会产生实际的买入和卖出信号。

策略优势

这种多指标融合策略最大的优势在于能够结合市场中的多个维度来判断买卖点。具体来说主要有以下几个方面的优势:

能够过滤假信号,避免在高位追涨杀跌。指标同时发出信号的可能性很小,从而能够过滤掉一些假信号。

能够把握市场的主要趋势。不同指标判断市场的角度不同,能较为全面地判断市场趋势。

策略参数优化空间大。可以通过调整各个指标的参数,优化策略的效果。

可根据市场调整权重。在牛市中可提高趋势型指标权重,在熊市中可提高反转型指标权重。

策略风险

该策略主要存在以下几类风险:

指标发出错误信号的风险。当多个指标同时发出错误信号时,该策略就会产生错误交易。

股票价格剧烈波动的风险。当市场出现异常波动时,多个指标可能同时发出错误信号。

买入信号延迟的风险。多个指标综合判断时,买入信号发出会有一定延迟。

参数优化困难风险。多指标组合优化参数较为复杂,不当优化可能产生反效果。

对策主要是调整指标参数,设置止损,并减少单笔投入资金量来控制风险。

优化方向

该策略可从以下几个维度进行进一步优化:

测试更多指标的组合,寻找最佳指标portfolio。可测试KD,BOLL等其他指标。

优化各个指标的参数,使得整体策略效果最优。可使用机器学习等方法自动优化。

为不同的股票和行业设置不同的参数组合。

在策略中加入止损机制。当价格突破支持位时自动止损。

更新股票池,选择细分行业内表现优异的个股。调整股票池可以提高整体收益。

总结

本策略整合四大经典指标MACD、RSI、CCI和StochRSI,通过判断多个时间维度上的信号,设定严格的买入卖出标准,能有效识别市场买卖点。该策略可有效提高盈利概率,减少止损概率。通过参数优化、更新股票池、加入止损等方式可进一步改进策略效果,属于非常有效的量化交易策略之一。

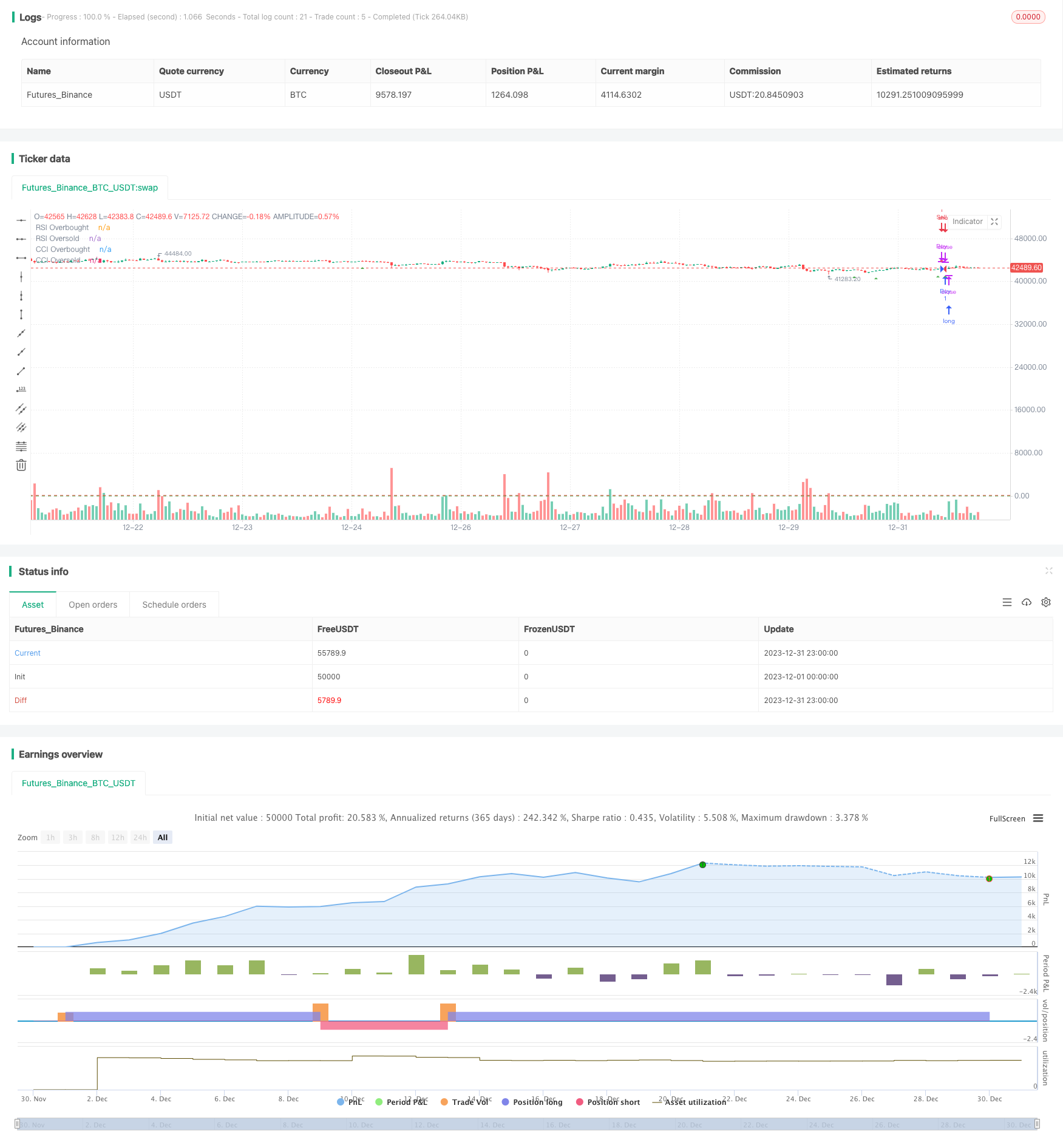

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("MACD RSI CCI StochRSI Strategy", shorttitle="MRCSS", overlay=true)

// MACD göstergesi

fastLength = input(12, title="Fast Length")

slowLength = input(26, title="Slow Length")

signalLength = input(9, title="Signal Length")

[macdLine, signalLine, _] = macd(close, fastLength, slowLength, signalLength)

// RSI göstergesi

rsiLength = input(14, title="RSI Length")

rsiLevel = input(70, title="RSI Overbought Level")

rsiValue = rsi(close, rsiLength)

// CCI göstergesi

cciLength = input(8, title="CCI Length")

cciLevel = input(100, title="CCI Overbought Level")

cciValue = cci(close, cciLength)

// Stochastic Oscillator göstergesi

stochLength = input(14, title="Stoch Length")

stochK = input(3, title="Stoch K")

stochD = input(3, title="Stoch D")

stochValue = stoch(close, high, low, stochLength)

stochDValue = sma(stochValue, stochD)

// Alış ve Satış Sinyalleri

buySignal = crossover(macdLine, signalLine) and rsiValue < rsiLevel and cciValue < cciLevel and stochValue > stochDValue

sellSignal = crossunder(macdLine, signalLine) and rsiValue > (100 - rsiLevel) and cciValue > (100 - cciLevel) and stochValue < stochDValue

// Ticaret stratejisi uygula

strategy.entry("Buy", strategy.long, when = buySignal)

strategy.close("Buy", when = sellSignal)

strategy.entry("Sell", strategy.short, when = sellSignal)

strategy.close("Sell", when = buySignal)

// Göstergeleri çiz

hline(rsiLevel, "RSI Overbought", color=color.red)

hline(100 - rsiLevel, "RSI Oversold", color=color.green)

hline(cciLevel, "CCI Overbought", color=color.red)

hline(100 - cciLevel, "CCI Oversold", color=color.green)

// Grafik üzerinde sinyal okları çiz

plotshape(series=buySignal, title="Buy Signal", color=color.green, style=shape.triangleup, location=location.belowbar, size=size.small)

plotshape(series=sellSignal, title="Sell Signal", color=color.red, style=shape.triangledown, location=location.abovebar, size=size.small)