概述

均线和RSI交叉策略(Moving Average and RSI Crossover Strategy)是一个结合移动均线和相对强弱指数(RSI)的量化交易策略。该策略通过计算快速移动均线(例如10日均线)和慢速移动均线(例如50日均线)的交叉以及RSI指标的超买超卖情况来产生交易信号。具体来说,当快速移动均线上穿慢速移动均线,同时RSI低于超卖线时,产生买入信号;当快速移动均线下穿慢速移动均线,同时RSI高于超买线时,产生卖出信号。

策略原理

该策略的核心理念是结合趋势跟踪和超买超卖指标来捕捉市场的买点和卖点。移动均线的上下交叉反映了短期和长期趋势的变化。RSI指标则判断市场是否处于超买或超卖状态。策略通过计算两个均线的交叉以及RSI的数值来产生交易信号。

具体来说,快速均线的上穿和下穿反映了短期趋势的变化方向。当短期均线上穿长期均线时,表示短期趋势转为上涨;而短期均线下穿长期均线时,表示短期趋势转为下跌。RSI指标则判断目前市场是否处于超买或超卖状态。RSI高于超买线表示市场可能处于超买状态,此时持有看跌仓位;RSI低于超卖线表示市场可能处于超卖状态,此时持有看涨仓位。

策略综合这两个指标的信号,在快速均线上穿慢速均线,同时RSI低于超卖线时产生买入信号,因为此时短期和长期趋势都转为看涨,而RSI的低位也说明市场目前处于超卖状态,是建立看涨仓位的机会。相反,当快速均线下穿慢速均线,同时RSI高于超买线时产生卖出信号,因为两种趋势都转为看跌,而RSI的高位也说明市场可能 Bubble,是减持看跌仓位的时机。

通过结合趋势分析和超买超卖判断,该策略能够在市场转折点附近产生交易信号,从而在短线上获得较好的收益。

优势分析

该策略最大的优势在于能够同时结合趋势和超买超卖两个维度来判断市场状态,避免漏掉重要的交易机会。

首先,移动均线的金叉死叉能比较清晰地判断出短期和长期之间的趋势关系。相比单一使用长短期均线,交叉结合能更准确地把握市场转折点,从而产生更及时的交易信号。

其次,RSI指标的超买超卖判断能有效过滤假突破。在实际操作中,价格可能出现一些短期的拉升或下挫,但并不代表真正趋势的转变。RSI指标能判断这些短期行情是否属于正常波动还是异常。所以结合RSI能过滤掉一些误导性交易信号。

最后,该策略只在趋势转折点附近才产生信号,不存在无效交易的问题。一般而言,量化策略容易在区域盘整时重复开仓且亏损。但该策略只在明确的买卖点才入场,能减少不必要的交易次数。

总的来说,均线和RSI交叉策略结合了趋势跟踪和超买超卖判断两个维度,交易信号较为准确可靠,是一种适合短线操作的量化策略。

风险分析

尽管均线和RSI交叉策略有许多优点,但也存在一定的风险需要密切关注。

首先是whipsaw风险,即价格出现剧烈波动导致止损被触发的概率较大。该策略主要适用于短线交易,仓位时间不会太长。如果遇到outlier行情,Stop loss可能很容易被击中。

其次,如果采用小周期均线,则交易频率会非常高。这对交易成本和心理控制力都有较大考验。过于频繁地交易不仅手续费负担重,也容易因操作失误而亏损。

最后,策略参数设置需要经过充分优化和验证。如果参数设定不当,如超买超卖阈值不合理,也会导致交易信号的误判。这需要进行充分的回测和模拟验证。

对于这些风险,可以通过调整周期参数、优化止损策略、严格遵守心理控制原则等方法加以控制和规避。同时也需要对策略进行全面验证,确保其稳定性和盈利能力。

优化方向

该策略还具有进一步优化的空间,主要可以从以下几个方面入手:

第一,可以引入自适应移动平均线或三重指数移动平均线,使均线系统对最新价格变化更敏感,产生更及时的交易信号。这可以提高策略的及时性。

第二,可以结合波动率指标如ATR来动态调整止损位置,从而减少whipsaw被止损的概率。这可以控制策略的风险。

第三,可以研究不同市场阶段(突破、回衰等)RSI的最优参数,使超买超卖判断更符合当前市场环境。这可以提高策略的适应性。

第四,可以结合机器学习等技术对策略信号进行过滤,去掉一些错误信号,使策略更加智能化。这可以提升策略的准确性。

通过以上几点优化,可以使该策略的收益回报更高,同时也能控制潜在的风险。这是未来的一个重要研究方向。

总结

均线和RSI交叉策略是一种典型的结合趋势和指标判断的短线策略。它把握市场在关键点的转折,能捕捉较好的短线交易机会。同时,RSI指标也能有效过滤虚假信号。该策略easy-to-use,逻辑清晰,是量化入门的良好选择。

但该策略也存在一定概率被套及高交易频率导致成本增加的风险。这需要通过参数调整、止损优化、心态控制等方法来规避。如果能继续优化,引入自适应均线、风险指标控制和智能过滤等机制,该策略的表现还能得到进一步提升。

总体而言,均线和RSI交叉策略结合了趋势和指标并重的思路,既容易上手,又具备良好扩展性。它是一种值得推荐的量化入门策略。

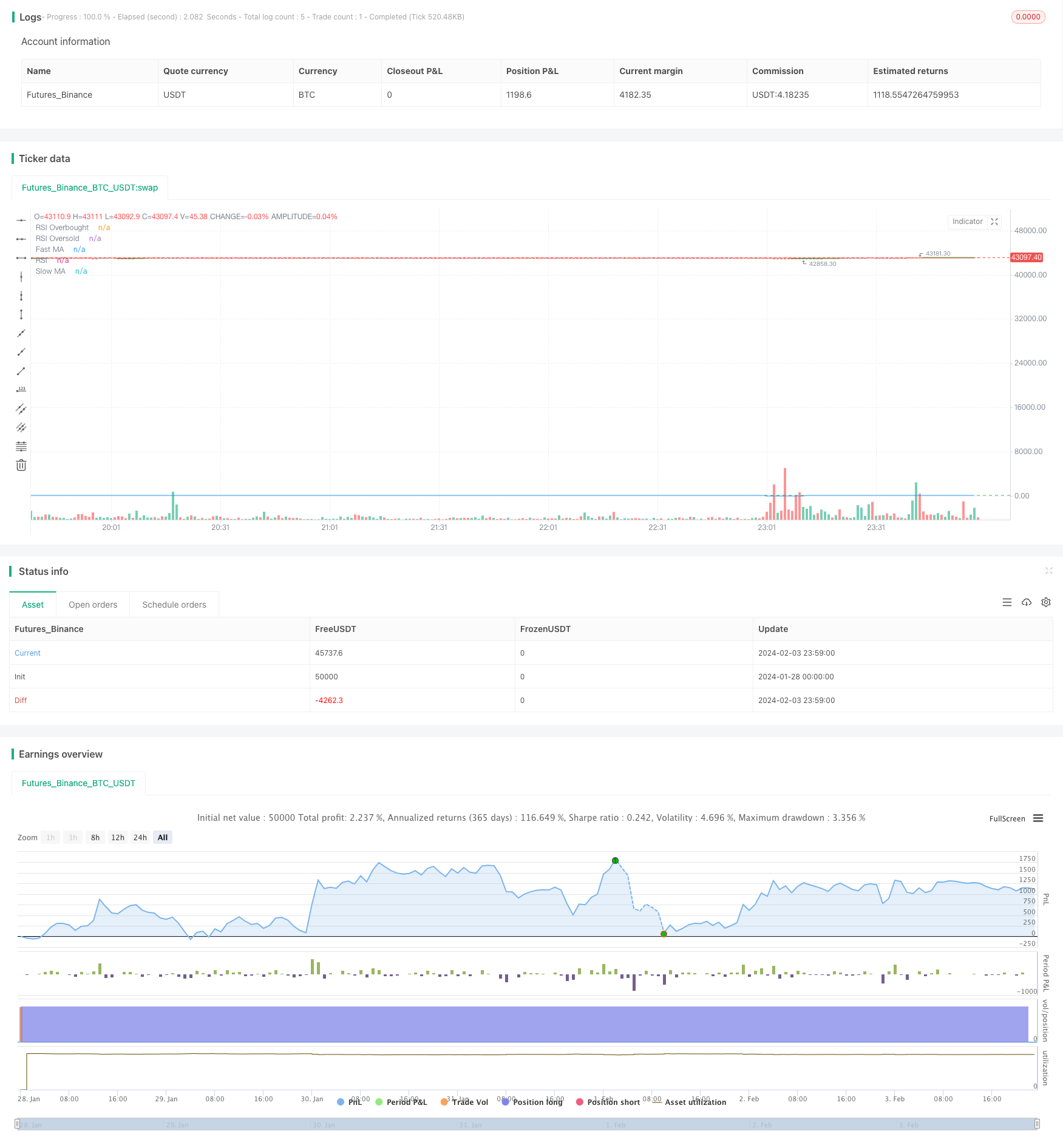

/*backtest

start: 2024-01-28 00:00:00

end: 2024-02-04 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("MA and RSI Crossover Strategy", shorttitle="MA_RSI_Strategy", overlay=true)

// 输入参数

fastLength = input(10, title="Fast MA Length")

slowLength = input(50, title="Slow MA Length")

rsiLength = input(14, title="RSI Length")

rsiOverbought = input(70, title="RSI Overbought Level")

rsiOversold = input(50, title="RSI Oversold Level")

// 计算移动平均线

fastMA = ta.sma(close, fastLength)

slowMA = ta.sma(close, slowLength)

// 计算相对强弱指数

rsiValue = ta.rsi(close, rsiLength)

// 定义买卖信号

buySignal = ta.crossover(fastMA, slowMA) and rsiValue < rsiOversold

sellSignal = ta.crossunder(fastMA, slowMA) and rsiValue > rsiOverbought

// 策略逻辑

strategy.entry("Buy", strategy.long, when=buySignal)

strategy.close("Buy", when=sellSignal)

// 绘制移动平均线

plot(fastMA, color=color.green, title="Fast MA")

plot(slowMA, color=color.red, title="Slow MA")

// 绘制RSI

hline(rsiOverbought, "RSI Overbought", color=color.red)

hline(rsiOversold, "RSI Oversold", color=color.green)

plot(rsiValue, color=color.blue, title="RSI")

// 在买入信号处标记买入点

plotshape(series=buySignal, title="Buy Signal", color=color.green, style=shape.triangleup, location=location.belowbar, size=size.huge)