概述

该策略名为“黄金交叉法则”,是一种同时结合指数移动平均线(EMA)和相对强弱指数(RSI)的量化交易策略。它的主要思想是在高需求区买入,在高供给区卖出,利用EMA判断总体趋势方向,利用RSI判断超买超卖区域。

策略原理

该策略首先计算50日EMA和14日RSI。然后设置高需求区和高供给区的布林带。当价格高于50日EMA且RSI高于55时为买入信号。当价格低于50日EMA且RSI低于45时为卖出信号。策略的入场点是在高需求区买入和在高供给区卖出。

具体来说,当收盘价高于50日EMA且在高需求区时,发出买入信号;当收盘价低于50日EMA且在高供给区时,发出卖出信号。这样,就利用EMA判断大致趋势,用RSI判断超买超卖区,在极端区域打反向战术交易,从而获得较高的胜率。

优势分析

该策略结合EMA和RSI双重指标,能够有效判断市场趋势和超买超卖区域。EMA平滑价格,判断大趋势,RSI判断局部调整空间。两者互补,避免假信号。

另外,该策略增设了高需求区和高供给区概念,就是利用布林带设置的超买超卖区间。这样可以过滤掉大部分噪音,只在极端区域出手,从而提高策略胜率。

总的来说,该策略综合多个指标和概念,利用不同工具的优势,钳形攻势,形成强势的价值选股和择时系统,能够获得较高的盈利率。

风险分析

该策略最大的风险在于布林带的设置。如果高需求区和高供给区设置得过大或过小,都会导致策略频繁损失。必须根据不同股票特点和市场环境Tuning参数。

另一个潜在风险是,如果行情出现长期筑顶或筑底,会出现EMA和RSI同时发出错误信号的概率。这时,必须介入人工干预,停止策略,避免巨额损失。

优化方向

第一,该策略可以引入机器学习算法,实现参数的动态优化。例如,使用强化学习调整布林带上下限,或者使用LSTM优化EMA和RSI的参数。

第二,该策略可以结合文本采集和自然语言处理技术,获取市场情绪指标,助力交易决策。在极端市场情绪出现时,手动干预策略,可以有效规避风险。

第三,该策略可以和选股策略结合。首先用深度学习等方法选出具有成长潜力的标的;然后再用该策略进行择时;从而全面提高策略效果。

总结

该策略总体来说,指标组合得当,优势明显,有效控制了风险。通过引入机器学习和文本分析等技术进行优化,有望进一步提升策略效果,成为新一代量化策略的典范。

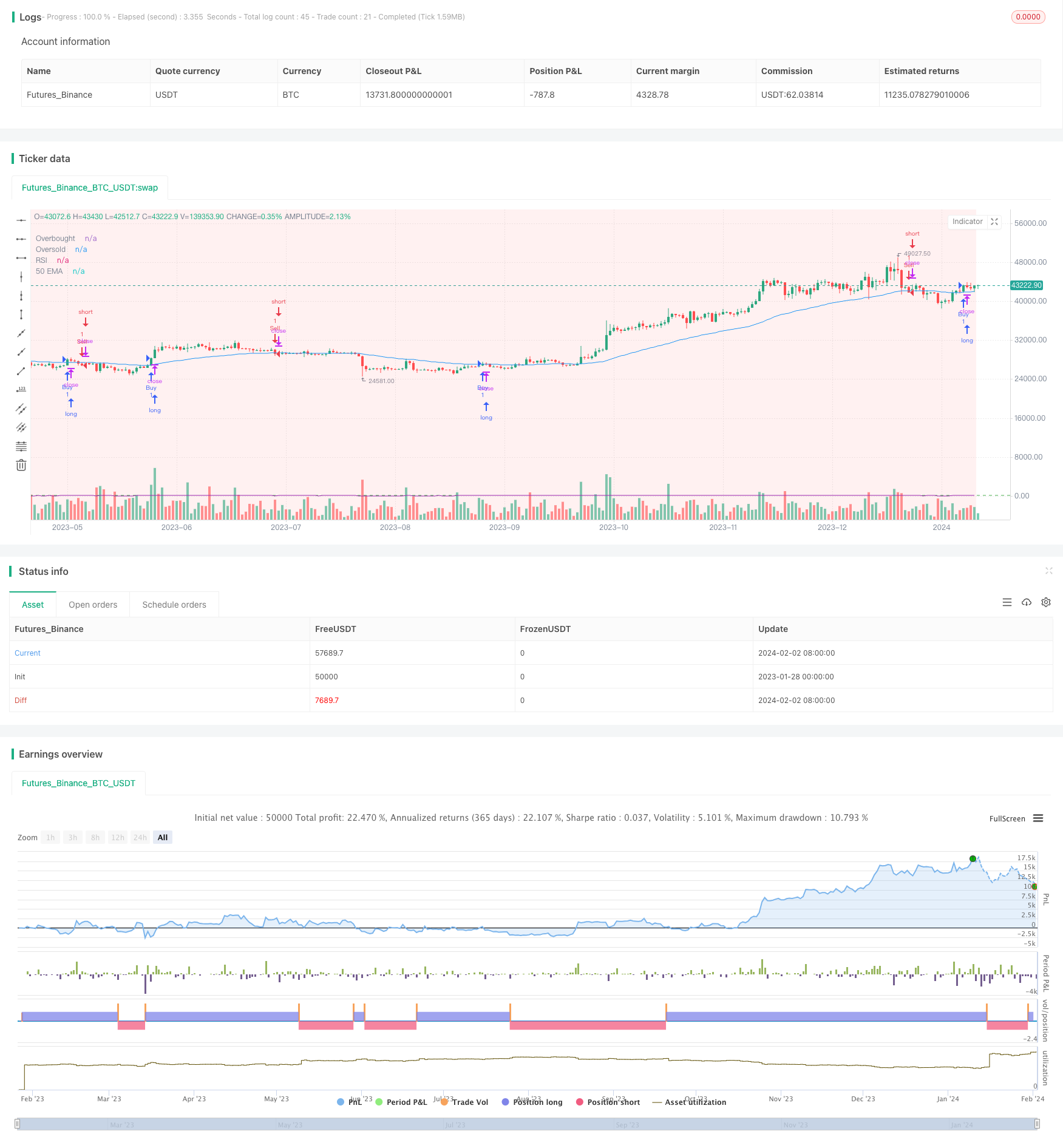

/*backtest

start: 2023-01-28 00:00:00

end: 2024-02-03 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Powerful EMA and RSI Strategy", overlay=true)

// Define EMA parameters

ema50 = ta.ema(close, 50)

// Calculate RSI

rsiLength = input(14, title="RSI Length")

rsiValue = ta.rsi(close, rsiLength)

// Define Demand and Supply zones

demandZone = input(true, title="Demand Zone")

supplyZone = input(true, title="Supply Zone")

// Define Buy and Sell conditions

buyCondition = close > ema50 and rsiValue > 55

sellCondition = close < ema50 and rsiValue < 45

// Entry point buy when the price is closed above 50 EMA at Demand area

buyEntryCondition = close > ema50 and demandZone

strategy.entry("Buy", strategy.long, when=buyCondition and buyEntryCondition)

// Entry point sell when the price is closed below 50 EMA at Supply area

sellEntryCondition = close < ema50 and supplyZone

strategy.entry("Sell", strategy.short, when=sellCondition and sellEntryCondition)

// Plot 50 EMA for visualization

plot(ema50, color=color.blue, title="50 EMA")

// Plot RSI for visualization

hline(55, "Overbought", color=color.red)

hline(45, "Oversold", color=color.green)

plot(rsiValue, color=color.purple, title="RSI")

// Plot Demand and Supply zones

bgcolor(demandZone ? color.new(color.green, 90) : na)

bgcolor(supplyZone ? color.new(color.red, 90) : na)