概述

S&P500高级RSI指标交易策略(S&P500 Advanced RSI Indicator Trading Strategy)是一个用于S&P500指数的中长期趋势跟踪策略。该策略结合多种过滤器,在RSI超买超卖信号的基础上进行交易,以控制风险并减少假信号。

策略原理

该策略的核心指标是RSI,以2周期RSI值为基础判断价格超买超卖。当RSI指标低于设置的超卖线时做多,当RSI指标高于设置的超卖线时平仓。此外,策略还设置了一系列辅助过滤器进行风险控制:

每周RSI过滤器:要求每周RSI低于设置线,避免在牛市中过于激进做多

MA过滤器:要求价格高于指定周期MA,确保只在趋势启动后买入

二次RSI过滤器:要求二次RSI指标也低于超卖线,避免假突破

ATR突破过滤器:避免价格快速下跌后仍做多,控制风险

以上多重过滤器结合使用,可有效识别价格中长线反转点,控制交易频率并降低风险。

优势分析

S&P500高级RSI指标交易策略具有以下几点优势:

结合多种辅助指标过滤,减少假信号,可靠性较高

通过ATR突破过滤器控制风险,避免价格急跌后追买

每周RSI过滤器可避免在牛市中买入,防止过于激进

MA过滤器要求价格高于趋势均线后买入,确保趋势启动后再入场

二次RSI过滤器避免RSI指标产生假突破做多

适用于中长线持仓,不会过于频繁交易

风险分析

该策略的主要风险来自以下几个方面:

使用RSI作为主要指标,会存在一定的滞后性

过滤条件过于严格,可能错过部分机会

在特大行情中,止损条件可能会被突破

基于简单的RSI指标和过滤器,对复杂行情的判断能力较弱

对应缓解方法如下:

适当调整参数,防止错过机会

加大仓位规模,以弥补一定的漏买概率

可适当放宽过滤条件,增加交易频率

可考虑结合更多指标判断复杂行情

优化方向

该策略还可从以下几个方向进行优化:

测试调整RSI参数,寻找最优超买超卖线

测试MA均线周期参数,确定最优的参数

测试调整ATR参数,优化价格突破过滤判断

尝试结合其他指标判断,提高对复杂行情的判断能力

优化每周RSI参数,确定每周RSI的最优参数

优化二次RSI的参数,寻找最佳的二次RSI周期和超买超卖线

总结

S&P500高级RSI指标交易策略通过RSI指标判断价格中长线趋势反转点,并设置多种过滤器条件控制风险。该策略充分利用RSI指标的效用之处,可有效锁定中长线趋势,避免过于频繁出入场。随着参数不断优化,策略表现有望不断改进。总体来说,该策略适用于中长线价值投资,是一种相对稳定的量化策略。

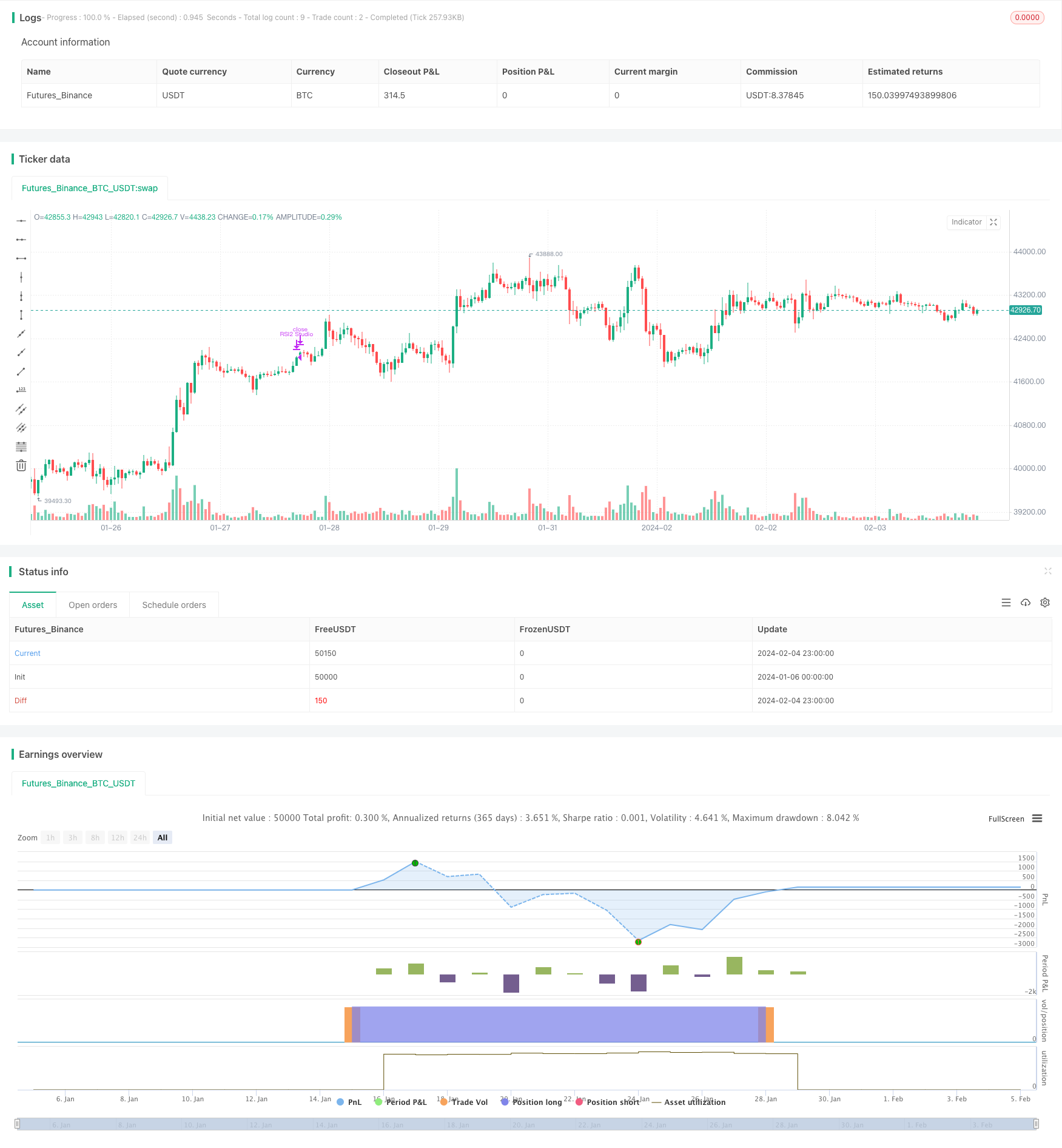

/*backtest

start: 2024-01-06 00:00:00

end: 2024-02-05 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// Lets connect on LinkedIn (https://www.linkedin.com/in/lets-grow-with-quality/)

// Optimized for S&P500 Daily. Use it as a buy confirmation on certain levels (Springs, Pullbacks, ...) or let it run

// without "Weekly RSI Filter" and pyramiding for 4 x more trades.

// This strategy is optimized for minimum drawdowns and has several filters on board for use on different securities

strategy("S&P500 RSI2 Studio", overlay=true)

baseLength = input(2, title="Base RSI Length")

overSold = input(10, title="Overbought Level")

overBought = input(90, title="Oversold Level")

overBoughtExit = input(70, title="Overbought Level Exit")

enableWeeklyRsiFilter = input(true, title="Enable Weekly RSI Filter")

weeklyOverSold = input(30, title="Weekly Oversold Level")

weeklyOverBought = input(70, title="Weekly OverOverbought Level")

weeklyRsiLength = input(2, title="weeklyRsiLength")

enableWmaFilter = input(false, title="Enable MA Filter")

wmaLength = input(100, title="WMA Length")

exitRsiLength = input(4, title="Exit RSI Length")

dailyRsiLength = input(4, title="Daily RSI Length")

enable2ndRSIFilter = input(false, title="Enable 2nd RSI Filter")

SecRSIFilterLengh = input(14, title="2nd RSI Filter Length")

SecRSIFilterOverSold = input(20, title="2nd RSI Filter Oversold Level")

enableAtrFilter = input(true, title="Enable ATR Filter")

numAtrDays = input(14, title="Number of Days ATR Average")

atrFilterFactor = input(2, title="ATR Filter Factor")

weeklyRsi = request.security(syminfo.tickerid, "W", ta.wma(ta.rsi(close, weeklyRsiLength), 1))

exitRsi = request.security(syminfo.tickerid, "D", ta.wma(ta.rsi(close, exitRsiLength), 2))

dailyRsi = request.security(syminfo.tickerid, "D", ta.wma(ta.rsi(close, dailyRsiLength), 2))

price = close

priceDropCondition = ta.atr(1) >= ta.atr(numAtrDays) * atrFilterFactor

preventEarlyEntry = not priceDropCondition

vrsi = ta.wma(ta.rsi(price, baseLength), 2)

wma = ta.wma(price, wmaLength)

buyCond1 = ta.crossunder(vrsi, overSold)

buyCond2 = enableWeeklyRsiFilter ? weeklyRsi < weeklyOverSold : true

buyCond3 = enable2ndRSIFilter ? ta.wma(ta.rsi(close, SecRSIFilterLengh),2) < SecRSIFilterOverSold : true

buyCond4 = enableWmaFilter ? price > ta.wma(close, wmaLength) : true

buyCond5 = enableAtrFilter ? preventEarlyEntry : true

buy = buyCond1 and buyCond2 and buyCond3 and buyCond4 and buyCond5

if (not na(vrsi))

if buy

strategy.entry("RSI2 Studio", strategy.long, comment="Long")

if (exitRsi > overBoughtExit)

strategy.close("RSI2 Studio", comment="Close Long")