概述

该策略通过WaveTrend指标判断价格趋势和超买超卖情况,结合RSI指标过滤信号,采用趋势追踪方式,在超买超卖位做反向操作。

策略原理

该策略使用WaveTrend指标判断价格趋势方向。WaveTrend指标基于Rainbow指标改进而来,通过计算Heikin-Ashi均线和价格绝对值之间的差值,来判断价格趋势方向。结合RSI指标判断超买超卖情况发出交易信号。

具体来说,策略中的WaveTrend公式为:

esa = ema(hlc3, 10)

d = ema(abs(hlc3 - esa), 10)

ci = (hlc3 - esa) / (0.015 * d)

wt = ema(ci, 21)

其中,esa是计算的Heikin-Ashi均线,d是Heikin-Ashi均线和价格绝对值之差的均值。ci就是所谓的适应性区间,反映价格波动力度。wt是ci的均线,判断价格趋势方向,多为空头的关键指标。

RSI指标用于判断超买超卖,代码中RSI的计算公式为:

rsiup = rma(max(change(close), 0), 14)

rsidown = rma(-min(change(close), 0), 14)

rsi = rsidown == 0 ? 100 : rsiup == 0 ? 0 : 100 - (100 / (1 + rsiup / rsidown))

其标准值为0-100,高于70为超买区,低于30为超卖区。

结合这两个指标,当RSI低于25,WaveTrend低于-60时为超卖区,做多信号;当RSI高于75,WaveTrend高于60时为超买区,做空信号。

优势分析

该策略具有以下优势:

- 使用WaveTrend指标判断价格趋势方向准确可靠。

- RSI指标过滤能避免不必要的交易,提高胜率。

- 采用趋势追踪方式,可以最大化捕捉价格趋势所带来的利润。

- 策略思路清晰易懂,参数设置灵活,可根据不同品种和市场调整。

- 策略实现简单,容易实盘验证,利于框架优化。

风险分析

该策略也存在一些风险:

- WaveTrend和RSI指标都存在一定滞后,可能错过价格反转点。

- 虽有过滤条件,但仍可能在震荡行情中产生错误信号。

- 追踪止损策略有待完善,无法有效控制单笔损失。

- 参数设置合理与品种特性和交易频率匹配非常关键。

对策: 1. 结合额外判断指标进行优化,提高信号准确率。 2. 加入止损策略,控制单笔损失。 3. 寻找最佳参数组合,调整策略适应市场品种。

优化方向

该策略可从以下几个方向进行优化:

更换judgment指标或增加judgment指标,优化信号的准确率。例如加入MACD,KD等判断指标。

优化参数设置,适应不同交易品种。例如调整平滑周期,寻找最佳参数组合。

加入追踪止损策略,有效控制单笔损失。例如余额百分比止损,移动止损等。

考虑不同加仓策略。例如使用马丁格尔加仓替代原有的固定数量加仓。

优化适应性区间参数,寻找最佳参数提高判断准确性。

总结

该策略整体思路清晰,使用波动力度指标判断价格趋势,并有效过滤噪音交易信号。策略优化空间较大,可从多个角度进行改进,使策略更稳定可靠。通过参数调整优化,可适应不同交易品种,值得进一步测试实盘验证。

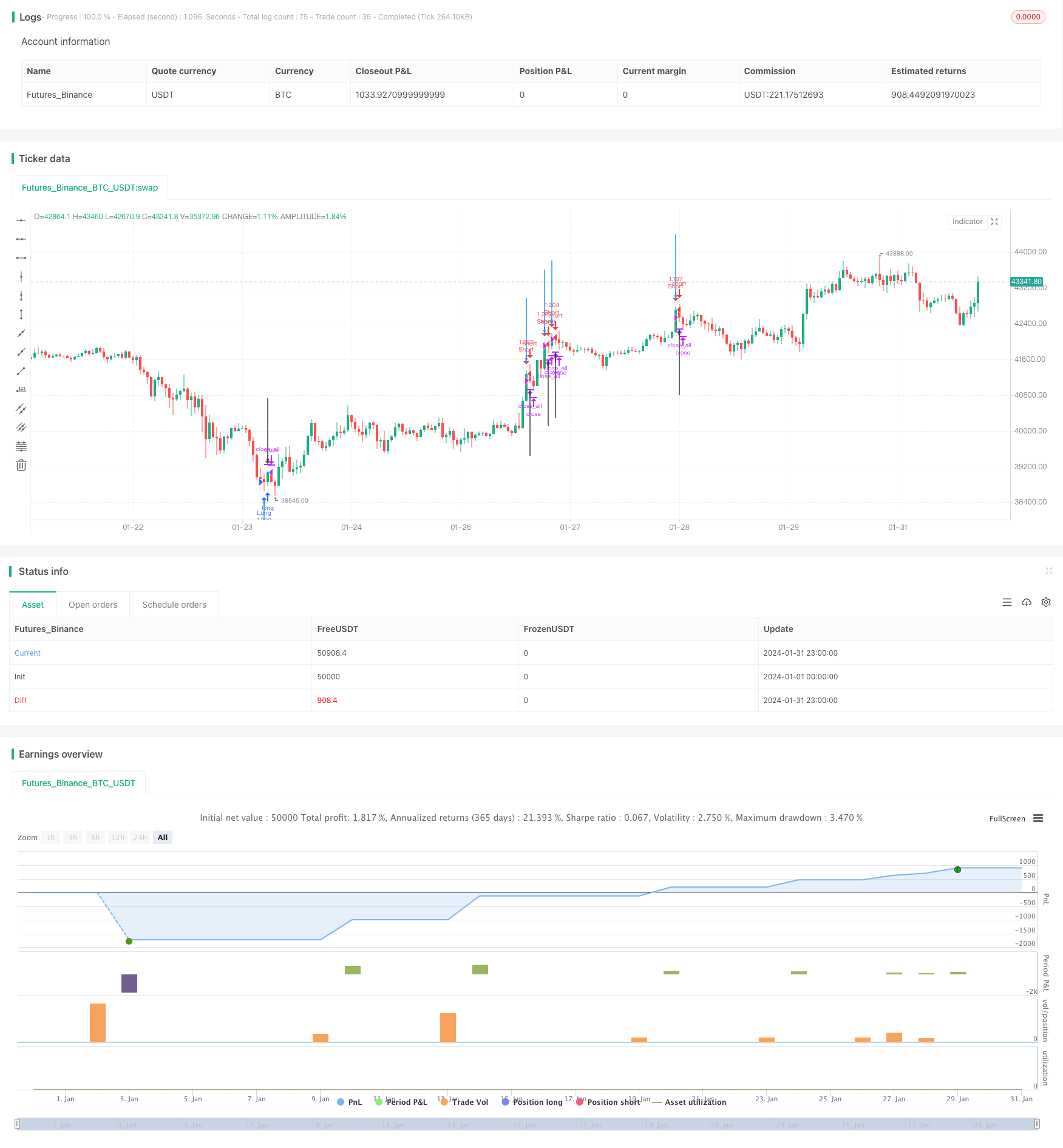

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Noro

//2018

//@version=2

strategy(title = "Noro's WaveTrender Strategy v1.0", shorttitle = "WaveTrender str 1.0", overlay = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 10)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

usemar = input(false, defval = false, title = "Use Martingale")

capital = input(100, defval = 100, minval = 1, maxval = 10000, title = "Capital, %")

showarr = input(true, defval = true, title = "Show Arrows")

fromyear = input(2018, defval = 2018, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

//RSI

rsiup = rma(max(change(close), 0), 14)

rsidown = rma(-min(change(close), 0), 14)

rsi = rsidown == 0 ? 100 : rsiup == 0 ? 0 : 100 - (100 / (1 + rsiup / rsidown))

//WaveTrend

esa = ema(hlc3, 10)

d = ema(abs(hlc3 - esa), 10)

ci = (hlc3 - esa) / (0.015 * d)

wt = ema(ci, 21)

//Body

body = abs(close - open)

abody = sma(body, 10)

//Signals

bar = close > open ? 1 : close < open ? -1 : 0

overs = rsi < 25 and wt < -60

overb = rsi > 75 and wt > 60

up1 = (strategy.position_size == 0 or close < strategy.position_avg_price) and overs and bar == -1

dn1 = (strategy.position_size == 0 or close > strategy.position_avg_price) and overb and bar == 1

exit = (strategy.position_size > 0 and overs == false) or (strategy.position_size < 0 and overb == false)

//Arrows

col = exit ? black : up1 or dn1 ? blue : na

needup = up1

needdn = dn1

needexitup = exit and strategy.position_size < 0

needexitdn = exit and strategy.position_size > 0

plotarrow(showarr and needup ? 1 : na, colorup = blue, colordown = blue, transp = 0)

plotarrow(showarr and needdn ? -1 : na, colorup = blue, colordown = blue, transp = 0)

plotarrow(showarr and needexitup ? 1 : na, colorup = black, colordown = black, transp = 0)

plotarrow(showarr and needexitdn ? -1 : na, colorup = black, colordown = black, transp = 0)

//Trading

profit = exit ? ((strategy.position_size > 0 and close > strategy.position_avg_price) or (strategy.position_size < 0 and close < strategy.position_avg_price)) ? 1 : -1 : profit[1]

mult = usemar ? exit ? profit == -1 ? mult[1] * 2 : 1 : mult[1] : 1

lot = strategy.position_size == 0 ? strategy.equity / close * capital / 100 * mult : lot[1]

if up1

if strategy.position_size < 0

strategy.close_all()

strategy.entry("Long", strategy.long, needlong == false ? 0 : lot)

if dn1

if strategy.position_size > 0

strategy.close_all()

strategy.entry("Short", strategy.short, needshort == false ? 0 : lot)

if exit

strategy.close_all()