概述

本策略采用双向自适应布林带指标来识别趋势方向,并结合市价单进行追踪止损,实现高效率的趋势追踪交易。

策略原理

- 根据一定周期计算布林中轨,上轨和下轨

- 判断价格突破上轨则做多追踪,突破下轨则做空追踪

- 采用市价单快速进场

- 设置止损位置,止盈位置进行持仓管理

优势分析

- 自适应布林带指标,对市场波动敏感,能快速判断趋势转向

- 采用市价单快速进入场内,减少滑点风险

- 自动止损止盈,严格控制风险,锁定利润

风险分析

- 布林带本身具有滞后性,不能完全避免假突破

- 采用市价单无法控制成交价格

- 需要合理设置止损位和止盈位

优化方向

- 调整布林带的参数,优化判断趋势的灵敏度

- 加入成交量或MACD等指标过滤假突破

- 优化止损位和止盈位的设置

总结

本策略充分利用布林带判断趋势方向和变化的优势,结合快速出场的市价单进行双向追踪,在控制风险的前提下获得超额收益。通过进一步优化布林带参数,加入辅助过滤指标,调整止损止盈逻辑等手段,可以获得更好的策略表现。该策略思路清晰易于实现,是一种高效可靠的趋势追踪交易策略。

策略源码

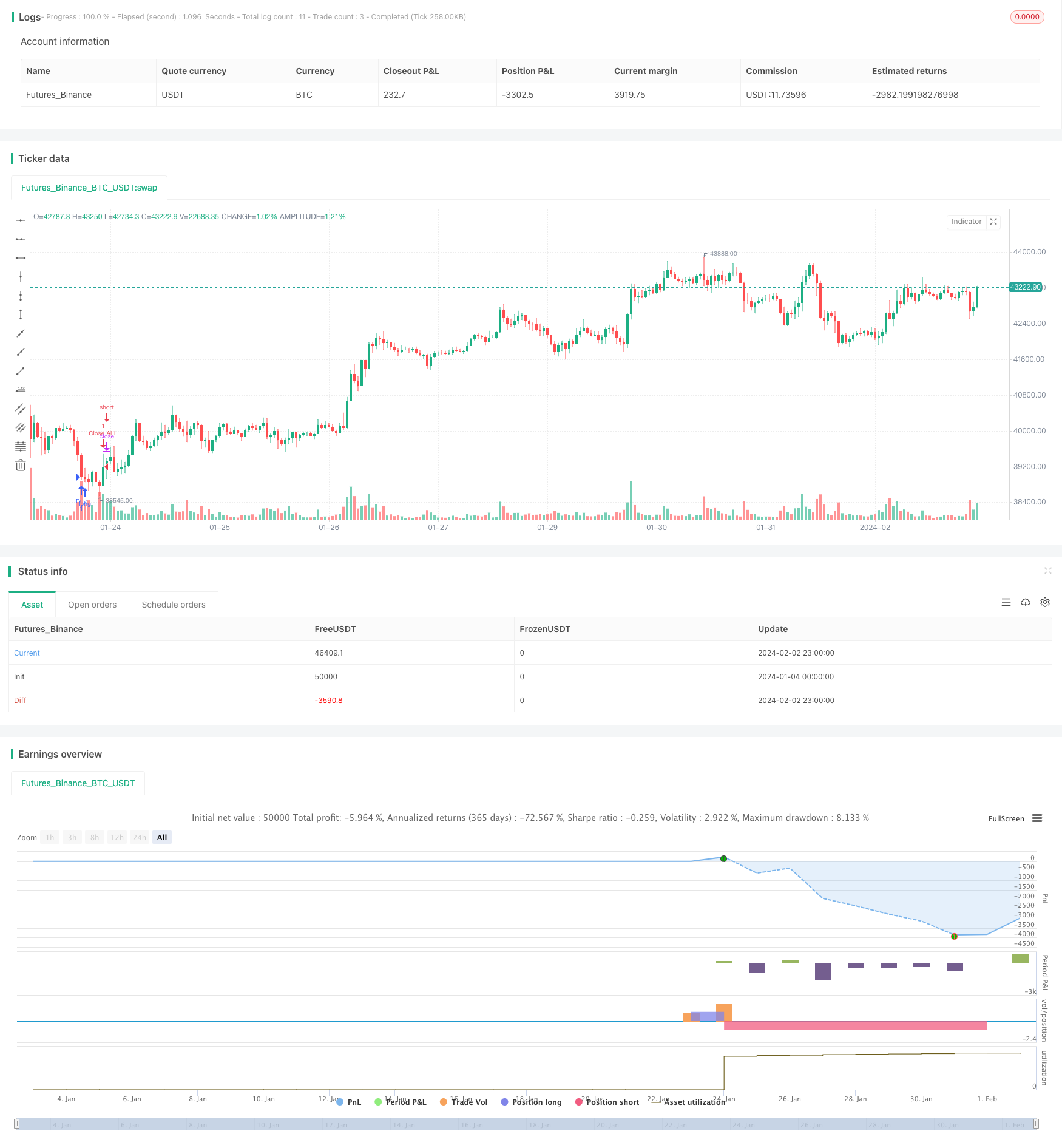

/*backtest

start: 2024-01-04 00:00:00

end: 2024-02-03 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © CryptoRox

//@version=4

//Paste the line below in your alerts to run the built-in commands.

//{{strategy.order.alert_message}}

strategy("Automated - Fibs with Market orders", "Strategy", true)

//Settings

testing = input(false, "Live")

//Use epochconverter or something similar to get the current timestamp.

starttime = input(1600976975, "Start Timestamp") * 1000

//Wait XX seconds from that timestamp before the strategy starts looking for an entry.

seconds = input(60, "Start Delay") * 1000

testPeriod = true

leverage = input(1, "Leverage")

tp = input(1.0, "Take Profit %") / leverage

dca = input(-1.0, "DCA when < %") / leverage *-1

fibEntry = input("1", "Entry Level", options=["1", "2", "3", "4", "5", "6", "7", "8", "9", "10"])

//Strategy Calls

equity = strategy.equity

avg = strategy.position_avg_price

symbol = syminfo.tickerid

openTrades = strategy.opentrades

closedTrades = strategy.closedtrades

size = strategy.position_size

//Fibs

lentt = input(60, "Pivot Length")

h = highest(lentt)

h1 = dev(h, lentt) ? na : h

hpivot = fixnan(h1)

l = lowest(lentt)

l1 = dev(l, lentt) ? na : l

lpivot = fixnan(l1)

z = 400

p_offset= 2

transp = 60

a=(lowest(z)+highest(z))/2

b=lowest(z)

c=highest(z)

fib0 = (((hpivot - lpivot)) + lpivot)

fib1 = (((hpivot - lpivot)*.21) + lpivot)

fib2 = (((hpivot - lpivot)*.3) + lpivot)

fib3 = (((hpivot - lpivot)*.5) + lpivot)

fib4 = (((hpivot - lpivot)*.62) + lpivot)

fib5 = (((hpivot - lpivot)*.7) + lpivot)

fib6 = (((hpivot - lpivot)* 1.00) + lpivot)

fib7 = (((hpivot - lpivot)* 1.27) + lpivot)

fib8 = (((hpivot - lpivot)* 2) + lpivot)

fib9 = (((hpivot - lpivot)* -.27) + lpivot)

fib10 = (((hpivot - lpivot)* -1) + lpivot)

notna = nz(fib10[60])

entry = 0.0

if fibEntry == "1"

entry := fib10

if fibEntry == "2"

entry := fib9

if fibEntry == "3"

entry := fib0

if fibEntry == "4"

entry := fib1

if fibEntry == "5"

entry := fib2

if fibEntry == "6"

entry := fib3

if fibEntry == "7"

entry := fib4

if fibEntry == "8"

entry := fib5

if fibEntry == "9"

entry := fib6

if fibEntry == "10"

entry := fib7

profit = avg+avg*(tp/100)

pause = 0

pause := nz(pause[1])

paused = time < pause

fill = 0.0

fill := nz(fill[1])

count = 0.0

count := nz(fill[1])

filled = count > 0 ? entry > fill-fill/100*dca : 0

signal = testPeriod and notna and not paused and not filled ? 1 : 0

neworder = crossover(signal, signal[1])

moveorder = entry != entry[1] and signal and not neworder ? true : false

cancelorder = crossunder(signal, signal[1]) and not paused

filledorder = crossunder(low[1], entry[1]) and signal[1]

last_profit = 0.0

last_profit := nz(last_profit[1])

// if neworder and signal

// strategy.order("New", 1, 0.0001, alert_message='New Order|e=binancefuturestestnet s=btcusdt b=long q=0.0011 fp=' + tostring(entry))

// if moveorder

// strategy.order("Move", 1, 0.0001, alert_message='Move Order|e=binancefuturestestnet s=btcusdt b=long c=order|e=binancefuturestestnet s=btcusdt b=long q=0.0011 fp=' + tostring(entry))

if filledorder and size < 1

fill := entry

count := count+1

pause := time + 60000

p = close+close*(tp/100)

strategy.entry("Buy", 1, 1, alert_message='Long|e=binancefuturestestnet s=btcusdt b=long q=0.0011 t=market')

if filledorder and size >= 1

fill := entry

count := count+1

pause := time + 60000

strategy.entry("Buy", 1, 1, alert_message='Long|e=binancefuturestestnet s=btcusdt b=long q=0.0011 t=market')

// if cancelorder and not filledorder

// pause := time + 60000

// strategy.order("Cancel", 1, 0.0001, alert_message='Cancel Order|e=binancefuturestestnet s=btcusdt b=long c=order')

if filledorder

last_profit := profit

closeit = crossover(high, profit) and size >= 1

if closeit

strategy.entry("Close ALL", 0, 0, alert_message='Close Long|e=binancefuturestestnet s=btcusdt b=long c=position t=market')

count := 0

fill := 0.0

last_profit := 0.0

//Plots

// bottom = signal ? color.green : filled ? color.red : color.white

// plot(entry, "Entry", bottom)