概述

该策略利用纤程指标自动设置止损和止盈价格,实现移动止损限价交易。它可以在趋势行情中获取更大利润,同时也可以在震荡行情中减少亏损。

策略原理

该策略主要基于纤程指标来设定价格。纤程指标可以反映市场的潜在支撑和阻力。该策略利用纤程指标的不同级别作为止损和止盈价格。

具体来说,策略会跟踪高点和低点,计算出10个纤程价格区间。然后根据配置选择一个纤程价格作为入场策略。当价格突破该纤程时,会按照配置的杠杆下单做多。同时,也会设定一个止盈价格,等于平均入场价再加上配置的止盈百分比。

在下单后,策略会继续跟踪最新纤程价格。当出现更低的纤程时,策略会撤销原有委托,重新下单,实现移动止损。当价格上涨突破止盈价格时,策略会平仓止盈。

优势分析

该策略最大的优势在于可以动态调整止损和止盈价格,专门用于趋势行情。具有以下特点:

能够在趋势行情中获取更大利润。配置了基于平均入场价格的止盈设置,可以最大程度参与趋势行情,获得更高收益。

能够在震荡行情中减少亏损。当价格重新触及更低纤程时,会及时止损,避免在震荡中被套。

支持加仓。配置了加仓设置,当价格下跌到一定幅度时,会加大仓位,减少平均持仓成本。

操作简单。只需要配置好纤程和止盈比例,整个交易全自动完成,无需人工操作。

风险分析

该策略也存在一些风险,主要集中在以下几点:

容易在震荡盘整中被反复止损止盈。当出现横盘或震荡行情时,价格可能会多次上下触发止损止盈,增加交易频率和手续费支出。

没有止损设置。为了追求更大利润,策略并没有设置止损。如果出现重大行情反转,可能面临巨额亏损。

加仓次数和金额没有限制。多次加仓可能导致亏损进一步扩大。

对应解决方法: 1. 可以设置条件,在震荡行情中暂停交易。 2. 可以手动监控行情,必要时强制平仓止损。 3. 对加仓次数和金额设置上限。

优化方向

该策略还具有很大的优化空间,主要可以从以下几个方面进行:

利用其他指标组合确认入场。可以在入场条件中加入EMA,MACD等指标的确认,避免在震荡行情中被套。

加入止损机制。配置固定止损或追踪止损,可以避免极端行情中巨额亏损。

优化加仓逻辑。可以根据具体市场情况,优化加仓的价格区间和次数。防止过度加仓。

结合机器学习算法。例如使用LSTM等算法预测价格可能的走势和支撑阻力。辅助 Determine 更优的入场出场逻辑。

总结

该策略整体来说适合追踪趋势行情。它可以通过动态调整止盈止损价格获取更大利润。同时也存在一定的风险,需要结合其他机制进行优化和改进,使其能够适应更复杂的市场环境。

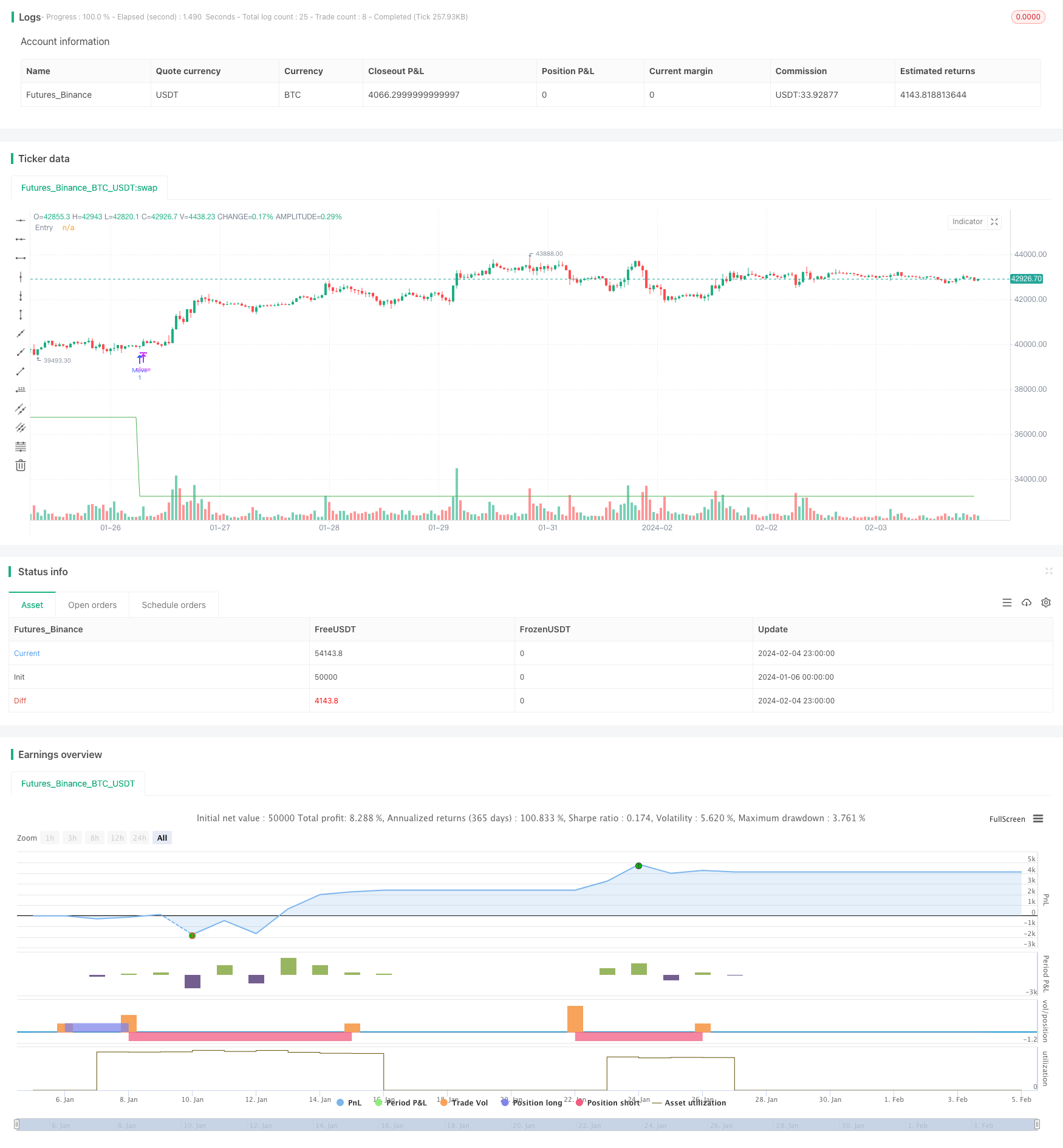

/*backtest

start: 2024-01-06 00:00:00

end: 2024-02-05 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © CryptoRox

//@version=4

//Paste the line below in your alerts to run the built-in commands.

//{{strategy.order.alert_message}}

strategy(title="Fibs limit only", shorttitle="Strategy", overlay=true, precision=8, pyramiding=1000, commission_type=strategy.commission.percent, commission_value=0.04)

//Settings

testing = input(false, "Live")

//Use epochconverter or something similar to get the current timestamp.

starttime = input(1600976975, "Start Timestamp") * 1000

//Wait XX seconds from that timestamp before the strategy starts looking for an entry.

seconds = input(60, "Start Delay") * 1000

testPeriod = true

leverage = input(1, "Leverage")

tp = input(1.0, "Take Profit %") / leverage

dca = input(-1.0, "DCA when < %") / leverage *-1

fibEntry = input("1", "Entry Level", options=["1", "2", "3", "4", "5", "6", "7", "8", "9", "10"])

//Strategy Calls

equity = strategy.equity

avg = strategy.position_avg_price

symbol = syminfo.tickerid

openTrades = strategy.opentrades

closedTrades = strategy.closedtrades

size = strategy.position_size

//Fibs

lentt = input(60, "Pivot Length")

h = highest(lentt)

h1 = dev(h, lentt) ? na : h

hpivot = fixnan(h1)

l = lowest(lentt)

l1 = dev(l, lentt) ? na : l

lpivot = fixnan(l1)

z = 400

p_offset= 2

transp = 60

a=(lowest(z)+highest(z))/2

b=lowest(z)

c=highest(z)

fib0 = (((hpivot - lpivot)) + lpivot)

fib1 = (((hpivot - lpivot)*.21) + lpivot)

fib2 = (((hpivot - lpivot)*.3) + lpivot)

fib3 = (((hpivot - lpivot)*.5) + lpivot)

fib4 = (((hpivot - lpivot)*.62) + lpivot)

fib5 = (((hpivot - lpivot)*.7) + lpivot)

fib6 = (((hpivot - lpivot)* 1.00) + lpivot)

fib7 = (((hpivot - lpivot)* 1.27) + lpivot)

fib8 = (((hpivot - lpivot)* 2) + lpivot)

fib9 = (((hpivot - lpivot)* -.27) + lpivot)

fib10 = (((hpivot - lpivot)* -1) + lpivot)

notna = nz(fib10[60])

entry = 0.0

if fibEntry == "1"

entry := fib10

if fibEntry == "2"

entry := fib9

if fibEntry == "3"

entry := fib0

if fibEntry == "4"

entry := fib1

if fibEntry == "5"

entry := fib2

if fibEntry == "6"

entry := fib3

if fibEntry == "7"

entry := fib4

if fibEntry == "8"

entry := fib5

if fibEntry == "9"

entry := fib6

if fibEntry == "10"

entry := fib7

profit = avg+avg*(tp/100)

pause = 0

pause := nz(pause[1])

paused = time < pause

fill = 0.0

fill := nz(fill[1])

count = 0.0

count := nz(fill[1])

filled = count > 0 ? entry > fill-fill/100*dca : 0

signal = testPeriod and notna and not paused and not filled ? 1 : 0

neworder = crossover(signal, signal[1])

moveorder = entry != entry[1] and signal and not neworder ? true : false

cancelorder = crossunder(signal, signal[1]) and not paused

filledorder = crossunder(low[1], entry[1]) and signal[1]

last_profit = 0.0

last_profit := nz(last_profit[1])

if neworder and signal

strategy.order("New", 1, 0.0001, alert_message='New Order|e=binancefuturestestnet s=btcusdt b=long q=0.0011 fp=' + tostring(entry))

if moveorder

strategy.order("Move", 1, 0.0001, alert_message='Move Order|e=binancefuturestestnet s=btcusdt b=long c=order|e=binancefuturestestnet s=btcusdt b=long q=0.0011 fp=' + tostring(entry))

if filledorder and size < 1

fill := entry

count := count+1

pause := time + 60000

p = close+close*(tp/100)

strategy.entry("Filled", 1, 1, alert_message='Long Filled|e=binancefuturestestnet s=btcusdt b=short c=order|delay=1|e=binancefuturestestnet s=btcusdt b=long c=position q=100% ro=1 fp=' + tostring(p))

if filledorder and size >= 1

fill := entry

count := count+1

pause := time + 60000

strategy.entry("Filled", 1, 1, alert_message='Long Filled|e=binancefuturestestnet s=btcusdt b=short c=order|delay=1|e=binancefuturestestnet s=btcusdt b=long c=position q=100% ro=1 fp=' + tostring(profit))

if cancelorder and not filledorder

pause := time + 60000

strategy.order("Cancel", 1, 0.0001, alert_message='Cancel Order|e=binancefuturestestnet s=btcusdt b=long c=order')

if filledorder

last_profit := profit

closeit = crossover(high, profit) and size >= 1

if closeit

strategy.entry("Close ALL", 0, 0, alert_message='Profit')

count := 0

fill := 0.0

last_profit := 0.0

//Plots

bottom = signal ? color.green : filled ? color.red : color.white

plot(entry, "Entry", bottom)