概述

该策略通过计算快速RSI指标和K线实体过滤,判断市场是否处于超卖状态,从而实现低吸操作。当快速RSI低于10并且K线实体放大,认为行情反转的信号出现,这样可以实现对市场底部的判断。

策略原理

该策略主要基于两部分指标进行判断:

快速RSI指标。通过计算最近2天的涨跌幅,来快速判断市场的超买超卖。当快速RSI低于10时,表示市场处于超卖状态。

K线实体过滤。通过计算K线实体体积与均线的比值,当实体体积大于1.5倍均线体积时,认为是底部信号出现。

首先,快速RSI低于10表示市场超卖;然后,K线实体放大,满足实体体积大于1.5倍均线体积。当两者条件同时满足时,发出做多信号,认为市场处于反转底部,这样可以过滤掉许多假信号。

策略优势

该策略有以下几个优势:

- 快速RSI指标灵敏,可以快速判断超买超卖。

- K线实体过滤增加确定性,避免假突破。

- 结合快速指标和K线形态,可以有效判断市场反转点。

- 实现低吸操作,可以在相对低点进入市场。

- 策略思路简单清晰,容易理解实现。

风险分析

该策略也存在一些风险:

- 市场可能存在拉胯期,即使超卖也可能持续下跌。

- 快速RSI可能产生假信号,実体过滤也可能被突破。

- 量化策略回测存在过拟合风险,实盘可能效果差异。

针对风险,可以通过以下方式优化:

- 结合趋势指标,避免메场持续下跌。

- 增加其他过滤条件,确保底部确认态势。

- 对参数进行多组合优化,提高稳定性。

优化方向

该策略可以从以下几个方向进行优化:

- 增加止损策略,控制亏损风险。

- 结合波动率指标,避免市场异常波动带来的风险。

- 增加多因子模型,确保交易信号效果。

- 利用机器学习算法进行参数优化。

- 在大时间周期判断趋势,避免逆势交易。

总结

本策略通过快速RSI指标判断超卖加上K线实体过滤,实现了对市场底部的有效判断。策略思路简单,易于实现,可以获取反转机会。但也存在一定的风险,需要进一步优化以提高稳定性和实盘表现。总体来说,基于该思路设计的底部反转交易策略值得进一步研究。

策略源码

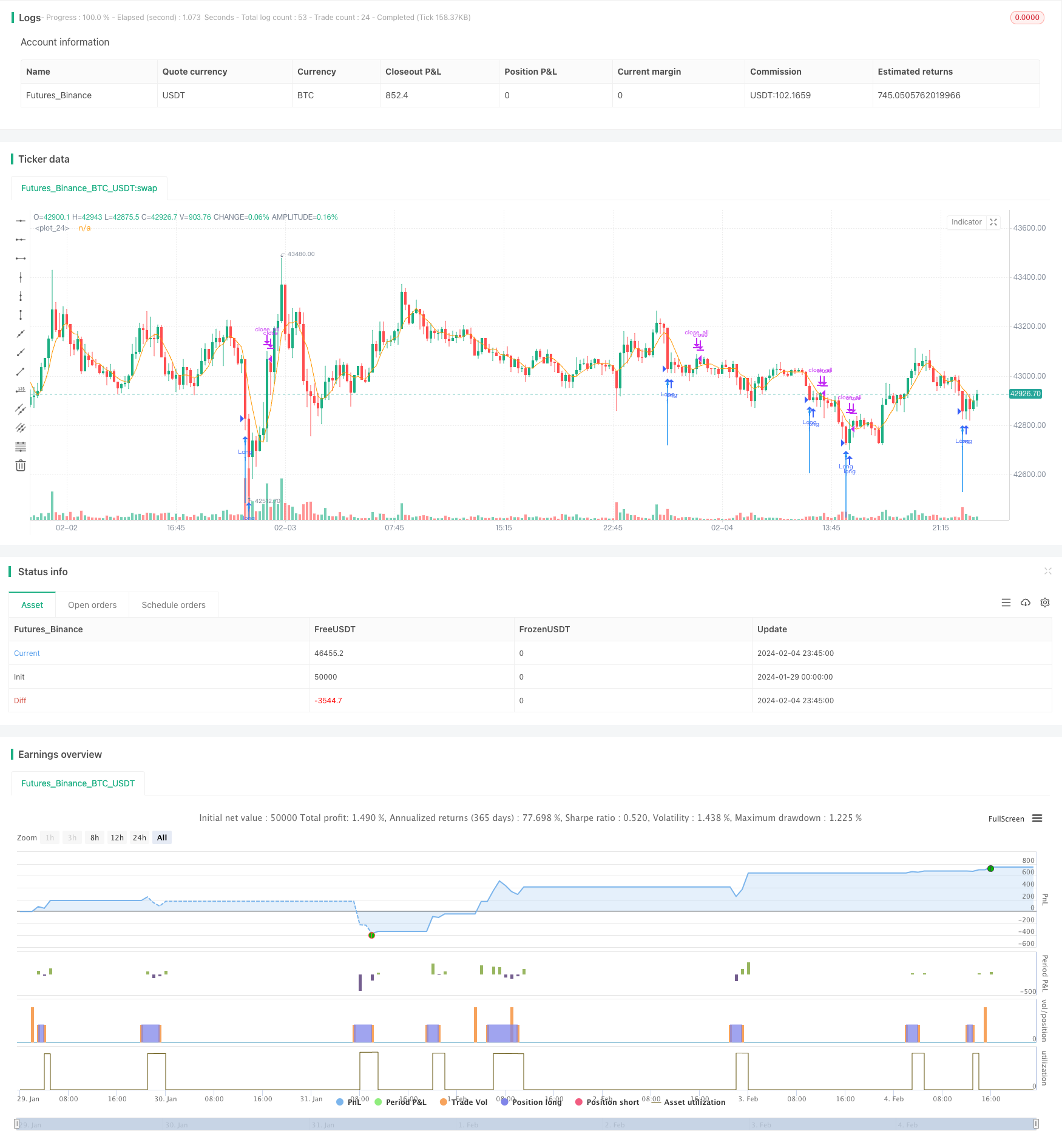

/*backtest

start: 2024-01-29 00:00:00

end: 2024-02-05 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("MarketBottom", shorttitle = "MarketBottom", overlay = true)

//Fast RSI

src = close

fastup = rma(max(change(src), 0), 2)

fastdown = rma(-min(change(src), 0), 2)

fastrsi = fastdown == 0 ? 100 : fastup == 0 ? 0 : 100 - (100 / (1 + fastup / fastdown))

//Body Filter

body = abs(close - open)

abody = sma(body, 10)

mac = sma(close, 10)

len = abs(close - mac)

sma = sma(len, 100)

max = max(open, close)

min = min(open, close)

up = close < open and len > sma * 2 and min < min[1] and fastrsi < 10 and body > abody * 1.5

plotarrow(up == 1 ? 1 : na, colorup = blue, colordown = blue)

sell = sma(close, 5)

exit = high > sell and close > open and body > abody

plot(sell)

if up

strategy.entry("Long", strategy.long)

if exit

strategy.close_all()