概述

RB量化交易三合一策略是一个结合大盘热度指标OBV、中短期运动量指标CMO和长线运动量指标Coppock曲线的复合策略。该策略综合考虑了市场多空热度、中短期趋势和长线趋势三个维度,形成交易信号,以达到更可靠的入场。

策略原理

该策略的交易信号来源于以下三个指标的组合:

OBV:反映大盘热度,多空势力的强弱。OBV上涨代表多方势力加强,OBV下跌代表空方势力加强。

CMO:反映中短期价格变化率的趋势性。CMO为正代表中短期处于上涨趋势,CMO为负代表下跌趋势。

Coppock曲线:反映长期价格变化率的趋势性。Coppock曲线向上代表长线处于上涨阶段,向下代表下跌阶段。

当OBV上升、CMO和Coppock曲线同时上涨时产生买入信号。这代表大盘多方势力加强,中长期处于上涨通道,是一个较好的买点。

反之,当OBV下降,CMO和Coppock曲线同时下跌时产生卖出信号。这代表空方势力加强,中长期下行通道打开,是比较好的离场时机。

策略优势

该策略最大的优势在于综合考量了市场的多空热度、中短期趋势和长期趋势三个维度,从大盘层面、中短期层面和长期层面确保趋势异动一致后才产生交易信号,因此可以有效避免假突破。同时利用CMO的灵敏度把握短期机会的同时,Coppock曲线提供长线滤波保证大方向正确。

另外,该策略同时利用构建买卖双向信号,可以实现较好的资金利用率。

策略风险

该策略的主要风险在于Coppock曲线和CMO所采用的ROC计算周期较长,会有一定的滞后性。当市场突发事件激烈变动时,Coppock曲线和CMO指标可能会延迟做出判断。这时就需要依赖OBV的快速判定。但OBV作为积累量能线,对突发事件也会有几根K线的滞后。

此外,将三个指标简单合并在一起判断,没有考虑指标之间的权重设定,这也会影响判断的准确性。

策略优化方向

该策略后续可以从以下几个方面进行优化:

对Coppock曲线和CMO指标采用自适应ROC周期设置,让指标的参数可以自动适应市场的变化频率。

增加指标的权重设定,让一些判断更为精确的指标起主导作用,提高信号的稳定性。

增加止损策略,利用类似ATR指标设定交易的止损范围,有效控制单笔交易的最大损失。

发挥OBV的快速响应优势,设定OBV反转作为止损信号,避免大幅亏损。

总结

RB量化交易三合一策略综合考虑大盘热度、中短期运动量和长期运动量三个维度,形成买卖信号。它融合了多个指标的优势,确保市场多空态势和中长期趋势趋于一致后产生交易信号。主要优势是信号稳定可靠,有效避免假突破。通过后续的优化设计,进一步提升策略的实战效果。

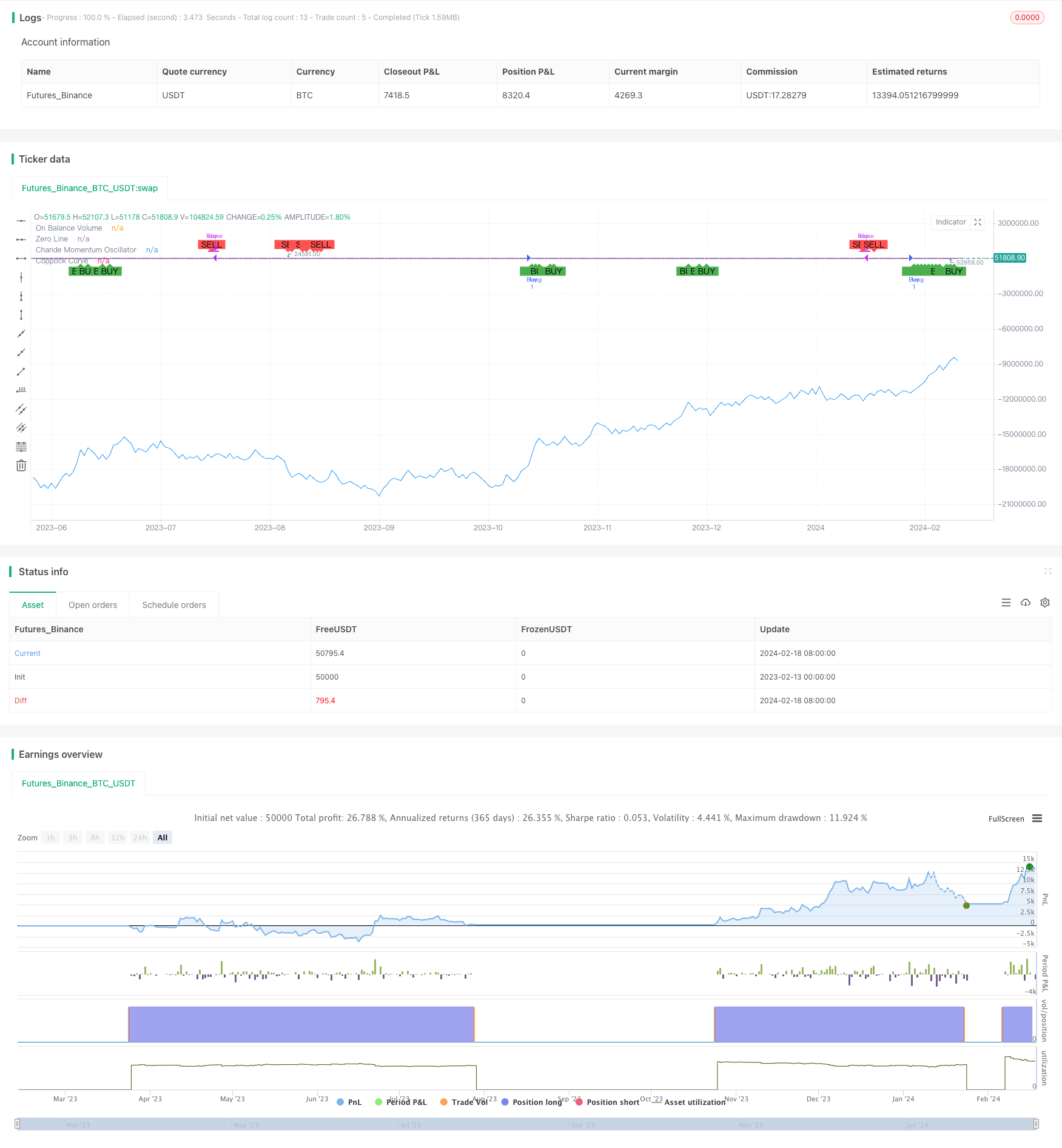

/*backtest

start: 2023-02-13 00:00:00

end: 2024-02-19 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("RB - OBV Coppock CMO Strategy", overlay=true)

// Input for CMO period

cmo_period = input(14, title="Chande Momentum Oscillator Period")

// Input for Coppock Curve periods

coppock_long = input(14, title="Coppock Curve Long ROC Period")

coppock_short = input(11, title="Coppock Curve Short ROC Period")

coppock_wma = input(10, title="Coppock Curve WMA Period")

// Thresholds for CMO

cmo_buy_threshold = input(50, title="CMO Buy Threshold")

cmo_sell_threshold = input(-50, title="CMO Sell Threshold")

// Calculating OBV

obv = cum(close > close[1] ? volume : close < close[1] ? -volume : 0)

// Calculating Coppock Curve

roc_long = roc(close, coppock_long)

roc_short = roc(close, coppock_short)

coppock_curve = wma(roc_long + roc_short, coppock_wma)

// Calculating Chande Momentum Oscillator

cmo = cmo(close, cmo_period)

// Generate buy and sell signals

buy_signal = obv > obv[1] and coppock_curve > 0 and coppock_curve > coppock_curve[1] and cmo > cmo_buy_threshold

sell_signal = obv < obv[1] and coppock_curve < 0 and coppock_curve < coppock_curve[1] and cmo < cmo_sell_threshold

// Plotting signals on the chart

plotshape(series=buy_signal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sell_signal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Setting up the strategy entry and exit points

if (buy_signal)

strategy.entry("Buy", strategy.long)

if (sell_signal)

strategy.close("Buy")

// Plot OBV and Coppock Curve for reference

plot(obv, title="On Balance Volume", color=color.blue)

hline(0, "Zero Line", color=color.gray)

plot(coppock_curve, title="Coppock Curve", color=color.purple)

plot(series=cmo, title="Chande Momentum Oscillator", color=color.orange)