概述

坎普敦15分钟蜡烛突破策略是一种旨在利用市场之间时段的波动性实现盈利的高频交易策略。该策略通过分析15分钟时间范围内的K线形态,在确定的交易时段捕捉短期价格波动,实现快速盈利退出。

策略原理

该策略主要判断K线的收盘价和开盘价,如果收盘价大于开盘价,表明该K线为多头K线,则产生买入信号;如果收盘价小于开盘价,表明该K线为空头K线,则产生卖出信号。同时,该策略还判断当前时间是否在设定的交易时间范围内,即南非开普敦当地时间16:00到16:15,只有在这个时间范围内的K线信号才被策略捕捉。

通过这种方法,该策略可以捕捉当地交易时段市场的短期波动机会,在出现多头信号时买入持有,空头信号出现时卖出套利,从中长短线转换的空档期实现盈利。

优势分析

捕捉市场关键时间波动:策略选择的16:00到16:15这个时段正处于欧洲和美国交易时段交替之际,这个时段的波动性和趋势转换机会较大,策略可以有效捕捉这一历史规律。

交易频率高:15分钟为交易的基本周期,交易频率较高,可以产生更多盈利机会。

策略规则简单易操作:仅需判断K线形态和交易时间两个维度,非常简洁和容易实践。

单次交易时间短:策略的盈利模式依赖于单次交易短线套利,可以快速切换仓位。

可扩展性强:策略框架简单通用,可以轻松扩展到其他交易品种和时间范围。

风险分析

缺乏整体趋势判断:策略没有考虑更高时间维度的整体趋势判断,可能与总体行情背离。

短期波动风险:过于依赖短线波动,会加大亏损风险。

交易时间风险:固定的交易时段可能错过更好的交易机会或者增加平仓风险。

隔夜仓位风险:波动过大可能导致无法在同一交易时段内平仓。

优化方向

整合长短期判断:结合更高级别如日线的趋势判断,避免与总体趋势背离。

优化止损策略:设定移动止损以锁定利润,降低亏损风险。

扩大或浮动交易时间范围:扩大观察以捕捉更多机会或避免平仓失败风险。

加强资金管理:优化仓位控制和风险调配,严格控制单笔亏损。

总结

坎普敦15分钟蜡烛突破策略是一种简单但实用的高频交易策略。它通过捕捉市场时段转换时的短期波动实现盈利。这种策略具有交易频率高、规则简单、扩展性强等优势,但也存在一定的风险,如缺乏对整体趋势判断以及波动过大的短期风险。我们可以通过结合更长周期分析、建立止损机制、扩大交易时段选择等方法来优化该策略,在控制风险的前提下获取更高的策略效率。

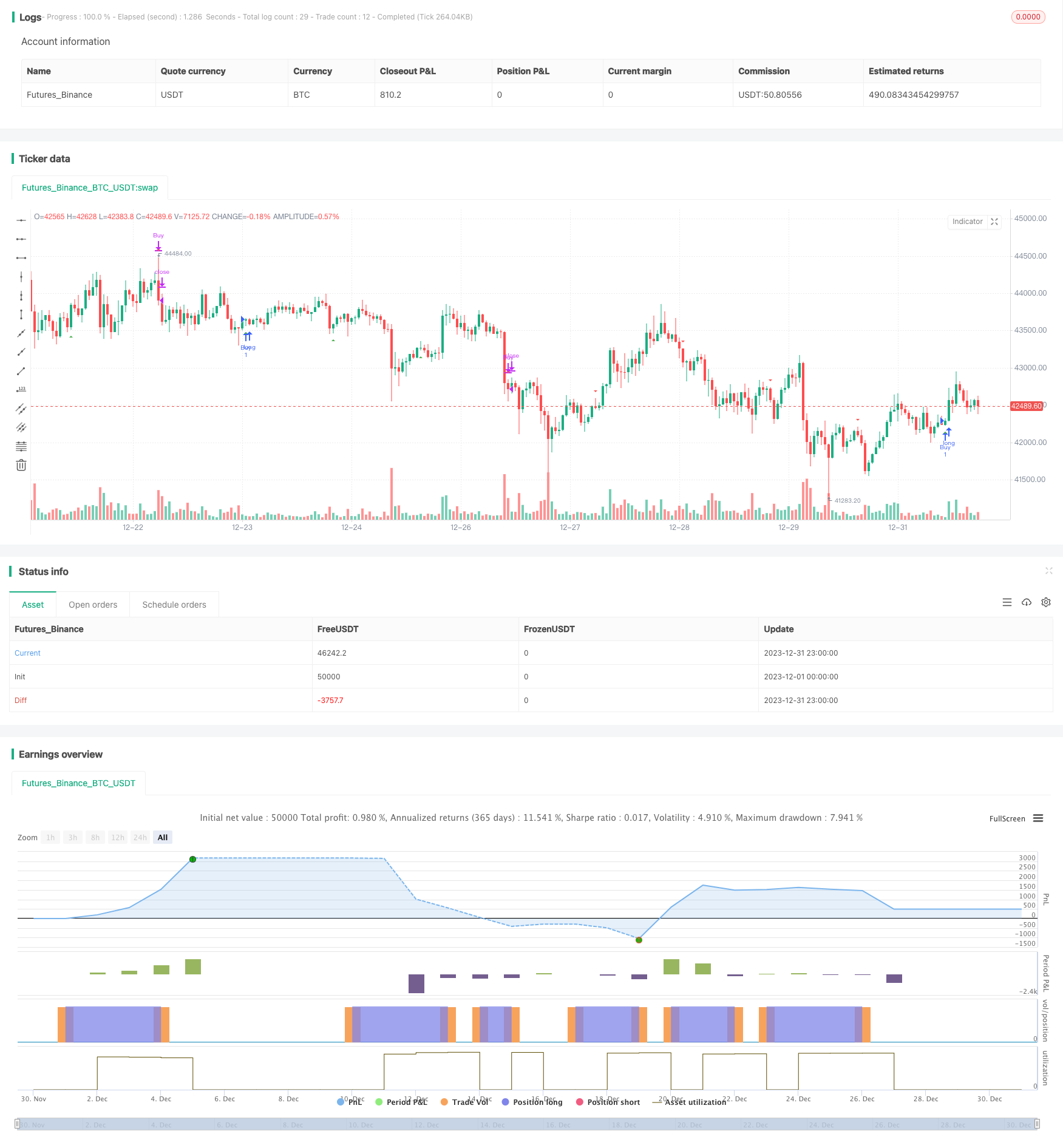

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Cape Town 15-Min Candle Strategy", overlay = true)

// Function to check if candle is bullish

isBullish() =>

close > open

// Function to check if candle is bearish

isBearish() =>

close < open

// Function to check if current candle is within specified time range (16:00 - 16:15 in Cape Town time)

isInTimeRange() =>

hour + 2 == 16 and minute >= 0 and minute <= 14

// Entry condition: Buy when candle is bullish and within time range

longCondition = isBullish() and isInTimeRange()

// Exit condition: Sell when candle is bearish and within time range

shortCondition = isBearish() and isInTimeRange()

// Plot buy and sell signals

plotshape(longCondition, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small, title="Buy Signal")

plotshape(shortCondition, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small, title="Sell Signal")

// Execute trade logic

strategy.entry("Buy", strategy.long, when = longCondition)

strategy.close("Buy", when = shortCondition)