概述

本策略采用双移动均线形成交易信号的方式,当短期移动均线上穿长期移动均线时生成买入信号;当短期移动均线下穿长期移动均线时生成卖出信号。该策略结合移动均线的趋势跟踪功能,可以有效捕捉价格趋势,实现趋势交易。

策略原理

本策略使用两条不同周期的指数移动均线(EMA)。EMA1为短期移动均线,周期设置为9;EMA2为长期移动均线,周期设置为21。当短期移动均线EMA1上穿长期移动均线EMA2时,产生买入信号;当EMA1下穿EMA2时,产生卖出信号。

这样可以利用移动均线的趋势跟踪功能,在价格开始新的趋势方向时及时捕捉信号,跟踪趋势进行交易。例如当价格从下跌转为上涨时,短期移动均线会先于长期移动均线上升,短期移动均线上穿长期移动均线是价格开始上涨的一个早期信号。

优势分析

本策略最大的优势在于可以有效识别价格趋势,尤其适合趋势性较强的市场。移动均线本身具有很好的趋势跟踪功能,双移动均线策略进一步增强了这一优势。此外,相比单一移动均线策略,双移动均线策略可以进一步过滤假信号,信号的可靠性更高。

风险分析

本策略最大的风险在于当价格出现剧烈波动时,移动均线会有滞后性,可能出现错过最佳入场或出场时机的情形。此外,当市场处于震荡区间时,该策略会产生更多无效信号,降低策略的稳定性。

为降低风险,可以适当调整移动均线的周期参数,或增加其他指标进行滤波。例如结合市场波动率指标设置阈值,避免在市场大幅震荡时依然进行交易等。

优化方向

本策略的优化空间主要在以下几个方面:

- 优化移动均线周期参数,寻找最优参数组合

- 增加其他指标结合进行滤波操作,提高信号的可靠性

- 根据不同品种和市场环境设定自适应的参数

- 结合量能指标等确定具体的入场点位

- 优化止损机制

总结

本策略采用双指数移动均线形成交易信号的方法,最大优势是价格趋势跟踪能力强,可以有效识别价格趋势转折。但也存在移动均线滞后等问题。下一步可以从提高信号质量、确定具体入场时机以及止损方面进行优化。

策略源码

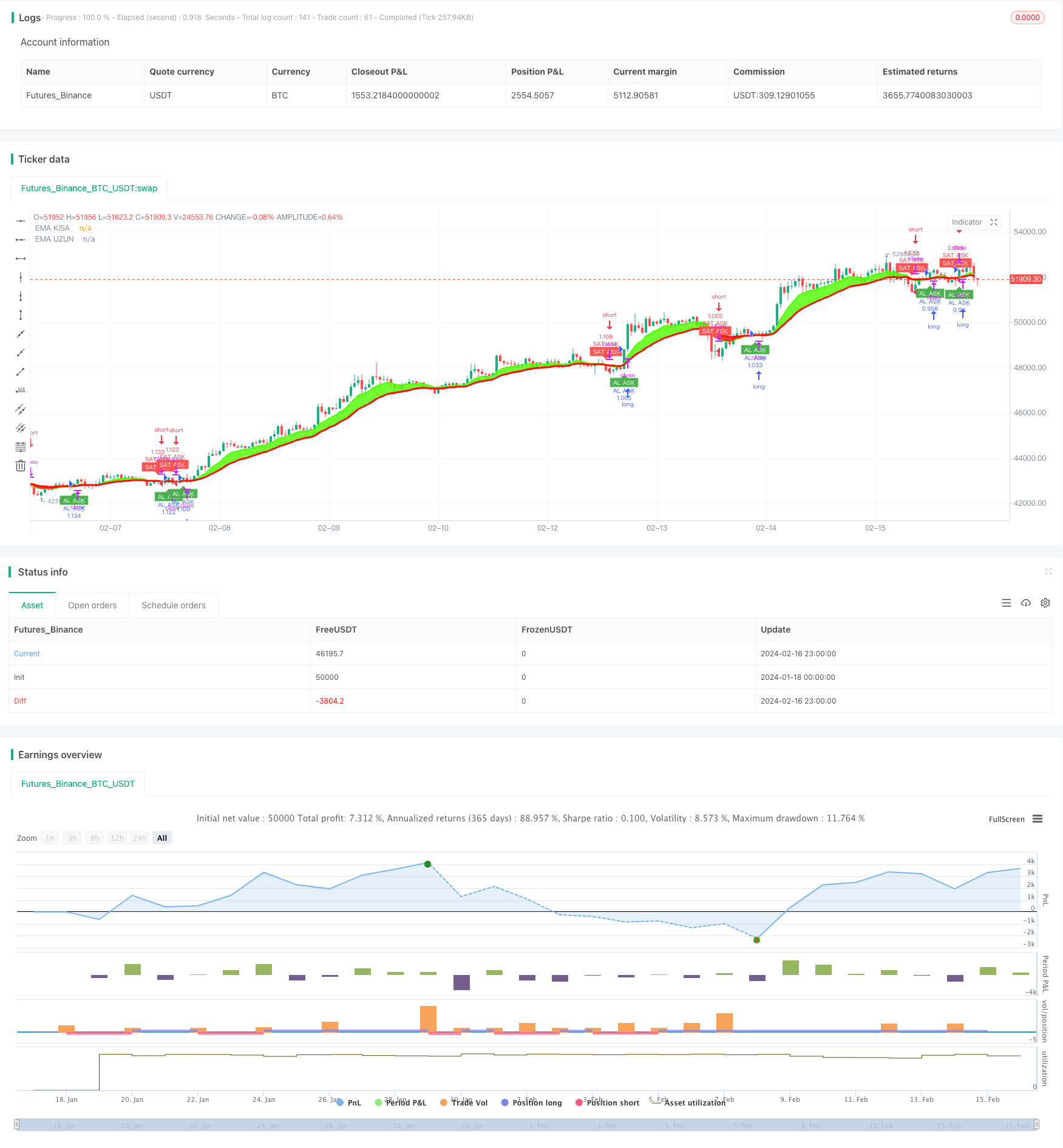

/*backtest

start: 2024-01-18 00:00:00

end: 2024-02-17 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © technicalTruff99446

//@version=4

strategy("AhmetMSA", overlay=true, initial_capital = 10000, commission_value = 0.002, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 0, calc_on_order_fills = true)

//2. DEĞERDEN SONRA GEÇMİŞ HESAPLAMA DEĞERİ, KOMİSYON ORANI, PARANIN TAMAMI, DEĞERLERİ EKLEMDİ

emaShPD = input (title="EMA KISA PERİYOT", defval=9, minval=1)

emaLngPD = input (title="EMA UZUN PERİYOT", defval=21, minval=1)

//input DEĞİŞKEN DEĞER ATAMA

ema1 = ema (close,emaShPD)

ema2 = ema (close,emaLngPD)

//EMALAR ARASINI BOYAMA upTrend downTrend

upTrend = plot (ema1, color=#4DFF00, linewidth=2, title= "EMA KISA", transp=0)

downTrend = plot (ema2, color=#FF0C00, linewidth=3, title= "EMA UZUN", transp=0)

//linewidth ÇİZGİ KALINLIĞI

//title İSİM VERME

//BACKTESTİN BAŞLANGIÇ TARİHİNİ BELİRLEME

yearin = input(2024, title = "Backtest Başlangıç Tarihi")

//longCondition = crossover(ema1, ema2)

//shortCondition = crossover(ema2, ema1)

buy = crossover(ema1, ema2) and yearin >= year

sell = crossover(ema2, ema1) and yearin >= year

//ta.crossunder KESİŞİM KODU

//Barları BOYAMA

barbuy = ema1 >= ema2

barsell = ema2 < ema1

//AL SAT AŞK KUTUCUKLU EKRANA YAZMA

plotshape(buy, title = "AL AŞK", text = 'AL AŞK', style = shape.labelup, location = location.belowbar, color= color.green, textcolor = color.white, transp = 0, size = size.tiny)

plotshape(sell, title = "SAT AŞK", text = 'SAT AŞK', style = shape.labeldown, location = location.abovebar, color= color.red, textcolor = color.white, transp = 0, size = size.tiny)

//Barları BOYAMA KOŞULU

barcolor(barbuy? #4DFF00: barsell? #FF0C00: #FF0C00)

fill(upTrend, downTrend, color = ema1 >= ema2?#4DFF00 : #FF0C00, transp = 80, title = "bgcolor")

//longCondition = ta.crossover(ta.sma(close, 14), ta.sma(close, 28))

//shortCondition = ta.crossunder(ta.sma(close, 14), ta.sma(close, 28))

//14 GÜNLÜĞÜN KAPANIŞDEĞERİNİN 28 GÜNLÜK KAPANIŞ DEĞERİNİ KESMESİ KOŞULU

if (buy)

strategy.entry("AL AŞK", strategy.long)

if (sell)

strategy.entry("SAT AŞK", strategy.short)