概述

该策略通过计算Keltner通道的中轨、上轨和下轨,以中轨为基础, ABOVE中轨和下轨填充颜色。在通道方向判断后,进行突破买卖。属于趋势跟踪策略的一种。

策略原理

核心指标为Keltner通道。通道中轨为典型价格(最高价+最低价+收盘价)/3的N日加权移动平均线。通道上轨线和下轨线分别离中轨线一个交易范围的N日加权移动平均线。 其中,交易范围可以选用真实波幅ATR,也可以直接采用振幅(最高价-最低价)。该策略采用后者。

具体来说,策略主要判断价格是否突破上轨或下轨,以中轨为分界进行多头或空头决策。 若收盘价大于上轨,做多;若收盘价小于下轨,做空。止损线为中轨 MA 值。

优势分析

- 使用Keltner通道指标,对价格波动范围有较好判断,避免假突破。

- 采用中轨均线作为支撑位,可以减少亏损。

- 突破上轨做多下轨做空,属于趋势跟踪策略,符合大部分股票的价格变化规律。

风险分析

- 突破通道策略对参数很敏感,需要反复测试寻找最佳参数组合。

- 股票价格短期内出现大幅波动时,会增加交易风险。可适当放宽通道宽度来降低误交易风险。

- 效果与参数设置和品种相关性较大,需要调整适应不同品种。

优化方向

- 结合其他指标过滤信号,避免误交易。例如量能指标、波动率指标等。

- 优化参数,寻找最佳参数组合。主要调整平均线参数和通道倍数。

- 不同品种参数设置会有较大差异,需要分类优化。

总结

该策略整体来说较为简单直接,属于常见的价格突破策略的一种。优点是思路清晰,容易理解实现,适合初学者学习。但也存在一定局限性,对参数敏感,效果参差不齐,需要反复测试优化。如果能够结合其他更复杂判断指标,可以形成较强大的交易策略。

策略源码

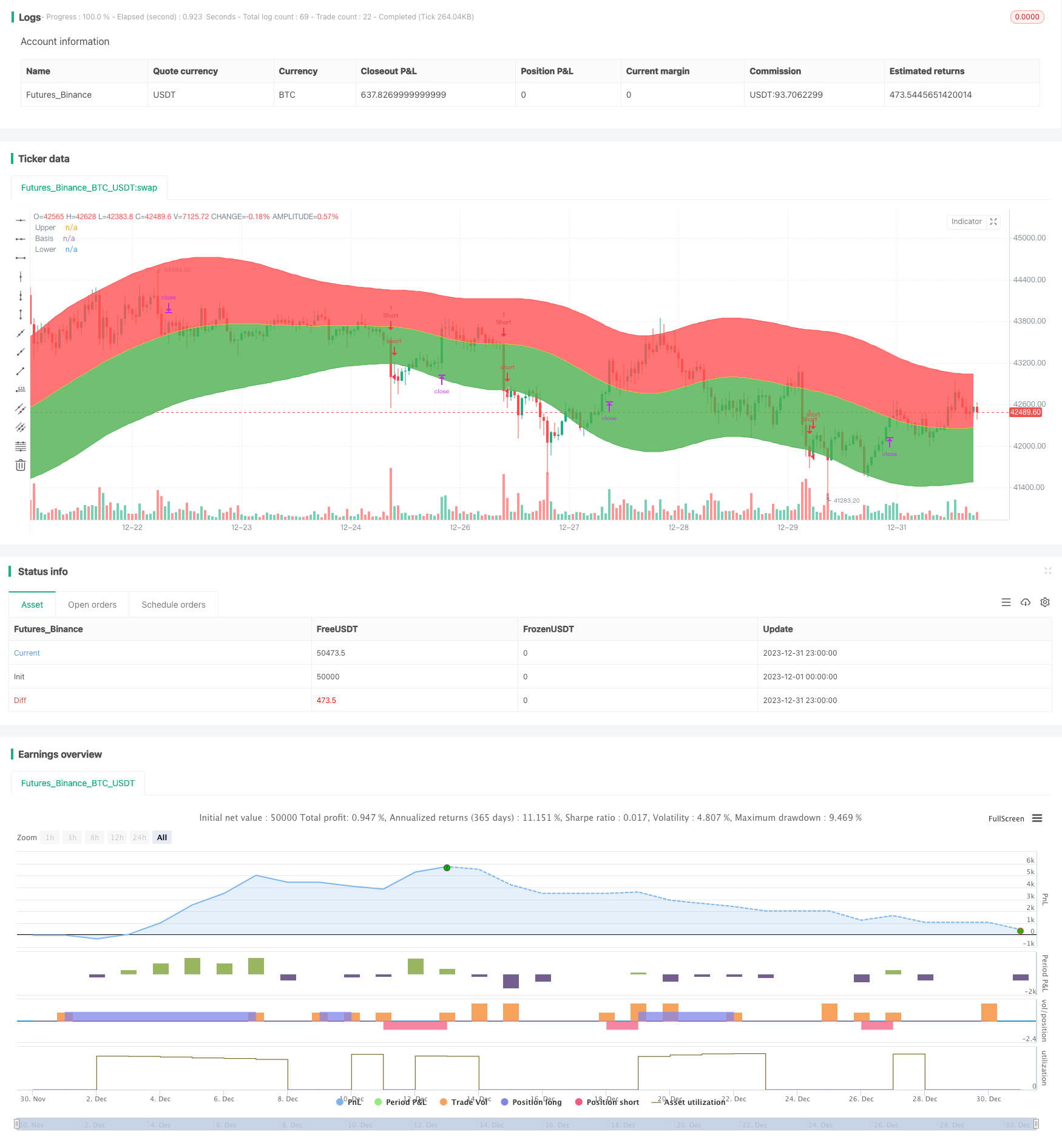

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © WMX_Q_System_Trading

//@version=3

strategy(title = "WMX Keltner Channels strategy", shorttitle = "WMX Keltner Channels strategy", overlay = true)

useTrueRange = input(true)

length = input(20, minval=5)

mult = input(2.618, minval=0.1)

mah =ema(ema( ema(high, length),length),length)

mal =ema(ema( ema(low, length),length),length)

range = useTrueRange ? tr : high - low

rangema =ema(ema( ema(range, length),length),length)

upper = mah + rangema * mult

lower = mal - rangema * mult

ma=(upper+lower)/2

uc = red

lc=green

u = plot(upper, color=uc, title="Upper")

basis=plot(ma, color=yellow, title="Basis")

l = plot(lower, color=lc, title="Lower")

fill(u, basis, color=uc, transp=95)

fill(l, basis, color=lc, transp=95)

strategy.entry("Long", strategy.long, stop = upper, when = strategy.position_size <= 0 and close >upper)

strategy.entry("Short", strategy.short, stop = lower, when = strategy.position_size >= 0 and close<lower)

if strategy.position_size > 0

strategy.exit("Stop Long", "Long", stop = ma)

if strategy.position_size < 0

strategy.exit("Stop Short", "Short", stop = ma)