概述

Supertrend Bitcoin长线策略是一个只做多头的比特币交易策略。它结合使用SuperTrend指标、RSI相对强弱指标和ADX平均方向指数来确定入场点。

策略原理

当满足以下入场条件时,策略会开仓做多:

- SuperTrend指标变为负向

- 21周期RSI低于66

- 3周期RSI高于80

- 28周期RSI高于49

- ADX信号高于20

当SuperTrend指标变为正向时,策略会平仓离场。

该策略使用账户权益的100% Margins率设定为10%。它会在图表上绘制策略权益曲线,用于分析。这种设置旨在在比特币市场的长线趋势中,在特定的技术指标条件下捕捉阳线行情。

优势分析

Supertrend Bitcoin长线策略最大的优势在于,它只在技术指标充分确认市场趋势后才入场。具体来说,它要求短期和长期RSI同时呈现超买或超卖信号,表示大周期和小周期走势达成共识,从而过滤掉很多噪音交易机会。同时结合ADX判断趋势力度,避免在盘整震荡市中随波逐流。

这种只做多不做空的策略,也避免了空头交易中无限亏损的风险。在长线看涨的大周期,追涨杀跌可以获得较好的胜率和收益回报率。

风险分析

Supertrend Bitcoin长线策略最大的风险在于,它无法响应突发消息引发的短期调整和回撤。当利空消息面市,价格出现断崖式下跌时,由于只做多无法切换方向,这时就会遭受巨额亏损。这属于无法规避的残余风险。

另一个潜在风险是,SuperTrend等指标判断市场结构转折点的效果并不理想。它们往往会滞后,从而错过最佳入场时机或出场时机。这可能导致获得的收益远低于市场本身。为减轻这一风险,可以适当调整参数,或增加其他先行指标进行确认。

优化方向

Supertrend Bitcoin长线策略还有进一步优化的空间:

可以增加游离股指标、OBV指标等,对买卖力度进行判断,防止在高位燥股中追高

可以结合波动率指标,只在波动加大时才入场,避免陷入无利可图的低波动区间

可以加入自动止损模块,设定回撤范围,避免出现超出风险偏好的大额亏损

可以进行参数优化,调整RSI周期参数,提高指标效果

可以结合机器学习模型,实现动态参数和多因子优化

通过这些优化,可以进一步提高策略的稳定性、胜率和盈利水平。

总结

Supertrend Bitcoin长线策略是一个简单直接的量化投资策略。它旨在捕捉比特币或加密货币市场中的长线阳线,通过追涨杀跌获得稳定收益。尽管仍存在一定风险,但通过参数调整和模型优化,这一策略可以进一步增强,成为量化交易的有利工具。它为投资者提供了一个整体乐观看多加密市场,分享数字资产增长红利的思路。

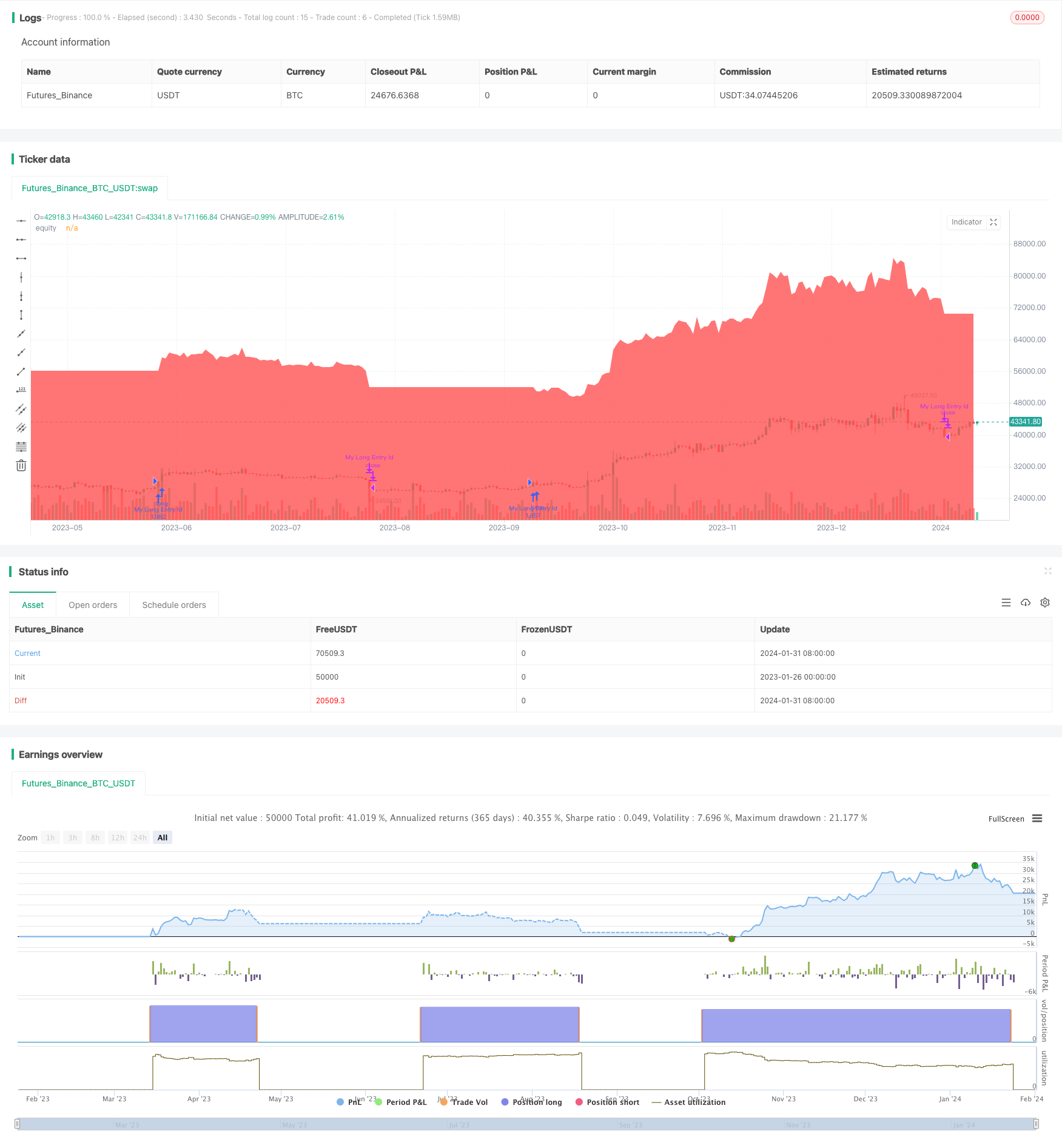

/*backtest

start: 2023-01-26 00:00:00

end: 2024-02-01 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Supertrend Bitcoin Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100, initial_capital=1000, margin_long=0.1)

atrPeriod = input(10, "ATR Length")

factor = input.float(3.0, "Factor", step = 0.01)

[_, direction] = ta.supertrend(factor, atrPeriod)

adxlen = input(7, title="ADX Smoothing")

dilen = input(7, title="DI Length")

dirmov(len) =>

up = ta.change(high)

down = -ta.change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = ta.rma(ta.tr, len)

plus = fixnan(100 * ta.rma(plusDM, len) / truerange)

minus = fixnan(100 * ta.rma(minusDM, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adx = 100 * ta.rma(math.abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

sig = adx(dilen, adxlen)

if ta.change(direction) < 0 and ta.rsi(close, 21) < 66 and ta.rsi(close, 3) > 80 and ta.rsi(close, 28) > 49 and sig > 20

strategy.entry("My Long Entry Id", strategy.long)

if ta.change(direction) > 0

strategy.close("My Long Entry Id") // Close long position

plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_areabr)