概述

该策略是一个长线趋势策略,用于股票和加密货币市场。它结合了ATR(平均真实波动幅度)、EOM(易动平均)和VORTEX(涡流指标)三个指标来识别趋势方向。

策略原理

ATR用于衡量市场波动性。这里我们计算10周期的ATR,再通过5周期EMA平滑ATR。如果当前ATR高于EMAATR,表示目前处于高波动的行情,属于牛市;相反,则属于熊市。

EOM属于量价指标。这里我们计算10周期的EOM。如果EOM为正,表示目前处于量能激增的行情,属于牛市;如果EOM为负,则属于熊市。

VORTEX代表涡流指标,用于判断长线趋势方向。我们分别计算近10周期价格波动的绝对值之和得到VMP和VMM。再用ATR求和作为归一化的分母,计算出VIP和VIM。取两者平均值,若大于1表示属于牛市,小于1为熊市。

综上,该策略通过ATR和EMAATR判断短期波动性,EOM判断量价特征,VORTEX判断长线趋势三者结合,来确定最终只做多的方向。

优势分析

该策略结合了三大类别指标来识别趋势方向,包括波动率类、量价类和趋势类,判断全面,信号较强。

ATR和VORTEX都具有一定的平滑特征,可以有效过滤震荡行情的噪音,避免错误的多头信号。

只做多而不做空,可以最大限度减少短线调整带来的亏损风险。

作为趋势跟踪策略,它专注于捕捉中长线方向性机会,利于获取行情主要趋势的收益。

风险分析

回测数据不足,实盘表现还需验证,参数设置也需要进一步优化测试。

无法搜索反转或震荡行情带来的获利机会,收益上限存在一定局限。

纯粹的趋势策略,无法有效控制持仓风险,存在一定程度的资金锁定风险。

无法做空,无法对冲头寸风险,亏损空间相对较大。

优化方向

测试不同ATR和VORTEX周期参数的稳定性。

尝试引入止损机制,如移动止损、时间止损等,控制单笔亏损。

基于ATR值设置仓位比例,高波动时减仓降低风险。

结合反转因子确认入场时机,避免不必要的锁定资金。

总结

该策略属于长线趋势跟踪策略,通过ATR、EOM和VORTEX三大指标确认趋势方向后进场,只做多而不做空,以期捕捉主趋势带来的超额收益。它具有判断综合性强、信号较清晰的优点,但也存在数据不足、风险控制能力较弱的劣势。未来可从引入止损、优化参数设置、仓位管理等方面进行改进与优化。

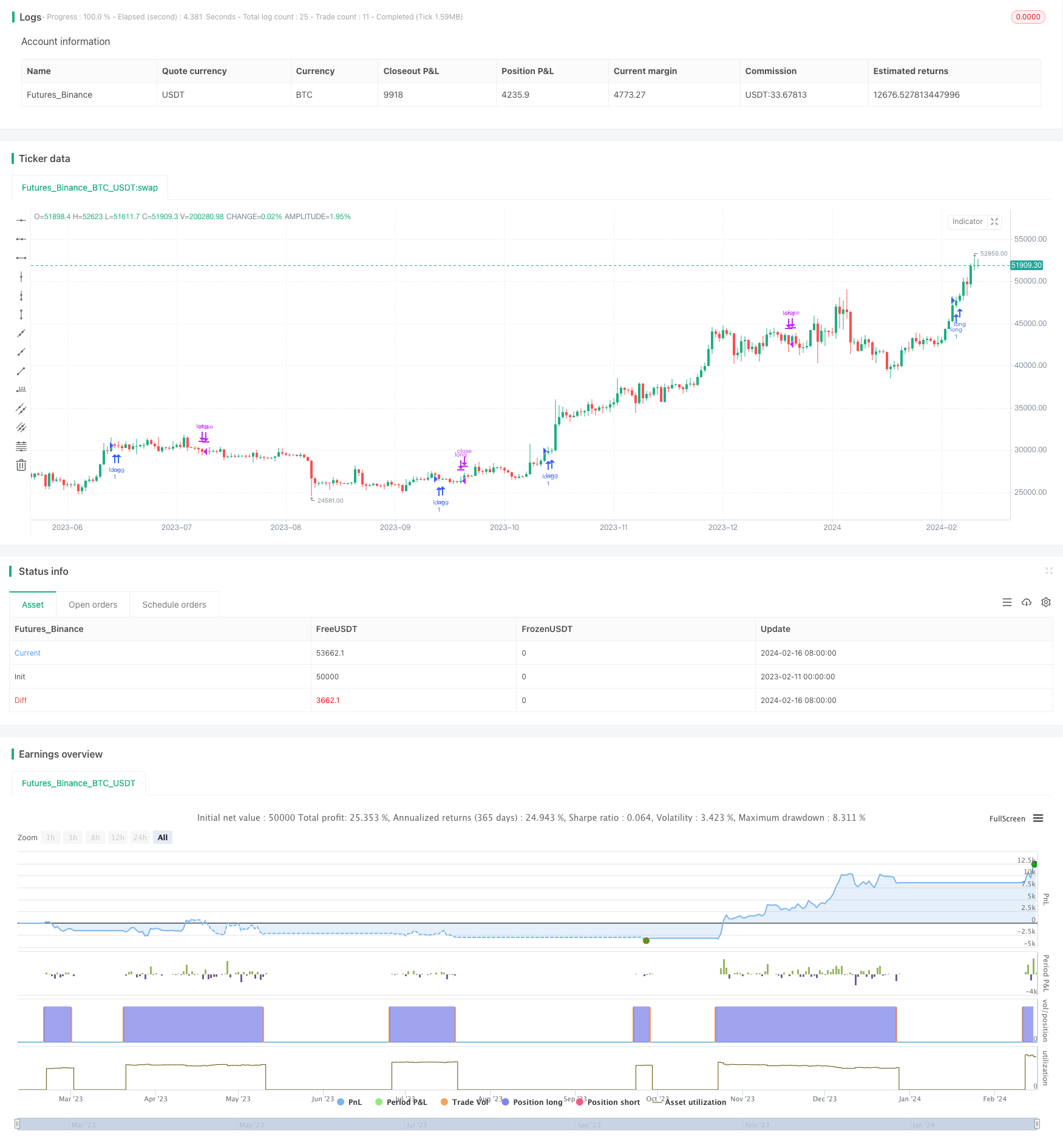

/*backtest

start: 2023-02-11 00:00:00

end: 2024-02-17 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © SoftKill21

//@version=4

strategy("atr+eom+vortex strat", overlay=true )

//atr and ema

atr_lenght=input(10)

atrvalue = atr(atr_lenght)

//plot(atrvalue)

ema_atr_length=input(5)

ema_atr = ema(atrvalue,ema_atr_length)

//plot(ema_atr,color=color.white)

//EOM and ema

lengthEOM = input(10, minval=1)

div = 10//input(10000, title="Divisor", minval=1)

eom = sma(div * change(hl2) * (high - low) / volume, lengthEOM)

// + - 0 long/short

//VORTEX

period_ = input(10, title="Length", minval=2)

VMP = sum( abs( high - low[1]), period_ )

VMM = sum( abs( low - high[1]), period_ )

STR = sum( atr(1), period_ )

VIP = VMP / STR

VIM = VMM / STR

avg_vortex=(VIP+VIM)/2

//plot(avg_vortex)

long= atrvalue > ema_atr and eom > 0 and avg_vortex>1

short=atrvalue < ema_atr and eom < 0 and avg_vortex<1

strategy.entry("long",1,when=long)

//strategy.entry("short",0,when=short)

strategy.close("long",when=short)