概述

本策略结合了移动平均线(EMA)、相对强弱指标(RSI)和移动平均聚散指标(MACD)三个指标,在多个时间框架内寻找交易机会,实现自动化交易。该策略可以有效跟踪市场趋势,降低交易风险。

策略原理

该策略主要是基于EMA、RSI和MACD三个指标实现的。其交易逻辑如下:

使用25日EMA和45日EMA形成金叉和死叉,作为交易信号。当短期EMA上穿长期EMA时买入,短期EMA下穿长期EMA时卖出。

结合RSI指标避免假突破。只有当RSI大于50时,才对金叉形成的买入信号进行交易;只有当RSI小于50时,才对死叉形成的卖出信号进行交易。

在RSI指标不同参数下寻找更多交易机会,包括RSI>30、RSI<30等条件。

MACD指标可以作为辅助判断指标,对EMA交易信号进行确认。

通过在不同时间框架内找到更多交易机会,可以提高策略盈利能力。同时,结合多个指标可以减少错误交易的发生,有效控制风险。

策略优势

该策略最大的优势在于结合多个指标,在多个时间框架内进行交易,可以提高盈利概率。主要优势有:

使用EMA金叉死叉可以有效跟踪市场趋势变化,及时捕捉交易机会。

RSI指标可以避免假突破,降低交易风险。

在多个RSI参数下寻找交易机会,增加入场次数,提高收益。

MACD指标可以对EMA交易信号进行二次验证,进一步减少风险。

多时间框架交易, LoginFormationTransactionModelTransactionModel翻倍获利机会。

策略风险

该策略也存在一定的风险,主要集中在以下几个方面:

EMA指标存在时滞,可能错过短线交易机会。

多指标组合交易,参数设置不当可能导致超优化。

多时间框架交易可能加重亏损,需要严格的止损管理。

实战中需关注交易成本控制,避免过高frequency交易。

策略优化方向

该策略还有进一步优化的空间,主要集中在以下几个方面:

对EMA参数进行测试优化,寻找最优参数组合。

测试更多辅助指标的加入,如BOLL通道、KD指标等。

加入自适应止损机制,可以根据市场波动率调整止损位置。

对开仓手数进行优化,不同参数下可采用不同的交易手数。

优化入场条件逻辑,避免冲突信号或加大信号过滤力度。

总结

本策略整合了多种指标信号,在多个时间周期内进行交易,既具有跟踪趋势的能力,也能抓住短线机会。同时,严格的入场过滤机制也使策略具有一定的风险控制能力。总的来说,该策略收益稳定,具有实战运用价值,值得推荐。

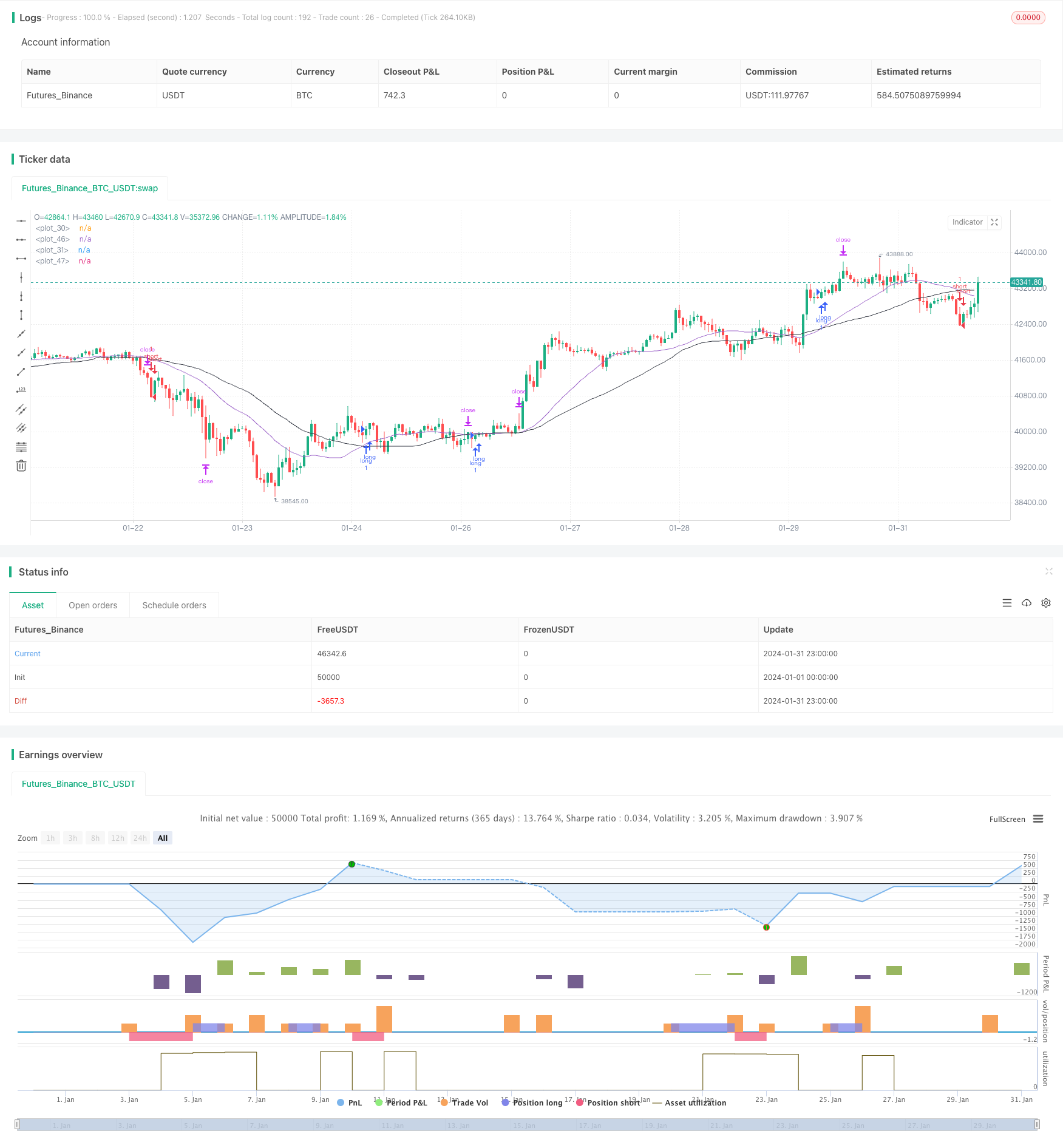

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Aqualizer

//@version=5

strategy("Aserin Buy and Sell", overlay=true)

shortSMA = ta.sma(close, 25)

longSMA = ta.sma(close, 45)

rsi = ta.rsi(close, 7)

ta.macd(close,12, 26, 9)

atr = ta.atr(3)

longCondition = ta.crossover(shortSMA, longSMA)

shortCondition = ta.crossunder(shortSMA, longSMA)

if (longCondition)

strategy.entry("long", strategy.long, 100, when = rsi > 50)

if (shortCondition)

strategy.entry("short", strategy.short, 100, when = rsi < 50)

if (longCondition)

strategy.entry("long", strategy.long, 100, when = rsi > 30)

if (shortCondition)

strategy.entry("short", strategy.short, 100, when = rsi < 30)

if (longCondition)

strategy.entry("long", strategy.long, 100, when = rsi > 20)

if (shortCondition)

strategy.entry("short", strategy.short, 100, when = rsi < 50)

plot(shortSMA)

plot(longSMA, color=color.black)

if (longCondition)

stopLoss = low - atr * 2,45

takeProfit = high + atr * 2,45

strategy.entry("long", strategy.long, 1, when = rsi > 30)

strategy.exit("exit", "long", stop=stopLoss, limit=takeProfit)

if (shortCondition)

stopLoss = high + atr * 3

takeProfit = low - atr * 3

strategy.entry("short", strategy.short, 1, when = rsi < 30)

strategy.exit("exit", "short", stop=stopLoss, limit=takeProfit)

plot(shortSMA)

plot(longSMA, color=color.black)