概述

该策略通过计算 zwei 个不同周期的指数移动平均线EMA,并比较它们的大小关系来判断行情趋势,实现趋势跟随。当短周期EMA上穿长周期EMA时,判断为 行情进入上升趋势,策略做多;当短周期EMA下穿长周期EMA时,判断为行情进入下跌趋势,策略做空。

策略原理

该策略的核心指标是指数移动平均线(Exponential Moving Average, EMA)。EMA指标能够过滤掉行情的随机性,反应真正的趋势变化。本策略采用了两个不同参数的EMA,一个短周期的34日EMA,一个长周期的89日EMA。

当短周期EMA从下方上穿长周期EMA时,表示短期趋势开始主导长期趋势,价格进入上升通道,这是策略的做多信号。当短周期EMA从上方下穿长周期EMA时,表示短期趋势开始反转长期趋势,价格进入下跌通道,这是策略的做空信号。这样,策略充分利用两个 EMA 的交叉来捕捉价格变化的趋势信号。

做多做空后,策略会一直持有头寸直到出现相反信号。例如,做多后遇到短周期EMA下穿长周期EMA的做空信号时,就会平掉做多头寸,同时开立做空头寸。这样可以顺势退出正利空头,又可以适时反向做空,最大程度锁定趋势获利。

优势分析

该策略最大的优势在于全面利用 EMA 交叉形态来判断行情趋势的变化,精准做多做空,从而可以较好的跟踪趋势。具体来说,优势主要体现在以下几个方面:

利用 EMA 工具判断主流价格趋势变化,ma 在趋势和附加的平滑处理上优于 基本均线工具。

采用双 EMA 结构,过滤掉部分噪音,使信号更加稳定可靠。

EMA 周期参数可调,可以灵活适应行情特征,获得更精确的交易信号。

顺势持仓,避免逆势交易,可以减少交易风险。

充分利用趋势获利,一旦获利后及时止盈,避免反转亏损。

风险分析

该策略主要面临以下几个方面的风险:

虽然 EMA 可以有效过滤噪音,判断趋势方向,但如果遭遇震荡行情,会出现多次losing信号交织,导致过分频繁交易,增加交易成本和风险。

EMA 的周期参数选择不当,会使得信号产生滞后,错过最佳入场时点。

无法判断趋势的转折点和反转时间,可能在转折来临前被套牢。

针对上述风险,可采取以下应对措施:

在震荡行情中,适当放宽止损线,减少losing,或者直接跳过交易等待明确趋势。

优化 EMA 周期参数的选择,找到最优参数组合。引入自适应 EMA 来动态调整周期。

增加附加指标判断趋势末、结构转折点,避免套牢。典型的组合可以考虑引入 MACD、KDJ、MA 等。

优化方向

该策略还具有进一步优化的空间,主要可以从以下几个方面入手:

进一步优化 EMA 周期的选择,找到最优参数组合。可以考虑动态周期、自适应 EMA 等。

增加止损策略,如移动止损、时间止损、波动止损等,控制单笔交易风险。

增加附加指标判断行情结构,避免套牢风险。典型的如引入 MACD、KDJ、MA 等。

根据大周期级别的结构震荡特点,调整策略的参数。具体来说, trending 市做多参数组合,range 市做空参数组合。

结合仓位管理,根据资金利用率、收益率等指标动态调整仓位大小。

总结

该策略核心思路简单清晰,通过 EMA 指标交叉判断行情趋势变化,实现做多做空。策略具有利用 EMA 工具判断趋势、顺势持仓、利用趋势获利等优势。但也存在选择周期、捕捉转折点等问题。这些问题都为策略进一步优化提供了方向。通过引入多种技术指标,丰富本策略的判断依据,可以使策略更稳定、更高效。

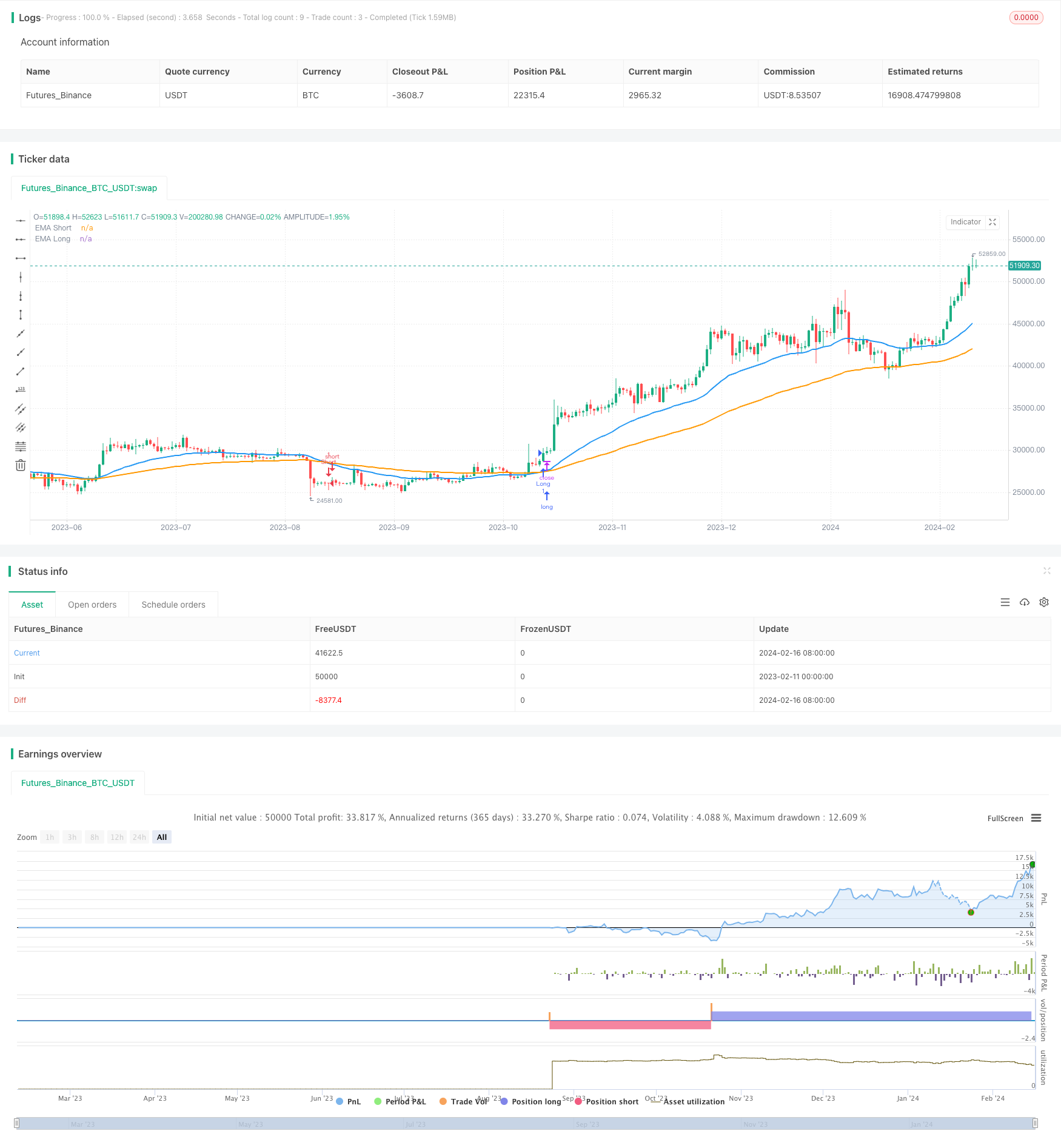

/*backtest

start: 2023-02-11 00:00:00

end: 2024-02-17 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Simple Moving Average Strategy", overlay=true)

// Input for EMA lengths

emaShortLength = input.int(34, title="Short EMA Length")

emaLongLength = input.int(89, title="Long EMA Length")

// Calculate EMAs based on inputs

emaShort = ta.ema(close, emaShortLength)

emaLong = ta.ema(close, emaLongLength)

// Plot the EMAs

plot(emaShort, color=color.blue, linewidth=2, title="EMA Short")

plot(emaLong, color=color.orange, linewidth=2, title="EMA Long")

// Generate long and short signals

longCondition = ta.crossover(emaShort, emaLong)

shortCondition = ta.crossunder(emaShort, emaLong)

// Enter long positions

if (longCondition)

strategy.entry("Long", strategy.long)

// Enter short positions

if (shortCondition)

strategy.entry("Short", strategy.short)

// Close long positions

if (shortCondition)

strategy.close("Long")

// Close short positions

if (longCondition)

strategy.close("Short")