概述

本策略基于超趋势通道指标设计 Entries 和 Exits 信号,实现自动化量化交易。超趋势通道指标可明确突破点和支持阻力位,帮助判断趋势方向。本策略融合该指标的优势,进行长短双向交易。

策略原理

本策略使用 ATR 和唐奇安通道计算长短两个止损线。具体来说,通过 ATR 周期和 ATR 倍数参数计算 ATR 值,然后与最高价和最低价的平均值相加减,得到长短两个止损线。当收盘价从下向上突破长止损线时产生做多信号;当收盘价从上向下突破短止损线时产生做空信号。

做多做空后,会实时更新止损线,以锁定利润。新的止损线不会低于或高于之前值,从而避免止损被击穿。在止损线和之前止损线之间出现新高或新低时,更新止损线到最新价格。

优势分析

本策略最大的优势在于,超趋势通道指标能清晰判断趋势方向和关键支持阻力位。结合 ATR 动态止损,可以有效控制单笔损失。

具体来说,超趋势通道指标中的两个止损线,一个代表持仓成本,一个代表最近支撑或压力位。这为 Entries 和 Exits 提供了非常明确的依据。同时,止损线会实时更新,可以锁定利润,避免止损被击穿。

整体来说,本策略在确定趋势后及时 Entries,通过动态止损控制风险,是一种相对稳健的量化交易策略。

风险分析

本策略的主要风险在于,可能出现止损线被突破的情况。当价格剧烈波动时,新的止损线有可能低于或高于之前值,导致止损被击穿,增加损失。

此外,在震荡行情中,超趋势通道指标生成的 Entries 信号效果不佳,容易形成错误交易。这时需要人工干预,判断趋势后再启动策略。

优化方向

本策略可以从以下几个方面进行优化:

优化 ATR 周期和 ATR 倍数参数,找到最佳组合。可以通过回测不同参数,分析收益率、夏普比率等指标。

增加其他指标过滤,避免在震荡行情出错 Entries。可以考虑加入移动平均线、布林带等指标判断趋势方向。

结合量能指标优化止损位置。可以根据成交量突增的位置来调整止损线,进一步锁定利润。

增加机器学习模型进行参数自适应优化。可以利用 RNN、LSTM 等模型预测参数值,实现参数动态优化。

总结

本策略基于超趋势通道指标设计,判断趋势方向明确,具有较高的胜率。同时,应用 ATR 动态跟踪止损来控制单笔损失。通过参数优化、指标优化等手段可进一步增强策略效果。总体来说这是一种适合自动化量化交易的稳健策略。

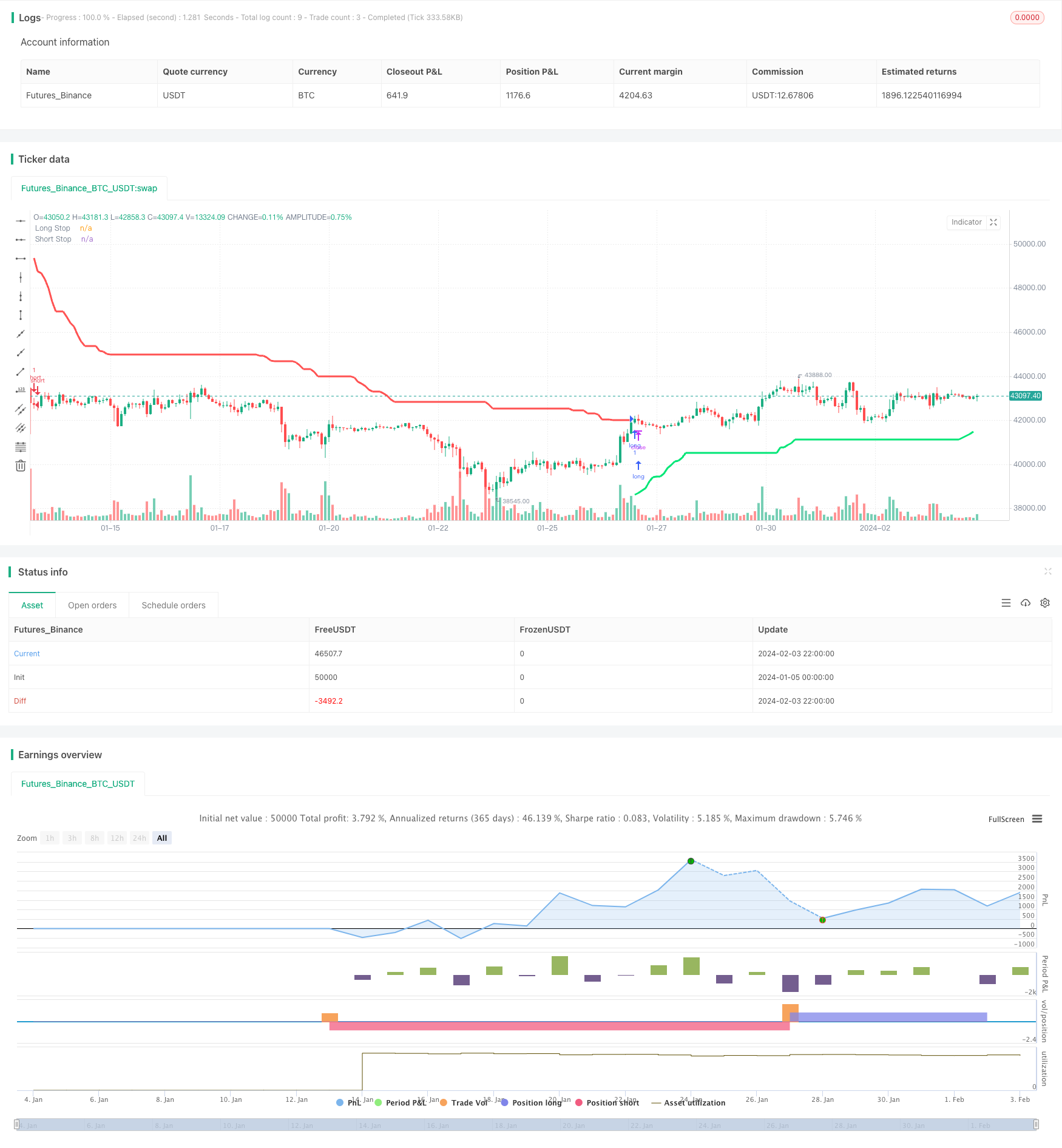

/*backtest

start: 2024-01-05 00:00:00

end: 2024-02-04 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//EU ESCREVI ISSO TUDO, PARA FICAR BEM CLARO

strategy("SuperTrend Strategy", overlay=true)

//AQUI OS INPUTS PARA A SUPERTREND

length = input(title="ATR Period", type=input.integer, defval=7)

mult = input(title="ATR Multiplier", type=input.float, step=0.1, defval=7)

showLabels = input(title="Show Buy/Sell Labels ?", type=input.bool, defval=true)

//AQUI O CALCULO DO ATR STOPS

atr = mult * atr(length)

//AQUI A TRANSFORMAÇÃO DO ATR STOPS EM SUPERTREND

//-

//A LÓGICA PARA LONGSTOP

longStop = hl2 - atr

longStopPrev = nz(longStop[1], longStop)

longStop := close[1] > longStopPrev ? max(longStop, longStopPrev) : longStop

//A LÓGICA PARA SELLSTOP

shortStop = hl2 + atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := close[1] < shortStopPrev ? min(shortStop, shortStopPrev) : shortStop

//DIREÇÃO DO INDICADOR

dir = 1

dir := nz(dir[1], dir)

dir := dir == -1 and close > shortStopPrev ? 1 :

dir == 1 and close < longStopPrev ? -1 : dir

//DEFININDO AS CORES DAS LINHAS DA SUPERTREND

longColor = color.lime

shortColor = color.red

//PLOTANDO NO GRÁFICO A SUPERTREND E A ESTRATÉGIA

plot(dir == 1 ? longStop : na, title="Long Stop", style=plot.style_linebr, linewidth=3, color=longColor)

buySignal = dir == 1 and dir[1] == -1

plot(dir == 1 ? na : shortStop, title="Short Stop", style=plot.style_linebr, linewidth=3, color=shortColor)

sellSignal = dir == -1 and dir[1] == 1

//DEFININDO AS FUNÇÕES DE COMPRA E VENDA

strategy.entry("long", strategy.long, when = buySignal)

strategy.entry("short", strategy.short, when = sellSignal)