概述

本策略名称为“双轮驱动策略”。该策略的主要思想是将Supertrend和RSI这两个强大的技术指标结合在一起,发挥各自的优势,实现更优秀的量化交易。

策略原理

该策略的核心部分在于使用Change函数来判断Supertrend指标的方向变化,从而产生交易信号。当Supertrend指标方向从上向下变化时,产生买入信号;当Supertrend指标从下向上变化时,产生卖出信号。

同时,策略还引入了RSI指标来辅助判断何时应该平仓。当RSI上穿设置的超买线时,做多单会被平掉;当RSI下穿设置的超卖线时,做空单会被平掉。这样,RSI指标帮助判断合理的止损点,从而锁定利润。

优势分析

这种结合了Supertrend和RSI指标的策略,最大的优势在于:

Supertrend擅长判断市场趋势变化,实现买入卖出的精确定位。

RSI擅长判断过冲回调的高低点,辅助确定合理止盈止损位置。

两者优势互补,更容易抓住市场机会,获得更稳定的盈利。

策略思路清晰简洁,容易理解和跟踪,适合不同水平的投资者。

实现鲁棒性较强,回撤风险可控,容易获得稳定收益。

风险分析

尽管双轮驱动策略有许多优势,但仍有一定风险需要注意:

Supertrend和RSI都可能会产生错误信号,导致不必要的亏损。可适当调整参数或引入其他指标进行验证。

多空双向交易风险更大,需要更严格的资金管理和风险控制。

当市场出现异常波动时,止损可能会被突破,应备用其他手段控制风险。

Supertrend指标对参数敏感度较高,不同市场需要调节ATR周期和因子大小。

优化方向

考虑到上述风险,该策略主要可从以下几个方面进行优化:

增加Volume和MACD等指标过滤假信号,使入场更加准确。

设置动态止损,跟踪突破来应对异常行情的风险。

对Supertrend参数和RSI参数进行优化,使其更适合不同市场的特点。

增加机器学习算法,辅助判断指标效果和参数选择。

采用期货、期权等衍生品进行套期保值,降低止损风险。

设定不同的仓位管理策略,控制单笔亏损和最大回撤。

总结

“双轮驱动策略”整合了Supertrend和RSI两个指标的优势,实现高效的趋势捕捉和止盈止损。相比单一指标,该策略信号更可靠,回撤更可控,是一种易于实施且收益稳定的算法交易策略。通过继续优化参数设置、增加信号过滤和风险管理模块,该策略有望获得更出色的表现。

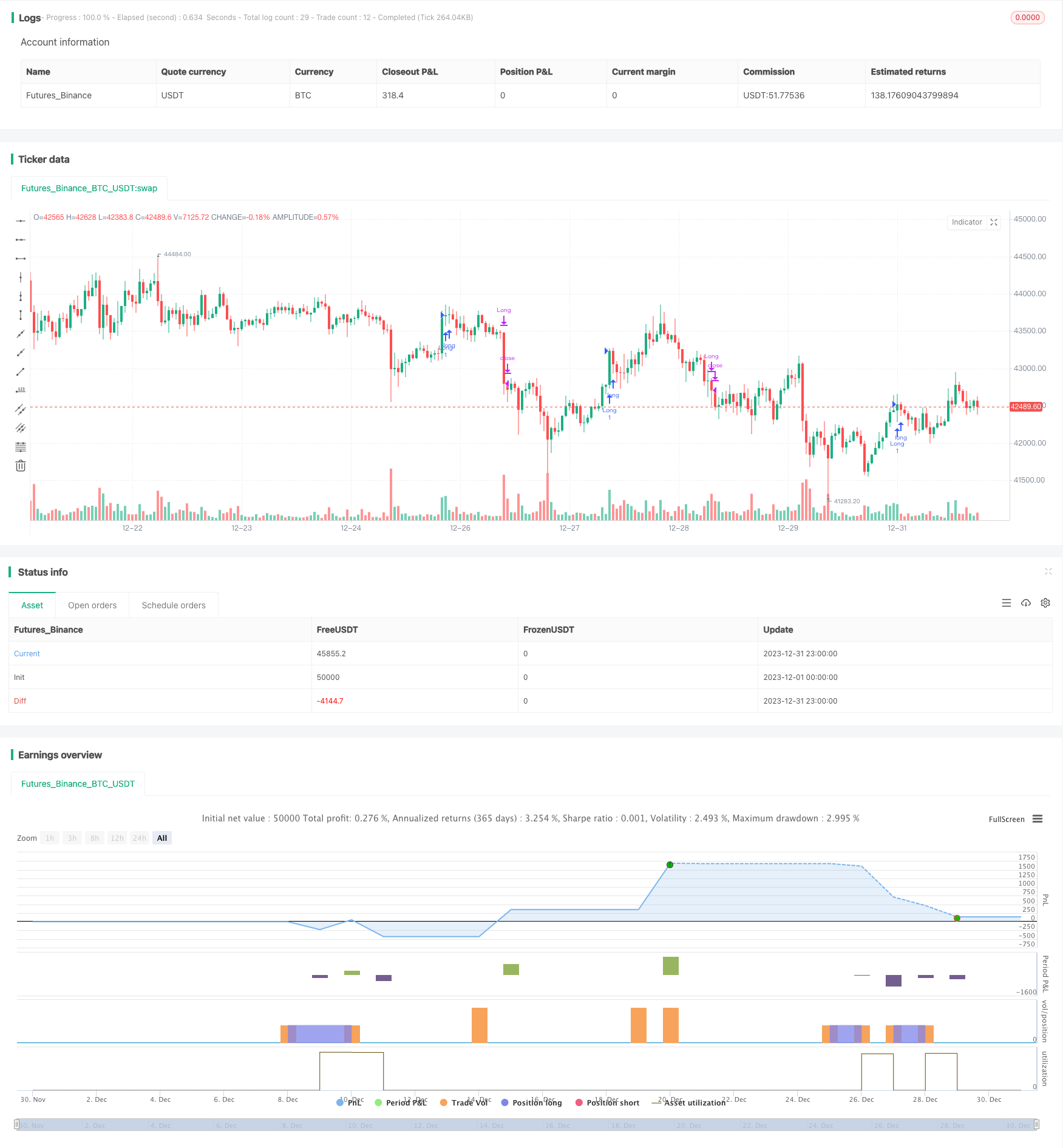

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © alorse

//@version=5

strategy("Supertrend + RSI Strategy [Alose]", overlay=true )

stGroup = 'Supertrend'

atrPeriod = input(10, "ATR Length", group=stGroup)

factor = input.float(3.0, "Factor", step = 0.01, group=stGroup)

[_, direction] = ta.supertrend(factor, atrPeriod)

// RSI

rsiGroup = 'RSI'

src = input(title='Source', defval=close, group=rsiGroup)

lenRSI = input.int(14, title='Length', minval=1, group=rsiGroup)

RSI = ta.rsi(src, lenRSI)

// Strategy Conditions

stratGroup = 'Strategy'

showLong = input.bool(true, title='Long entries', group=stratGroup)

showShort = input.bool(false, title='Short entries', group=stratGroup)

RSIoverbought = input.int(72, title='Exit Long', minval=1, group=stratGroup, tooltip='The trade will close when the RSI crosses up this point.')

RSIoversold = input.int(28, title='Exit Short', minval=1, group=stratGroup, tooltip='The trade will close when the RSI crosses below this point.')

entryLong = ta.change(direction) < 0

exitLong = RSI > RSIoverbought or ta.change(direction) > 0

entryShort = ta.change(direction) > 0

exitShort = RSI < RSIoversold or ta.change(direction) < 0

if showLong

strategy.entry("Long", strategy.long, when=entryLong)

strategy.close("Long", when=exitLong)

if showShort

strategy.entry("Short", strategy.short, when=entryShort)

strategy.close("Short", when=exitShort)