概述

本策略通过计算RSI指标并设定超买超卖区间,结合动态止损和目标利润退出来构建交易策略。当RSI指标上穿超卖区间时做空,下穿超卖区间时做多,同时设定追踪止损和目标利润来退出仓位。

策略原理

本策略使用14日RSI指标判断市场技术形态。RSI指标反映了一段时间内涨跌动量的比例,用于判断市场是超买还是超卖。本策略中的RSI长度为14。当RSI上穿70时市场被认为超买,这时做空;当RSI下穿30时市场被认为超卖,这时做多。

另外,本策略还使用了动态追踪止损机制。当持有多头仓位时,追踪止损价为收盘价的97%;当持有空头仓位时,追踪止损价为收盘价的103%。这样可以锁定大部分利润,同时避免止损被震出。

最后,本策略还使用目标利润机制。当持仓盈利达到20%时会退出仓位。这可以锁定部分利润,避免利润回吐。

优势分析

本策略具有以下几个优势:

- 使用RSI指标判断超买超卖情况,可以及时抓住市场转折点

- 采用动态追踪止损,可以有效控制风险

- 设置目标利润水平,可以锁定部分利润

- 策略思路清晰易理解,参数较少,便于实盘操作

- 可方便优化参数如RSI长度、超买超卖水平、止损幅度等

风险分析

本策略也存在一些风险需要关注:

- RSI指标作出假信号的可能性,这会导致不必要的亏损

- 止损被突破的概率,这会扩大损失

- 目标利润设置过低无法持仓赚足够多利润的情况

针对上述风险,可以通过优化RSI参数,调整止损幅度,适当放宽目标利润要求来解决。

优化方向

本策略可以从以下几个方向进行优化:

- 优化RSI指标参数,调整超买超卖判断标准,降低假信号概率

- 增加其他指标过滤,避免RSI单一度造成错误信号

- 动态优化目标利润水平,让策略可以根据市场情况灵活调整

- 结合交易量指标,避免低量假突破

- 增加机器学习算法,自动优化参数

总结

本策略整体思路清晰,使用RSI指标判断超买超卖,配合动态止损和目标利润退出。优点是易于理解实现,风险控制到位,可扩展性强。下一步可以从提高信号质量、动态调整参数等方向进行优化,使策略更加智能化。

策略源码

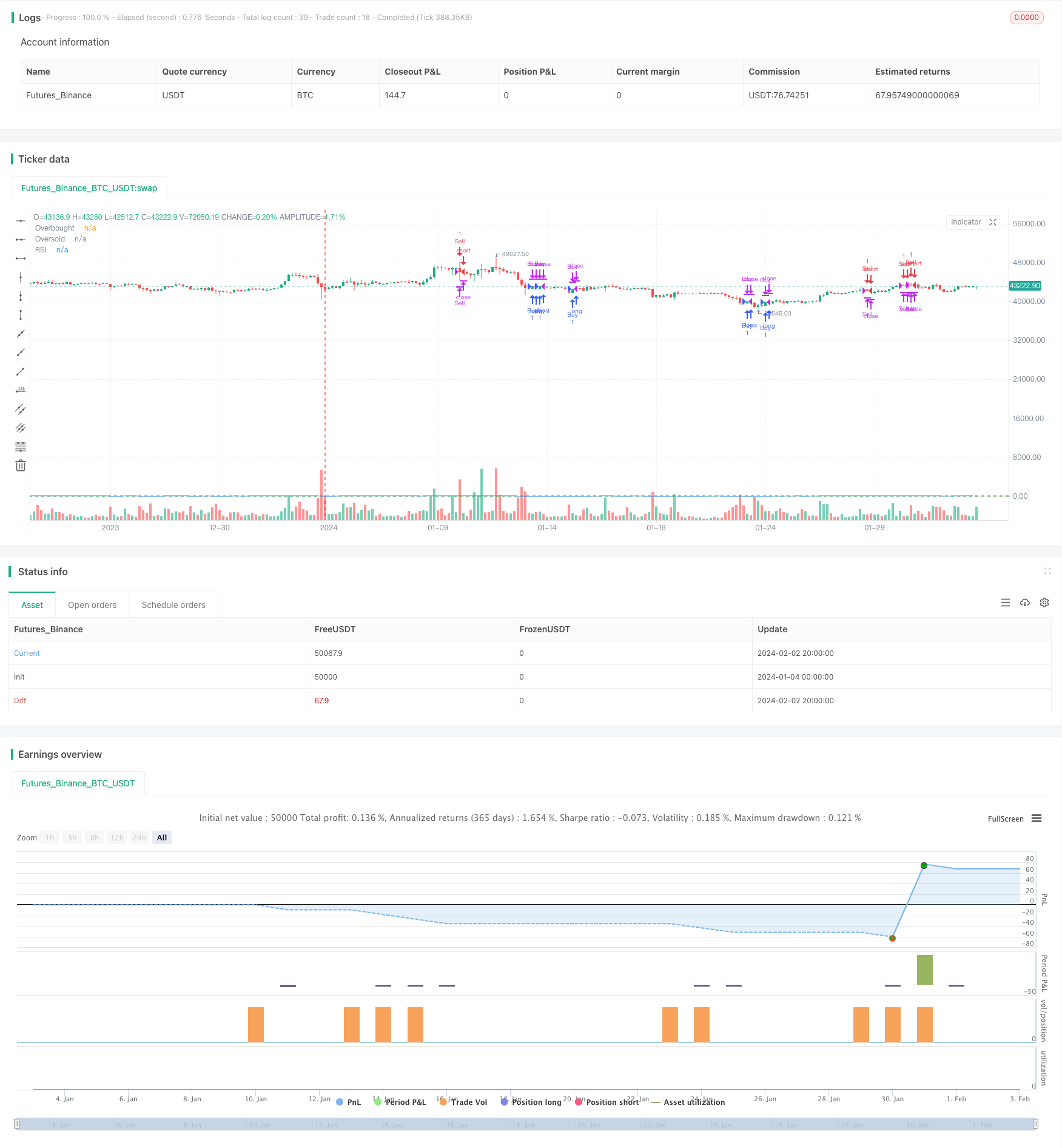

/*backtest

start: 2024-01-04 00:00:00

end: 2024-02-03 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Modified RSI-Based Trading Strategy", overlay=true)

// RSI settings

rsiLength = input(14, title="RSI Length")

overboughtLevel = 70

oversoldLevel = 30

// User-defined parameters

trailingStopPercentage = input(3, title="Trailing Stop Percentage (%)")

profitTargetPercentage = input(20, title="Profit Target Percentage (%)")

rsiValue = ta.rsi(close, rsiLength)

var float trailingStopLevel = na

var float profitTargetLevel = na

// Entry criteria

enterLong = ta.crossover(rsiValue, oversoldLevel)

enterShort = ta.crossunder(rsiValue, overboughtLevel)

// Exit criteria

exitLong = ta.crossover(rsiValue, overboughtLevel)

exitShort = ta.crossunder(rsiValue, oversoldLevel)

// Trailing stop calculation

if (strategy.position_size > 0)

trailingStopLevel := close * (1 - trailingStopPercentage / 100)

if (strategy.position_size < 0)

trailingStopLevel := close * (1 + trailingStopPercentage / 100)

// Execute the strategy

if (enterLong)

strategy.entry("Buy", strategy.long)

if (exitLong or ta.crossover(close, trailingStopLevel) or ta.change(close) > profitTargetPercentage / 100)

strategy.close("Buy")

if (enterShort)

strategy.entry("Sell", strategy.short)

if (exitShort or ta.crossunder(close, trailingStopLevel) or ta.change(close) < -profitTargetPercentage / 100)

strategy.close("Sell")

// Plot RSI and overbought/oversold levels

plot(rsiValue, title="RSI", color=color.blue)

hline(overboughtLevel, "Overbought", color=color.red, linestyle=hline.style_dashed)

hline(oversoldLevel, "Oversold", color=color.green, linestyle=hline.style_dashed)