概述

反转追踪策略是一种趋势追踪策略,它结合移动平均线作为市场过滤器,在股价出现反转信号时建立仓位,实现低买高卖,追踪股价反转后的趋势,获得超额收益。

策略原理

该策略的核心逻辑是:当收盘价低于N天前的低点时建立做多仓位;当收盘价高于N天前的高点时平掉做多仓位。同时,它结合了200天简单移动平均线作为市场滤波器——只有当价格高于200天移动平均线时才会建立做多仓位。

该策略基于价格反转理论,认为股价的趋势会反复出现高点和低点。当价格跌破N天前形成的低点时,是建立做多仓位的时机点;当价格涨破N天前的高点时,说明反转利好已经消退,是平仓止盈的时机点。

具体来说,该策略有以下核心模块:

- 市场滤波器

使用200天简单移动平均线作为市场趋势的判断指标。只有当股价高于200天线时,才允许建仓。这可以避免在牛市中建立做空仓位,或者在熊市中建立做多仓位。

- 反转信号判断

判断逻辑:收盘价 < N天前的最低价

收盘价低于N天前(默认5天)的最低价,表明股价出现下跌突破,启动买入信号。

- 止盈信号判断

判断逻辑:收盘价 > N天前的最高价

收盘价高于N天前(默认5天)的最高价,表明股价反转行情已经结束,启动止盈信号。

- 5% 止损

从入市价位开始,设置5%的止损线,避免损失过大。

优势分析

该策略具有以下主要优势:

- 采用价格反转理论,可以在股价反转开始阶段建立仓位,追踪后续趋势。

- 结合移动平均线作为市场滤波器,避免建立不适宜的做多或做空仓位,减少套牢风险。

- 采用N天前的最高价和最低价判断反转信号,参数灵活,可以根据市场调整N的值。

- 设置5%的止损幅度,可以快速止损,避免单笔损失过大。

- 实现了低买高卖,追踪股价反转带来的超额收益。

风险分析

该策略也存在一些风险:

- 股价反转信号可能是假突破,无法启动真正的趋势反转,从而导致亏损。

- N天参数设置不当,可能错过真正的反转时点或提前止损。

- 止损幅度设置太大,单笔亏损可能过大;止损幅度太小,可能过早止损。

- 该策略更适合作用在股指和一些已确立上涨趋势的个股,不适合全部股票池的橡皮球交易。

优化方向

该策略可以从以下几个方面进行优化:

- 优化移动平均线的参数,测试不同天数参数的效果。

- 测试调整反转信号判断的N参数,寻找最优参数组合。

- 优化止损幅度参数,平衡止损与持仓时间。

- 添加动量指标等过滤器,确保交易信号更加可靠。

- 针对不同的交易品种设定独立的参数组合进行回测优化。

总结

反转追踪策略结合移动平均线指标,在确定市场环境后,通过反转理论选择买入时机;止盈止损机制控制风险,实现低买高卖,获取超额收益。该策略可以通过参数优化、添加辅助过滤器等手段进行改进,在趋势行情中获得较好收益。

策略源码

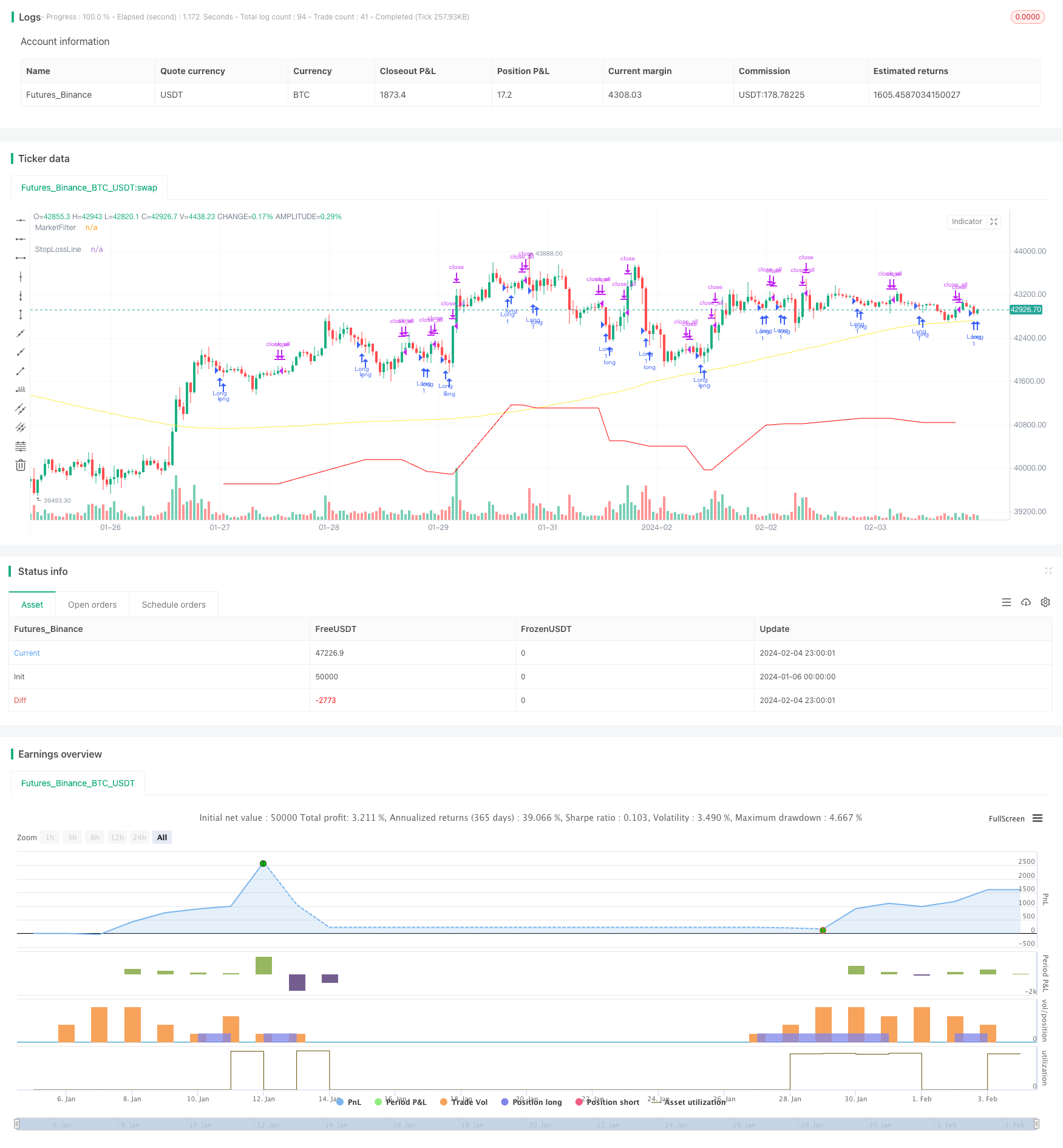

/*backtest

start: 2024-01-06 00:00:00

end: 2024-02-05 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// @version=4

// © HermanBrummer

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// BUYS WHEN THE CLOSE IS SMALLER THAN THE LOW OF 5 DAYS AGO

// SELLS WHEN THE CLOSE IS HIGHER THEN THE HIGH OF 5 DAYS AGO

// USES A 200 MOVING AVERGE AS A FILTER, AND DOESN'T TAKE TRADES IF THE MARKET IS BELOW IT'S 200 MA

// USES A 5% STOP LOSS FROM ENTRIES

strategy("REVERSALS", overlay=true)

StopLoss = input(.95, step=0.01)

HowManyBars = input( 5 )

/// EXITS

if close > sma(high,HowManyBars)[1]

strategy.close_all()

/// ENTRIES

MarketFilter = sma(close, 200)

F1 = close < sma(low,HowManyBars)[1]

F2 = close > MarketFilter

plot(MarketFilter, "MarketFilter", color.yellow)

strategy.entry("Long", true, 1, when=F1 and F2)

/// STOP LOSS

StopLossLine = strategy.position_avg_price * StopLoss

plot(StopLossLine, "StopLossLine", #FF0000)

strategy.exit("Exit", stop=StopLossLine)