概述

本策略是一种基于MACD指标与随机指标组合的加密货币交易策略。它通过计算比特币价格的MACD指标并对其施加随机指标,产生交易信号,以捕捉加密货币市场的趋势变化。

策略原理

该策略首先计算MACD指标。MACD代表移动平均收敛离差,是一种趋势跟踪指标。它由快线和慢线组成,快线是较短期的指数移动平均线,慢线是较长期的指数移动平均线。当快线上穿慢线时为金叉信号,表示市场转为看涨;当快线下穿慢线时为死叉信号,表示市场转为看跌。

在计算出MACD指标后,该策略对MACD指标本身再施加随机指标%K。随机指标%K的计算公式为:

%K = (当前收盘价 - N日内最小价) / (N日内最大价 - N日内最小价) * 100

随机指标反映股价脱离最近范围的变化情况。%K值在20-80之间的波动代表股价走势处于盘整范围。当%K从下向上穿过20线时,为买入讯号。当%K从上向下穿过80线时,为卖出讯号。

本策略结合MACD指标和随机指标%K的交易信号,在加密货币市场中进行交易。当随机指标%K向上穿过20时产生买入讯号;当随机指标%K向下穿过80时产生卖出讯号。

策略优势

这种策略结合了趋势分析和超买超卖指标,能有效识别市场重要的转折点。相比单一使用MACD或随机指标,%K和MACD的组合使用,可以增加信号的可靠性,减少假信号。

另外,本策略应用股票市场中常用的技术指标于加密货币交易,这是一种跨市场的化用。这种指标在数字货币市场同样适用,甚至会由于数字货币的高波动性而获得更好的效果。

风险及解决方法

该策略最大的风险在于加密货币市场高度波动,容易产生虚假信号导致交易亏损。此外,技术指标发出信号时,价格可能已经产生一定幅度的变动,存在无法充分捕捉趋势初期的风险。

为控制这些风险,建议采用移动止损来锁定利润,避免亏损进一步扩大。同时,也可以适当调整参数,使用不同周期长度来发掘更多潜在机会。

策略优化方向

第一,该策略可以尝试将移动平均线与波动率指标结合使用,例如布林带,设置波动率参数来识别突破的有效性,避免虚假信号。

第二,可以引入机器学习模型对历史数据进行训练,建立随机森林或者LSTM神经网络模型,辅助判断指标信号的有效性。

第三,增加止损机制。当价格向不利方向移动超过一定幅度时,自动执行止损以控制风险。

总结

本策略结合MACD指标和随机指标%K,利用两种指标互相验证信号的方法,制定加密货币的交易策略。这种组合指标策略,可以在一定程度上提高信号的准确性。但我们也需要警惕指标组合过于复杂可能带来的noise和lagging效应。参数设置和风险控制同样重要,需要根据不同市场环境进行调整优化,才能获得较好的策略表现。

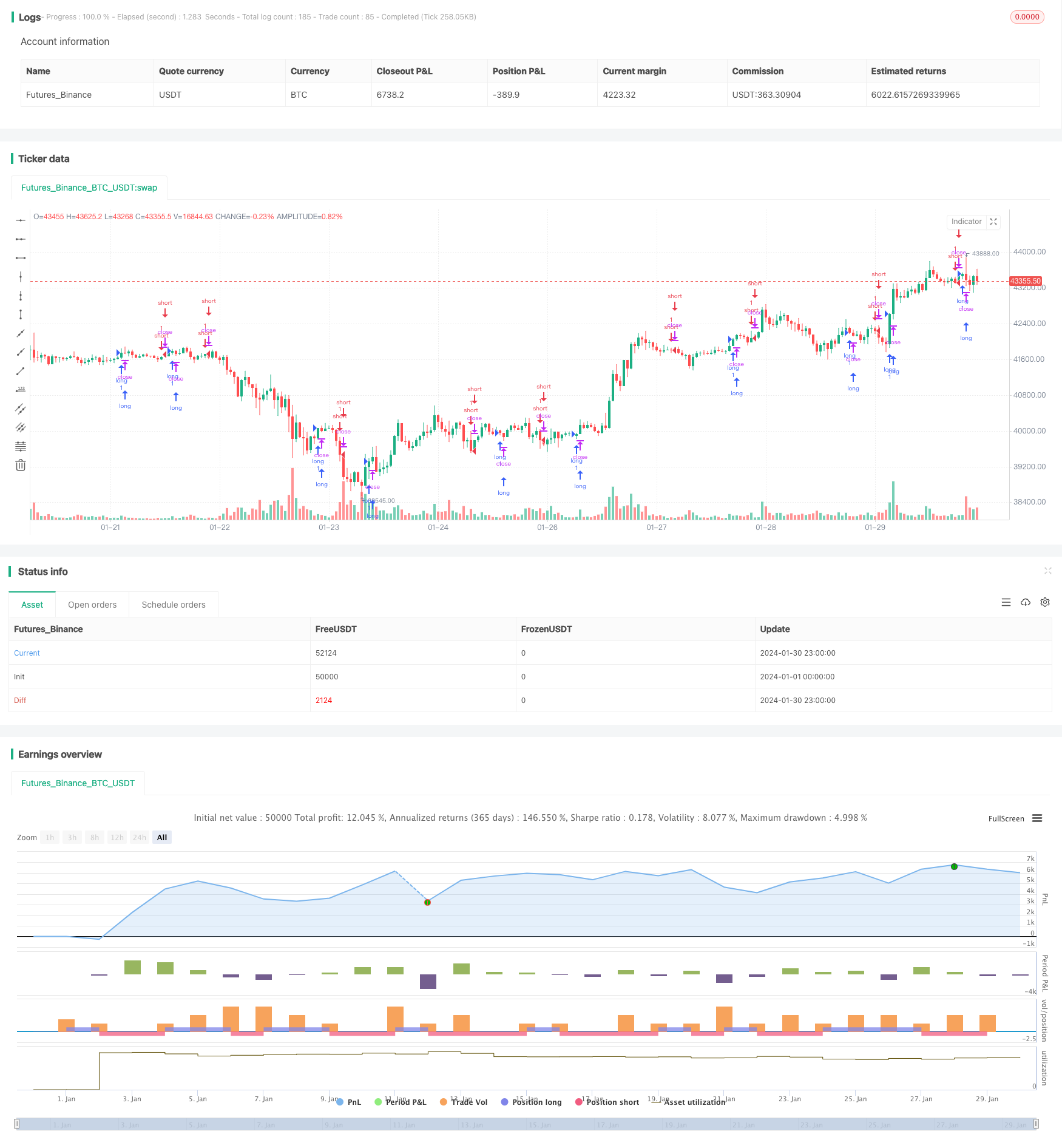

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("Schaff Trend Cycle Strategy", shorttitle="STC Backtest", overlay=true)

fastLength = input(title="MACD Fast Length", defval=23)

slowLength = input(title="MACD Slow Length", defval=50)

cycleLength = input(title="Cycle Length", defval=10)

d1Length = input(title="1st %D Length", defval=3)

d2Length = input(title="2nd %D Length", defval=3)

src = input(title="Source", defval=close)

highlightBreakouts = input(title="Highlight Breakouts ?", type=bool, defval=true)

macd = ema(src, fastLength) - ema(src, slowLength)

k = nz(fixnan(stoch(macd, macd, macd, cycleLength)))

d = ema(k, d1Length)

kd = nz(fixnan(stoch(d, d, d, cycleLength)))

stc = ema(kd, d2Length)

stc := stc > 100 ? 100 : stc < 0 ? 0 : stc

upper = input(75, defval=75)

lower = input(25, defval=25)

long = crossover(stc, lower) ? lower : na

short = crossunder(stc, upper) ? upper : na

long_filt = long and not short

short_filt = short and not long

prev = 0

prev := long_filt ? 1 : short_filt ? -1 : prev[1]

long_final = long_filt and prev[1] == -1

short_final = short_filt and prev[1] == 1

//alertcondition(long_final, "Long", message="Long")

//alertcondition(short_final,"Short", message="Short")

//plotshape(long_final, style=shape.arrowup, text="Long", color=green, location=location.belowbar)

//plotshape(short_final, style=shape.arrowdown, text="Short", color=red, location=location.abovebar)

strategy.entry("long", strategy.long, when = long )

strategy.entry("short", strategy.short, when = short)