概述

该策略的主要思想是根据系统信号动态加仓,在牛市中逐步建立头寸,以控制风险并获得较低的平均入场价。

策略原理

该策略首先设置启动资金和DCA配置百分比。在每根K线收盘时,它会根据价格变动计算调整后的配置百分比。如果价格上涨,它会降低百分比;如果价格下跌,它会增加百分比。这样可以在价格较低时增加头寸。然后根据调整后的百分比和剩余资金计算订单大小。在每根K线收盘时,它会下单加仓,直到启动资金用完。

这样,它可以在行情波动时,控制风险,获得较低的平均入场价。同时,它还会统计平均入场价和中位数价格,这样可以判断目前的入场情况。

优势分析

该策略具有以下优势:

可以动态加仓,在行情下跌时加大仓位,在行情上涨时减小仓位,从而控制风险。

获得了比中位数价格更低的平均入场价,有利于获得更高的收益空间。

适合牛市中波动的行情,可以获得较好的风险收益比。

可以预设启动资金和DCA百分比,控制每次加仓的资金数量,避免风险过大。

提供平均入场价和中位数价格的统计,可以直观判断入场的优劣。

风险分析

该策略也存在一定的风险:

在行情出现断崖式下跌时,该策略会持续加仓,从而可能带来较大的资金损失。可以设置止损来控制风险。

如果行情出现急速上涨,该策略的加仓幅度会下降,可能错过大部分上涨机会。这时需要利用其他信号进行敏捷的LSI。

参数设置不当也会带来一定风险。启动资金过大、DCA百分比过高都会扩大损失。

优化方向

该策略还可以从以下几个方面进行优化:

可以添加止损逻辑,在大幅下跌时停止加仓。

可以根据波动率或其他指标动态调整DCA百分比。

可以添加机器学习模型,预测价格变动,从而指导加仓决策。

可以结合其他技术指标判断市场结构,在结构转折点停止加仓。

可以添加资金管理模块,根据账户资金情况动态调整每次加仓资金。

总结

该策略是一个非常实用的动态加仓策略。它可以根据行情波动灵活调整仓位,在牛市中获得较低的平均入场价。同时,它内置了参数设置以控制风险。如果与其他技术指标或模型结合,可以获得更好的效果。该策略适用于追求长线投资收益的投资者。

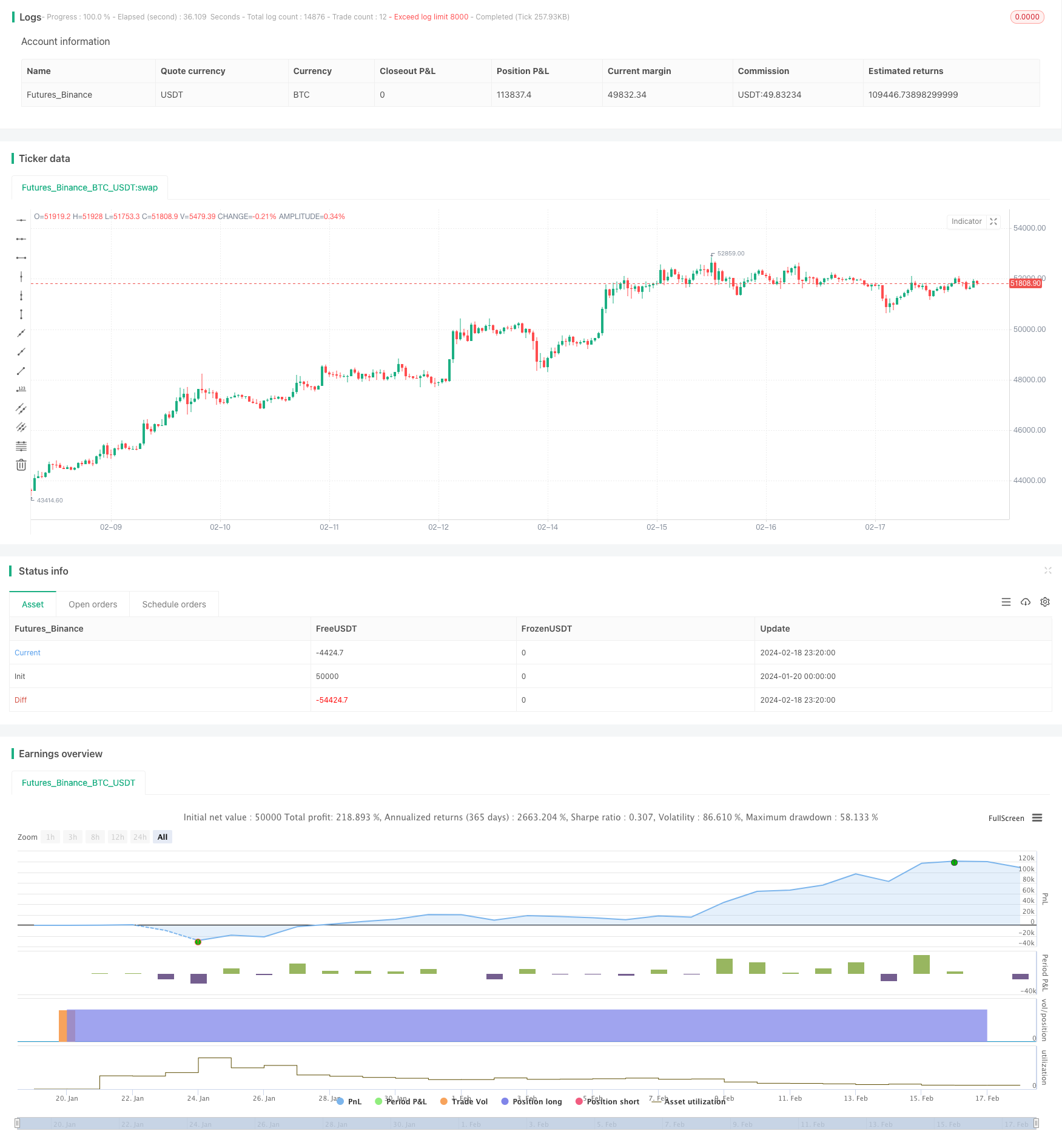

/*backtest

start: 2024-01-20 00:00:00

end: 2024-02-19 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © RWCS_LTD

//@version=5

strategy("DCA IN Calculator {RWCS}", overlay=true, pyramiding=999, default_qty_type=strategy.cash, initial_capital=10000, commission_value=0.02)

// User inputs

backtestStartDate = input(timestamp("1 Jan 2024"),

title="Start Date", group="Backtest Time Period",

tooltip="This start date is in the time zone of the exchange " +

"where the chart's instrument trades. It doesn't use the time " +

"zone of the chart or of your computer.")

start_date = true

starting_capital = input.float(defval=5000, title="Starting Capital")

dca_allocation_percentage = input.int(defval=10, title="DCA Allocation Percentage")

// Calculate DCA allocation based on price change

price_change_percentage = ((close - close[1]) / close[1]) * 100

adjusted_allocation_percentage = close > close[1] ? dca_allocation_percentage - price_change_percentage : dca_allocation_percentage + price_change_percentage // If price action is negative, increase allocations

adjusted_allocation_percentage1 = dca_allocation_percentage - price_change_percentage // If price action is positive, reduce allocations

// Calculate order size based on adjusted allocation percentage

order_size = (adjusted_allocation_percentage / 100) * starting_capital

// Track remaining capital

var remaining_capital = starting_capital

// Long on the close of every bar

if true

// Ensure the order size doesn't exceed remaining capital or adjusted allocation

order_size := math.min(order_size, remaining_capital, adjusted_allocation_percentage / 100 * starting_capital)

// Ensure order size is not negative

order_size := math.max(order_size, 0)

strategy.entry("DCA", strategy.long, qty = order_size)

remaining_capital := remaining_capital - order_size

// Plot average entry price

var float total_entry_price = 0.0

var int total_signals = 0

if start_date

total_entry_price := total_entry_price + close

total_signals := total_signals + 1

avg_entry_price = total_entry_price / total_signals

// Calculate and plot median price

var float median_price = na

if start_date

var float sum_prices = 0.0

var int num_prices = 0

for i = 0 to bar_index

if (time[i] >= backtestStartDate)

sum_prices := sum_prices + close[i]

num_prices := num_prices + 1

median_price := sum_prices / num_prices

// Reset variables at the start of each day

if (dayofweek != dayofweek[1])

total_entry_price := 0.0

total_signals := 0

//table colors

borders_col = color.new(color.black, 90)

top_row_col = color.new(color.gray, 90)

size = input.string(defval='Normal', options=['Tiny', 'Small', 'Normal', 'Large'], title='Table size', inline='design', group='Table Design')

table_size = size == 'Tiny' ? size.tiny : size == 'Small' ? size.small : size == 'Normal' ? size.normal : size == 'Large' ? size.large : na

var tablee = table.new(position=position.top_right, columns=2, rows=3, frame_color=borders_col, frame_width=4, border_color=borders_col, border_width=4)

table.cell(tablee, 0, 0, "Average Entry Price", bgcolor=top_row_col, text_color=color.white, text_size=table_size)

table.cell(tablee, 1, 0, str.tostring(avg_entry_price, '#.##'), text_color=color.white, text_size=table_size)

table.cell(tablee, 0, 1, "Median Price", bgcolor=top_row_col, text_color=color.white, text_size=table_size)

table.cell(tablee, 1, 1, str.tostring(median_price, '#.##'), text_color=color.white, text_size=table_size)

table.cell(tablee, 0, 2, "Remaining Capital", bgcolor=top_row_col, text_color=color.white, text_size=table_size)

table.cell(tablee, 1, 2, str.tostring(remaining_capital, '#.##'), text_color=color.white, text_size=table_size)