概述

本策略的主要思想是结合时间和ATR指标来实现自动化的止损止盈。策略会在固定的时间点开仓进行买入或卖出,并结合ATR指标计算出合理的止损止盈价格。这样可以实现高效自动化的交易,降低人工操作的频率,同时通过ATR指标可以有效控制风险。

策略原理

本策略利用hour和minute变量结合if条件判断,在策略参数tradeTime指定的时间点触发开仓操作。例如设置为0700,则代表北京时间早上7点整会触发开仓。

开仓后,策略会利用ta.atr()函数计算last 5 min内的ATR指标值,并以此作为止损止盈的基础。例如在买入后,止盈价格=买入价格+ATR值;卖出后,止盈价格=卖出价格-ATR值。

这样就实现了基于时间点的自动化开仓,以及基于ATR指标的止损止盈。从而降低了人工操作的频率,同时有效控制了风险。

优势分析

本策略具有以下优势:

自动化程度高。可以在指定时间点无人值守自动下单,大幅降低人工操作频率。

基于ATR指标的止损止盈可以有效控制单笔损失。ATR指标可以动态捕捉市场波动程度,从而设置合理止损距离。

可扩展性强。可以轻松结合更多指标或机器学习算法来辅助决策。例如结合均线指标判断趋势。

容易实现多品种套利。只需为不同品种设置相同的交易时间,就可以轻松实现张开合约的套利策略。

容易集成到自动化交易系统。结合定时任务管理,可以无人值守24小时运行策略程序,实现完全的自动化交易。

风险分析

本策略也存在一些风险:

市场突发事件风险。重大黑天鹅事件可能导致极端价格波动,触发止损而产生较大亏损。

标的流动性风险。部分品种流动性较差,无法在限价止盈点完全成交,无法平仓止盈。

ATR参数优化风险。ATR参数需要反复测试优化,如果设置过大过小都会影响策略效果。

时间点优化风险。固定的开仓时间可能会错过市场机会,需要结合更多指标调整时间点。

策略优化

本策略可以从以下维度进行进一步优化:

结合更多指标判断市场状况,避免在不利 market environment 中开仓。例如MACD,RSI等。

使用机器学习算法预测最佳开仓时间点。可以收集更多历史数据,使用LSTM等进行模型训练。

利用Heartbeat等平台扩展到多品种套利。结合行业相关性寻找套利机会。

优化ATR参数以及止盈止损的设定。可以通过更多反复回测找到最佳参数。

把策略跑在server上,集成定时任务,实现7x24小时完全自动化运行。无人值守持续盈利。

总结

本策略整合时点和ATR指标,实现高效的自动化止损止盈交易。通过参数优化,可以获得稳定的alpha。同时也具有很强的可扩展性和集成能力,是值得推荐的量化策略之一。

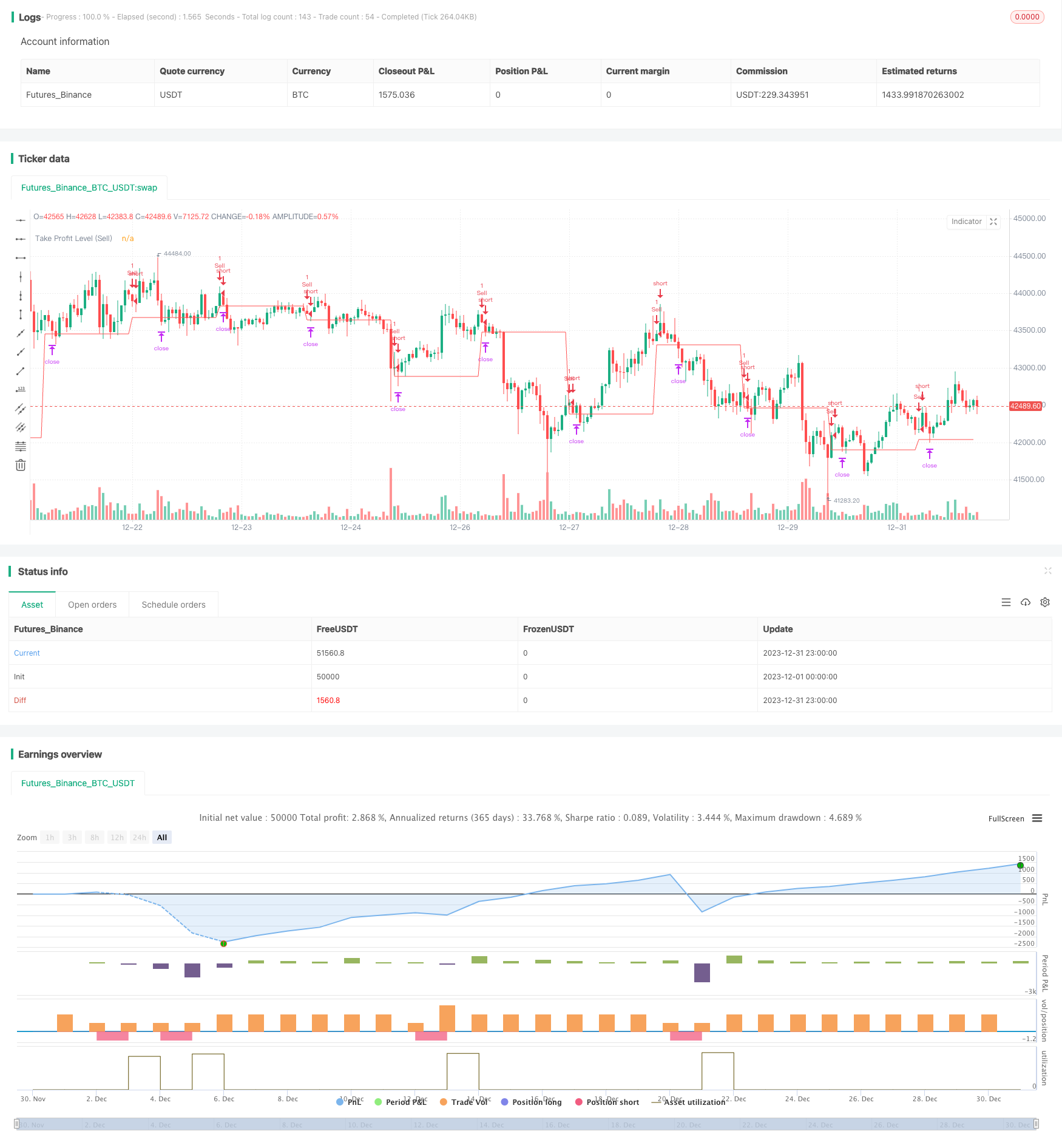

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Time-based Strategy with ATR Take Profit Sell", overlay=true)

// Initialize take profit levels

var float takeProfitLevel = na

var float takeProfitLevelForSell = na

var float buyprice = na

var float sellprice = na

// Input for the time when the trade should be executed

tradeTime = input(0700, "Trade Execution Time (HHMM)", "Specify the time in HHMM format", group="Time Settings")

// Calculate ATR for the last 5 minutes

atrLength = input(14, "ATR Length", "Specify ATR length", group="ATR Settings")

atrValue = request.security(syminfo.tickerid, "5", ta.atr(atrLength))

// Define conditions for buy and sell

buyCondition = hour * 100 + minute == tradeTime // and strategy.position_size == 0

sellCondition = hour * 100 + minute == tradeTime // and strategy.position_size > 0

// Execute Buy and Sell orders

// if (buyCondition)

// strategy.entry("Buy", strategy.long)

// buyprice := close

// takeProfitLevel := buyprice + atrValue

// strategy.exit("Take Profit BUY", from_entry="Buy", limit =takeProfitLevel)

if (sellCondition)

strategy.entry("Sell", strategy.short)

sellprice := close

takeProfitLevelForSell := sellprice -atrValue

strategy.exit("Take Profit Sell", from_entry="Sell", limit=takeProfitLevelForSell)

// Plot horizontal lines for take profit levels

plot(takeProfitLevel, color=color.green, title="Take Profit Level (Buy)")

plot(takeProfitLevelForSell, color=color.red, title="Take Profit Level (Sell)")