概述

均值回归渐进开仓策略是HedgerLabs设计的一个先进的量化交易策略脚本,专注于金融市场的均值回归技术。该策略针对于更喜欢系统化方法,并且强调基于价格相对移动平均线的渐进开仓方式的交易者。

策略原理

该策略的核心是简单移动平均线(SMA)。所有入场和出场交易都围绕着移动平均线进行。交易者可以自定义MA长度,使其适用于不同的交易风格和时间范围。

该策略的独特之处在于其渐进开仓机制。当价格从移动平均线上偏离超过一定百分比时,该策略会启动第一个头寸。随后,随着价格继续从移动平均线偏离的程度越来越大,该策略会以交易者定义的渐进方式增加头寸。这种方法可以在市场波动加大时获得更高收益。

该策略还会智能管理头寸。当价格低于移动平均线时做多,高于时做空,以适应不同市场条件。平仓点设定在价格触及移动平均线时,旨在抓住潜在的反转点以实现最优关闭头寸。

通过启用calc_on_every_tick,该策略可以不断评估市场条件并做出及时反应。

优势分析

均值回归渐进开仓策略具有以下优势:

- 系统化程度高,可以减少主观误操作的风险

- 渐进开仓可以在市场大幅波动时获得更高收益

- 可以自定义参数如MA周期等以适应不同品种

- 头寸管理机制较为智能,可以自动调整多空仓位

- 出场点选择合理,有利于抓住反转 并关闭头寸

风险分析

该策略也存在一些风险:

- 依赖技术指标,可能发生平假信号的风险

- 无法判断市场趋势,容易被套住

- MA参数设置不当可能导致频繁止损

- 渐进开仓会加大仓位风险

可以通过适当优化 exits,更好判断趋势,或适当缩减开仓幅度来缓解上述风险。

优化方向

该策略可以从以下几个方面进行优化:

- 增加剔除趋势条件,避免逆势开仓

- 结合波动率指标优化开仓幅度

- 优化移动止损以锁定利润

- 尝试不同类型的移动平均线

- 添加过滤器减少无效信号

总结

均值回归渐进开仓策略专注于均值回归交易技术,采用系统化渐进开仓管理头寸,可自定义参数适用于不同交易品种。该策略在波动市中表现较好,适合关注短线操作的量化交易者。

策略源码

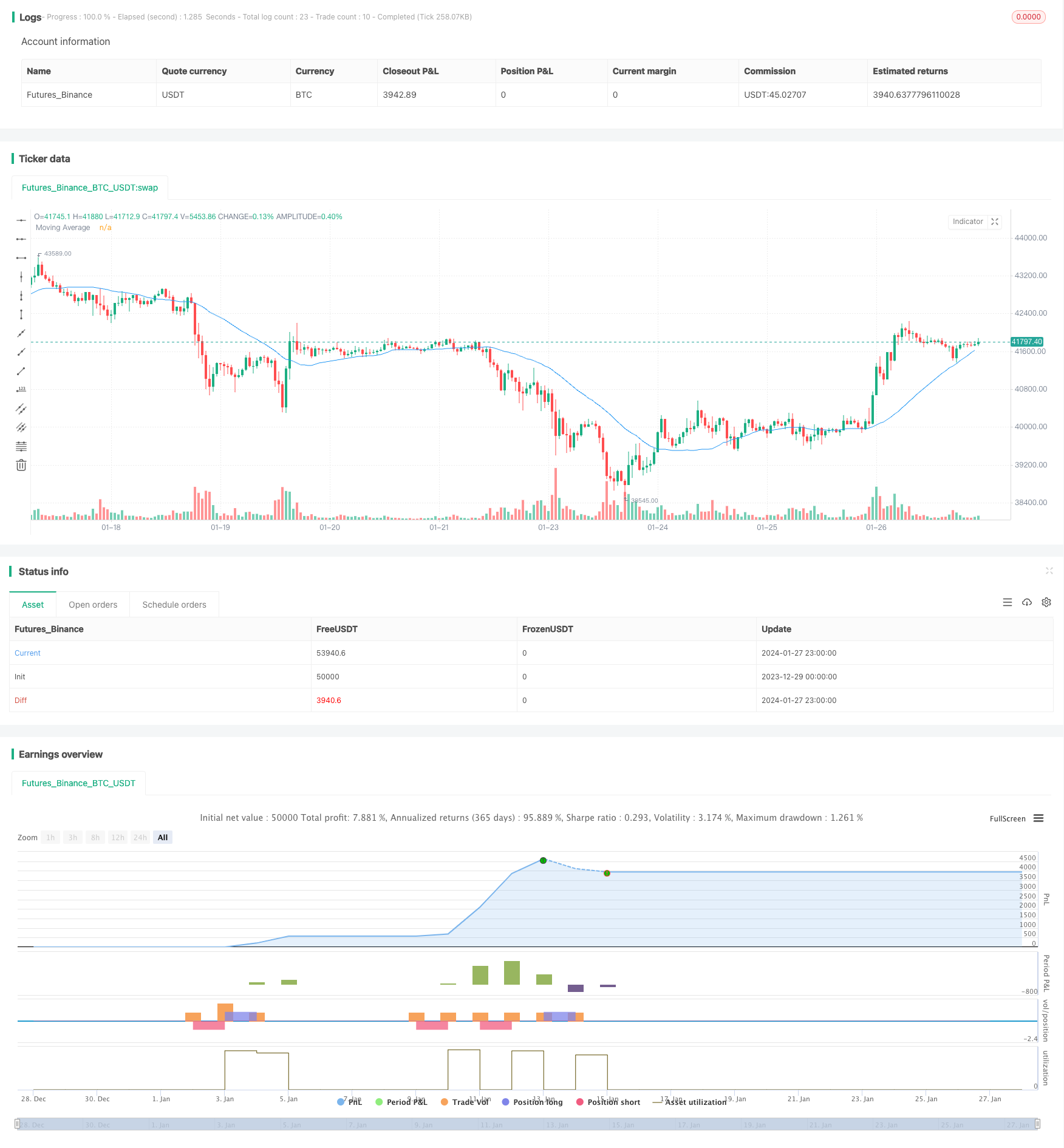

/*backtest

start: 2023-12-29 00:00:00

end: 2024-01-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Mean Reversion with Incremental Entry by HedgerLabs", overlay=true, calc_on_every_tick=true)

// Input for adjustable settings

maLength = input.int(30, title="MA Length", minval=1)

initialPercent = input.float(5, title="Initial Percent for First Order", minval=0.01, step=0.01)

percentStep = input.float(1, title="Percent Step for Additional Orders", minval=0.01, step=0.01)

// Calculating Moving Average

ma = ta.sma(close, maLength)

// Plotting the Moving Average

plot(ma, "Moving Average", color=color.blue)

var float lastBuyPrice = na

var float lastSellPrice = na

// Function to calculate absolute price percentage difference

pricePercentDiff(price1, price2) =>

diff = math.abs(price1 - price2) / price2 * 100

diff

// Initial Entry Condition Check Function

initialEntryCondition(price, ma, initialPercent) =>

pricePercentDiff(price, ma) >= initialPercent

// Enhanced Entry Logic for Buy and Sell

if (low < ma)

if (na(lastBuyPrice))

if (initialEntryCondition(low, ma, initialPercent))

strategy.entry("Buy", strategy.long)

lastBuyPrice := low

else

if (low < lastBuyPrice and pricePercentDiff(low, lastBuyPrice) >= percentStep)

strategy.entry("Buy", strategy.long)

lastBuyPrice := low

if (high > ma)

if (na(lastSellPrice))

if (initialEntryCondition(high, ma, initialPercent))

strategy.entry("Sell", strategy.short)

lastSellPrice := high

else

if (high > lastSellPrice and pricePercentDiff(high, lastSellPrice) >= percentStep)

strategy.entry("Sell", strategy.short)

lastSellPrice := high

// Exit Conditions - Close position if price touches the MA

if (close >= ma and strategy.position_size > 0)

strategy.close("Buy")

lastBuyPrice := na

if (close <= ma and strategy.position_size < 0)

strategy.close("Sell")

lastSellPrice := na

// Reset last order price when position is closed

if (strategy.position_size == 0)

lastBuyPrice := na

lastSellPrice := na