概述

移动平均线交叉策略是一种比较常见的股票交易策略。该策略通过计算快速移动平均线和慢速移动平均线,并在它们交叉时产生买入和卖出信号。具体来说,当快速移动平均线从下方上穿慢速移动平均线时,产生买入信号;当快速移动平均线从上方下穿慢速移动平均线时,产生卖出信号。

策略原理

该策略的核心逻辑是:快速移动平均线代表股票的短期趋势,慢速移动平均线代表股票的长期趋势。当短期趋势转为上升(金叉),说明股票进入买入区间;当短期趋势转为下降(死叉),说明股票进入卖出区间。

具体来看,该策略中定义了快速移动平均maFast和慢速移动平均maSlow。maFast长度为9,代表股票9天的短期趋势;maSlow长度为18,代表股票18天的长期趋势。策略通过计算两个移动平均线的交叉情况来判断短期和长期趋势的变化。当maFast上穿maSlow时,产生买入信号;当maFast下穿maSlow时,产生卖出信号。

优势分析

该策略具有以下优势:

- 原理简单易懂,容易理解和实现。

- 移动平均线能有效滤去股票价格的噪音,产生较为可靠的交易信号。

- 快慢移动平均线结合短长期趋势,交易信号比较稳定。

- 可灵活调整移动平均线参数,适应不同股票的特性。

- 可通过优化移动平均线周期参数来获得更好的交易效果。

风险分析

该策略也存在一些风险:

- 当股票价格波动较大时,会产生更多错误信号和过多交易。

- 参数设置不当会导致交易频率过高或信号延迟。

- 无法有效跟踪快速变化的市场和个股。

- 存在一定的时间滞后,可能错过关键的买入卖出点位。

可以通过调整移动平均线参数、设置停损策略等方法来降低上述风险。

优化方向

该策略还有进一步优化的空间:

- 结合其他技术指标过滤信号,例如交易量,STOCH等。

- 增加趋势判断机制,避免错失主要趋势。

- 优化移动平均线参数,找到最佳参数组合。

- 设置止损策略,控制单笔损失。

- 结合深度学习等模型预测价格走势。

总结

移动平均线交叉策略整体来说是一个非常经典和实用的策略。它原理简单,容易实现,在实际交易中应用广泛。通过参数调优和辅助技术指标的应用,可以进一步改进该策略,获得更好的风险收益比。总的来说,该策略是量化交易的一个重要基石,值得深入研究和应用。

策略源码

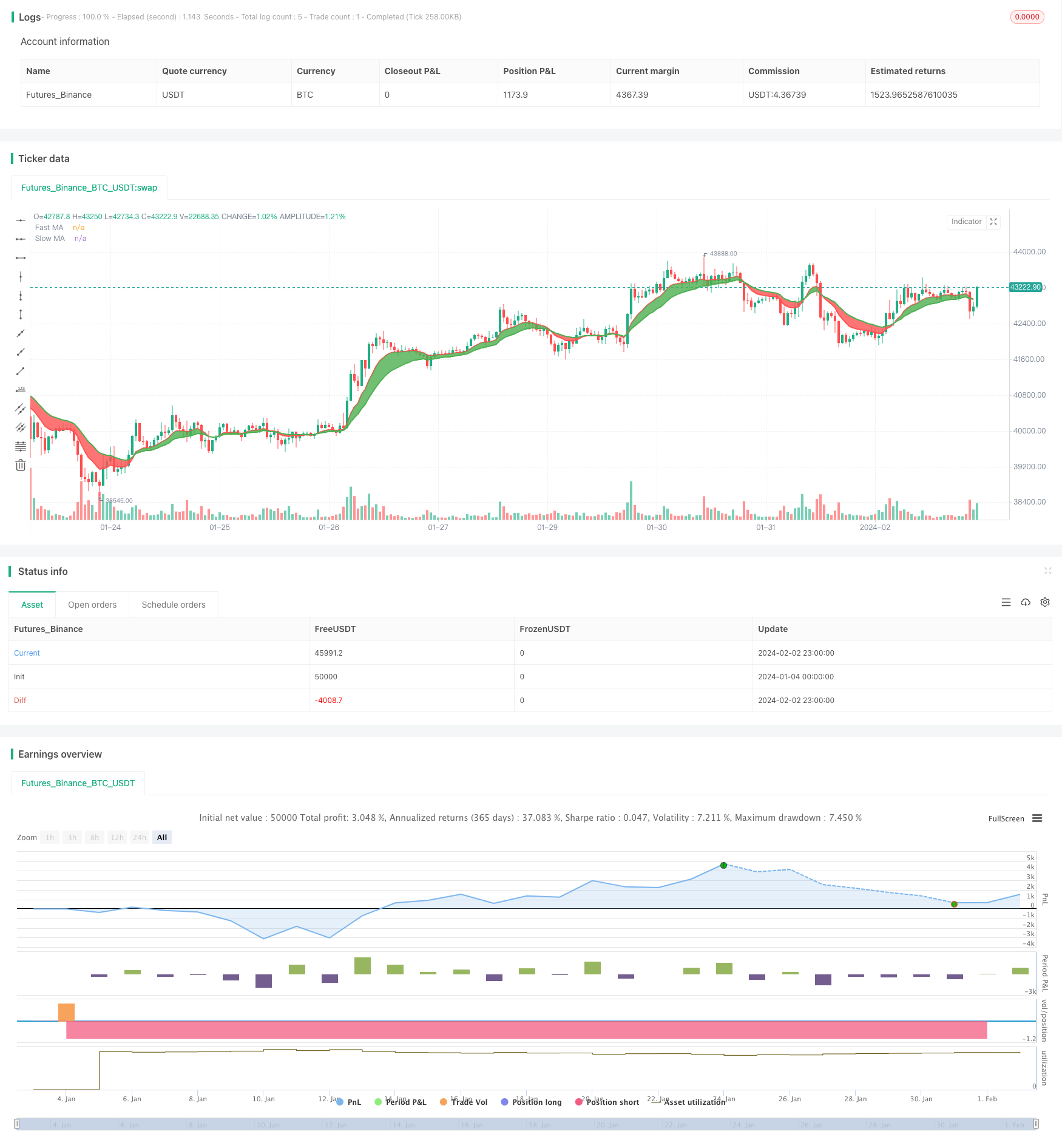

/*backtest

start: 2024-01-04 00:00:00

end: 2024-02-03 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(title="Moving Average Cross", overlay=true, initial_capital=10000, currency='USD')

// === GENERAL INPUTS ===

// short ma

maFastSource = input(defval = close, title = "Fast MA Source")

maFastLength = input(defval = 9, title = "Fast MA Period", minval = 1)

// long ma

maSlowSource = input(defval = close, title = "Slow MA Source")

maSlowLength = input(defval = 18, title = "Slow MA Period", minval = 1)

// === SERIES SETUP ===

/// a couple of ma's..

maFast = ema(maFastSource, maFastLength)

maSlow = ema(maSlowSource, maSlowLength)

// === PLOTTING ===

fast = plot(maFast, title = "Fast MA", color = red, linewidth = 2, style = line, transp = 30)

slow = plot(maSlow, title = "Slow MA", color = green, linewidth = 2, style = line, transp = 30)

// === LOGIC ===

enterLong = crossover(maFast, maSlow)

exitLong = crossover(maSlow, maFast)

// Entry //

strategy.entry(id="Long Entry", long=true, when=enterLong)

strategy.entry(id="Short Entry", long=false, when=exitLong)

// === FILL ====

fill(fast, slow, color = maFast > maSlow ? green : red)