概述

该策略基于著名的“海龟交易员策略”,该策略已经经过多年验证。它发送长仓和空仓信号,最多可进行5次金字塔订单,这意味着该策略可以在同一方向触发多达5个订单。具有良好的风险和资金管理。

需要注意的是,该策略结合了两个一起工作的系统(S1和S2)。

策略原理

仓位大小对于海龟交易员来说非常重要,以便妥善管理风险。该仓位调整策略适应市场波动性和账户(收益和损失)。它基于ATR(平均真实范围),也可以称为“N”。其长度默认为20。

买入的单位数为:

unit = (percentage_to_risk/100)*account/atr*syminfo.pointvalue

根据您的风险偏好,您可以增加账户的百分比,但是海龟交易员默认为1%。 如果您交易合约,则单位必须默认向下取整。

还有一个附加规则,用于在账户值低于初始资本时减少风险:在这种情况下,在单位公式中必须用下式替换:

account := (strategy.equity-strategy.openprofit)*(strategy.equity-strategy.openprofit)/strategy.initial_capital

有两个系统一起工作: 突破是一个新的高点或新低点。 如果这是一个新的高点,我们打开多头头寸,反之,如果这是一个新的低点,我们进入空头头寸。

我们添加一个额外的规则: 该额外规则允许交易员参与主要趋势,如果跳过了系统1信号。 如果跳过了系统1的信号,而下一根K线也是一个新的20日突破,则S1不会发出信号。 我们必须等待S2信号或等待不产生新的突破的K线来重新激活S1。

优势分析

海龟策略允许我们在价格走势对我们有利时向头寸添加额外的单位。 我将策略配置为允许在同一方向添加多达5个订单。 因此,如果价格从买入变化,我们会添加单位。

我们将首订单(多头或空头)设置为最大订单。 后续的金字塔订单将比首个订单的单位数更少。

我们为首个订单设置了10%的最大止损,这意味着您不会损失超过首个订单价值的10%。 然而,由于止损会增加/减少0.5 * ATR(20),您的金字塔订单可能会损失更多,此时不会保证损失不超过10%。 风险仍然得到很好的管理,因为这些订单的价值低于首个订单的价值。

风险分析

该策略最大的风险在于持仓过大。由于委托下单采用市价单,如果同时下达多笔巨额市价单,会对报价有很大的冲击,造成大额的滑点。这会造成极大的资金损失。

另一个风险就是不适当的资金管理配置。如止损配置错误或者比例过大,都会导致巨额亏损。这需要根据自己的风险偏好谨慎配置。

优化方向

该策略可以在以下几个方面进行优化:

可以测试不同参数对收益率和夏普比率的影响,如ATR周期,止损的ATR倍数等。找到最优参数组合。

可以测试不同的进场和出场规则。如用K线形态作为额外的过滤条件。

可以尝试其他类型的止损方式,如移动止损,动态止损。这可能可以减少止损被击穿的概率。

可以测试不同数量的金字塔订单。订单越多,杠杆和风险越大。找到最佳平衡点。

可以尝试在特定的时间段内(如美国非农就业数据发布前)停止交易,以规避重大事件的冲击。

总结

该策略整体来说,风险收益平衡良好,适合中长线趋势交易。它具有交易系统化,风险可控等优势。通过优化,可以进一步提高策略的稳定性和收益率。

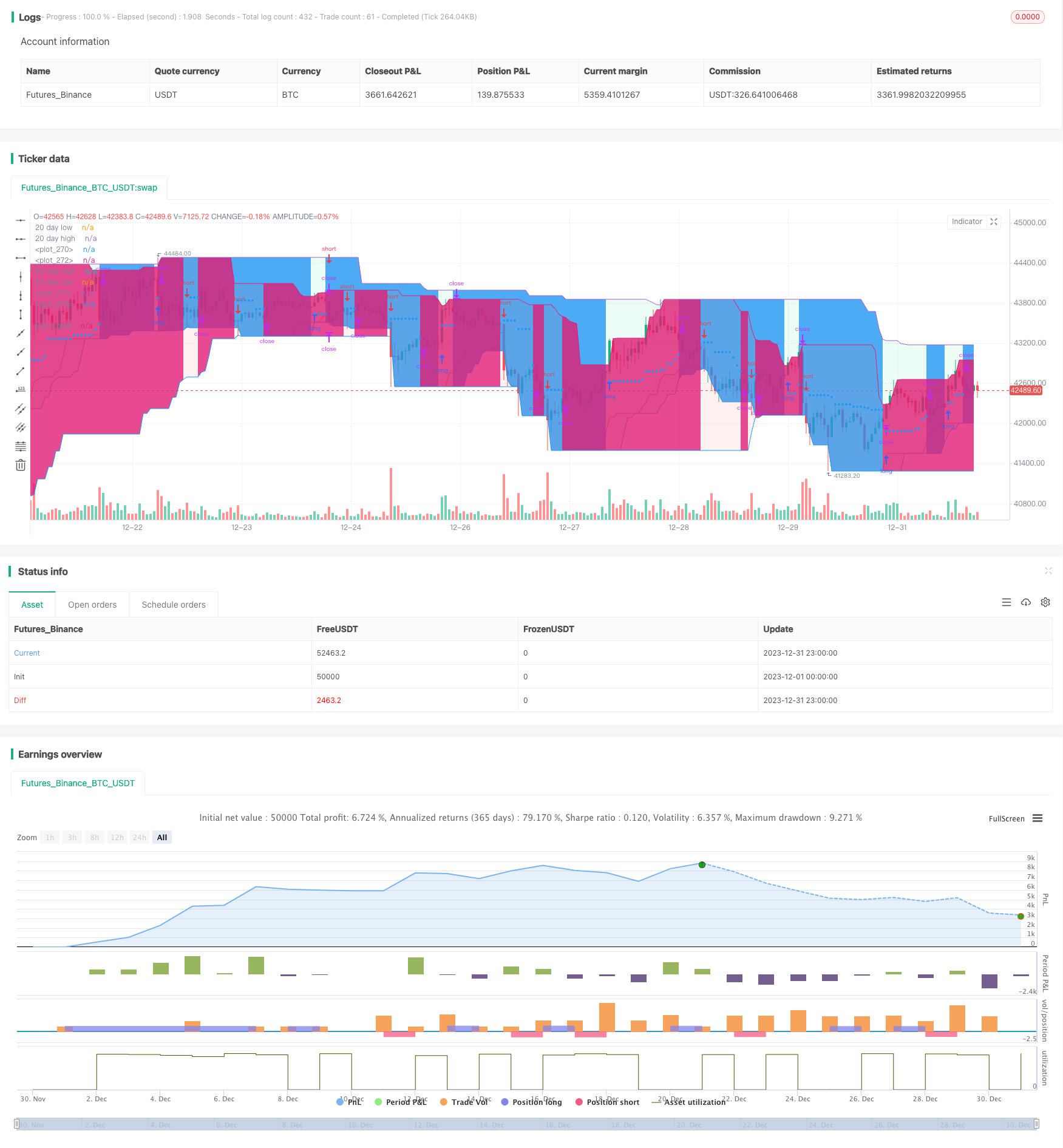

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © gsanson66

//This strategy is based on the famous "Turtle Strategy"

//A well-known strategy which proved its performance during past years

//@version=5

strategy("TURTLE STRATEGY", overlay=true)

//------------------------------TOOL TIPS--------------------------------//

t1 = "Percentage of the account the trader is willing to lose. This percentage is used to define the position size based on previous gains or losses. Turtle traders default to 1%."

t2 = "ATR Length"

t3 = "ATR Multiplier to fix the Stop Loss"

t4 = "Pyramiding : ATR Multiplier to set a profit target to increase position size"

t5 = "System 1 enter long if there is a new high after this selected period of time"

t6 = "System 2 enter long if there is a new high after this selected period of time"

t7 = "Exit Long from system 1 if there is a new low after this selected period of time"

t8 = "Exit Long from system 2 if there is a new low after this selected period of time"

t9 = "System 1 enter short if there is a new low after this selected period of time"

t10 = "System 2 enter short if there is a new low after this selected period of time"

t11 = "Exit short from system 1 if there is a new high after this selected period of time"

t12 = "Exit short from system 2 if there is a new high after this selected period of time"

//----------------------------------------FUNCTIONS---------------------------------------//

//@function Displays text passed to `txt` when called.

debugLabel(txt, color) =>

label.new(bar_index, high, text=txt, color=color, style=label.style_label_lower_right, textcolor=color.black, size=size.small)

//@function which looks if the close date of the current bar falls inside the date range

inBacktestPeriod(start, end) => true

//---------------------------------------USER INPUTS--------------------------------------//

//Risk Management and turtle system input

percentage_to_risk = input.float(1, "Risk % of capital", maxval=100, minval=0, group="Turtle Parameters", tooltip=t1)

atr_period = input.int(20, "ATR period", minval=1, group="Turtle Parameters", tooltip=t2)

stop_N_multiplier = input.float(1.5, "Stop ATR", minval=0.1, group="Turtle Parameters", tooltip=t3)

pyramid_profit = input.float(0.5, "Pyramid Profit", minval=0.01, group="Turtle Parameters", tooltip=t4)

S1_long = input.int(20, "S1 Long", minval=1, group="Turtle Parameters", tooltip=t5)

S2_long = input.int(55, "S2 Long", minval=1, group="Turtle Parameters", tooltip=t6)

S1_long_exit = input.int(10, "S1 Long Exit", minval=1, group="Turtle Parameters", tooltip=t7)

S2_long_exit = input.int(20, "S2 Long Exit", minval=1, group="Turtle Parameters", tooltip=t8)

S1_short = input.int(15, "S1 Short", minval=1, group="Turtle Parameters", tooltip=t9)

S2_short = input.int(55, "S2 Short", minval=1, group="Turtle Parameters", tooltip=t10)

S1_short_exit = input.int(7, "S1 Short Exit", minval=1, group="Turtle Parameters", tooltip=t11)

S2_short_exit = input.int(20, "S2 Short Exit", minval=1, group="Turtle Parameters", tooltip=t12)

//Backtesting period

startDate = input(title="Start Date", defval=timestamp("1 Jan 2020 00:00:00"), group="Backtesting Period")

endDate = input(title="End Date", defval=timestamp("1 July 2034 00:00:00"), group="Backtesting Period")

//----------------------------------VARIABLES INITIALISATION-----------------------------//

//Turtle variables

atr = ta.atr(atr_period)

var float buy_price_long = na

var float buy_price_short = na

var float stop_loss_long = na

var float stop_loss_short = na

float account = na

//Entry variables

day_high_syst1 = ta.highest(high, S1_long)

day_low_syst1 = ta.lowest(low, S1_short)

day_high_syst2 = ta.highest(high, S2_long)

day_low_syst2 = ta.lowest(low, S2_short)

var bool skip = false

var bool unskip_buffer_long = false

var bool unskip_buffer_short = false

//Exit variables

exit_long_syst1 = ta.lowest(low, S1_long_exit)

exit_short_syst1 = ta.highest(high, S1_short_exit)

exit_long_syst2 = ta.lowest(low, S2_long_exit)

exit_short_syst2 = ta.highest(high, S2_short_exit)

float exit_signal = na

//Backtesting period

bool inRange = na

//------------------------------CHECKING SOME CONDITIONS ON EACH SCRIPT EXECUTION-------------------------------//

strategy.initial_capital = 50000

//Checking if the date belong to the range

inRange := inBacktestPeriod(startDate, endDate)

//Checking if the current equity is higher or lower than the initial capital to adjusted position size

if strategy.equity - strategy.openprofit < strategy.initial_capital

account := (strategy.equity-strategy.openprofit)*(strategy.equity-strategy.openprofit)/strategy.initial_capital

else

account := strategy.equity - strategy.openprofit

//Checking if we close all trades in case where we exit the backtesting period

if strategy.position_size!=0 and not inRange

strategy.close_all()

debugLabel("END OF BACKTESTING PERIOD : we close the trade", color=color.rgb(116, 116, 116))

//--------------------------------------SKIP MANAGEMENT------------------------------------//

//Checking if a long signal has been skiped and system2 is not triggered

if skip and high>day_high_syst1[1] and high<day_high_syst2[1]

unskip_buffer_long := true

//Checking if a short signal has been skiped and system2 is not triggered

if skip and low<day_low_syst1[1] and low>day_low_syst2[1]

unskip_buffer_short := true

//Checking if current high is lower than previous 20_day_high after a skiped long signal to set skip to false

if unskip_buffer_long

if high<day_high_syst1[1]

skip := false

unskip_buffer_long := false

//Checking if current low is higher than previous 20_day_low after a skiped short signal to set skip to false

if unskip_buffer_short

if low>day_low_syst1[1]

skip := false

unskip_buffer_short := false

//Checking if we have an open position to reset skip and unskip buffers

if strategy.position_size!=0 and skip

skip := false

unskip_buffer_long := false

unskip_buffer_short := false

//--------------------------------------------ENTRY CONDITIONS--------------------------------------------------//

//We calculate the position size based on turtle calculation

unit = (percentage_to_risk/100)*account/atr*syminfo.pointvalue

//Long order for system 1

if not skip and not (strategy.position_size>0) and inRange

strategy.cancel("Long Syst 2")

//We check that position size doesn't exceed available equity

if unit*day_high_syst1>account

unit := account/day_high_syst1

stop_loss_long := day_high_syst1 - stop_N_multiplier*atr

//We adjust SL if it's greater than 10% of trade value and fix it to 10%

if stop_loss_long < day_high_syst1*0.9

stop_loss_long := day_high_syst1*0.9

strategy.order("Long Syst 1", strategy.long, unit, stop=day_high_syst1)

buy_price_long := day_high_syst1

//Long order for system 2

if skip and not (strategy.position_size>0) and inRange

//We check that position size doesn't exceed available equity

if unit*day_high_syst2>account

unit := account/day_high_syst2

stop_loss_long := day_high_syst2 - stop_N_multiplier*atr

//We adjust SL if it's greater than 10% of trade value and fix it to 10%

if stop_loss_long < day_high_syst2*0.9

stop_loss_long := day_high_syst2*0.9

strategy.order("Long Syst 2", strategy.long, unit, stop=day_high_syst2)

buy_price_long := day_high_syst2

//Short order for system 1

if not skip and not (strategy.position_size<0) and inRange

strategy.cancel("Short Syst 2")

//We check that position size doesn't exceed available equity

if unit*day_low_syst1>account

unit := account/day_low_syst1

stop_loss_short := day_low_syst1 + stop_N_multiplier*atr

//We adjust SL if it's greater than 10% of trade value and fix it to 10%

if stop_loss_short > day_low_syst1*1.1

stop_loss_short := day_low_syst1*1.1

strategy.order("Short Syst 1", strategy.short, unit, stop=day_low_syst1)

buy_price_short := day_low_syst1

//Short order for system 2

if skip and not (strategy.position_size<0) and inRange

//We check that position size doesn't exceed available equity

if unit*day_low_syst2>account

unit := account/day_low_syst2

stop_loss_short := day_low_syst2 + stop_N_multiplier*atr

//We adjust SL if it's greater than 10% of trade value and fix it to 10%

if stop_loss_short > day_low_syst2*1.1

stop_loss_short := day_low_syst2*1.1

strategy.order("Short Syst 2", strategy.short, unit, stop=day_low_syst2)

buy_price_short := day_low_syst2

//-------------------------------PYRAMIDAL------------------------------------//

//Pyramid for long orders

if close > buy_price_long + (pyramid_profit*atr) and strategy.position_size>0

//We calculate the remaining capital

remaining_capital = account - strategy.position_size*strategy.position_avg_price*(1-0.0018)

//We calculate units to add to the long position

units_to_add = (percentage_to_risk/100)*remaining_capital/atr*syminfo.pointvalue

if remaining_capital > units_to_add

//We set the new Stop loss

stop_loss_long := stop_loss_long + pyramid_profit*atr

strategy.entry("Pyramid Long", strategy.long, units_to_add)

buy_price_long := close

//Pyramid for short orders

if close < buy_price_short - (pyramid_profit*atr) and strategy.position_size<0

//We calculate the remaining capital

remaining_capital = account + strategy.position_size*strategy.position_avg_price*(1-0.0018)

//We calculate units to add to the short position

units_to_add = (percentage_to_risk/100)*remaining_capital/atr*syminfo.pointvalue

if remaining_capital > units_to_add

//We set the new Stop loss

stop_loss_short := stop_loss_short - pyramid_profit*atr

strategy.entry("Pyramid Short", strategy.short, units_to_add)

buy_price_short := close

//----------------------------EXIT ORDERS-------------------------------//

//Checking if exit_long_syst1 is higher than stop_loss_long

if strategy.opentrades.entry_id(0)=="Long Syst 1"

if exit_long_syst1[1] > stop_loss_long

exit_signal := exit_long_syst1[1]

else

exit_signal := stop_loss_long

//Checking if exit_long_syst2 is higher than stop_loss_long

if strategy.opentrades.entry_id(0)=="Long Syst 2"

if exit_long_syst2[1] > stop_loss_long

exit_signal := exit_long_syst2[1]

else

exit_signal := stop_loss_long

//Checking if exit_short_syst1 is lower than stop_loss_short

if strategy.opentrades.entry_id(0)=="Short Syst 1"

if exit_short_syst1[1] < stop_loss_short

exit_signal := exit_short_syst1[1]

else

exit_signal := stop_loss_short

//Checking if exit_short_syst2 is lower than stop_loss_short

if strategy.opentrades.entry_id(0)=="Short Syst 2"

if exit_short_syst2[1] < stop_loss_short

exit_signal := exit_short_syst2[1]

else

exit_signal := stop_loss_short

//If the exit order is configured to close the position at a profit, we set 'skip' to true (we substract commission)

if strategy.position_size*exit_signal>strategy.position_size*strategy.position_avg_price*(1-0.0018)

strategy.cancel("Long Syst 1")

strategy.cancel("Short Syst 1")

skip := true

if strategy.position_size*exit_signal<=strategy.position_size*strategy.position_avg_price*(1-0.0018)

skip := false

//We place stop exit orders

if strategy.position_size > 0

strategy.exit("Exit Long", stop=exit_signal)

if strategy.position_size < 0

strategy.exit("Exit Short", stop=exit_signal)

//------------------------------PLOTTING ELEMENTS-------------------------------//

plotchar(atr, "ATR", "", location.top, color.rgb(131, 5, 83))

//Plotting enter threshold

plot(day_high_syst1[1], "20 day high", color.rgb(118, 217, 159))

plot(day_high_syst2[1], "55 day high", color.rgb(4, 92, 53))

plot(day_low_syst1[1], "20 day low", color.rgb(234, 108, 108))

plot(day_low_syst2[1], "55 day low", color.rgb(149, 17, 17))

//Plotting Exit Signal

plot(exit_signal, "Exit Signal", color.blue, style=plot.style_circles)

//Plotting our position

exit_long_syst2_plot = plot(exit_long_syst2[1], color=na)

day_high_syst2_plot = plot(day_high_syst2[1], color=na)

exit_short_syst2_plot = plot(exit_short_syst2[1], color=na)

day_low_syst2_plot = plot(day_low_syst2[1], color=na)

fill(exit_long_syst2_plot, day_high_syst2_plot, color=strategy.position_size>0 ? color.new(color.lime, 90) : na)

fill(exit_short_syst2_plot, day_low_syst2_plot, color=strategy.position_size<0 ? color.new(color.red, 90) : na)