概述

该策略采用逐步加仓的方式,根据收盘价与前一日收盘价的比较来判断行情方向。当判断为看涨机会时,会分多次逐步加仓做多;当判断为看跌机会时,会分多次逐步加仓做空。加仓次数可以通过参数进行设置。同时,策略加入了时间段过滤,只有在设置的时间段内才会发出交易信号。

策略原理

比较当前K线收盘价close与前一K线收盘价close[1],如果close > close[1],则判断为看涨机会,设置longCondition=1;如果close < close[1],则判断为看跌机会,设置shortCondition=1。

在允许交易的时间段内,如果longCondition=1,则逐步加仓做多;如果shortCondition=1,则逐步加仓做空。

加仓次数由参数pyramiding设置,可选择1到5次加仓,默认为4次。

每次加仓后,会同时设置对冲条件,如果行情转向,会立即止损。

可选择把交易信号输出到不同的交易接口,如toast、telegram等。

该策略主要考虑突破型策略与均线型策略的优点,在看涨或看跌时,采取逐步加仓的方法,既能充分跟踪趋势,又能控制风险。同时结合时间过滤,避免在非主交易时间GENERATED信号。

优势分析

逐步加仓方式能更好跟踪趋势

加仓次数可调,更灵活

可选择不同的交易接口,拓宽数量型

有止损机制,可控风险

时间过滤功能,避免错误信号

风险分析

参数设置不当可能导致亏损加大

网络问题可能导致无法及时止损

需适当调整参数以适应不同品种

需适时止损以锁定利润

解决方法:

调整加仓次数,默认4次为宜

检查网络连接

根据品种特点调整参数

设置止损位

优化方向

可以考虑加入更多指标判断信号强弱

可以测试不同品种参数优化效果

可以加入机器学习算法优化参数

可以优化风险管理机制

总结

该逐步加仓均线突破策略整合了趋势跟踪与风险控制的优点,在判断到有效信号时,采取逐步加仓的方式跟踪趋势,通过加仓次数的调整来控制风险敞口。同时结合了时间段过滤等功能来控制误信号。该策略可通过多种方式进行优化,具有很大的拓展性。总的来说,该策略对于跟踪趋势型品种具有非常好的效果,是一种值得推荐的策略。

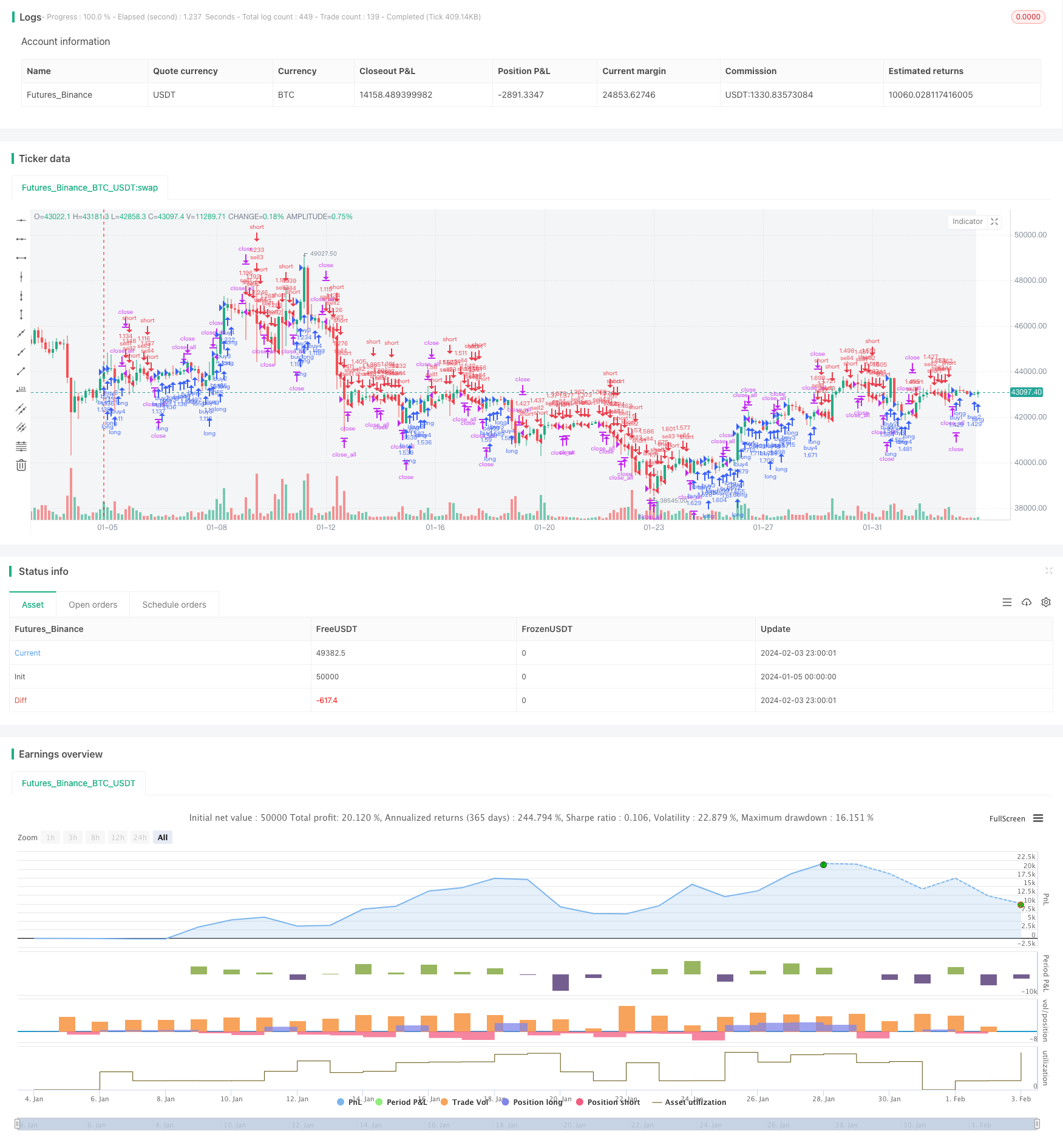

/*backtest

start: 2024-01-05 00:00:00

end: 2024-02-04 00:00:00

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © torresbitmex

//@version=5

strategy("torres_strategy_real_test_v1.0", process_orders_on_close=true, overlay=true, initial_capital=1000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_value=0.03, calc_on_order_fills=false, pyramiding=4)

in_trade(int start_time, int end_time) =>

allowedToTrade = (time>=start_time) and (time<=end_time)

if barstate.islastconfirmedhistory

var myLine = line(na)

line.delete(myLine)

myLine := line.new(start_time, low, start_time, high, xloc=xloc.bar_time, color = color.rgb(255, 153, 0, 50), width = 3, extend = extend.both, style = line.style_dashed)

allowedToTrade

// 매매시간세팅

start_time = input(timestamp("31 Jan 2024 00:00 +0900"), title="매매 시작", group='매매 시간세팅')

end_time = input(timestamp("31 Dec 2030 00:00 +0900"), title="매매 종료", group='매매 시간세팅')

start_trade = true

bgcolor(start_trade ? color.new(color.gray, 90) : color(na))

var bool Alarm_TVExtbot = false

var bool Alarm_Alert = false

bot_mode = input.string(title='봇선택', defval = "POA", options = ["TVEXTBOT", "POA"], group = "봇선택", inline = '1')

if bot_mode == "TVEXTBOT"

Alarm_TVExtbot := true

else if bot_mode == "POA"

Alarm_Alert := true

else

Alarm_TVExtbot := false

Alarm_Alert := false

// 계정정보

account = input.string(title='계정', defval='아무거나입력', inline='1', group='계정정보')

token = input.string(title='TVExtBot 인증키', defval='', inline='1', group='계정정보')

mul_input = input.float(4, minval=1, maxval=5, step=1, title="분할진입수", group='진입 세팅', inline='1')

// 진입주문메세지입력

buyOrderid = input.string(title='롱 진입1', defval='', group='진입주문 메세지입력', inline='2')

buyOrderid2 = input.string(title='롱 진입2', defval='', group='진입주문 메세지입력', inline='3')

buyOrderid3 = input.string(title='롱 진입3', defval='', group='진입주문 메세지입력', inline='4')

buyOrderid4 = input.string(title='롱 진입4', defval='', group='진입주문 메세지입력', inline='5')

buyOrderid5 = input.string(title='롱 진입5', defval='', group='진입주문 메세지입력', inline='6')

sellOrderid = input.string(title='숏 진입1', defval='', group='진입주문 메세지입력', inline='2')

sellOrderid2 = input.string(title='숏 진입2', defval='', group='진입주문 메세지입력', inline='3')

sellOrderid3 = input.string(title='숏 진입3', defval='', group='진입주문 메세지입력', inline='4')

sellOrderid4 = input.string(title='숏 진입4', defval='', group='진입주문 메세지입력', inline='5')

sellOrderid5 = input.string(title='숏 진입5', defval='', group='진입주문 메세지입력', inline='6')

// 종료주문메세지입력

buycloseOrderid = input.string(title='롱 전체종료', defval='', group='종료주문 메세지입력', inline='1')

sellcloseOrderid = input.string(title='숏 전체종료', defval='', group='종료주문 메세지입력', inline='1')

longCondition = 0, shortCondition = 0

if(close[1] < close)

longCondition := 1

else

longCondition := 0

if(close[1] > close)

shortCondition := 1

else

shortCondition := 0

if start_trade

if Alarm_Alert

if strategy.position_size == 0

if (longCondition == 1)

strategy.entry("buy1", strategy.long, alert_message = buyOrderid)

if (shortCondition == 1)

strategy.entry("sell1", strategy.short, alert_message = sellOrderid)

if strategy.position_size > 0

if (longCondition == 1)

if (strategy.opentrades == 1) and (mul_input == 2 or mul_input == 3 or mul_input == 4 or mul_input == 5)

strategy.entry("buy2", strategy.long, alert_message = buyOrderid2)

if (strategy.opentrades == 2) and (mul_input == 3 or mul_input == 4 or mul_input == 5)

strategy.entry("buy3", strategy.long, alert_message = buyOrderid3)

if (strategy.opentrades == 3) and (mul_input == 4 or mul_input == 5)

strategy.entry("buy4", strategy.long, alert_message = buyOrderid4)

if (strategy.opentrades == 4) and (mul_input == 5)

strategy.entry("buy5", strategy.long, alert_message = buyOrderid5)

if strategy.position_size < 0

if (shortCondition == 1)

if (strategy.opentrades == 1) and (mul_input == 2 or mul_input == 3 or mul_input == 4 or mul_input == 5)

strategy.entry("sell2", strategy.short, alert_message = sellOrderid2)

if (strategy.opentrades == 2) and (mul_input == 3 or mul_input == 4 or mul_input == 5)

strategy.entry("sell3", strategy.short, alert_message = sellOrderid3)

if (strategy.opentrades == 3) and (mul_input == 4 or mul_input == 5)

strategy.entry("sell4", strategy.short, alert_message = sellOrderid4)

if (strategy.opentrades == 4) and (mul_input == 5)

strategy.entry("sell5", strategy.short, alert_message = sellOrderid5)

if (longCondition == 1 and strategy.position_size > 0)

if mul_input == 1 and strategy.opentrades == 1

strategy.close_all(comment='롱전체종료', alert_message = buycloseOrderid)

if mul_input == 2 and strategy.opentrades == 2

strategy.close_all(comment='롱전체종료', alert_message = buycloseOrderid)

if mul_input == 3 and strategy.opentrades == 3

strategy.close_all(comment='롱전체종료', alert_message = buycloseOrderid)

if mul_input == 4 and strategy.opentrades == 4

strategy.close_all(comment='롱전체종료', alert_message = buycloseOrderid)

if mul_input == 5 and strategy.opentrades == 5

strategy.close_all(comment='롱전체종료', alert_message = buycloseOrderid)

if (shortCondition == 1 and strategy.position_size < 0)

if mul_input == 1 and strategy.opentrades == 1

strategy.close_all(comment='숏전체종료', alert_message = sellcloseOrderid)

if mul_input == 2 and strategy.opentrades == 2

strategy.close_all(comment='숏전체종료', alert_message = sellcloseOrderid)

if mul_input == 3 and strategy.opentrades == 3

strategy.close_all(comment='숏전체종료', alert_message = sellcloseOrderid)

if mul_input == 4 and strategy.opentrades == 4

strategy.close_all(comment='숏전체종료', alert_message = sellcloseOrderid)

if mul_input == 5 and strategy.opentrades == 5

strategy.close_all(comment='숏전체종료', alert_message = sellcloseOrderid)

else if Alarm_TVExtbot

if strategy.position_size == 0

if (longCondition == 1)

strategy.entry("buy1", strategy.long, alert_message = '롱 1차 진입 📈📈 TVM:{"orderid":"' + buyOrderid + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if (shortCondition == 1)

strategy.entry("sell1", strategy.short, alert_message = '숏 1차 진입 📉📉 TVM:{"orderid":"' + sellOrderid + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if strategy.position_size > 0

if (longCondition == 1)

if (strategy.opentrades == 1) and (mul_input == 2 or mul_input == 3 or mul_input == 4 or mul_input == 5)

strategy.entry("buy2", strategy.long, alert_message = '롱 2차 진입 📈📈 TVM:{"orderid":"' + buyOrderid2 + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if (strategy.opentrades == 2) and (mul_input == 3 or mul_input == 4 or mul_input == 5)

strategy.entry("buy3", strategy.long, alert_message = '롱 3차 진입 📈📈 TVM:{"orderid":"' + buyOrderid3 + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if (strategy.opentrades == 3) and (mul_input == 4 or mul_input == 5)

strategy.entry("buy4", strategy.long, alert_message = '롱 4차 진입 📈📈 TVM:{"orderid":"' + buyOrderid4 + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if (strategy.opentrades == 4) and (mul_input == 5)

strategy.entry("buy5", strategy.long, alert_message = '롱 5차 진입 📈📈 TVM:{"orderid":"' + buyOrderid5 + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if strategy.position_size < 0

if (shortCondition == 1)

if (strategy.opentrades == 1) and (mul_input == 2 or mul_input == 3 or mul_input == 4 or mul_input == 5)

strategy.entry("sell2", strategy.short, alert_message = '숏 2차 진입 📉📉 TVM:{"orderid":"' + sellOrderid2 + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if (strategy.opentrades == 2) and (mul_input == 3 or mul_input == 4 or mul_input == 5)

strategy.entry("sell3", strategy.short, alert_message = '숏 3차 진입 📉📉 TVM:{"orderid":"' + sellOrderid3 + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if (strategy.opentrades == 3) and (mul_input == 4 or mul_input == 5)

strategy.entry("sell4", strategy.short, alert_message = '숏 4차 진입 📉📉 TVM:{"orderid":"' + sellOrderid4 + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if (strategy.opentrades == 4) and (mul_input == 5)

strategy.entry("sell5", strategy.short, alert_message = '숏 5차 진입 📉📉 TVM:{"orderid":"' + sellOrderid5 + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if (longCondition == 1 and strategy.position_size > 0)

if mul_input == 1 and strategy.opentrades == 1

strategy.close_all(comment='롱전체종료', alert_message = '롱 종료 📈⛔TVM:{"orderid":"' + buycloseOrderid + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if mul_input == 2 and strategy.opentrades == 2

strategy.close_all(comment='롱전체종료', alert_message = '롱 종료 📈⛔TVM:{"orderid":"' + buycloseOrderid + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if mul_input == 3 and strategy.opentrades == 3

strategy.close_all(comment='롱전체종료', alert_message = '롱 종료 📈⛔TVM:{"orderid":"' + buycloseOrderid + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if mul_input == 4 and strategy.opentrades == 4

strategy.close_all(comment='롱전체종료', alert_message = '롱 종료 📈⛔TVM:{"orderid":"' + buycloseOrderid + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if mul_input == 5 and strategy.opentrades == 5

strategy.close_all(comment='롱전체종료', alert_message = '롱 종료 📈⛔TVM:{"orderid":"' + buycloseOrderid + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if (shortCondition == 1 and strategy.position_size < 0)

if mul_input == 1 and strategy.opentrades == 1

strategy.close_all(comment='숏전체종료', alert_message = '숏 종료 📉⛔TVM:{"orderid":"' + sellcloseOrderid + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if mul_input == 2 and strategy.opentrades == 2

strategy.close_all(comment='숏전체종료', alert_message = '숏 종료 📉⛔TVM:{"orderid":"' + sellcloseOrderid + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if mul_input == 3 and strategy.opentrades == 3

strategy.close_all(comment='숏전체종료', alert_message = '숏 종료 📉⛔TVM:{"orderid":"' + sellcloseOrderid + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if mul_input == 4 and strategy.opentrades == 4

strategy.close_all(comment='숏전체종료', alert_message = '숏 종료 📉⛔TVM:{"orderid":"' + sellcloseOrderid + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if mul_input == 5 and strategy.opentrades == 5

strategy.close_all(comment='숏전체종료', alert_message = '숏 종료 📉⛔TVM:{"orderid":"' + sellcloseOrderid + '","memo":"' + account + '","token":"' + token + '"}:MVT')