概述

本策略基于相对强弱指数(RSI)指标设计了一个自动设置止损止盈的交易策略。当RSI指标超过设定的过买线或超过设定的过卖线时,策略会分别开仓做多头或空头。同时,策略会根据开仓价格和设定的止损比例及止盈比例自动设置止损价位和止盈价位。

策略原理

本策略使用RSI指标判断市场的超买超卖现象。当RSI指标低于设定的低点(默认为30)时,认为市场处于超卖状态,此时做多;当RSI指标高于设定的高点(默认为70)时,认为市场处于超买状态,此时做空。

做多做空后,策略会根据止损比例(默认为5%)和止盈比例(默认为10%)自动设置止损价位和止盈价位。例如,做多后,止损价位为开仓价格的(1 - 止损比例),止盈价格为开仓价格的(1 + 止盈比例)。

优势分析

本策略最大的优势在于可以自动设置止损和止盈,降低交易风险。止损可以减少亏损,止盈可以锁定利润。同时,相对强弱指数是一项成熟的技术指标,可以较好地判断市场是否处于超买或超卖状态。

风险分析

本策略也存在一定风险。RSI指标可能发出错误信号,导致不必要的亏损。此外,止损或止盈被触发也可能使利润损失一部分。设置止损止盈比例需要谨慎,过于宽松可能无法有效控制风险,过于激进可能造成不必要的止损。

可以通过优化RSI参数或调整止损止盈来降低这些风险。另外,本策略也可结合其他指标来验证信号,提高决策的准确性。

策略优化

本策略可从以下几个方面进行优化:

优化RSI参数,寻找最佳的参数组合

测试不同的止损止盈比例设置

结合其他指标过滤信号

添加趋势判断规则,避免震荡市场的假信号

优化入场时机,设置一个追踪止损来锁定利润

总结

本策略基于RSI指标设计了一个简单实用的止损止盈策略。策略逻辑清晰易于实现,可以自动设置止损和止盈来控制风险。同时也需要注意优化参数和规则,防范RSI指标错误信号的风险。综合来说,本策略为量化交易提供了一个不错的思路,值得进一步研究和优化。

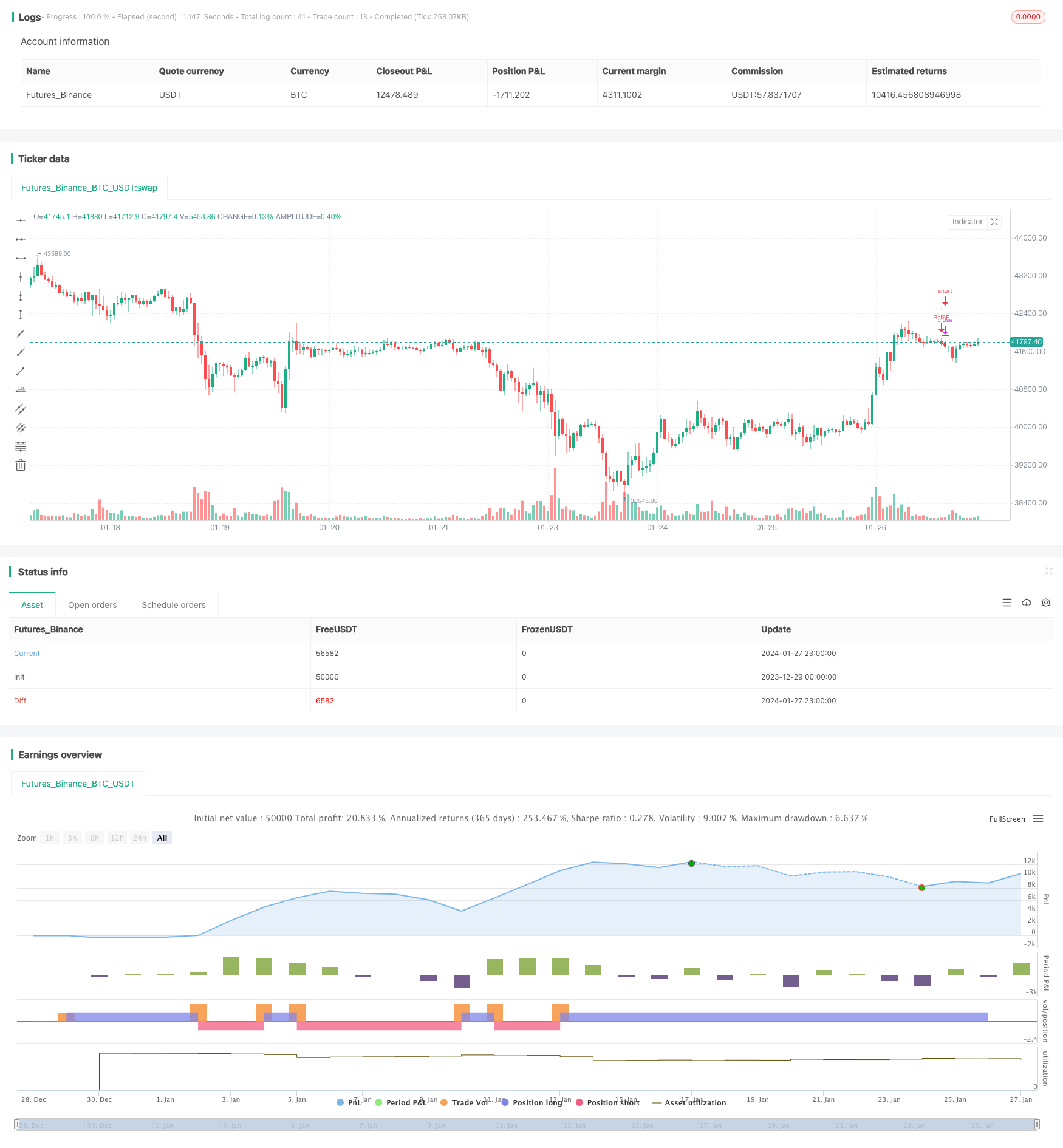

/*backtest

start: 2023-12-29 00:00:00

end: 2024-01-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("twelve12 first RSI remix", overlay=true)

length = input(14)

overSold = input(35)

overBought = input(65)

stopLossPercent = input(5, title="Stop Loss (%)") / 100

takeProfitPercent = input(10, title="Take Profit (%)") / 100

price = close

vrsi = ta.rsi(price, length)

co = ta.crossover(vrsi, overSold)

cu = ta.crossunder(vrsi, overBought)

if (not na(vrsi))

if (co)

strategy.entry("RsiLE", strategy.long, comment="RsiLE")

if (cu)

strategy.entry("RsiSE", strategy.short, comment="RsiSE")

// Calculate stop loss and take profit levels for long and short positions

longStopLoss = strategy.position_avg_price * (1 - stopLossPercent)

longTakeProfit = strategy.position_avg_price * (1 + takeProfitPercent)

shortStopLoss = strategy.position_avg_price * (1 + stopLossPercent)

shortTakeProfit = strategy.position_avg_price * (1 - takeProfitPercent)

// Set stop loss and take profit for long position