概述

三重指标碰撞策略(Triple Indicator Collision Strategy)是一个非常经典的量化交易策略。它结合使用了移动平均线、MACD指标和RSI指标三个经典的技术指标,当三者同时出现买入或卖出信号时,进行相应的交易操作。

策略原理

该策略同时使用了20日EMA、MACD(12,26,9)和14日RSI三个指标。具体交易逻辑为:

当价格上穿20日EMA,MACD线上穿信号线,RSI上穿20日EMA时,做多;当价格下穿20日EMA,MACD线下穿信号线,RSI下穿20日EMA时,做空。

这样需要三个指标同时出现交易信号,可以过滤掉部分假信号,使策略更加稳定可靠。

优势分析

这种多指标碰撞的策略有以下几个优势:

过滤噪音,减少假信号。单一指标容易受到市场噪音的影响,产生大量假信号。而三重指标可以有效过滤噪音,使信号更加可靠。

捕捉趋势的转折点。不同指标对价格波动的反应时间不同,当三者近期出现同向信号时,常常预示着趋势反转。这为策略捕捉转折点提供了可能。

多维度判断市场。三个指标从不同维度判断市场,互相验证,可以更全面准确判断市场走势。

降低仓位风险。多指标过滤可以减少无效交易次数,降低无谓的资金周转,有利于风险控制。

风险分析

该策略也存在一些风险:

参数优化风险。移动平均线长度、MACD参数组合、RSI参数等都可能影响策略表现,不合适的参数组合可能导致策略行情不佳。因此需要对参数组合进行全面的测试和优化,找到最佳参数。

错失交易机会。三重指标策略相对保守,可能错过部分交易机会。如果不能捕捉主要趋势,会影响策略收益。

实盘滑点控制。实盘中交易成本和滑点也会对策略产生一定影响,需要控制好交易频率,确保盈利空间大于交易成本。

优化方向

该策略可以从以下几个方面进行优化:

测试不同的参数组合,找到最佳参数。可以改变移动平均线长度、MACD参数、RSI参数等,通过回测找到最优参数组合。

增加止损机制。设定移动止损或挂单止损,可以有效控制单笔亏损。

结合其它指标过滤信号。比如布林带、KDJ等指标也可以用来验证信号,过滤假信号。

根据不同品种、周期调整参数。参数可以根据交易品种和周期进行调整优化。

总结

三重指标碰撞策略同时利用移动平均线、MACD和RSI三个指标的信号,进行多空决策。它可以有效过滤噪音信号,识别潜在趋势转折点,提高信号的可靠性。通过参数优化、止损设定、信号过滤等手段,可以不断改进该策略,使其信号更加清晰,收益更加可靠。

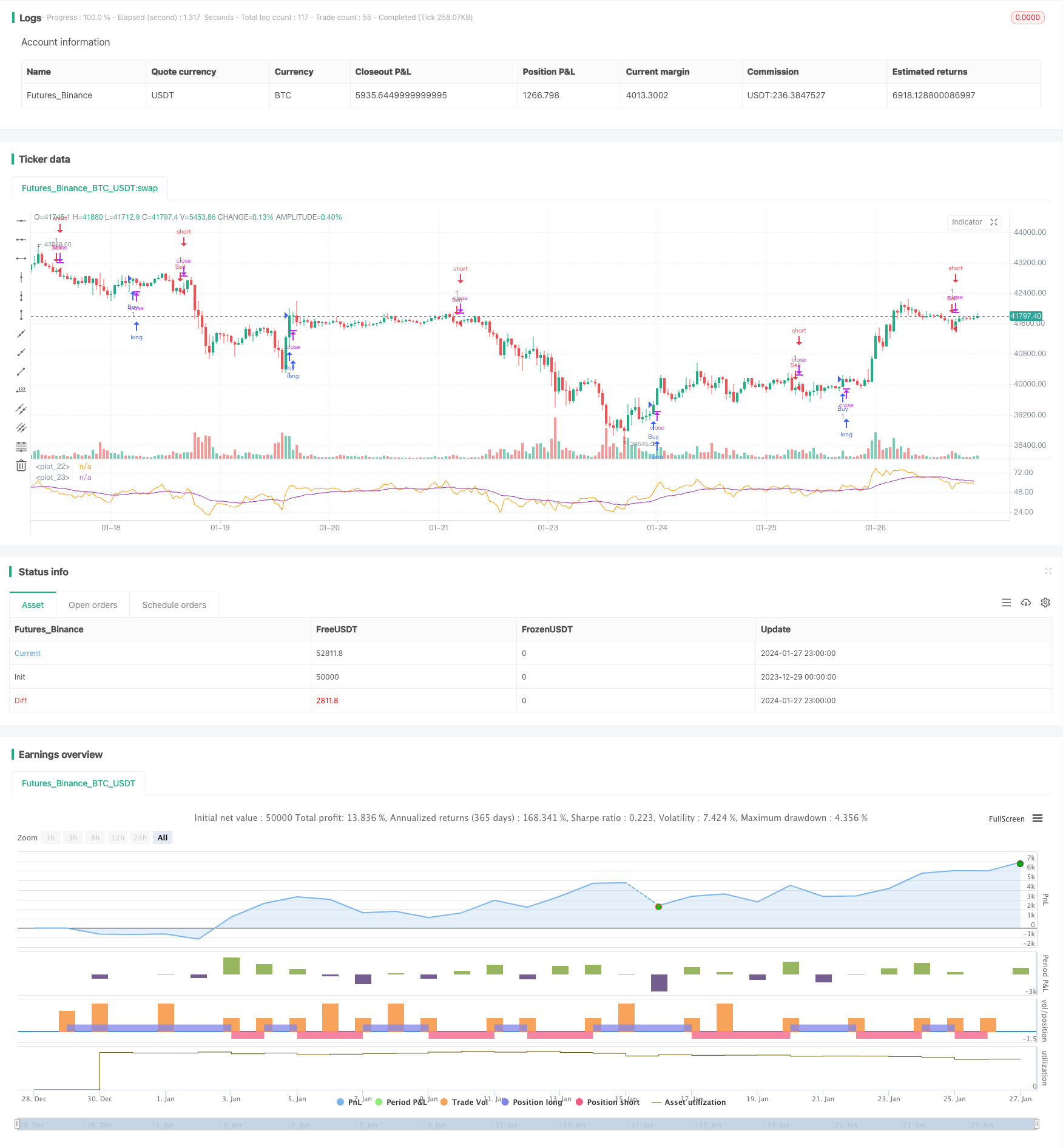

/*backtest

start: 2023-12-29 00:00:00

end: 2024-01-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © fangdingjun

//@version=4

strategy("MACD_RSI strategy", overlay=false)

_ema_len = input(20, title="EMA length")

_macd_fast = input(12, title="MACD Fast")

_macd_slow = input(26, title="MACD Slow")

_macd_signal_len = input(20, title="MACD Signal length")

_rsi_len = input(14, title="RSI length")

_rsi_signal_len = input(20, title="RSI signal length")

_ema = ema(close, _ema_len)

_macd = ema(close, _macd_fast) - ema(close, _macd_slow)

_macd_signal = ema(_macd, _macd_signal_len)

_rsi = rsi(close, _rsi_len)

_rsi_signal = ema(_rsi, _rsi_signal_len)

plot(_rsi, color=color.orange)

plot(_rsi_signal, color=color.purple)

longCondition = close > _ema and _macd > _macd_signal and _rsi > _rsi_signal

if (longCondition)

strategy.entry("Buy", strategy.long)

shortCondition = close < _ema and _macd < _macd_signal and _rsi < _rsi_signal

if (shortCondition)

strategy.entry("Sell", strategy.short)